GenAI and the Power of the Use Case

Vendors capable of playing nice in the GenAI sandbox and backing up their GenAI stories and promises with delivered results for clients will outpace peers in 2024. Vendors missing any of those components will still be able to benefit from the GenAI gold rush, but they will experience poorer results and diminishing relevance in the market. Download your free copy of TBR’s AI & GenAI Spotlight Report to read more on TBR’s GenAI market research.

What is GenAI?

Generative AI (GenAI) is a type of AI that allows users to create completely unique items, including text, images, video and audio, from written requests. The most critical difference between commonly used AI tools and GenAI is simply the difference between answering a question using available information verse creating a unique answer. AI is asking Alexa who won the Boston Celtics game last night. GenAI is asking Alexa to write a text to a friend to tell him he should have bet on the Celtics for last night’s game.

At TBR we’re continually examining the business models and financial, resource and go-to-market strategies of companies in the technology ecosystem, so we’re often looking beyond the marketing hype to the delivered value and financial results. The use of the word “stories” rather than “strategies” when it comes to GenAI highlights the critical need for use cases for this new technology. In the case of GenAI, what clearly mattered in 2023 and will continue to matter in 2024 is not nuanced strategic decisions or even fine-tuned market positioning but the need to tell a good story.

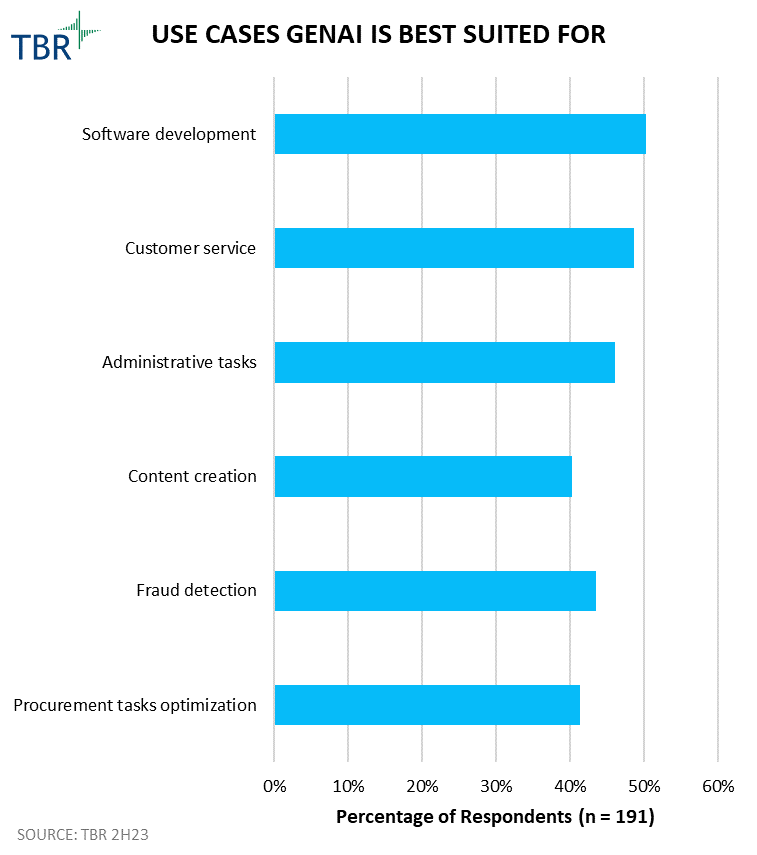

Top GenAI Uses Cases

Relentless GenAI hype has carried in its wake both credible examples of the technology deployed in pilot projects and wild speculation about use cases that could be scaled once the analytics, compute power, and change management approaches are acquired and aligned.

It is still too early to catalog credible, deployed-at-scale use cases or speculate on which vendors across the entire IT ecosystem have taken any kind of use case lead. Anticipating that kind of analysis in mid-to-late 2024, TBR instead has followed the leads provided by enterprise GenAI buyers who have noted that use cases have mostly been presented in tiers:

- Short term: Productivity improvements. Notably, these use cases can most credibly and quickly be attested to by IT services vendors and consultancies applying GenAI solutions to their own operations.

- Midterm: Standard enterprise applications, such as CRM, ERP, HCM and SCM. For these, while the IT services vendors and consultancies may play the role of data and ecosystem orchestrators, the heavy lifting will come from the software and cloud vendors, provided, of course, the infrastructure can support GenAI compute and storage needs.

- Long term: As one PwC leader put it, “You’re talking to your business, and it talks back.”

What Makes GenAI Different From Other Next-generation Technology?

How is GenAI technology, especially the popularized applications exemplified by ChatGPT, unique? Well, exactly that popularization, for starters. Enterprise technology buyers and employees influencing technology decision making don’t cower at technical complications; rather, these personas are enthused — possibly terrified, but that’s a short-term phenomenon — by what GenAI can do for them. Plus, most people respond to a story, not a strategy.

A good story around deploying GenAI will stand out in an overhyped market. In the countless discussions around GenAI that TBR has had with clients in the last 13 months, we’ve frequently been asked about use cases, which are, essentially, stories about a company finding a way to use this new magic. Without these use cases, there are no stories around GenAI and, therefore, no excitement. Use cases will remain necessary to GenAI strategy in 2024, but “playing nice in the GenAI sandbox” will increasingly become the clearest marker of a successful GenAI strategy.

While GenAI became the tech world’s darling in 2023, a pivot to ecosystems dominated how TBR began thinking about the changing technology market landscape. At the request of clients and built on decades of deep research around individual vendors, we launched dedicated analysis of how companies we cover interact, including interdependencies, revenues realized, and alignment challenges.

Among the constant themes: Companies that partner well outperform peers. The traditional boast of “end-to-end” makes no sense in today’s technology environment, particularly when one considers the implications of wider GenAI adoption, including challenges around talent, compute power, and compliance. “Playing nice in the GenAI sandbox” will be the difference between making money from GenAI and making a business out of GenAI.

Learn More About the GenAI Landscape

At TBR we’re covering GenAI from nearly every market angle. We publish a wide-ranging view of the GenAI sandbox, from management consultancies to cloud vendors and infrastructure providers to device and chip manufacturers.

Our analysis on how companies will interact around GenAI and, critically, what these companies will look for in alliance partners is just the tip of the iceberg for TBR’s research on the technology. Our recently published new research stream, AI & GenAI Market Landscape, covers GenAI from the perspective of TBR’s Telecom, Devices, Cloud, Infrastructure, IT Services and Consulting experts. Additional market-specific AI research will publish later in the year.

To learn more about TBR’s AI & GenAI Market Landscape, download your free Spotlight Report.