With TBR’s Telecom market and competitive intelligence research, examine telecom operator and telecom vendor markets as well as key industrywide trends and developments, such as 5G, edge computing, private networks, and the encroachment of hyperscalers into the telecom industry.

Understand operator business models, capital expenditure, subscriber metrics and next-generation technology adoption, with coverage spanning wireless, wireline, cable and enterprise markets. Access vendor customer demand analysis, portfolio analysis and competitive benchmarking.

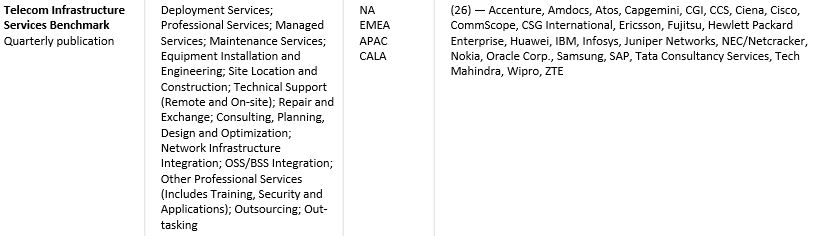

Additionally, we are the leading resource for telecom infrastructure services (TIS) market research.

A free trial of TBR’s Insights Center platform gives you access to our entire Telecom research portfolio and the ability to customize and curate reports detailing our analysis based on your company’s specific needs. Start your free trial today!

Trends we’re watching in 2024:

- New round of M&A and bolder combinations are likely to be allowed by regulators.

- Cash flow management becomes priority due to increase in cost of capital and other headwinds.

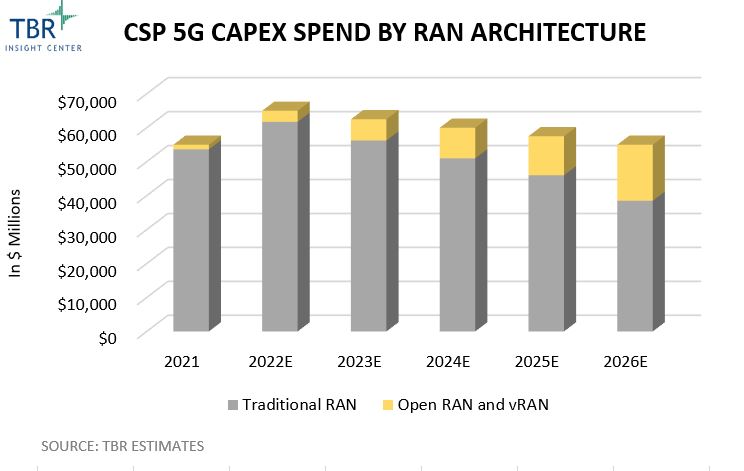

- Open RAN will not be ready for mainstream adoption in 2024.

Benchmark

TBR’s Telecom benchmark research provides clients a comparison of vendor performance in a market, including analysis on vendor strategies, financial performance, go-to-market and resource management. The research graphically portrays comparisons of vendors by myriad metrics, calling out leaders, laggards and business models.

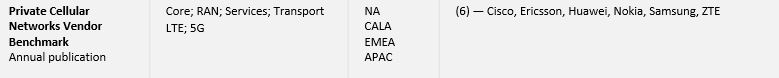

Private Cellular Networks Vendor Benchmark

Telecom Infrastructure Services Benchmark

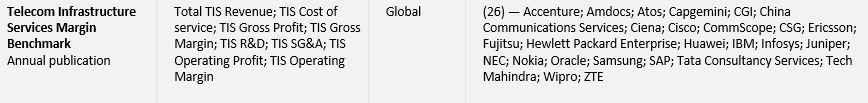

Telecom Infrastructure Services Margin Benchmark

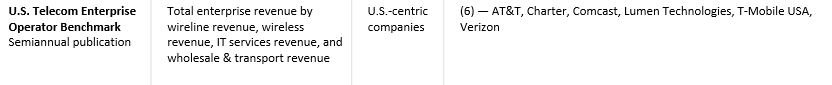

U.S. Telecom Enterprise Operator Benchmark

U.S. Telecom Operator Public Sector Benchmark

U.S. Mobile Operator Benchmark![]()

