An Atos, DXC merger no threat to Indian IT’s appeal

“‘If Atos acquires DXC Technology, three years of failed attempts by DXC Technology to turn around eroding revenues and thinning profitability would be forgiving …”‘ — India Times

“‘If Atos acquires DXC Technology, three years of failed attempts by DXC Technology to turn around eroding revenues and thinning profitability would be forgiving …”‘ — India Times

“Atos will be closer to the size of Accenture which has reported $45 billion revenue in 2020. Atos will be larger than Tata Consultancy Services (TCS) which will have $22 billion estimated revenue in 2020. Atos will also be larger than IBM Services after the Global Technology Services spin-off at the end of 2021. IBM’s Services revenue will be $23 billion after the spin-off, TBR senior analyst Elitsa Bakalova said.” — YouStartups Networks

The STEM field is growing, creating tremendous opportunity for well-trained applicants. While STEM has traditionally been a male-dominated field, cultivating interest at the undergraduate level can help draw in more women who may have the necessary skills but have never considered STEM as a career path. In TBR’s monthly series Women in STEM, we discuss how female leaders have successfully pursued careers in STEM and are encouraging more female representation by passing on the lessons they have learned to other women who are pursuing this path.

Kris Lovejoy took a nontraditional path to her current position as a cybersecurity leader and advocate of quantum developments at EY. Prior to working at EY, Lovejoy worked in IBM’s cybersecurity business for seven years and was CEO of BluVector, an AI-powered security automation firm, prior to its acquisition by Comcast in 2019.

Lovejoy holds a Bachelor of Arts degree in English from Lafayette College in Easton, Penn., but opportunities that arose at the beginning of her career led her to shift her focus to a career in STEM.

Lovejoy emphasizes the importance of those we entrust with our children during their formative years. “The importance of educators can’t be underestimated,” Lovejoy says. She notes that one of the most influential people in her decision to enter the STEM field was her high school French language teacher, Donna Matles, who “gave me the courage to recognize my own value during some very dark days.”

As a woman with more than two decades of experience in the male-dominated cybersecurity field, Lovejoy says, “Finding the courage to continue where one feels very alone has not been easy, but I and my colleagues in cybersecurity are optimistic that we’re bringing diversity to the field.” It is an unfortunate reality that women with vocal opinions are often labeled as difficult. “Many women, in my experience, don’t feel comfortable speaking out,” says Lovejoy. “Instead, we talk about concerns within trusted circles.”

Often, one of the biggest roadblocks to personal progress is ourselves. In Lovejoy’s opinion, a key way to overcome this roadblock is to “learn how to empathize with others, including those who perpetuate stereotypes. It’s a matter of recognizing that the people you’re working with are human beings, and you can help them see the world through a different lens.” In short: Changing the landscape of STEM requires not being afraid to speak up and ask questions when something does not seem right.

Perhaps the most impactful piece of advice from Lovejoy: “Innovation benefits hugely from diversity.” STEM fields are some of the most innovative fields, yet remain male-dominated. Lovejoy states, “Based on various major tech companies’ diversity reports, female employees make up between 27% and 47% of the workforce, with the percentage dropping much lower when it comes to actual tech jobs, even though women make up more than half of the U.S.’ professional workforce.”

“We must work harder to raise the status of women technologists and promote female role models if we are to attract more women to the industry,” says Lovejoy. In 2018 EY launched EY Women in Technology (WiT) to promote a steady increase in female leaders in technology. “WiT is the articulation and demonstration of EY’s commitment to achieving a greater level of gender equality in a technology-enabled world,” says Lovejoy. Because the gender disparity in STEM fields is a global issue, EY’s global scale, coupled with the efforts of the WiT movement, positions the company well to make an impactful difference. EY is also a member of the Global Innovation Coalition for Change (GICC), a UN Women initiative that brings together private sector companies, academic institutions and nonprofit organizations to improve women’s access to and participation in STEM education.

