On July 11, TBR met with SoftwareONE executives to discuss how SoftwareONE fits within the competitive landscape for SAP Business Suite 4 HANA (S/4HANA) software and IT services. The executives included Chief Marketing Officer Susanna Parry-Hoey, President of Solutions & Services Bernd Schlotter, Chief Technology Officer Mike Fitzgerald, and Global Analyst Relations Director Jochen Wolf. During the introductory discussion for TBR, the SoftwareONE team provided extensive details about the company’s size, strategy and performance. The following reflects both the July 11 discussion and TBR’s ongoing analysis of the software and IT services space.

Looking into clients’ current environments to understand the future

In TBR’s view, SoftwareONE’s business model and operations over time have positioned the vendor to understand software and IT services customers’ changing behaviors, in terms of how customers use technologies and complementary services as well as how customers adjust their budgets and spending patterns.

At a time when accelerated moves to cloud appear to be every enterprise’s top priority, SoftwareONE’s view into customer behavior provides a potentially differentiated approach to serving clients’ needs. Translating those views into analysis and shared knowledge and turning accelerated decision-making into growth of SoftwareONE’s own solutions and products will challenge the vendor in the near term, but TBR believes the executive team presented a compelling case for SoftwareONE’s potential in a highly competitive market.

In outlining the company’s approach, Fitzgerald said SoftwareONE provides clients a “safe pair of hands” and noted the vendor’s contentment with solving problems, “helping clients with the basics.” In TBR’s view, this grounded assessment of SoftwareONE’s place in the ecosystem reflects the company’s strategic decision to remain exceptional at what it can do, rather than trying to expand into adjacent or tangential areas, potentially compromising quality delivery and SoftwareONE’s brand.

Additionally, TBR believes many clients find “innovation” scary and unnecessarily disruptive when they are simply trying to keep pace with moving to cloud or retiring old software. Being reliable — a safe pair of hands — may be a greater strength than being perceived as innovative.

A full-spectrum services, software and solutions vendor, deeply rooted in the ecosystem

To provide context, the SoftwareONE team walked TBR through some of the company’s key highlights, including a roughly 9,000 employee headcount, 65,000 clients across 90 countries, and 2021 revenues that topped $1 billion, split almost evenly between the Software & Cloud and Solutions & Services business units. The executives noted that 2021’s revenues represented a 16% increase year-to-year, with the Solutions & Services business unit growing around 38% in the same comparison.

Additionally, the team described core services offerings as focused on customers’ technology journeys and commercial journeys. Offerings for the former are grouped by application services, cloud services, SAP services, and digital workplace. For the commercial journey, SoftwareONE has capabilities around IT asset management, software digital supply chain, FinOps (cloud financial management), and software publisher advisory.

The SoftwareONE team provided details on the newly launched Goatpath by SoftwareONE brand of offerings, which are a blend of cloud-enablement software and a marketplace, described as an “E-commerce for buying, selling and managing software, services and solutions.” SoftwareONE executives described a company capable of meeting clients’ needs across the “advise & design, buy, implement & build, and optimize & manage” spectrum through both its own solutions and services and those of technology partners, including the hyperscalers and SAP.

The evolution of SoftwareONE’s strategy, from transactional to a true partnership model with customers, fills a clear gap for many end customers. As cloud technology becomes a larger part of most organizations’ IT strategy, the need for guidance, implementation and ongoing managed services is becoming quite clear. The largest enterprise customers can look to global systems integrators for that guidance, but midsize and smaller organizations need a partner that can match their scale and budgetary constraints. With more than 65,000 clients, SoftwareONE is serving organizations across a wide spectrum, filling the gaps end customers have in designing, procuring and managing their increasingly cloud-led IT strategies.

SoftwareONE has a huge client base to build on, and the company aims to offer net-new IP and unique value that support customers’ cloud transitions. Unique IP with the Goatpath brand and growing managed service capabilities illustrate that the company is about much more than just augmenting clients’ internal staff. Furthermore, SoftwareONE remains focused on ROI as it touts its cloud optimization and cost savings outcomes from more active management of cloud and technology solutions. In these ways, SoftwareONE is modernizing its value proposition in line with the IT strategies of its sprawling base of customers of different sizes.

