With TBR’s Professional Services market and competitive intelligence research, understand the vendor strategies that are resulting in market-leading performance.

Examine portfolios, go-to-market strategies, services delivery, and revenue and profitability around IT services; strategy, operations, technology and organizational practices of management consulting firms; and vendor investment, divestment and portfolio repositioning of public sector vendors, focusing on professional, technical and IT services.

A free trial of TBR’s Insights Center platform gives you access to our entire Professional Services research portfolio and the ability to customize and curate reports detailing our analysis based on your company’s specific needs. Start your free trial today!

Trends we’re watching in 2024:

- The 2023 focus on reskilling and training will pay off in accelerated revenues in 2024.

- Generative AI will create a pivot to outcomes-based pricing.

- Regulations will become a major pain point for all.

Benchmark

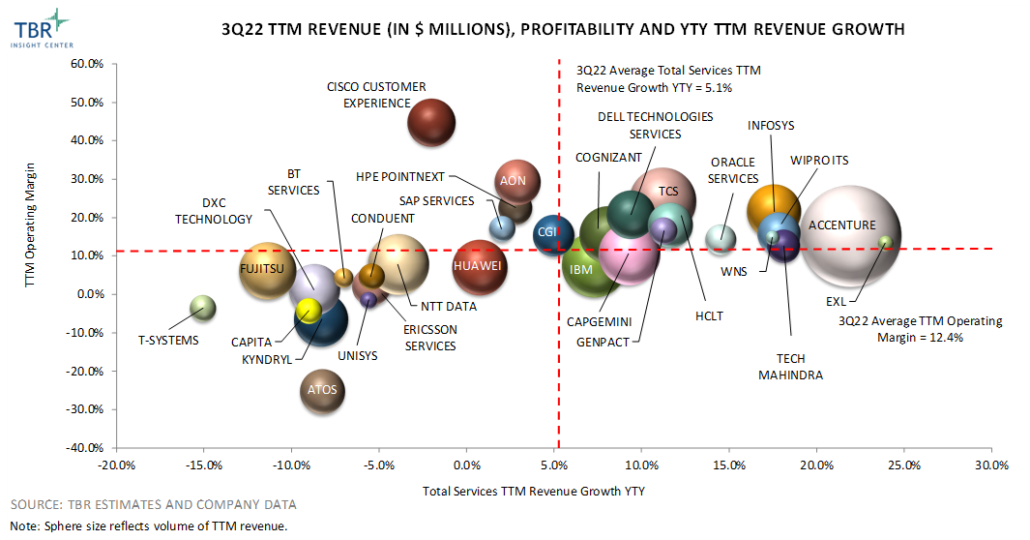

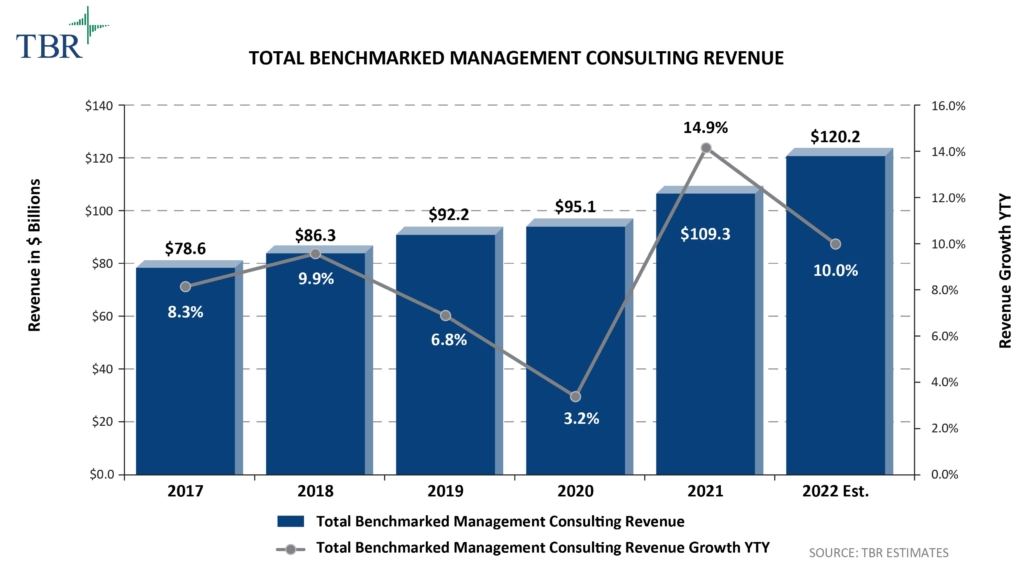

TBR’s Professional Services benchmark research provides clients a comparison of vendor performance in a market, including analysis on vendor strategies, financial performance, go-to-market and resource management. The research graphically portrays comparisons of vendors by myriad metrics, calling out leaders, laggards and business models.