From an economic standpoint, access to STEM opportunities decreases in line with a student’s socioeconomic status. STEM fields often require access to technical tools or technologies to adequately learn the basic skills. Lovejoy highlights the EY STEM Tribe Platform, which was created in collaboration with Tribal Planet to engage people globally on social impact priorities. This platform enables students worldwide to engage in STEM learning activities on their mobile device, in an entertaining and game-like manner, with modules on everything from climate change and space exploration to 3D printing and AI. “The global platform was previously piloted in India to 6,000 girls, and then EY launched this pilot in two U.S. cities, Seattle and Atlanta,” Lovejoy explains.

While there is still a long way to go in reducing access barriers to STEM resources and increasing the number of women in STEM fields, there have been successes we can celebrate and learn from. For example, Lovejoy states that EY’s cybersecurity team in Saudi Arabia is made up of 46% women. While still technically the minority, this is a massive and surprising win in a region where it is often believed that women are given very little opportunity to thrive.

As we look to these successes and try and replicate them on a global scale, Lovejoy leaves us with one final piece of advice, “Find people that you work with — male or female, doesn’t matter — people willing to speak on your behalf and coach you when you need it.”

EY’s Asia-Pacific Blockchain Summit started with the firm’s Global Blockchain leader, Paul Brody, making three clear points. First, EY is committed to China and to the region, seeing huge potential for blockchain growth. Second, EY is committed to public blockchain as the long-term solution for most business and governments. Third, Brody’s concept of blockchain as the bridge between enterprises — as the tool to tackle the previously uncrossable chasm between different enterprises’ data and business processes — remains a driving force behind how EY sees the future of blockchain, in Asia and the rest of the world.

TBR’s December 2020 special report EY 2021: Hybrid and omnipresent discussed these latter two points: “Public blockchain, in Brody’s words, ‘will do for networks of enterprises and business ecosystems what ERP did for the single company.’ Brody added that conducting B2B [business-to-business] transactions over a public blockchain increases transparency and compliance with commercial terms.” The February event carried that discussion further, and specifically into Asia.

Brody outlined a few major developments for EY in China, with all his comments reinforced by the subsequent panel speakers and EY professionals who provided additional color, both for the China-specific elements and developments impacting the entire region. In short:

In addition, Brody touched on the opportunity blockchain presents in Asia, highlighting China and the Chinese market’s emphasis on digital payments as a precursor to blockchain adoption as well as a robust startup scene. He also highlighted three sectors where EY has been “making exceptionally large” investments: financial services, supply chain and the public sector, which underscored one of Brody’s main points around the importance of public blockchain as the core, foundational building block. He noted that “money and stuff are tokens … contracts are a mix of legal agreements and business processes,” so all business could be conducted on the public blockchain, which is EY’s focus on enterprise solutions.

On Feb. 2, EY hosted an Asia-Pacific Blockchain Summit, a virtual event run by the EY Blockchain practice based in Singapore that included EY professionals and clients, startup executives, and industry experts who are primarily, but not exclusively, based in Asia. The three-hour event included a keynote from EY Global Blockchain Leader Paul Brody, a blockchain solution demonstration, and panel discussions covering the technology, including the challenges and opportunities associated with blockchain and the broader emerging technology space. The following is TBR’s commentary on noteworthy announcements and participants’ assertions made during the event as well as EY’s overall blockchain strategy.

IBM (NYSE: IBM) spent the second half of the 2010s laying the foundation for its quantum business. This foundation predominantly focused on hardware development and hardening until the available quantum systems at IBM supported more sophisticated software capabilities. In the 2020s, IBM is now able to pivot its strategy toward more sophisticated aspects of quantum computing, mainly software and control, but with a constant current of hardware innovation to fundamentally support more sophisticated software innovation.

Reminiscent of Intel’s tick-tock development cycle, where the “tick” represented a new chip design and the “tock” represented software optimizations, IBM now has sufficiently stable quantum componentry within the systems to begin working on the next evolutionary step, which is the creation of dynamic circuits within the next two years. As IBM has decided to build off existing, classical programming languages, Python is at the core of IBM Quantum’s software strategy. This provides IBM with access to about 8 million existing classical computing Python coders, who need minimal quantum-specific training to pivot into this new world of computing.

