As the efficiencies of automation, analytics and AI begin benefiting technology companies themselves, not just their enterprise clients, TBR sees the latter half of 2024 as fundamentally business model disruptive for pretty much every technology company we cover, from McKinsey & Co. to Infosys to Dell Technologies to Amazon Web Services to IBM to Ericsson to NVIDIA. In this blog we look at what happens when GenAI comes for the IT services companies, the consultants and their technology ecosystem partners; what happens when GenAI “customer zero” starts to scale inside IT services firms, consultancies and technology ecosystem partners; and more.

The Collapse of the Classic Labor Pyramid

At the same time that post-pandemic macroeconomic conditions led most enterprises to prioritize cost reductions and operational optimization over digital transformation and new growth, technology companies and large consultancies began adopting GenAI-enabled solutions to their own operations and delivery. IT services companies, telecom equipment providers, and others across the IT ecosystem built business models around long-term contracts with limited flexibility. In a sustained inflation macroenvironment, cutting costs helps maintain margins and deploying AI can be a quick move for cutting costs.

As the efficiencies of automation, analytics and AI begin benefiting technology companies themselves, not just their enterprise clients, TBR sees the latter half of 2024 as fundamentally business model disruptive for pretty much every technology company we cover, from McKinsey & Co. to Infosys to Dell Technologies to Amazon Web Services (AWS) to IBM to Ericsson to NVIDIA.

Sometimes We Are So Smart It Is Scary

In 2017, in a market untouched by GenAI hype, TBR wrote the following in a special report, Service delivery model evolution, metrics and survival tips: “Development and adoption of analytics-enhanced service delivery and project management platforms signal vendors’ delivery future lies in cognitive-enabled automation, not labor arbitrage.” And we explained why: “The integration of automation solutions positions vendors to not only offset investments in onshore digital talent and client centers but also monetize their own IP through value-added service offerings.”

Put another way and updated only slightly to account for GenAI succeeding automation, what happens when GenAI comes for the IT services companies, the consultants and all their technology ecosystem partners? Massive business model disruption littering the competitive landscape with successes and failures.

For TBR, the next transformational wave generated by GenAI will come from the implementation of GenAI-enabled solutions within the companies delivering services around technology. As we said in 2017, the “future lies in cognitive-enabled automation” (read: GenAI), not the perfect resource pyramid.

In summer 2023, TBR noted that GenAI use cases that resonated the most were “customer zero” — that is, companies developing GenAI-enabled solutions, deploying them internally, and measuring the benefits while working out the kinks so they could then credibly tell clients, “This really works, and here’s the impact.”

Internal knowledge management, sales and marketing enablement, and supply chain enhancement are all use cases that have been touted by tech companies and consultancies as being tested and tried internally before being deemed ready for pilot projects and maybe even scaled deployments. Among the most-hyped customer-zero use cases were the ones promising a reduction in labor hours dedicated to routine tasks, including software coding and testing.

Some of those labor hours were precisely what clients were paying for, as they were what tech companies and consultancies brought as their value proposition. While perhaps an oversimplification from the perspective of an IT veteran skeptical that GenAI-enabled automations could implement, test, troubleshoot and upgrade, from the IT buyer’s perspective, isn’t this what all the GenAI hype was all about: getting to decisions faster, minimizing costs and leveraging technologies, especially the ones enterprises already paid for? More on the last point below, but the short answer is yes. The early GenAI promises were not about changing the world; they were just taking out the mundane tasks.

So what happens when customer zero starts to scale inside IT services vendors, consultancies and other ecosystem participants? Disruption, yes — and when we look at our data, listen to our clients and check inside our crystal ball*, we see the following:

- Low-risk, fast-return GenAI solutions compelling companies to invest time and cost savings into upskilling and training, or companies displacing people who are unable to add value on top of the tasks that AI and automation took over

- Traditional staffing pyramids morphing into obelisks, diamonds and multiple other shapes, challenging talent managers at technology and services companies to maintain a balance between enough skilled people to meet clients’ demands for expertise at scale and too many people sitting on the bench, diminishing financial performance

