Trade Wars and the Professional Services Fallout: Talent, Growth and Operational Models in Flux

Significant market disruption likely in near and long term

Trade wars and tariff uncertainties conjure up visions of cargo ships, ports, factories and stacks of goods stranded by economic chaos, not consultants and IT services professionals. Fear, uncertainty and doubt are usually good for the consulting business, while the higher costs of running a business fuel demand for more outsourcing. This time, things might be different. This trade war, even if partially suspended for now, may significantly disrupt professional services, especially if tariffs continue creeping into new areas and the trust deficit continues to grow. Steel now, services later.

TBR believes three areas will likely experience added near-term stress if the trade war continues: acquisitions, sales cycles and staffing. Longer-term, more seismic changes may come to the H-1B visa program, regionalization efforts among the Big Four firms, and onshore/offshore talent models. Looming over all of these disruptions, at least at the moment, is the potential for a grand decoupling of the U.S. and China economies, with incomprehensible knock-on effects. Those near-term disruptions share a common denominator: macroeconomic uncertainty.

Making the business case for a significant acquisition becomes harder in a recession-fearing market. When clients extend sales cycles because they’re afraid to commit suddenly more precious resources to upgrades, modernizations or transformations, growth slows for consultancies and IT services companies. And when growth slows, so does hiring.

At its core, professional services is all about people. And when recruiting, rewarding and retaining people are pressured, everything is pressured. To understand how tariffs and trade wars could hurt consultancies and IT services companies, even in the short run, it is critical to step back and realize these professional services providers serve every industry. They may be in and of one industry themselves — professional services — but their clients span every industry that exists. When the steel, computer chip, automobile, bourbon and lumber industries get upended by tariffs, so do the consultancies and IT services companies serving them.

Local and regional talent may be key to revenue growth

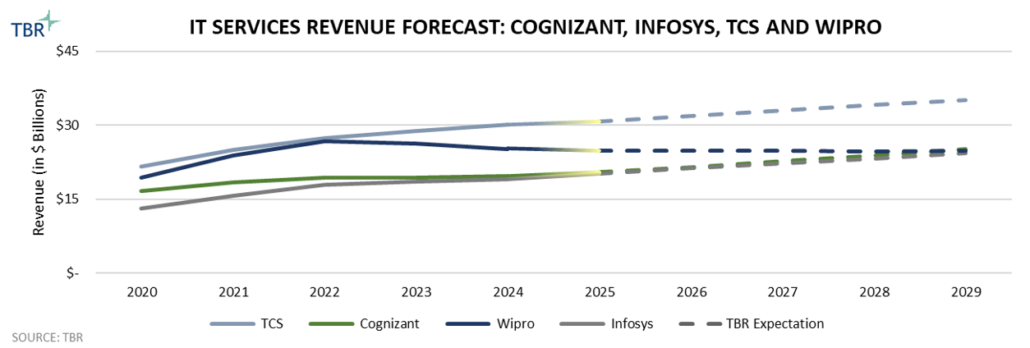

Powering through the near-term challenges, IT services companies and consultancies may then face structural changes to their operating environment, many centered on talent, starting with a reevaluation of the onshore/offshore mix. India-centric companies, which have historically relied on H-1B visas (at least to some degree; TBR appreciates that their reliance has varied widely), may find a less accommodating atmosphere in the U.S. and possibly even an unwillingness by potential candidates to relocate to the U.S.

At the same time, the Big Four firms may slow down their regionalization efforts, as having highly country-specific capabilities and dedicated staff may become a greater asset than more explicitly globalized organizations. TBR believes the more extreme outcomes around H-1B visas remain unlikely, while staying cognizant that the current trade war and tariff uncertainty also seemed unlikely a year ago. TBR does believe one highly likely outcome of the current trade crisis is a reassessment — by all IT services companies and global consultancies — of the overall onshore/offshore model. The recent uptick in global captive centers in India may be indicative of an enterprise trend toward more tightly owned and controlled offshore resources, but that was already the norm among IT services companies and consultancies prior to the trade war threat.

If trade wars persist, local and regional talent may become the key to sustained revenue growth, tied to local and regional economic growth overall. In other words, whichever company has the most and the best people on the ground in the fastest-growing places will continue to grow the most rapidly. It seems like a good time for the Big Four to have every country member firm run its own show as the on-the-ground market conditions start becoming even more disparate.