A key pillar of IBM’s quantum road map and a game-changer in scalability and speed to insight is the development of dynamic circuits, which IBM has listed as a 2022 goal on its road map. Dynamic circuits will enable quantum computation to more closely mimic classical computation in that if/then statements will become possible on quantum computing. Without dynamic circuits, quantum algorithms cannot pivot midway through a process. Therefore, one must run an algorithm through completion, analyze that data and then run another circuit based on insights gained halfway through the process. Dynamic circuits enable an algorithm to measure a qubit’s state — a 0 or a 1 — at a predetermined point in the process and react accordingly, reducing the need to rerun algorithms and reducing the time to insight as well as the volume of qubits consumed.

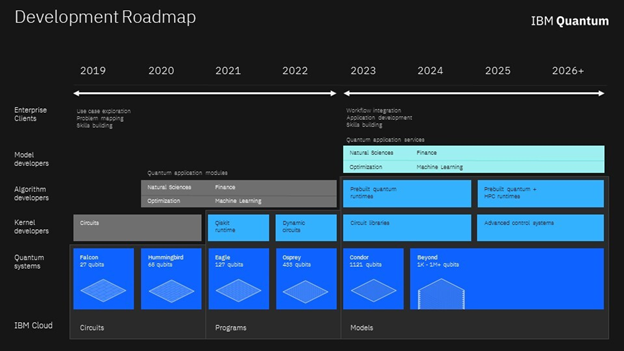

Market overview: IBM’s five-year quantum road map comprises developments across the entire quantum infrastructure stack, including hardware, software, services, ecosystem and use-case-specific goals. General focus areas include an emphasis on application modules through 2022 and on application services from 2023 to 2025. Underpinning these broad goals is the systematic development of hardware, software and services capabilities, much of which hinges on a quantum ecosystem IBM has invested in and built, the foundation of which is Qiskit and the IBM Quantum Network. Developing cloud-based solutions is a theme of quantum developments, as COVID-19 has both highlighted and accelerated the need and desire by customers to consume compute capabilities via the cloud.

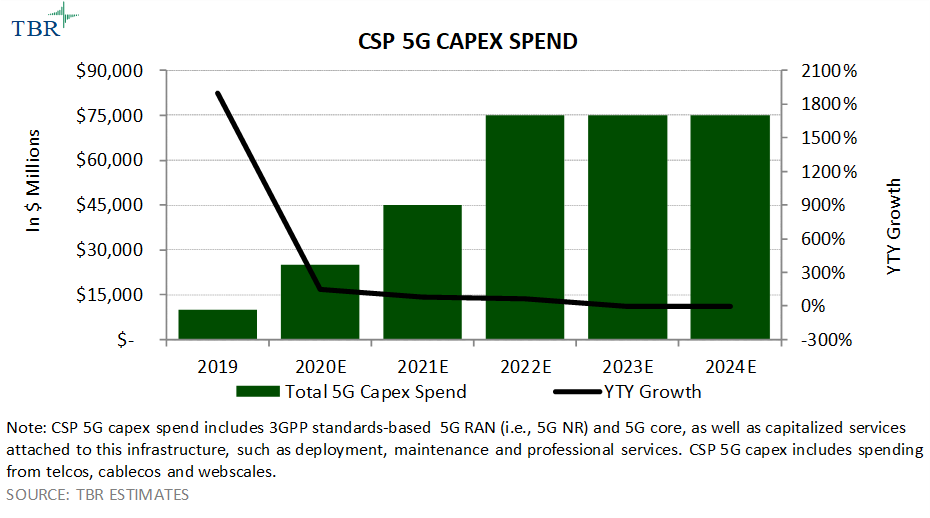

An increasing number of governments worldwide are becoming directly and/or indirectly involved in ensuring new technologies, such as 5G, are widely deployed in their respective countries. This spend is, in many cases, tied to economic recovery packages to counter the impact of the COVID-19 crisis and is being justified based on economic, national security and public health grounds.

TBR’s research indicates governments worldwide will invest in excess of $2 trillion in the ICT sector over the next five years, starting in earnest in 2021. Of that $2 trillion, several hundred billion dollars will flow directly into the 5G market, primarily for the purposes of providing internet access to underserved and unserved people around the world as well as ensuring respective economies are able to transform to be relevant and competitive in the digital era.