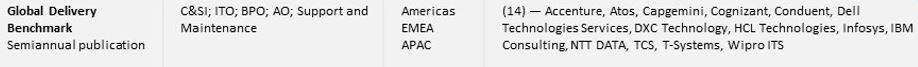

Global Delivery Benchmark

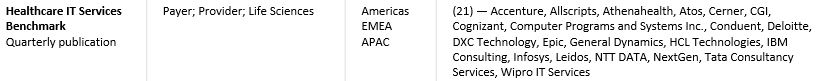

Healthcare IT Services Benchmark

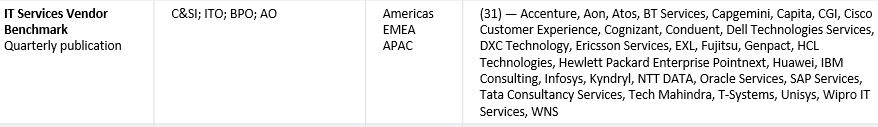

IT Services Vendor Benchmark

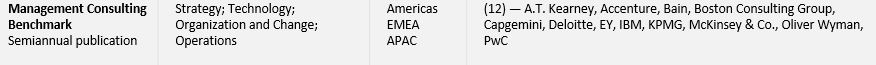

Management Consulting Benchmark

Even if the global economy slows during 2023, clients’ IT spending will not disappear as IT is a necessity that enables clients to establish new business models, grow revenues and create efficiencies to drive cost savings. Vendors’ talent management strategies emphasize finding highly specialized talent and right-sizing nonspecialized talent pools to establish resource benches to address demand for digital transformation. While intense competition for talent remains, macroeconomic headwinds will cool down the labor market in 2023 and shift vendors’ activities from hiring to upskilling, reskilling, career development and improving employee experience.

Market conditions remain unpredictable, leading firms to prepare business models with resilience and the capabilities to respond to a wide range of needs and goals spanning strategy, operations, resource management and technology. As the lines between business segments begin to blur, requiring input from each group, firms will need to bring together the right people and capabilities to drive value for clients. Talent recruitment and retention will remain a challenge for firms, which will dictate success. Lastly, maintaining client trust will help vendors offset competitive pressures and remain go-to-market partners by increasing visibility across different environments.

Market landscape

Professional Services market landscape research includes analysis of an emerging or disruptive market segment or technology, including insight into how vendors and customers address the emerging technology as well as market sizing, vendor positioning, strategies, acquisitions, alliances and customer adoption trends.

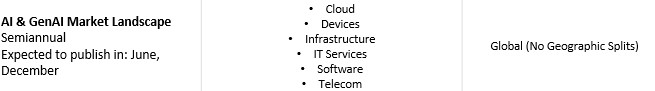

AI and GenAI Market Landscape

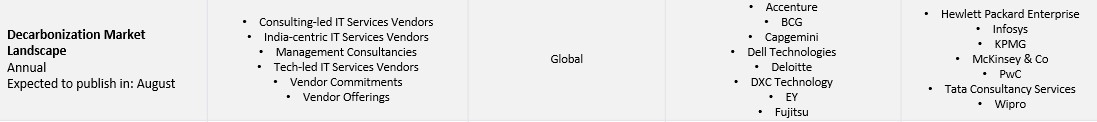

Decarbonization Market Landscape

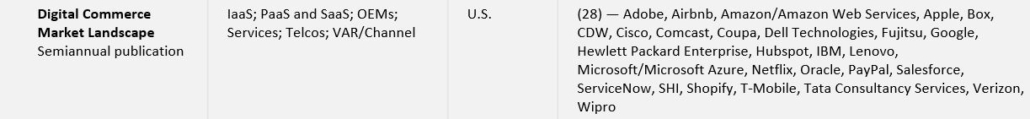

Digital Commerce Market Landscape

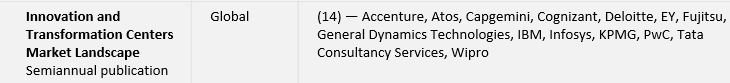

Innovation and Transformation Centers Market Landscape

Click the Images Below to Join TBR’s Subject-matter Experts for An Upcoming TBR Insights Live Session on GenAI Impact on IT Services and Consulting

Vendor Analysis

TBR’s Professional Services vendor reports, profiles and snapshots provide deep-dive analysis into a single vendor across corporate strategies, tactics, SWOT analysis, financials, go-to-market strategies and resource strategies.

We believe the opportunity around cloud, analytics, cybersecurity and product engineering services remains strong as enterprise buyers continue to adjust their operating models to ensure business continuity, leveraging cloud-enabled technologies at both the infrastructure and applications layers. Given its continued success, Accenture has raised expectations about its future performance, a target we believe the company is capable of reaching as long as it does not drift too far into one particular area, such as the metaverse, and instead maintains a pragmatic approach to its diversified go-to-market strategy.

Accenture

Atos

Capgemini

CGI

Cisco Customer Experience

Cognizant

Dell Technologies Services

Deloitte

DXC Technology

Fujitsu

HCLTech

HPE Services

Individual Management Consulting Vendor Profiles on: Accenture, Bain, Boston Consulting Group, Capgemini, Deloitte, EY, IBM, KPMG, McKinsey & Co., PwC

IBM Consulting

Infosys

Kearney Vendor Profile

Kyndryl

LTI Mindtree Vendor Profile

NTT DATA

Oliver Wyman Vendor Profile

T-Systems

Tech Mahindra

Tata Consultancy Services

Wipro IT Services

WNS Vendor Profile

Expectations for GenAI Deployment in IT Services in 2024

Generative AI (GenAI) has been unavoidable, but the early 2023 hype has now been tempered by concerns around cost, technology challenges and ethics. To keep clients interested, IT services vendors and consultancies have pivoted from art-of-the-possible to business-backed use cases. Persistent challenges around deploying actual GenAI-enabled solutions at scale have not abated, even as IT services vendors, consultancies and their clients have become more familiar with AI’s potential and limitations.

KPMG Leaders Talk 2024 Priorities and Plans to Scale Execution

KPMG’s decision to ease into an analyst event with small groups wandering around Lakehouse played to the firm’s strengths as approachable and multifaceted, with each of the three sessions quietly reinforcing the firm’s commitments to maintaining trust with clients, advancing technology-enabled solutions to business problems, and supporting the firm’s own people through professional development and firm culture.