With TBR’s Cloud & Software market and competitive intelligence research, gain a true understanding of how technology and business strategies are being used by leading vendors to address the growing desire for cloud-enabled solutions. Our unique research in this space includes financial data that goes beyond just reported data, revenue and growth benchmarks, go-to-market analysis, ecosystem and partnership teardowns, and market sizing and forecasting.

Receive in-depth financial and business model analysis of the leading vendors in the cloud, rounded out with marketwide perspectives and direct insight from end-customer primary research. This combination of perspectives allows TBR to quantify the financial returns being generated from leading vendor strategies and identify where the market is headed based on feedback from customers making cloud investment decisions.

A free trial of TBR’s Insights Center platform gives you access to our entire Cloud and Software research portfolio and the ability to customize and curate reports detailing our analysis based on your company’s specific needs. Start your free trial today!

Trends we’re watching in 2024:

- Simply providing cloud services at scale is no longer enough for vendors to gain cloud market share

- IaaS will become more tailored to workloads and regulations

- SaaS vendors will promote multiproduct sales with generative AI

Benchmark

TBR’s Cloud & Software benchmark research provides clients a comparison of vendor performance in a market, including analysis on vendor strategies, financial performance, go-to-market and resource management. The research graphically portrays comparisons of vendors by myriad metrics, calling out leaders, laggards and business models.

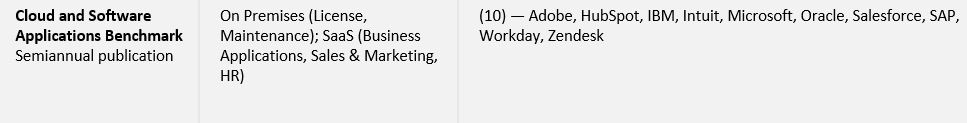

Cloud and Software Applications Benchmark

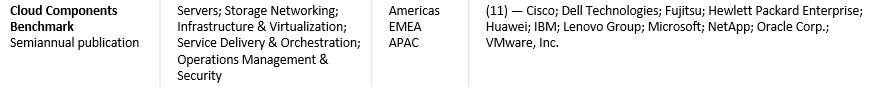

Cloud Components Benchmark

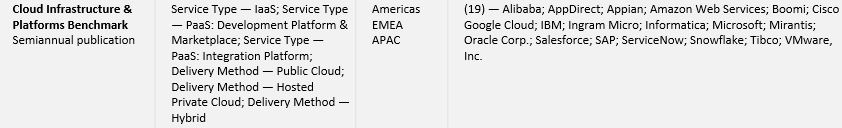

Cloud Infrastructure & Platforms Benchmark

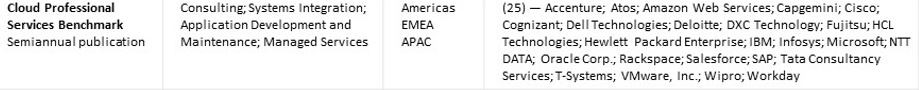

Cloud Professional Services Benchmark

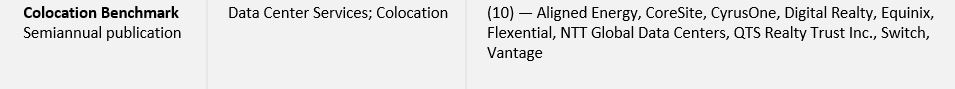

Colocation Benchmark

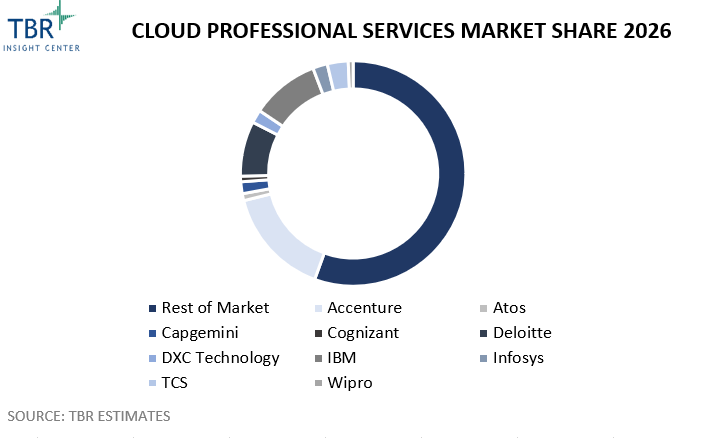

Although cloud providers have attempted to disrupt the cloud professional services industry and secure more share via emerging technologies, GSIs remain the industry leaders across segments. Partnering with these leaders has enabled cloud providers to capture opportunities in the market.

Market Forecast

TBR’s Cloud & Software market forecast research provide analysis of market opportunity as well as current market sizing and five-year forecasts, including analysis on growth drivers, top trends and leading market players.