- Persistent disruption across the technology ecosystem generating headlines around layoffs, mergers and bankruptcies, all while enterprise buyers continue to pay their IT utility bill, thus enabling technology companies with scale, agility and adept financial and resource management strategies to continue growing profitability, even while the market roils

*data = TBR benchmarks; listen to clients = TBR special reports, project work, Voice of the Customer research; crystal ball = our vast body of quarterly work

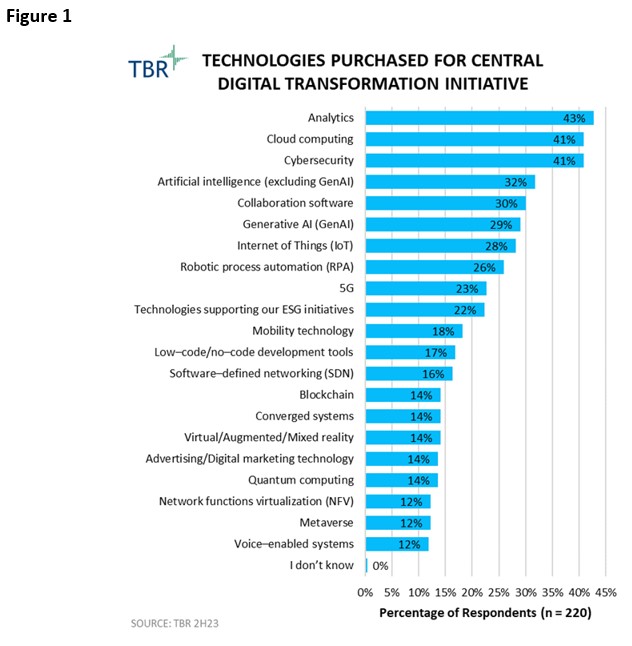

As stated above, at the same time that post-pandemic macroeconomic conditions led most enterprises to prioritize cost reductions and operational optimization over digital transformation and new growth, technology companies and large consultancies began adopting GenAI-enabled solutions to their own operations and delivery. Figure 1 shows analytics jumped to the top place in technologies bought to support digital transformation initiatives, underscoring enterprise buyers’ need not for flashy new AI, but for the outcomes — through analytics — that come from deployed technologies.

As the efficiencies of automation, analytics and AI begin benefiting technology companies themselves, not just their enterprise clients, TBR sees the latter half of 2024 as fundamentally business model disruptive for pretty much every technology company we cover, from McKinsey & Co. to Infosys to Dell Technologies to AWS to IBM to Ericsson to NVIDIA.

People Who Use GenAI Are Displacing People Who Do Not

Every company that TBR tracks recognized in early 2023 that training and upskilling around GenAI needed to be prioritized as an immediate-term investment. Nearly every $1 billion, $2 billion or $3 billion GenAI announcement included some callout around professional development. One year later, many companies have publicly touted their training successes; although with no industry standards, no one can definitively say which companies have followed through and which ones have not. Anecdotally, TBR has had its 2023 assessments confirmed: companies that train their people well were the quickest to train on GenAI, and companies that focused on training to their partners’ technologies and solutions have best leveraged the GenAI ecosystem.

TBR has long questioned the conventional thinking that automation would allow people to do more higher-value tasks. If those tasks have always been higher value, someone is already doing them or maybe they do not need doing at all. GenAI, as it is deployed at scale within technology companies, will begin rapidly exposing who can and who cannot find and do those higher-value — and GenAI-enabled — tasks.

According to TBR’s 2017 special report, Service delivery model evolution, metrics and survival tips: “Just like the use of automation results in the need for new technologies to be integrated with existing systems, grooming the right skilled bench will remain a key challenge and an opportunity for IT services vendors, which for many years have relied on an army of people to develop, deploy and manage what today can be seen as low-level tasks. Educating and developing technical experts who can create differentiating business applications and processes in the era of AI will guide suppliers in their resource management strategies. We do not believe automation will black out the outsourcing industry, but rather partially eclipse it [emphasis added], creating new partnerships between humans and machines, demanding society readiness and fine-tuning the public-private trust.”

