Global IT talent: Accelerated hiring for IT services counters persistent attrition

In TBR’s latest Global Delivery Benchmark, one particular number leapt out as both surprising and indicative of the sustained battle for technology talent.

In TBR’s latest Global Delivery Benchmark, one particular number leapt out as both surprising and indicative of the sustained battle for technology talent.

Two of IBM’s core quantum offerings are of particular interest, as each is indicative of the growing market interest in becoming quantum ready and in trialing different prototypes ahead of the development of commercial-grade quantum computing capabilities.

If the conflict in Ukraine remains hot, labor unions may kick into higher gear, extracting additional concessions and making it more costly for companies to exit any European market.

As Russia continues its invasion of Ukraine, analysts monitoring the war’s global repercussions have also noted Saudi Arabia intriguingly stating the kingdom would consider accepting yuan payments for oil sold to China.

In the near term, ceased or slowed operations in Russia and Belarus will not significantly affect the revenues or strategic directions of most IT services vendors and management consultancies. Firms will stay clear of Russia, understanding any lost revenues will be well worth forgoing to alleviate the risks of running afoul of sanctions or committing a public relations blunder by staying on in an increasingly isolated country.

Within Europe, management consultancies and IT services vendors with strong consulting capabilities (such as Accenture and Capgemini) will likely see near-term opportunities to provide crisis management, operational expertise and supply chain consulting. Some vendors may repurpose pandemic-created solutions to meet the logistical challenges brought on by the mounting refugee crisis. PwC, for example, could apply the design and technology used to ensure its employees’ safety and security while working remotely during the pandemic to assist Ukrainian refugee families trying to stay connected across multiple borders and amid changing circumstances.

Over the remainder of 2022, how the war in Ukraine will change IT services vendors’ and consultancies’ European operations depends on three factors: the length and resolution (or lack thereof) of the conflict; the macroeconomic fallout; and each vendor’s willingness to take risks with talent, acquisitions and clients.

The first two factors necessarily influence each other. A hot war sustained throughout 2022 would severely curtail broader European economic growth, likely keep inflation high, and shift spending by governments and commercial clients alike. Cybersecurity and supply chain opportunities may flourish, but overall reduced spending and economic activity would slow or reverse growth, at least in Europe. A cease-fire and stalemate, with a low-intensity insurgency in eastern Ukraine coupled with an uneasy rebuilding in western Ukraine, would likely produce additional opportunities around risk management, compliance and Industrial IoT. Again, the growth associated with those new opportunities would be tamped down by overall economic uncertainty.

In both scenarios, energy costs in Europe and globally will provide persistent headwinds. TBR anticipates that in the face of persistent macroeconomic pressures in Europe, vendors already active elsewhere will accelerate those investments. In APAC, IT services vendors and consultancies have increasingly invested in regional opportunities, notably the Australian public sector, automation-enabled BPO in Japan, and digital- and e-commerce-driven demand for customer experience applications in many countries in Southeast Asia. In TBR’s view, vendors with the most diversified footprints are the best positioned to absorb new risks — not a novel observation but newly important.

A quick resolution, followed by a return to some measure of normality, would likely alleviate macroeconomic pressures while bringing forward the third factor: appetite for risk. IT services vendors and consultancies would have the opportunity to hire (or rehire) Russian consulting and technology talent, move quickly again on acquisitions, and re-evaluate taking on Russian clients, particularly those pledging to help rebuild Russia’s credibility and good standing in the global market. Clients, both European governments and multinational companies, looking to escape inflationary pressures and find quick growth after a war-based shock to Europe’s economy may look to vendors, particularly the management consultancies, for assistance. And these vendors will be forced to decide whether or not to help high-value clients resume their business in Russia. As quickly as the world closed the Russian economic spigot, it could be reopened.

More than any other factor, leadership will determine how these vendors handle the war in Ukraine and its effects on their business, and TBR will be assessing leadership decisions, announcements and strategy shifts over the next few weeks for markers of the most likely near-term and 2022 outcomes.

“Digital twin is a decarbonization enabler” and in the next five years “people will generate carbon credits out of digital twin.” Sandeep Bhan, Atos’ global senior expert on digital twin made those assertions at the end of a LinkedIn webinar today in response to TBR’s question about the more-than-marginal business impacts possible through deploying digital twins.