Following the temporary shutdown associated with China’s initial battle with COVID-19 in 1Q20, China’s CSPs accelerated rollout of 5G RAN, deploying 700,000 5G base stations in 2020, in addition to the 100,000 base stations that were rolled out in 2019. China’s investment in 5G will remain elevated in 2021, with between 600,000 and 1,000,000 base stations set for deployment as the government makes 5G a centerpiece technology of its newest infrastructure development initiative.

These investments will primarily benefit China Communications Services (CCS), Huawei and ZTE, though Ericsson and smaller China-based vendor CICT are also taking part in 5G RAN builds. China’s government heavily influences CSPs’ contract allocation and prioritizes business for domestic firms. Huawei was allocated the bulk of business in the 5G cycle, increasing its share from the LTE cycle.

TBR believes China’s ICT ecosystem has sufficient chipsets to meet the country’s 5G RAN deployment targets in 2021, which suggests the supply chain encumbrances instituted by the U.S. government are not having a significant impact on China’s original deployment timelines.

The 5G Telecom Market Landscape includes key findings, market size, customer adoption, operator positioning and strategies, geographic adoption, vendor positioning and strategies, and acquisition and alliance strategies and opportunities.

Welcome to TBR’s monthly newsletter on the quantum computing market: Quick Quantum Quips (Q3). This market changes rapidly, and the hype can often distract from the realities of the actual technological developments. This newsletter keeps the community up to date on recent announcements while stripping away the hype around developments.

For more details, reach out to Stephanie Long or Geoff Woollacott to set up a time to chat.

An increasing number of companies across a variety of industries are making deals and forming partnerships to seize opportunities for first movers in emerging quantum technology. Many organizations and several international governments are focused on laying a broad foundation for quantum innovation. However, with quantum expected to be a major disruptor in biopharma research and development as the technology matures, a considerable number of biotech and pharmaceutical companies are approaching quantum investments from a narrower perspective. Together, private organizations and public entities will continue to drive the emergence of new quantum use cases through investments that will also accelerate the adoption of the technology.

If you would like more detailed information around the quantum computing market, please inquire about TBR’s Quantum Computing Market Landscape, a semiannual deep dive into the quantum computing market. Our latest version, published in December, focuses on the software layer of quantum systems.

India-centric vendors demand considerable attention at the start of 2021 for three trends cutting across their sales motions, talent strategies, and avenues to new partnerships and intellectual property.

In a return to the old-school tactic of rebadging client employees, India-centric vendors have begun winning larger outsourcing deals, in part because the pendulum has swung back to clients demanding “run-the-business” IT services, which naturally favors outsourcing by low-cost offshore IT services vendors. Using an old-school approach to buy their way into mega-sized contacts or secure renewals may heighten competitive pressures for IT services vendors that lack the same scale in offshore locations or willingness to absorb headcount to open doors for long-tail managed services opportunities. Across the outsourcing space, TBR sees a broad trend of vendor consolidation in contracts up for renewal, further pressuring all competitors to expand contract sizes in any way possible.

The most challenged, but also the vendor group with the biggest opportunity, will be the Big Four. Over the past five-plus years, all four firms, to varying degrees, have expanded their application services capabilities delivered through low-cost locations to better appeal to new buyers. Although firms like Deloitte have experienced some initial success, reaching critical mass will require partnering more strategically with the India-centric vendors, unless the Big Four want to adjust their pricing for more mainstream, almost commoditized IT services.

With attrition diminished by COVID-19, India-centric vendors will continue to push to expand onshore U.S. talent, including in ruralshore locations. By focusing on recent university graduates, the India-centric vendors can access relatively cheap talent, spend less on visas, and market locally based talent as part of their sales pitch. In addition, all IT services vendors could face a tech talent threat from cloud and software majors. While companies such as Google (Nasdaq: GOOGL) and Microsoft (Nasdaq: MSFT) have mostly gone after upper-mid-level and senior-level services talent, strategies could change as those software and cloud vendors expand their services capabilities (for more detail on technology vendors’ expansions in the services realm, see TBR’s September 2020 Digital Transformation: Cross-vendor Analysis).

