Overarching Takeaways from Mobile World Congress 2024

Mobile World Congress 2024 (MWC24) brought together more than 2,700 exhibitors and 101,000 attendees from across the global ICT sector, including representatives from many other industries that are pursuing digital transformation. TBR notes that MWC Barcelona is closing in on the pre-pandemic high-water mark for attendance and exhibitors set in 2019.

The MWC ecosystem has proved resilient, confirming MWC Barcelona’s role as the most important, must-attend event in the world for all things related to mobile technology. The most popular topics discussed at MWC24 included generative AI (GenAI), traditional AI, network APIs, private networks, satellite connectivity, sustainability and cloud transformation.

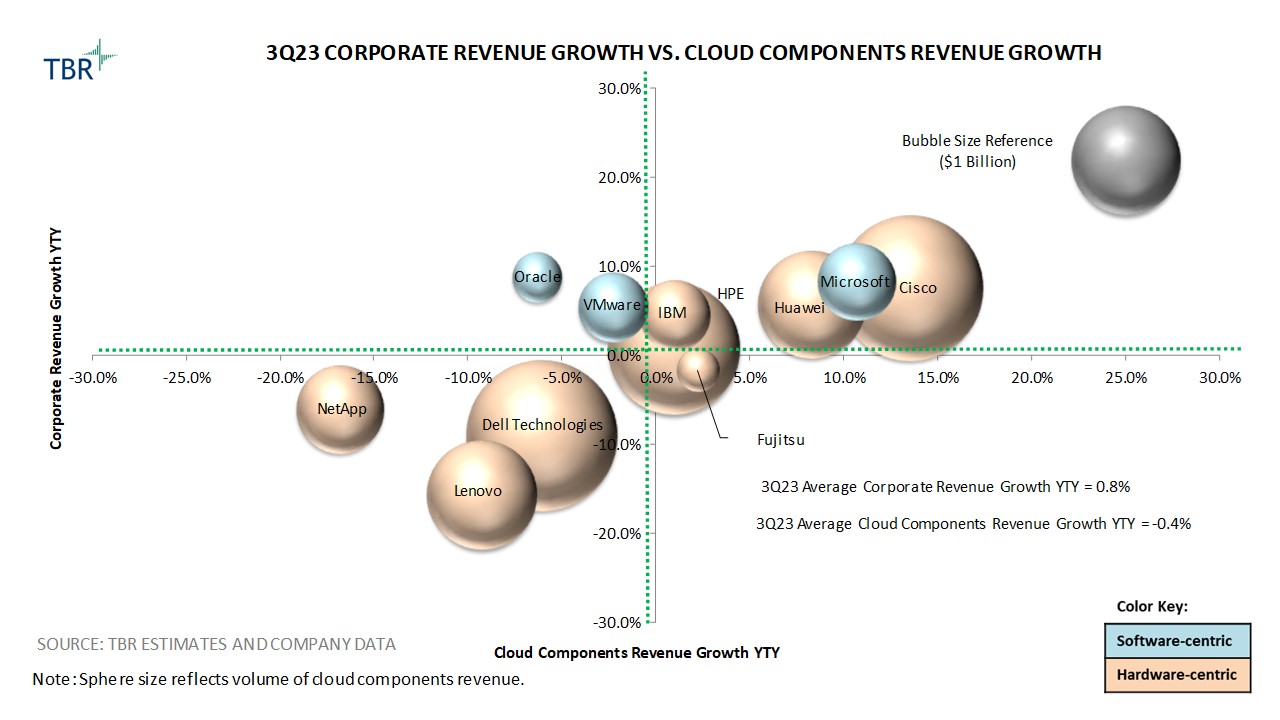

TBR notes that hyperscalers (particularly Amazon Web Services [AWS] [Nasdaq: AMZN], Microsoft [Nasdaq: MSFT] and Google [Nasdaq: GOOGL]) kept a lower profile at MWC this year, a marked change from the loud and flashy presence they had at MWC23. Hyperscalers also continued to double down on positioning themselves as partners with communication service providers (CSPs).

Additionally, TBR notes that the AI/GenAI hype feels tangible and is unlikely to fall by the wayside like the metaverse, crypto, blockchain, and other hyped-up concepts and technologies that have come and gone in years past. Many use cases and business cases for AI and GenAI in the telecom industry make logical sense and have the potential to produce profoundly significant business outcomes, especially related to cost efficiency. Technological readiness for and commercialization of AI and GenAI are in process, and much more innovation is in store.

One of the most interesting takeaways TBR analysts observed from MWC24 was how little 5G, 5G-Advanced and 6G were discussed. While AI/GenAI, network APIs and private networks dominated mindshare at the event, as was widely expected, the lack of content about cellular technology market development was striking and underscores the challenges the telecom industry continues to face with revenue growth and ROI. This lack of discussion also underscores how CSPs are loathe to make further investments in 5G, especially 5G-Advanced, pending measurable ROI, and that vendors see this and are concerned 5G-Advanced will not generate significant revenue.