As IT services vendors, consultancies and their clients increasingly talk about sustainability, TBR has kept a skeptical eye on what emerging technologies or consulting trends bring true change to decarbonization and what’s just hype. Bhan and his colleague Murli Mohan Srinivas, Atos’ global leader for Industry 4.0 & digital twin, made a compelling case that digital twin, as part of a greater toolkit, will be part of many companies’ sustainability efforts. Incremental improvements in operational efficiency enabled by digital twin and taken to scale could bring substantial energy and cost savings, potentially converted into tangible decarbonization results. As Srinivas noted, “Every 0.1% increase in asset availability in wind turbine translated to a few hundred thousand units of power generated, which directly translated, in terms of months … into millions of dollars of real energy.”

From TBR’s perspective, digital twin has been an emerging technology more hyped than understood or deployed. The title of the Atos webinar, “Digital Twin Demystified,” reinforces how the intricacies and impacts of digital twin remain largely underappreciated across the broader technology space. This combination of digital twin mystification and increasing hype around sustainability fuels TBR’s uncertainty around the long-term potential of both.

Listening to experts drill down on specific use cases and tie specific technology implementations with real-world business outcomes helps alleviate some of those concerns while uncovering additional questions around applicability beyond asset-heavy industries, demands on change management and talent, and prioritization of digital twin in any sustainability or digital transformation engagement. TBR will continue probing Atos and other IT services vendors and consultancies on their digital twin offerings and capabilities and will consider Bhan’s assertion about digital twin enabling decarbonization in TBR’s inaugural Decarbonization Market Landscape, (scheduled to publish in June).

During the Atos webinar, Bhan and Srinivas made a few other key points about digital twin, including:

Over the quick 30-minute primer, the speakers made a compelling case for the company’s expertise, capabilities, and offerings around digital twin. TBR will continue following Atos’ efforts in the digital twin space and include our assessments and analysis in quarterly reports on the vendor, as well as in TBR’s Digital Transformation reports, when applicable.

What happens in Dubai … well, happens everywhere

On March 1, PwC Dubai hosted a LinkedIn webcast, “Transforming Our Region,” featuring commentary by Stephen Anderson, PwC Middle East markets leader; Richard Boxshall, PwC chief economist for the region; and Hanan Abboud, a partner in PwC’s International Tax & M&A practice. This latest episode of the webcast series, which started in the summer of 2020, included three main themes, two of which likely resonate strongly outside the Middle East region.

Global inflation can be a drag, but regionally not so bad

First, Anderson and Boxshall noted recent regional economic growth and an overall positive picture, particularly as the pandemic begins to wane, but cautioned about inflation as a damper in the near term, with a critical caveat: Many of the global inflationary pressures and trends have been more muted in the Middle East, particularly within the economies of Saudi Arabia and the United Arab Emirates (UAE). Boxshall reported that inflation has been relatively low and well managed locally, at around 2% for the region, but varies widely across countries.

Like elsewhere, energy prices and supply chain snafus drive most of the inflationary concerns and effects in the Middle East, but high oil prices act as a double-edged sword for some of the most important regional economies, as more money flows into government coffers while demand is put at risk of being suppressed in the long run. Overall, PwC reported on the cautious sentiment in the region as the business leaders it surveyed see inflation elsewhere and hope for sustained smart economic stewardship to keep inflation low in the region.

Cybersecurity tops concerns

Investment and innovation comprised a second regional trend with global echoes, primarily because of the main concern about what could hold back growth: cybersecurity risks. According to Anderson, cybersecurity generated more worry among Middle East business leaders than geopolitical tensions or lingering pandemic-related healthcare risks. Notably, PwC’s survey did not factor in Russia’s invasion of Ukraine, which could bring geopolitics to the forefront. In TBR’s view, consultancies like PwC that can address clients’ cybersecurity concerns in concert with offerings around innovation, transformation and sustainability will continue to outpace cyber-centric or niche vendors as client leaders increasingly appreciate the business value of integrating cybersecurity into enterprisewide strategy.