Lastly, India-centric vendors, especially those lacking software-specific talent and IP, have begun promoting their value to Microsoft and other cloud and software giants by investing in and developing more talent through open-source consortiums. In contrast to traditional R&D efforts, open-source consortiums can provide less costly and time-consuming avenues to developing IP and possibly unlock new business opportunities through consortium partners. TBR also believes increased participation in open-source consortiums could potentially have long-term impacts on services vendors themselves, including development of software mindsets and associated practices.

In late 2020, KPMG’s blockchain team outlined to TBR the efforts the firm has made to evolve its blockchain practice, expanding into concrete and discrete areas in which the firm can “create an ecosystem around something that already exists, then add a layer of trust, enabled by blockchain,” as made evident by the three focus areas detailed by the KPMG team: cryptoasset custody and analytics, climate accounting infrastructure, and energy trading reconciliation. KPMG explained that the firm’s digital transformation initiatives, which underpin the entire blockchain practice, remain anchored by data, identity and ecosystem — conveniently core elements of blockchain.

Americas Blockchain and Digital Assets Leader Arun Ghosh went one step further, saying KPMG had intentionally moved away from “leading with blockchain” to building a message around digitalization and trust: “Blockchain is digitizing the infrastructure. Fundamentally what blockchain does is digitize trust.” In TBR’s view, this business-problem-first, technology-second approach mirrors what consulting clients say they want and plays to KPMG’s strengths.

Businesses face challenges in proving to clients, stakeholders and regulators that their efforts to address climate change have a measurable impact on the environment and meet enterprisewide goals. Stepping up to address that challenge, KPMG saw an opportunity to deploy blockchain solutions as part of a Climate Accounting Infrastructure (CAI) offering. In essence, verifiable emissions data depends on trust, which can best be built and sustained through a combination of tools, including blockchain solutions, AI, enhanced IoT sensors and cloud.

For KPMG, the journey to a blockchain-enabled climate accountability offering started with a client in the financial services sector that was seeking help to meet its sustainability goals. Operating across multiple regions, with overlapping and sometimes conflicting standards and regulations, the client wanted to invest smartly, prove value to its shareholders, and build trust with customers and regulators, all while fully understanding the costs and potential impacts, both positive and negative. Once KPMG devised a blockchain-enabled approach — which KPMG says provides “near real-time climate accounting and reporting to help clients meet their climate goals” — the firm narrowed its focus down to two core industries: real estate and oil & gas.

As Ghosh explained to TBR, these industries face increasing compliance pressures, as well as structural challenges to meeting environmental standards, making them excellent initial target clients. The specific blockchain component, according to KPMG, comes through securing the massive amounts of structured and unstructured data in a way that can be verified but not altered, leading to greater trust and transparency for all parties.

In a Dec. 29, 2020, article, The New York Times detailed the pressures facing the real estate industry in New York City, starting with the sheer volume of carbon emissions coming from the city’s buildings (close to 70% of the city’s total emissions). According to the article, a 2019 law “requires owners of structures 25,000 square feet or larger to make often sizable cuts in carbon emissions starting in 2024 or pay substantial fines” and “affects 50,000 of the city’s roughly one million buildings, including a substantial number of residential buildings.” The city’s role as a global financial hub and KPMG’s heritage in accounting and financial services present a strong opportunity for the firm to begin building a use case for its CAI offering, particularly if the firm leverages its existing NYC-based client relationships to gain introductions to commercial real estate owners.

Last fall, TBR met with KPMG’s blockchain leadership team, including Americas Blockchain and Digital Assets Leader Arun Ghosh, and discussed changes the company’s blockchain practice has undergone since the October 2019 Blockchain Analyst Day. As TBR prepares in 2021 to add a blockchain-specific component to our Digital Transformation portfolio, examining in detail how IT services vendors and consultancies have been building blockchain practices, we will publish special reports describing specific vendor offerings and how those offerings and supporting capabilities fit within the larger blockchain ecosystem.