Though CSPs continue to talk a big game about B2B use cases, network slicing, private networks, cloud-native transformation, AI/GenAI and network APIs as key enablers of the digital economy and new revenue for themselves, their loud, echoing chorus rings hollow and is losing credibility as they do not have anything of significant, sustainable value to show for their efforts in these areas. This is forcing the vendor community, hyperscalers and some enterprises to hedge their bets and seek alternative routes to meet their business objectives.

TBR notes that the situation CSPs find themselves in is becoming increasingly dire, and as an industry CSPs are reaching a point where they will have to reckon with two decades of underachieving on transformation initiatives and weakening business metrics. Additionally, with the cost of capital now at levels last reached nearly 20 years ago in most major markets, CSPs’ financial pictures are worsening, and this will likely prompt a new wave of M&A as well as bankruptcies and structural reorganizations. CSPs also have a people problem, which is arguably the primary reason CSPs have been unable to realize their objectives of shifting from telcos to techcos.

TBR’s research indicates that the telecom industry has entered a period of rationalization and that the operator and vendor landscape, as well as the telecom business model, will fundamentally change over the next decade. The anti-pragmatic, restrictive and often hostile regulatory environment, coupled with macroeconomic headwinds (especially the relatively high cost of capital), and the inability for CSPs to truly transform into cloud-native digital service providers have brought the industry to this precipice.

By the end of this decade, TBR expects the telecom industry to look much different than it looks now, with fewer, but larger and stronger, CSPs and vendors remaining and new business models for network connectivity and related technology enablers disrupting the status quo enjoyed by the industry for decades.

Click the image below to join TBR live for an in-depth recap of Mobile World Congress 2024

Impact and Opportunities

AI Will Help CSPs Significantly Reduce Costs

Myriad use cases for AI and GenAI were discussed at MWC, spanning all aspects of a CSP. Use cases related to call centers and customer lifecycle management present the biggest opportunity to move the cost savings needle. OSS and BSS, which underpin customer lifecycle management, will be key domains through which AI/GenAI evangelization will take place within CSPs. Network-oriented use cases for AI/GenAI are also numerous but will take a bit longer to materialize compared to call center and customer lifecycle management use cases. The bigger issues surrounding AI/GenAI pertain to governance, privacy and societal considerations, any of which could stifle market development.

Labor will ultimately be significantly impacted by AI/GenAI, but TBR expects gradual attrition, with vacated positions not being filled, rather than abrupt, large-scale layoffs at CSPs. Importantly, the AI and GenAI outputs shown in use cases demonstrated at MWC24 essentially all required vetting by human resources, at least at this stage of market development.

CSPs Have a People Problem

Shifting from a telco to a techco requires cultural, talent and mindset changes at CSPs. For example, to become a techco, CSPs would need to think and behave like a techco and have a workforce that understands techco concepts such as CI/CD (continuous integration, continuous delivery) pipelines, agile workflow methodology, cloud, APIs, software engineering, computer programming languages like Python, as well as containers and microservices.

Change management initiatives, including at the senior management level, are likely to become more prevalent as leading CSPs attempt to cross this chasm, and management consultancies are poised to play a key role in facilitating this change. Though the presence of unions among some CSPs could stifle this shift, CSPs have had more than a decade to make progress toward this human resource transition.

Upskilling and reskilling are viable, partial solutions to address these issues, but these types of initiatives need more formalized structure, investment, and executive sponsorship and oversight to deliver relevant and meaningful results. TBR also expects more CSPs to adopt “cap and fizzle” or “captive” strategies to make this shift from telco to techco, whereby the legacy is wound down and separate entities are stood up in a more techco-oriented structure.

Still No “New Deal” or “Digital Single Market” for Europe’s Telecom Industry

Europe-based operators continued to use MWC as a mouthpiece to plead with governments and related institutions on the continent for regulatory reform (especially regarding consolidation, spectrum policy and evolving outdated regulations, some of which date back many decades). However, while some additional M&A is likely to be approved that may not have been allowed pre-pandemic (such as the Vodafone-3 U.K. and MasMovil-Orange Spain deals), no significant changes are visible on the horizon.

Using history as a guide, structural changes at the level hoped for by the telecom industry will likely only occur when macroeconomic deterioration forces governments into action and drives broader restructuring and change management at organizations. Said differently, the only way Europe’s telecom industry (and quite frankly, the global telecom industry) will see broad regulatory and structural changes is amid a catalyst moment, which tends to occur during periods of unprecedented economic stress.

