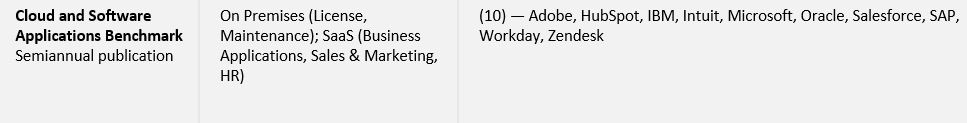

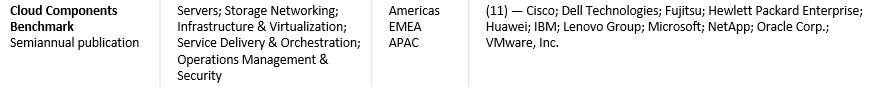

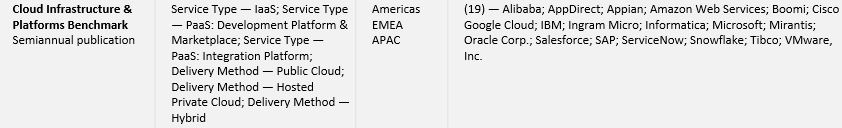

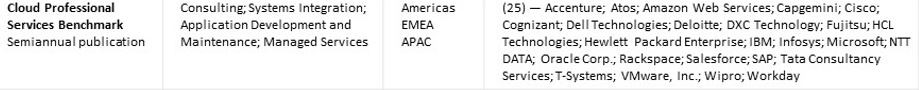

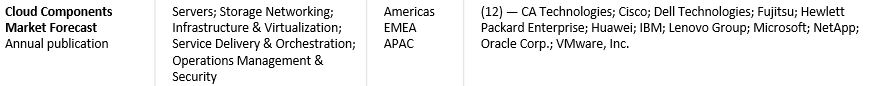

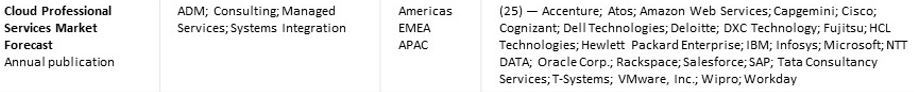

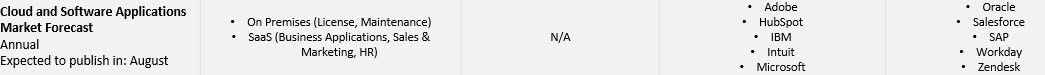

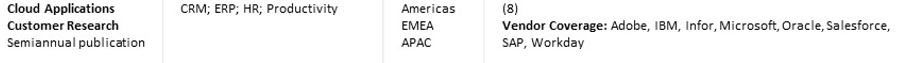

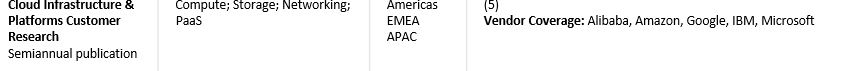

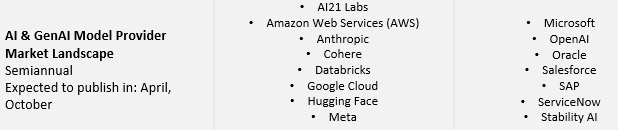

With TBR’s Cloud & Software market and competitive intelligence research, gain a true understanding of how technology and business strategies are being used by leading vendors to address the growing desire for cloud-enabled solutions. Our unique research in this space includes financial data that goes beyond just reported data, revenue and growth benchmarks, go-to-market analysis, ecosystem and partnership teardowns, and market sizing and forecasting.

Receive in-depth financial and business model analysis of the leading vendors in the cloud, rounded out with marketwide perspectives and direct insight from end-customer primary research. This combination of perspectives allows TBR to quantify the financial returns being generated from leading vendor strategies and identify where the market is headed based on feedback from customers making cloud investment decisions.

A free trial of TBR’s Insights Center platform gives you access to our entire Cloud and Software research portfolio and the ability to customize and curate reports detailing our analysis based on your company’s specific needs. Start your free trial today!

Hybrid, Proximity and Ecosystems Are Elevating the Importance of Colocation

/in Special Reports /by Allan Krans, Practice Manager and Principal AnalystWhether due to existing legacy investments, divisional or regional nuances, or acquisition and divestiture activity, heterogeneity will remain in most IT environments. At one point, the benefits of public cloud made organizations consider a homogeneous, fully cloud-based IT delivery strategy, but those visions have faded for most. The challenge — and goal — is to embrace the hybrid heterogeneous approach and find the best way to integrate, manage and optimize services across these diverse sets of delivery methods and assets. Colocation data centers play a critical role for customers, offering a hybrid approach to facilities and in the interconnection of cloud and on-premises services.