Peraton’s purchase of Perspecta: The latest move in the quest for scale in federal IT

Scale is king

Peraton’s purchase of Northrop Grumman’s (NYSE: NOC) IT services business and pending acquisition of Perspecta (NYSE: PRSP) are clearly aimed at obtaining the scale necessary to compete for large enterprise and digital transformation deals, which have become common in the public sector IT services market.

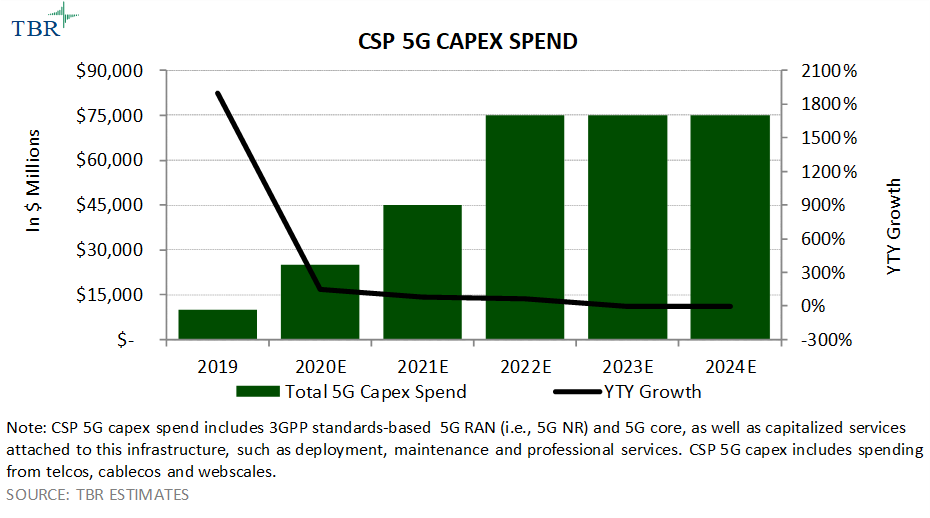

Peraton is hardly the first in this space to make such transformative purchases. SAIC (NYSE: SAIC) made two large acquisitions in two years with Engility and Unisys Federal in 2019 and 2020, respectively; General Dynamics IT (NYSE: GD) purchased CSRA in 2018; and Leidos (NYSE: LDOS) perhaps started the trend with its purchase of Lockheed Martin (NYSE: LMT) Information Systems & Global Solutions (IS&GS) in 2016. As federal agencies seek to modernize and transform their operations to take advantage of emerging technologies such as cloud, 5G, AI, machine learning, and AR and VR, large monolithic deals, such as the Next Generation Enterprise Networks Recompete (NGEN-R), Defense Enterprise Office Solution (DEOS), Global Solutions Management – Operations II (GSM-O II) and Joint Enterprise Defense Infrastructure (JEDI), among others, illustrate the importance of being able to deliver these technologies and surrounding services at scale.

Companies such as Leidos, General Dynamics Technologies (GDT) and Booz Allen Hamilton (NYSE: BAH) have come out as the clear winners on the vast majority of multibillion-dollar deals like the ones mentioned above, thanks largely to their ability to deliver digital transformation at scale and proven past performance. TBR believes this trend is only going to become more pervasive in 2021 as the federal government pursues continued IT modernization across defense, intelligence and civilian agencies. Alternatively, if the federal government begins to move toward smaller contracts in terms of total value and/or duration, Peraton’s newly acquired scale would no longer be an asset. However, this is likely only a long-term concern, as the federal government shows no signs of ramping down contract sizes or duration for the foreseeable future.

Why Perspecta had to die

Perhaps nothing illustrates the importance of scale more than the death of Perspecta. When the company was formed from the merger of DXC Technology’s (NYSE: DXC) public sector business with Vencore and KeyPoint Government Solutions in 2018, the clear intention was to create a federally focused contractor of scale that could compete for the large transformative deals that have become commonplace. Most important among these was the NGEN-R contract, whose predecessor, the NGEN contract, was held by Perspecta and represented nearly 20% of the company’s total revenue.

Despite this, Perspecta was unable to win the $7.7 billion NGEN-R, which was awarded to Leidos and will begin to ramp up in 2H21, leaving Perspecta with a loss of 19% of its total revenue, which cannot be replaced quickly enough to avoid steep losses year-to-year.

Losing the NGEN-R bid put Perspecta in a very difficult place, beyond the obvious financial burden. The company’s leadership has fielded tough questions from Wall Street about where the company is headed without NGEN-R. Perspecta has been unable to win any comparable deals, such as DEOS or GSM-O II, on which it has bid in the last year or two. Additionally, the company does not have as strong of a portfolio in emerging technologies as many of its competitors, and it is highly unlikely Perspecta on its own could have returned to growth quickly enough to appease its stakeholders. In this context, it is clear that Perspecta needed to die. With its pending sale to Peraton, there is opportunity to reemerge as a more formidable competitor in the federal IT services market, free from the burdens associated with its past failures as part of Peraton.

On Jan. 27, Perspecta announced its purchase by Peraton, a Veritas Capital portfolio company, for an all-cash price of $7.1 billion. This acquisition comes on the heels of Peraton’s purchase of Northrop Grumman’s IT services business, which closed Feb. 1 (outlined in TBR’s special report End game for Northrop Grumman’s IT services business). The resulting company, which will retain the Peraton name, will be a $7.6 billion to $7.9 billion business on a pro forma basis with approximately 24,300 employees, in TBR’s estimates.