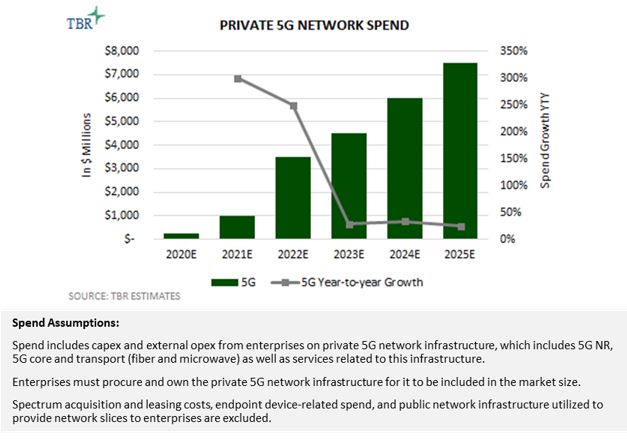

Leading companies in their respective verticals, such as Amazon, Walmart, Walgreens, Ford and Deere & Co., are preparing to make relatively large investments in digital transformation (DT) over the next few years as they adjust to the post-pandemic new normal, respond to competitive pressures and capitalize on new opportunities. In many cases 5G will play a key role in these digital transformations, serving as a foundational platform that will support these enterprises’ digital infrastructure and business operations (e.g., drone operations and reimagined in-store experience). Ecosystem players are striking strategic partnerships with some of these key enterprises (e.g., Verizon with Walmart and Walgreens) to capitalize on opportunities brought about by 5G as well as edge computing and AI.

Several leading enterprises, such as Whirlpool, have made a strategic decision to deploy 5G versus Wi-Fi 6 in their factories after their assessments deemed 5G can better meet their long-term needs. These decisions are in line with TBR’s belief that 5G should be viewed as a future-proof connectivity platform that will serve as a foundation for enterprise digitalization. Though Wi-Fi 6 (and LTE) will have their place in enterprise networks going forward, TBR expects the pendulum to swing more toward 5G as the de facto connectivity technology for enterprise communications and IT-OT convergence.

TBR’s Private Cellular Networks Market Landscape deep dives into the market for private cellular networks. This global report covers enterprises that are investing in private cellular networks as well as all of the major vendors and some nascent players that provide infrastructure products and services in this space. The research includes key findings, key market developments, market sizing and forecast, regional trends, technology trends, vertical trends, use cases, and key customer deals, alliances and acquisitions that are occurring in the market.

This site uses cookies. By continuing to browse the site, you are agreeing to our use of cookies.

Accept settingsHide notification onlySettingsWe may request cookies to be set on your device. We use cookies to let us know when you visit our websites, how you interact with us, to enrich your user experience, and to customize your relationship with our website.

Click on the different category headings to find out more. You can also change some of your preferences. Note that blocking some types of cookies may impact your experience on our websites and the services we are able to offer.

These cookies are strictly necessary to provide you with services available through our website and to use some of its features.

Because these cookies are strictly necessary to deliver the website, refuseing them will have impact how our site functions. You always can block or delete cookies by changing your browser settings and force blocking all cookies on this website. But this will always prompt you to accept/refuse cookies when revisiting our site.

We fully respect if you want to refuse cookies but to avoid asking you again and again kindly allow us to store a cookie for that. You are free to opt out any time or opt in for other cookies to get a better experience. If you refuse cookies we will remove all set cookies in our domain.

We provide you with a list of stored cookies on your computer in our domain so you can check what we stored. Due to security reasons we are not able to show or modify cookies from other domains. You can check these in your browser security settings.

We also use different external services like Google Webfonts, Google Maps, and external Video providers. Since these providers may collect personal data like your IP address we allow you to block them here. Please be aware that this might heavily reduce the functionality and appearance of our site. Changes will take effect once you reload the page.

Google Webfont Settings:

Google Map Settings:

Google reCaptcha Settings:

Vimeo and Youtube video embeds:

You can read about our cookies and privacy settings in detail on our Privacy Policy Page.

Privacy Policy