3 key points: SAP, sales and SMEs

Considering SoftwareONE within the broader market, particularly for IT services, a few points stand out for TBR:

- A fast-growing, well-staffed and experienced SAP practice gives SoftwareONE an advantage in a crowded market for SAP-related services. For instance, SoftwareONE’s expertise across both SAP and all public cloud providers (Azure, Amazon Web Services and Google Cloud) will strengthen its value proposition to enterprises considering running SAP in the cloud and moving to SAP S/4HANA. The growing adoption of public cloud infrastructure to replace on-premises or private cloud hosting as well as the closing window to replace the old ECC solution with next generation S/4HANA is driving higher demand for SAP services; yet organizations are less keen to embark on large and complex greenfield projects and prefer a more pragmatic and step-by-step approach for their journey toward S/4HANA running on public cloud. As such, by threading its SAP practice together with talent and experience with the hyperscalers, SoftwareONE is positioned to benefit from this trend and TBR expects SoftwareONE’s SAP revenue growth will continue to outperform that of peers.

- With separate teams selling advisory and software, SoftwareONE has clearly learned a lesson many consultancies new to the SaaS game have only begun to understand: Sales motions for software — especially marketplace click-to-buy models — fundamentally differ from sales motions for consulting, and individuals or teams rarely excel at selling both. That being said, SoftwareONE is able to capitalize on both license renewals and cloud moves as triggers for cross-selling the two motions.

- Small and medium enterprises account for around 70% of SoftwareONE’s clients, giving the company an exceptional presence in a marketplace increasingly eyed by the Big Four firms and other consulting-led IT services vendors. This presence, combined with SoftwareONE’s relationships with the hyperscalers and certified talent, will likely lead the Big Four and others to increasingly seek opportunities to partner with SoftwareONE, especially as SoftwareONE builds its talent and client base in Latin America, Europe and Asia Pacific.

Know Your Customer to be a better partner and play to your strengths

For TBR, SoftwareONE’s ability to see into its clients’ technology environments, buying behaviors and upcoming needs — akin to U.S. banks’ Know Your Customer requirements — provides the company an excellent opportunity to compete aggressively in a crowded and messy marketplace for services, solutions and software. TBR thinks SoftwareONE is doing three things particularly well by leveraging this position.

First, the company values partnering with the hyperscalers and SAP, even if that creates potential for competing with them.

Second, SoftwareONE works with clients where they are, not where they could or should be. Rather than direct clients toward services and solutions better suited to more technologically advanced or mature enterprises, SoftwareONE stays within a client’s space and immediate needs, perhaps reflecting that deep understanding of the client’s environment and budget. SoftwareONE can provide innovative thinking and road maps for transformations, but rather than lead with the imaginative future it emphasizes the safe pair of hands.

Third, SoftwareONE’s executive team has a firm handle on the company’s future, through strategic acquisitions, smart partnering with the hyperscalers and SAP, and investments in company IP to complement ecosystem partners’ offerings and expand value across the ecosystem. Play nice in the sandbox, listen to what your clients want, and play to your own strengths to build sustainable growth — a proven formula for success in the IT services and software marketplace.

TBR’s coverage of the software, cloud, IT services and management consulting markets includes vendor-specific reports, multivendor benchmarks and market landscapes, published quarterly or semiannually. Foundational research for this special report included the following:

- Cloud Ecosystem Market Landscape

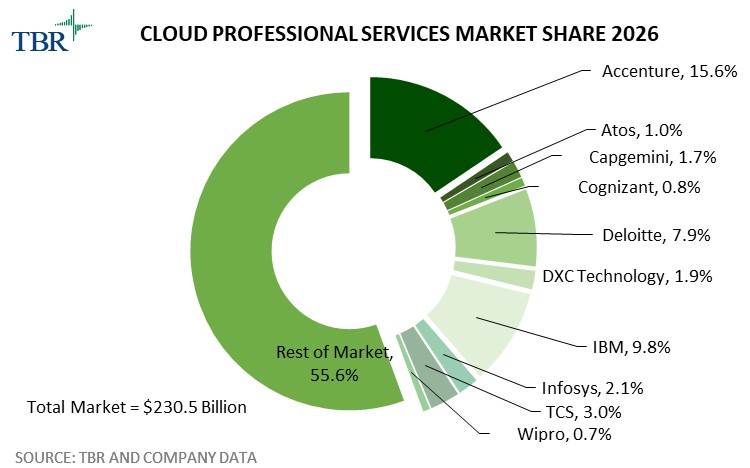

- Cloud Professional Services Market Landscape

- IT Services Vendor Benchmark

- Management Consulting Benchmark