If You Thought the Pandemic Was Hard on HR Managers, Watch What Happens in the GenAI Age

Add some GenAI complexity to the usual recruit-and-retain challenges in the technology space, and TBR anticipates a collapse of the traditional staffing pyramid, especially in IT services. Some quick context: Accenture employs over 700,000 people, making it the fourth-largest employer in the world. Tata Consultancy Services (TCS), with over 600,000 employees, is sixth. When these companies adjust their pyramids, the entire IT market will feel it. After the rash of layoffs in 2023, tech sector leaders saw an opening to improve financial metrics and trim staff.

Concurrently, as noted above, these same companies invested heavily in training the remaining workforce on GenAI. Raise a toast to the HR managers who navigated the pandemic successfully and then had to grapple with firings and upskilling demands.

One year later, TBR sees IT services and consultancies, in particular, on the brink of a sea change as their business models have to adjust to a GenAI reality, brought on, in part, by these companies themselves. At their core, IT services companies and consultancies rent out talent to their clients. Need a strategy whiz, an experienced SAP implementer or a whole team of people who can guide your company through a digital transformation? Look to McKinsey, Infosys and Accenture. For a fee, and maybe with a little risk-sharing thrown in, you get people with skills and knowledge for as long as you need them, without the hassle of hiring, promoting or firing them.

So what happens when GenAI-enabled solutions can capably and reliably do many of the routine tasks typically handled by junior-level IT services employees and entry-level consultants? And what happens when the apprentice model gets displaced by AI-enabled learning, when skills become more critical than accumulated — and highly searchable — knowledge? Pyramids collapse, and experienced IT services professionals and consultants manage a small team of people equipped with a big team of bots.

Consulting might be the third-oldest profession, and the business model at times seems unshakable as people will always want to turn to other people for advice. On the consulting services value spectrum — tell me what to do, help me do it, do it for me — that first request will always remain a human-driven endeavor. But the army of consultants gathering data, assembling knowledge and filtering options will disappear, leaving only the captains, lieutenant colonels and generals (plus the IT guy).

According to TBR’s Top 3 Predictions for Global Delivery in 2022: “It took a pandemic for IT buyers and decision makers to fully appreciate the capabilities of AI-enabled automations, although adoption has been neither universal nor without challenges. Just as the pandemic highlighted the business case for cloud computing, virtual delivery from everywhere highlighted the case for increased use of automation for as many routine tasks as possible, with the added benefit that AI-enabled platforms could begin learning which tools performed best and which assets were essential to a fully functioning process. In short, the robots used the pandemic to get smarter and will now begin hiring other robots to speed up automation adoption [emphasis added] across enterprises.”

News Is Not a Trend, and Leadership Still Matters More Than Marketing

TBR’s research consistently shows that IT spending grows year after year, at roughly the same pace, almost like utility rates governed by a state board. But the company that gets a larger share of that IT budget pie changes constantly, as is also borne out by TBR’s research.

Tracking quarter-by-quarter leaders and laggards the way TBR does provides value to professionals looking to understand the intricacies of the technology ecosystem, but the larger picture appears to show chaos and uncertainty as mercurial leaders generate headlines and record-setting valuations make household names out of previously niche players. Throw the magic of GenAI into the mix, and clarity may seem unlikely to some in the near term.

TBR begs to differ. Leading tech companies continue to do a few things exceptionally well, even as the news coverage presents a maelstrom and the markets do their fickle thing. First, leading companies lean on their scale or the scale of their ecosystem partners. No client wants to wait. Clients do not want the B team. No client wants to choose which internal demands to prioritize if they believe it can all be done concurrently. And scale, as with all strengths, is relative, allowing even small tech companies to leverage scale, provided they know their market and — critically — know how to use their ecosystem.

Second, leaders at successful tech companies move with precision. Sometimes quickly, sometimes with patience, but always with well-communicated strategic intent. TBR can point to a number of tech companies and consultancies that leapt on the GenAI bandwagon without strategic purpose or a clear understanding about what would come next or what the billions invested were intended to deliver. Smarter leaders articulated a strategy, positioned their companies for 2024 and beyond, and stayed focused on executing. Agility is not making decisions fast; it is moving precisely and with a purpose.