Joining the global movement toward 15% tax rate

The last development PwC highlighted will have the greatest near-term effect in the UAE but bodes well for global economic growth and regional good governance. Anderson and his colleagues noted that the UAE became the first country in the region to announce plans to adhere to Organization for Economic Co-operation and Development (OECD) guidelines by instituting a 15% minimum corporate tax rate. With the country planning to implement the 15% tax rate effective June 1, 2023, and the local business corporate tax rate capped at 9%, PwC acknowledged plenty of unknowns and expects plenty of exemptions. But overall UAE is continuing its decades-long efforts to keep the country economically attractive and closely intertwined with the global economy.

Advising clients on adjustments to the new 15% tax rate, to include navigating free-trade-zone rules, will provide near-term opportunities in the UAE and longer-term revenues as other regional governments adopt similar tax structures. For PwC, a new UAE tax regime aligns perfectly with PwC’s The New Equation strategy and emphasis on trust, transparency and global interconnectedness. As TBR noted in November, “Globally, PwC partners were leaning into the trust and leadership components of The New Equation and finding clients receptive to, and even welcoming of, PwC’s efforts to ‘peek around the corner’ at trends, challenges and opportunities on the near and far horizons.”

Don’t bet against the Emirates

In TBR’s estimates, PwC’s 2021 management consulting revenues in the Middle East topped $670 million, roughly one-third of the firm’s APAC revenues but growing faster than any other PwC region. Inflation spikes and cybersecurity strikes may slow that growth, but a more likely scenario is that the UAE, the Kingdom of Saudi Arabia and other regional economies will maintain their rapid growth as their booming talent pools and friendly tax and corporate governance structures continue to draw investments and continue to create opportunities for consultancies like PwC. I served in Dubai, UAE, as a foreign service officer for the State Department in the late 1990s and know it’s a fool’s bet to think the UAE won’t, eventually and sometimes in surprising ways, do exactly what they say they’re going to do.

In TBR’s most recent Digital Transformation: Digital Marketing Services Benchmark, my colleague Boz Hristov examined trends across different regions and wrote, “While regional nuances … compel vendors to build local resources to ensure they can tailor culturally aligned campaigns, the evolving nature of the DMS [digital marketing services] market is also creating country-specific openings. For example, the last three Olympic Games including PyeongChang (South Korea), Tokyo (Japan) and Beijing (China) have been driving investments and opportunities within Southeast Asia.” In covering Capgemini for more than a dozen years, I’ve seen how the company has been able to combine internal capabilities development and highly strategic acquisitions to stay on the leading edge of trends across the IT services space, including digital marketing services. At the same time, acquisitions enable Capgemini to diversify its geographic reach outside its home market of Europe, namely in North America and APAC.

Overall, APAC is becoming a region of acquisition focus as Capgemini strives to diversify global revenues and expand work with local clients in the region. APAC is a major global service delivery location, but activities with local clients are limited outside of Australia and New Zealand. Recent acquisitions in APAC that build on Capgemini’s local market reach include those of Empired in Australia, around digital and cloud; Acclimation in Australia, around SAP consulting and systems integration; Multibook’s SAP global services line in Japan; RXP Services in Australia, around digital, data and cloud; and WhiteSky Labs in Australia around MuleSoft consulting.

Capgemini’s innovation, design and transformation brand, Capgemini Invent, is rolling out its capabilities across APAC. Capgemini is establishing a new network around frog, the brand experience design consulting arm of Altran. During 2020 frog scaled from about 500 people in the U.S. and Europe to about 2,000 by absorbing Capgemini Invent’s customer experience team and employees from Capgemini’s acquisitions of global design studio Idean, innovation firm Fahrenheit 212, agency June 21 and customer engagement marketing firm LiquidHub. Frog initially had one studio in Shanghai but has expanded in APAC with studios in Singapore; Hong Kong; Sydney and Melbourne, Australia; and India. Frog’s APAC business emphasizes industrial and special design, tied with the new Capgemini Engineering brand experience and design-led transformation.

In some ways, this is a natural outcome of making related tuck-in acquisitions: Eventually, Capgemini creates scale to establish a new business unit or service line. Additionally, it is a way of retaining acquired talent by showing that employees will be part of a special group assembled from similar acquisitions.