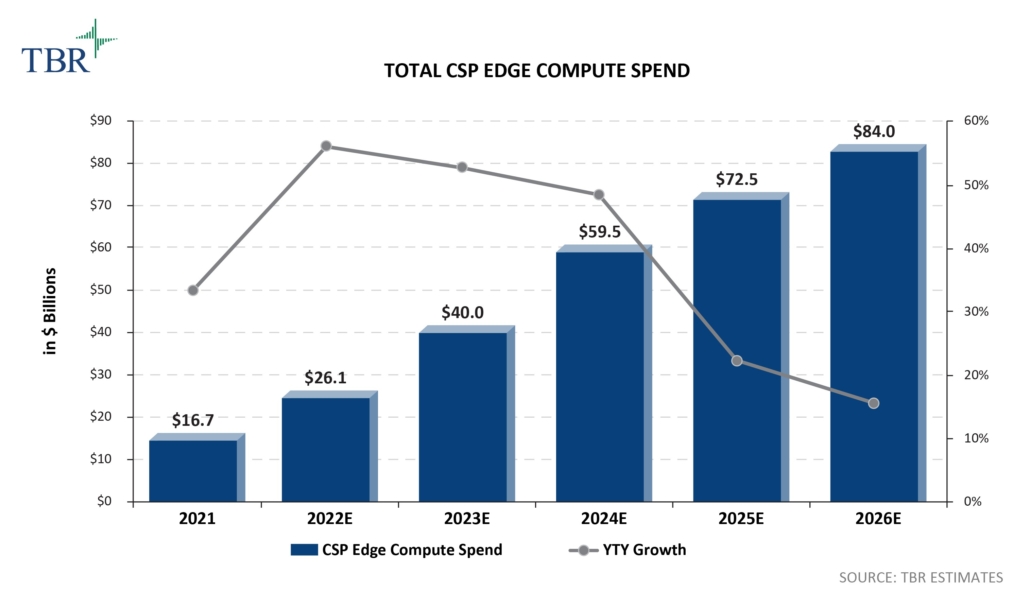

TBR expects continued supply-side and geopolitical disruption in the post-pandemic global economy, but these market challenges will push out rather than reduce total CSP edge compute spend. Digital transformation remains a secular trend that will only be accelerated by ongoing economic and geopolitical gyrations, and edge computing is a key enabling technology for realizing outcomes such as Industry 4.0.

Market Forecast

TBR’s Telecom market forecast research provide analysis of market opportunity as well as current market sizing and five-year forecasts, including analysis on growth drivers, top trends and leading market players.