And third, TBR’s research demonstrates that tech companies and consultancies with robust talent management consistently outperform peers. CHROs matter as much — maybe more — than CFOs, as was made blindingly clear during the pandemic. As described above, the talent challenges will only grow tougher in the GenAI age. And an evolving tech ecosystem will further demand that companies train their people on their partners’ technology and value proposition.

Until GenAI Do Us Part

As described in TBR’s special report, PwC stepping up when technology fails to deliver value, and the 2Q24 AI & GenAI Technology Market Landscape, IT buyers and C-Suite decision makers have tired of technology. Decades of multiyear implementations, delayed delivery of promised gains and admonishments to buy the next wave of emerging tech have cooled the lust for the latest thing, a sentiment sometimes overshadowed by the hype around GenAI.

IT companies and consultancies can continue making money from run-the-business IT, and the more adept ones will make more (and more profitable) money off confusion, FOMO and genuine risk-taking around GenAI. (Note: TBR has extensive research on technology companies’ strategies for becoming more adept, as well as the data to show which ones have succeeded.)

Lurking behind all this, and waiting to surface like the shark in Jaws, is the business model disruption that will be coming to IT services vendors and consultancies. Accelerated adoption of previous emerging technologies like cloud, blockchain and edge did not compel most technology companies to entirely rethink their staffing models and consider 10% to 20% workforce reductions. GenAI, particularly for services companies, is dependent on people – people doing tasks, many of which can be replaced by cheaper and faster GenAI-enabled solutions.

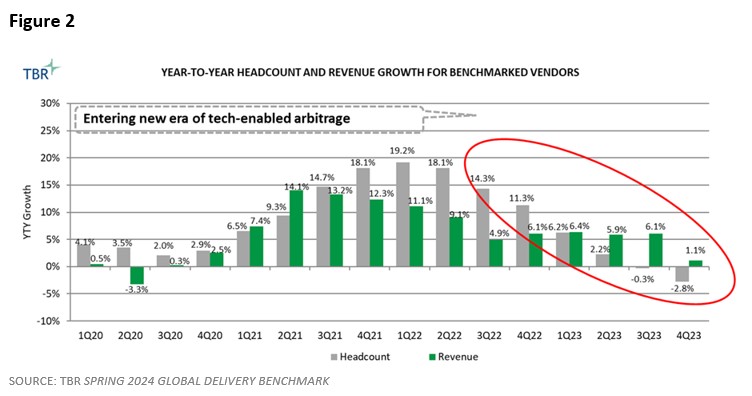

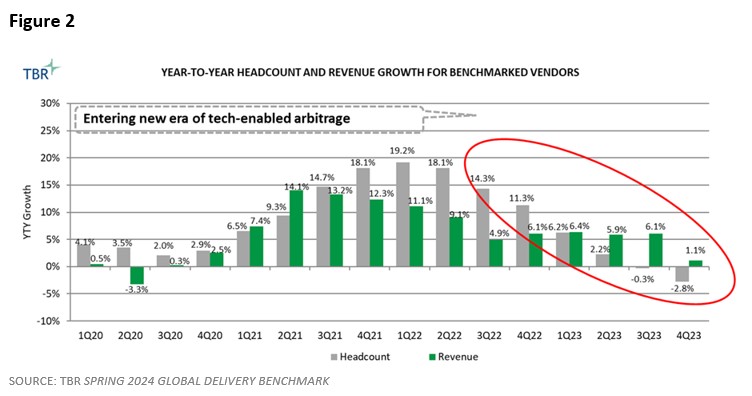

As shown in Figure 2, at the end of 2023 and for the first time since TBR started tracking the offshore headcount of the largest IT services companies, those companies decreased their overall headcount while increasing their revenues. GenAI will, in the near term, accelerate that trend. For IT services companies and consultancies, as we wrote in our 2017 special report, the near future “lies in cognitive-enabled automation, not labor arbitrage.” For the unprepared, here comes the shark.