In 2016, 2017 and 2018, Capgemini made several acquisitions in North America to initially build out its digital services capabilities, some of which now reside in frog. Fahrenheit 212, which Capgemini acquired in February 2016, enhanced Capgemini’s business transformation consulting and digital customer experience solutions portfolio. Lyons Consulting Group, which Capgemini acquired in September 2017, strengthened the company’s position in digital commerce, specifically around integrating Salesforce Commerce Cloud solutions. Idean, which Capgemini acquired in February 2017, expanded Capgemini’s digital transformation consulting capabilities and added seven digital design studios worldwide.

The acquisition of LiquidHub in February 2018 further expanded Capgemini’s digital services, notably digital consulting capabilities in North America. With LiquidHub, Capgemini gained customer experience capabilities and improved its ability to capture digital opportunities with clients in the U.S. LiquidHub augmented Capgemini’s client base by adding logos, such as Wells Fargo, Chase, Godiva, Subaru, Microsoft and Amgen, and improved Capgemini’s relationships with clients’ CXOs.

By making acquisitions, expanding its portfolio, keeping up with trends around digital marketing services, and even leaning on its core strengths around engineering services, Capgemini could become more disruptive in the APAC market in the very near term. The vendor’s combined revenue from APAC and LATAM accounted for 7.8% of total revenue in 2021 and increased 26.2% year-to-year as reported in euros, outpacing revenue growth in other regions.

TBR’s most recent report on Capgemini was published on March 7 and provides a detailed analysis of the company’s performance and investments in 4Q21 and 2021. Recent deals such as with Volvo Cars to enable digital transformation of the client’s operations in the Asia-Pacific Economic Cooperation by implementing Salesforce solutions such as Sales Cloud, Service Cloud, Marketing Cloud, Experience Cloud and Configure Price Quote software exemplify Capgemini’s activities that are supported through investments in digital and cloud capabilities. APAC provides opportunities for Capgemini and might be even better suited to pave the way to growth now that the company’s home market of Europe might be disrupted by the war in Ukraine. The deal with Volvo Cars provides Capgemini with a good opportunity to expand into the emerging China market, as Volvo is a well-known European brand but is now managed out of China.

Inflation is very much in the U.S. news as it reaches 40-year highs. This means a person has to be near the end of their professional careers to have experienced the previous inflationary period. One of the authors dimly recalls his economics professors trying to parse what, at the time, was called stagflation, which impacted the United States in the 1970s. Oil price shocks drove up prices, while unemployment remained high. Inflation previously had been explained as too many dollars chasing too few goods and was generally assigned to economies overheating because of very low unemployment rates.

Today economists seek to assess economic fundamentals to predict whether this inflationary spike will be temporary or persistent. Factors suggesting a short-term spike revolve around the well-publicized supply chain disruptions coupled with record savings levels during the pandemic when discretionary spending on things like travel and restaurant meals was greatly hindered and retail spending shifted from in-store shopping to e-commerce.

On the other hand, some economists point to persistent government deficits due to pumping money into the economy. Given various regulatory and economic uncertainties, that money has been sitting on the sidelines. Further stock market run-ups in valuation have been attributed to investor money seeking higher returns that can be achieved in traditional savings and bond ownership because of low interest rates on these conservative investment instruments.

Partisans will selectively mention these factors to explain away or criticize the current economic climate. Businesses, on the other hand, have a recently dormant financial risk rearing its ugly head that can dramatically impact long-term financial forecasting.

Transaction-based businesses in the IT industry will be able to follow traditional methods of passing costs on to the customer. But, for those business units working from Anything as a Service (XaaS) subscription models, ITO contracts and infrastructure managed service agreements, the near-term impact could be more acute.

Cloud-enabled SaaS models are a relatively new phenomenon as Industry 4.0 gains momentum. Proponents of these business models also assert that legacy business model metrics and analysis do not apply given the majority of selling expenses are recognized in the first fiscal quarter of multiyear agreements while the revenue is then recognized ratably over the contract term. As such, the financial spokespeople for these business models lean heavily on relatively new business metrics — annual recurring revenue (ARR), net dollar revenue retention and lifetime customer value — that chart a forecast course for when operating profits will materialize.