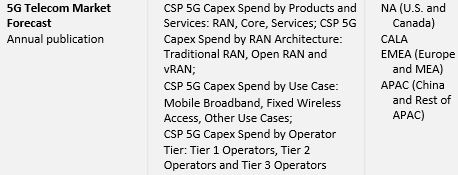

5G Telecom Market Forecast

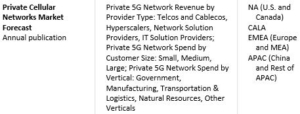

Private Cellular Networks Market Forecast

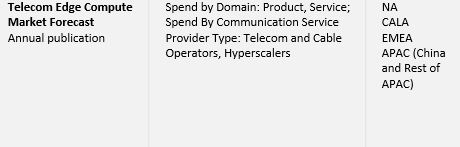

Telecom Edge Compute Market Forecast

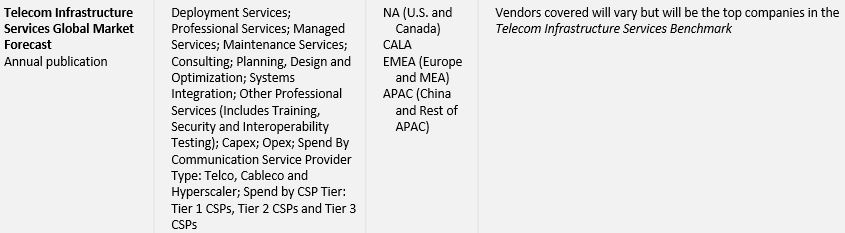

Telecom Infrastructure Services Global Market Forecast

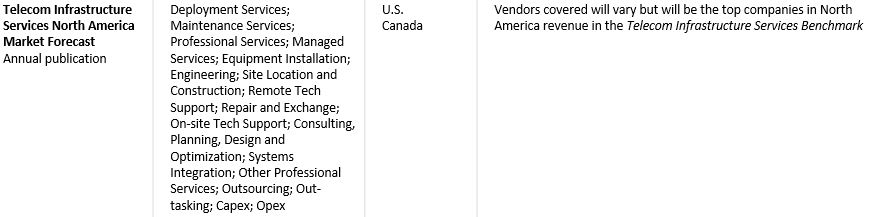

Telecom Infrastructure Services North America Market Forecast

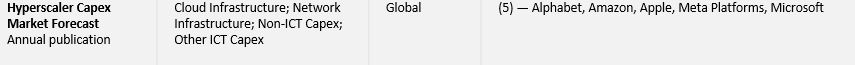

Hyperscaler Capex Market Forecast

Market landscape

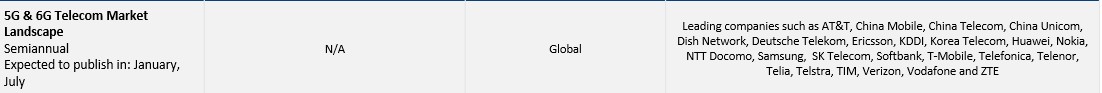

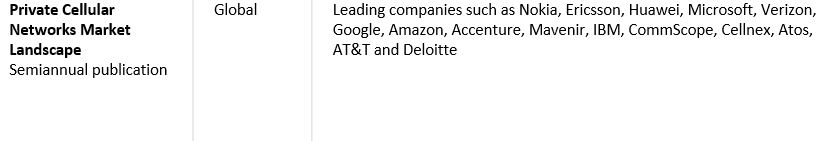

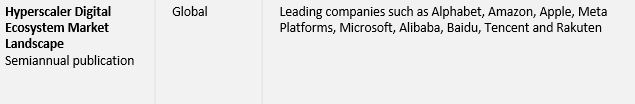

Telecom market landscape research includes analysis of an emerging or disruptive market segment or technology, including insight into how vendors and customers address the emerging technology as well as market sizing, vendor positioning, strategies, acquisitions, alliances and customer adoption trends.

5G & 6G Telecom Market Landscape

Private Cellular Networks Market Landscape

Telecom Edge Compute Market Landscape

Hyperscaler Digital Ecosystem Market Landscape

Telecom AI Market Landscape

Vendor Analysis

TBR’s Telecom vendor reports, profiles and snapshots provide deep-dive analysis into a single vendor across corporate strategies, tactics, SWOT analysis, financials, go-to-market strategies and resource strategies.

Ericsson’s earnings were buoyed by the favorable resolution of its patent dispute with Apple and accelerated rollout of 5G RAN in India, but market headwinds such as inflation and slowing 5G rollouts in the U.S. will continue to place downward pressure on financial metrics throughout 2023.

Alphabet (Google)

AT&T

AT&T Global Public Sector Vendor Profile

Cisco Systems

Comcast

Ericsson

Huawei

Nokia

T-Mobile USA

Verizon

Verizon Public Sector Vendor Profile

From Front to Back Office: A Look at GenAI Use Cases in Telecom

TBR’s research indicates the domains that will be the most disrupted by, and also yield the greatest ROI from, the use of GenAI are customer care, administrative functions and sales. For example, the cost of operating contact centers could be reduced by as much as 80% via the use of GenAI. In addition to significant cost reduction, CSPs can expect to derive other benefits from GenAI, such as better customer outcomes and lower churn compared to more traditional, human agent-centric contact centers. GenAI chatbots are expected to behave like seasoned, top-rated human agents, able to guide customers and address their issues in a much more efficient manner.

U.S. Telecom Operator Outlook: Public Sector Revenue Growth for 2024 [Infographic]

TBR estimates public sector revenue from U.S.-based service providers grew 6.1% year-to-year in 4Q23 to $5.4 billion (highlighted in the TBR infographic below). Total public sector revenue growth was driven by wireless revenue, which increased 9% year-to-year to an estimated $2.8 billion. First responder initiatives such as AT&T FirstNet and Verizon Frontline are the main drivers of public sector wireless revenue growth as these units are attracting public safety agencies seeking enhanced reliability to support mission-critical workloads and use cases.