Watch now: TBR Principal Analyst & Practice Manager Patrick M. Heffernan discusses trend expectations for GenAI in the Professional Services market in 2025

Tariffs on services could further complicate market landscape

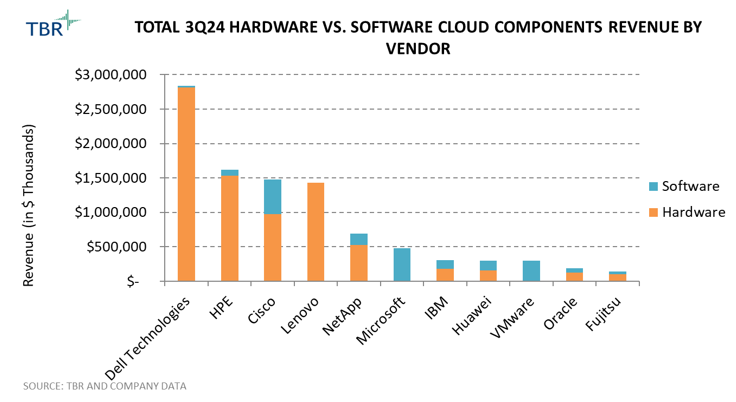

Returning to the starting image, trade wars evoke cargo ships, not consultants, and so far the Trump administration has not included services on the various tariff schedules. The U.S. currently runs a services trade surplus, and tariffs on services (as well as software) for various countries would be insanely difficult to assess. Artificial intelligence and the application of generative AI (GenAI) to procurement could make tariffs on services more manageable, but any efficiencies gained through those efforts would potentially erode the low-cost arbitrage advantage enjoyed by IT services companies and technology providers, damaging the overall U.S. trade balance.

Further complicating this picture, advances in AI and automation could mean any manufacturing jobs created in the U.S. as a direct result of tariffs would be digital FTEs, benefiting technology companies but undermining the Trump administration’s stated goals. In all, a mess, even if services remain off the tariff schedule.

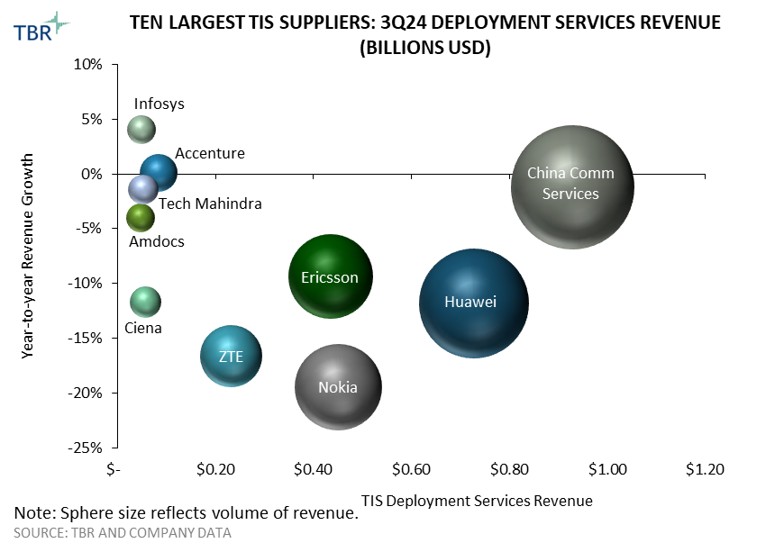

Companies pursue multiple strategies around U.S.-China decoupling

Another potential scenario: Some economic and consulting leaders have been advocating for a U.S.-China decoupling for a few years, a possibility that is more likely now as every day brings another parry in the U.S.-China trade war. Some global consultancies have been kicked out of China. Others have downgraded their offices or quietly left on their own. And some are maintaining an arm’s-length relationship, and some are doing business as usual. Fools would predict which strategies will win out. TBR simply notes that companies may pursue multiple strategies.

For example, in August 2024 IBM closed its China Development Lab and China Systems Lab, laying off more than 1,000 employees across Beijing, Shanghai and Dalian. The closure was part of IBM’s initiative to relocate R&D functions to India and other countries due to competition and geopolitical tensions. However, IBM remains committed to working with clients in the Greater China region. In March IBM launched an initiative to expand in enterprise AI, hybrid cloud and industry-specific consulting services to drive digital transformation and implement AI and cloud solutions in China. As part of this initiative, IBM is working with China-based Great Wall Motor Co. Ltd. on digital transformation and global expansion. A complete decoupling may be unlikely, but consultancies and IT services companies that have financial flexibility and leaders who are prepared to take risks and withstand uncertainty will likely continue to thrive.