ITO contracts have had a somewhat longer evolution, starting as multiyear deals where vendors could reap greater profits as operating costs declined due to the increased automation of the overall monitoring and maintenance. These contracts then moved to shorter-term durations and, more recently, have stipulated cost decreases over time such that any operating costs savings created by the vendor are passed along, or at least shared with, the customer. The ITO market has likewise seen a shift or rebranding of these customer offers into infrastructure managed services to pivot the contract model to be more in line with SaaS constructs.

When inflation was last a top-of-mind economic consideration, most IT was on premises and operated by company personnel. TBR seriously doubts strategic scenario planning for these new subscription consumption models prior to perhaps late 2020 anticipated the current inflationary levels and their potential operating impact.

SaaS models take several years to generate profit in what is variously described as the flywheel effect or the force multiplier effect. Increased labor and utility costs beyond forecast and tethered to long-term contracts will add several percentage points of operating costs to these models. In this sense, the newer the SaaS operating model the less risk it will have to cost structure as it has less renewed revenue. TBR expects the more mature the SaaS model, and greater amount of accrued or committed revenue, the more adverse the bottom-line operating impact.

The ITO market, on the other hand, has shown persistent declines, resulting in consolidations and divestments to profitably manage eroding streams traditional ITO vendors seek to convert into managed services agreements. The inflation impact on costing will amplify the need to infuse these business practices with more automated capabilities or increased low-cost (typically offshore) labor as offsets. Still, the operating profit declines in this space will likely worsen unless vendors seek to negotiate incremental cost increases that customers may or may not be willing to accept based on their own issues with cost containment.

Inflation is not new, but the operating models prevalent now were not around when we last experienced it. Business strategists still have a blend of initiatives they can embrace to preserve their operating models and their customer relationships:

Inflation as a business risk will persist for the foreseeable future. TBR will be assessing it closely as public companies report their earnings and release their financial filing documents.