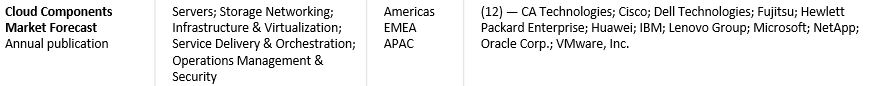

Cloud Components Market Forecast

Cloud Infrastructure & Platforms Market Forecast

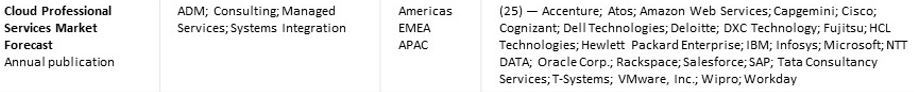

Cloud Professional Services Market Forecast

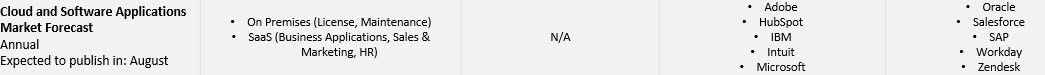

Cloud and Software Applications Market Forecast

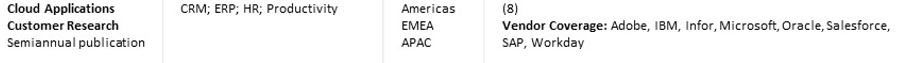

Cloud Applications Customer Research

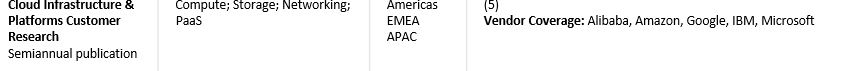

Cloud Infrastructure & Platforms Customer Research

Market landscape

Cloud & Software market landscape research includes analysis of an emerging or disruptive market segment or technology, including insight into how vendors and customers address the emerging technology as well as market sizing, vendor positioning, strategies, acquisitions, alliances and customer adoption trends.

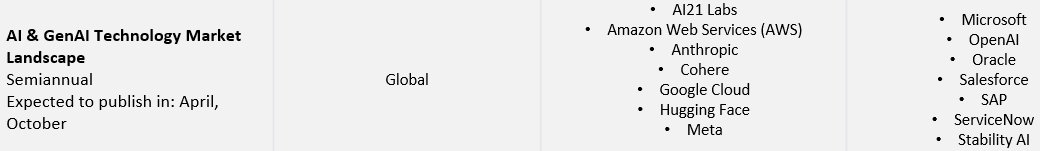

AI & GenAI Technology Market Landscape

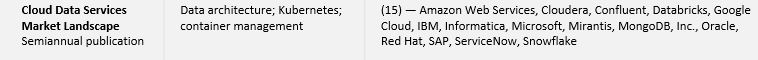

Cloud Data Services Market Landscape

Digital Commerce Market Landscape

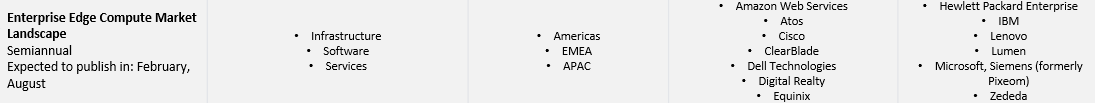

Enterprise Edge Compute Market Landscape

Ecosystem report

Ecosystem reports compile data and analysis from multiple streams of TBR coverage to assess, quantify and model revenues, team compositions, go-to-market strategies and other qualitative insights, including accreditation and training of sell-through and sell-with partnerships, channels or alliances across global ICT markets.

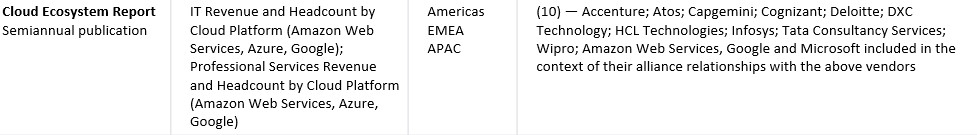

Cloud Ecosystem Report

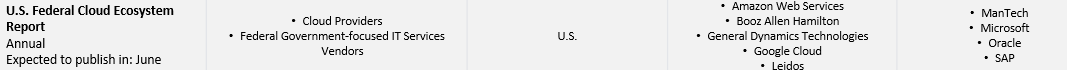

U.S. Federal Cloud Ecosystem Report

Vendor Analysis

TBR’s Cloud & Software vendor reports, profiles and snapshots provide deep-dive analysis into a single vendor across corporate strategies, tactics, SWOT analysis, financials, go-to-market strategies and resource strategies.

Evidenced by the recent overhaul to its partner program, ServiceNow will more heavily rely on global systems integrators (GSIs), resellers and ISVs throughout 2023. In doing so, ServiceNow can rein in some go-to-market and headcount-related costs, giving it the freedom to invest in R&D and strengthening the Now Platform’s position in the market.

Accenture Cloud

Adobe Vendor Profile

Alibaba Cloud

Amazon Web Services

Atos Cloud

Broadcom Vendor Profile

Capgemini Cloud

Cloudera Vendor Profile

Flexera Vendor Profile

Google Cloud

IBM Cloud

Infor Vendor Profile

Informatica Vendor Profile

Intuit Vendor Profile

Microsoft Cloud

Oracle Cloud

Salesforce

SAP Cloud

ServiceNow

Snowflake Vendor Profile

VMware Inc.

UKG Vendor Profile

How to Gain Cloud Market Share in 2024

In 2024 the cloud landscape will become segmented between vendors that can sustain high rates of growth and expansion and those that cannot. Simply providing cloud services at scale is no longer enough for vendors to gain cloud market share. More complex strategies will define the cloud leaderboard in 2024. Additionally, delivering AI-enabled next-generation capabilities and nurturing ecosystems will garner investment despite the slower market growth and macroeconomic uncertainty.

Reliable, Proven and High-functioning: HCLTech’s Cloud-native and GenAI Labs

HCLTech considers the “art of the possible” to be what clients can deploy at scale in the near term. In HCLTech’s Cloud Native Labs, “the possible” is grounded completely in what can be done, not what is theoretically possible. In a decade of visiting innovation and transformation centers, TBR has heard every version of blue-sky creativity and out-of-the-box thinking but cannot recall another IT services vendor definitively connecting “the possible” to “deployable at scale.”