For example, the last significant, large-magnitude industrial changes across major societies occurred during the Great Depression of the 1930s, which reshaped labor and industrial dynamics, and the Great Recession of 2007-2009, which reshaped the financial services industry. Telecom will, unfortunately, need a similar economically driven crisis to bring about the structural changes that the industry seeks.

Telco-led Initiatives Are Unlikely to Have Staying Power

CSPs continue to attempt to band together in key areas, such as network APIs via CAMARA and the Open Gateway API program, and on telco-specific large language models (LLMs) via the Telco AI Alliance, a recently created consortium spearheaded by SK Telecom and joined by several other major CSPs.

Using history again as a guide, initiatives such as these are unlikely to gain critical mass due to competitive, cultural and resourcing reasons, both between CSPs and within CSPs. For example, the recent past has seen AT&T’s (NYSE: T) Enhanced Control, Orchestration, Management & Policy (ECOMP)/ONAP (Open Network Automation Platform) and Deutsche Telekom’s (DT) MobiledgeX initiatives falter, with both being taken over by hyperscalers (Microsoft took over ONAP via its strategic arrangement with AT&T, and Google acquired MobiledgeX). The last major telco-led initiative to gain broad, global traction and yield significant benefits across the industry was the SMS initiative over 20 years ago.

TBR continues to believe that the best-suited players to make network APIs and LLMs relevant and outcome producing at scale are the hyperscalers, with CSPs likely to partner with hyperscalers for their boundarized portion of the overall market opportunity. Most CSPs are likely to remain technology consumers instead of technology producers, keeping them confined to connectivity providers and dependent on the vendor community and other players like hyperscalers for innovation.

CSPs Continue to Put the Cart Before the Horse with Enterprise Use Cases and Lack Focus on More Promising Consumer Opportunities, such as FWA

Most CSPs still have not deployed 5G standalone (SA) at scale, and those that have are not running truly cloud-native, microservices-based 5G cores. New enabling technologies, such as network slicing, are dependent on the adoption of cloud-native 5G core in a 5G SA architecture. This means that most CSPs globally are still not prepared to deliver on the promises of 5G for enterprise or to capitalize on the technology’s benefits.

CSPs can and should focus more on consumers, where fixed wireless access (FWA) is a proven, ROI-positive and scalable use case that is broadly relevant in most countries worldwide. CSPs’ current 5G non-SA networks and noncloud-native 5G SA networks are capable of supporting 5G FWA at scale, and this use case should be garnering more investment to drive more immediate revenue growth.

FWA Remains the Largest Revenue-generating Use Case for 5G and has Room to Scale

Though CSP deployment of 5G FWA is growing, most CSPs continue to underestimate the potential of the technology, likely because FWA ties up a lot of spectrum resources for relatively low average revenue per user (ARPU). TBR continues to believe that FWA represents one of the biggest opportunities for mobile network operators to monetize their 5G investments and drive scalable revenue growth.

Technological innovations currently available (e.g., multiband carrier aggregation, beamforming, extended range millimeter wave) and coming in the not-too-distant future (e.g., New Radio Unlicensed [NR-U], integrated access backhaul, silicon advancements) are likely to bring dramatic improvements in network performance, energy efficiency, and the usability of spectrum to support services such as FWA at large scale.

TBR maintains that 5G FWA should be thought of as wireless fiber and that the notion of having to deploy fiber to every business and residential premise globally is not only economically unfeasible but also unrealistic from a pure time-to-market standpoint to meet digital equity initiatives. 5G FWA can address these challenges and is a far more realistic and economically feasible technology to help the world bridge the digital divide, bring more competition in the global broadband market and support new use cases.

Finance Industry Indirectly Drives Investment in Private Cellular Networks

TBR analysts learned at MWC24 that the financial services industry is indirectly driving investment in private cellular networks. For example, the ability to track and obtain information from disparately located assets using IoT connectivity, such as heavy machinery and automobiles, is enabling businesses such as agriculture companies, fleet operators, mining companies, logistics companies and auto manufacturers to become eligible for various financial products, such as asset insurance and extended warranties, as well as lower premiums on existing insurance policies. Situations such as these are incentivizing the aforementioned types of businesses to invest in their own private cellular networks or pull CSPs into hybrid network situations.

Conclusion

The telecom industry is entering a new, more precarious phase of uncertainty. What CSPs and their vendors should be doing, they have been unable to do (or are moving far too slow), and what they should not be doing, they continue to cling to and do. If structural changes do not occur in the telecom industry in the next couple of years, the probability grows that other players (e.g., hyperscalers, software-centric vendors) will increasingly circumvent CSPs to pursue their own digital transformation-related interests.

The only players TBR has seen that have the financial and talent wherewithal, ability and credibility to deliver digital transformation and technological innovation at scale in the industrial internet era are hyperscalers and is likely to remain exclusively hyperscalers.