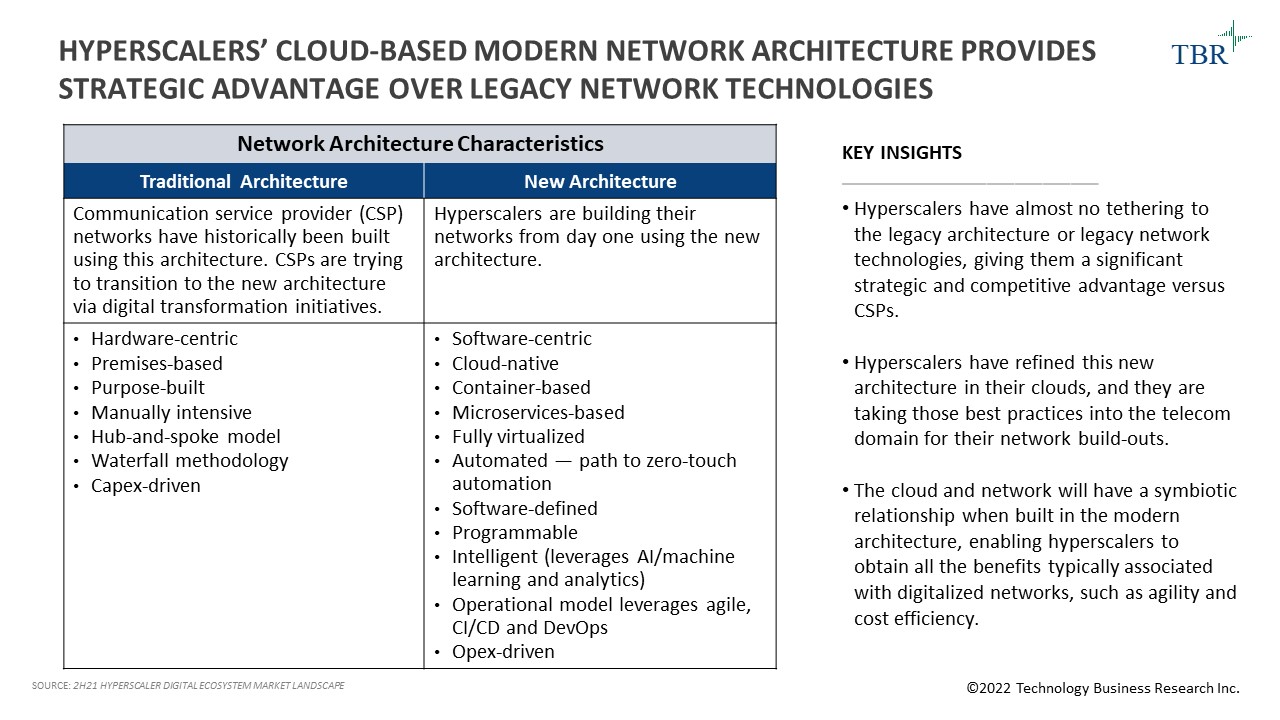

Hyperscalers are building end-to-end networks that embody all the attributes and characteristics coveted by communication service providers (CSPs) as part of their digital transformations. The most significant differences are in the software stack and the access layer, where new technologies enable hyperscalers to build dense mesh networks in unlicensed and/or shared spectrum bands and build out low Earth orbit (LEO) satellite overlays for access and backhaul. Mesh networks will likely be used to provide low-cost, wireless-fiber-like connectivity in urban and suburban environments, while satellites will primarily be leveraged to provide connectivity to rural and remote environments.

Hyperscalers are starting from scratch, completely reimagining how networks should be built and operated. Their clouds, numerous network-related experiments over the past decade, plus the raft of new network-related technologies on the road map will enable hyperscalers to build asset-light, automated networks at a fraction of the cost of traditional networks.

TBR estimates hyperscaler networks cost 50% to 80% less to build than traditional networks (excludes the cost of spectrum, which would make the cost differential even more pronounced because hyperscalers will primarily leverage unlicensed and shared spectrum, which is free to use). Most of the cost savings stems from innovations, such as mesh networking, carrier aggregation, LEO satellites and integrated access-backhaul, that enable significantly less wired infrastructure to be deployed in the access layer for backhaul and last-mile connection purposes.

For example, Meta’s Terragraph mesh access point can autonomously hop signals through multiple other access points before sending the data through the nearest available backhaul conduit. In the traditional architecture, some form of backhaul would need to connect to each access point to backhaul the traffic. Mesh signals could also be backhauled through LEO satellites, further limiting the need to deploy wired infrastructure in the access layer, which is one of the most significant costs of traditional networks.

Another key area of cost savings stems from cutting out certain aspects of the traditional value chain. By open-sourcing some innovations, such as hardware designs, hyperscalers can foster a vibrant ecosystem of ODMs to manufacture white boxes to compose the physical network. The white-boxing of ICT hardware can lead to cost savings of up to 50% compared to proprietary, purpose-built appliances.

Related Content:

Top 3 Predictions for Telecom in 2022

Webinar: 2022 Predictions: Telecom

This site uses cookies. By continuing to browse the site, you are agreeing to our use of cookies.

Accept settingsHide notification onlySettingsWe may request cookies to be set on your device. We use cookies to let us know when you visit our websites, how you interact with us, to enrich your user experience, and to customize your relationship with our website.

Click on the different category headings to find out more. You can also change some of your preferences. Note that blocking some types of cookies may impact your experience on our websites and the services we are able to offer.

These cookies are strictly necessary to provide you with services available through our website and to use some of its features.

Because these cookies are strictly necessary to deliver the website, refusing them will have impact how our site functions. You always can block or delete cookies by changing your browser settings and force blocking all cookies on this website. But this will always prompt you to accept/refuse cookies when revisiting our site.

We fully respect if you want to refuse cookies but to avoid asking you again and again kindly allow us to store a cookie for that. You are free to opt out any time or opt in for other cookies to get a better experience. If you refuse cookies we will remove all set cookies in our domain.

We provide you with a list of stored cookies on your computer in our domain so you can check what we stored. Due to security reasons we are not able to show or modify cookies from other domains. You can check these in your browser security settings.

We also use different external services like Google Webfonts, Google Maps, and external Video providers. Since these providers may collect personal data like your IP address we allow you to block them here. Please be aware that this might heavily reduce the functionality and appearance of our site. Changes will take effect once you reload the page.

Google Webfont Settings:

Google Map Settings:

Google reCaptcha Settings:

Vimeo and Youtube video embeds:

You can read about our cookies and privacy settings in detail on our Privacy Policy Page.

Privacy Policy