Amid a sea of portfolio offerings, Accenture’s TS&A practice helps the company translate tech into business outcomes

Accenture’s TS&A practice provides path into re-architecting clients’ DT programs

Accenture’s value proposition continues to revolve around the company’s ability to deliver services through integrated scale, addressing clients’ pain points across the various stages of the advise-build-run life cycle. In mid-December TBR had a chance to hear from the leaders of Accenture’s Technology Strategy and Advisory (TS&A) practice, which, in TBR’s view, has been one of the industry’s best-kept secrets as it provides a bridge between the various parts of Accenture’s organization. Launched following the company’s pivot to the Next-Gen Growth model in March 2020, the TS&A practice is part of Accenture’s Strategy & Consulting business, which is focused on architecting and translating the value of technology to both tech and business clients.

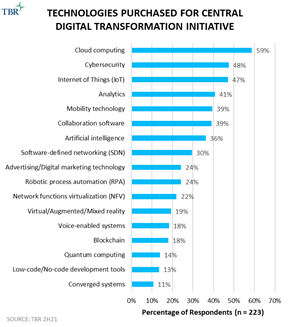

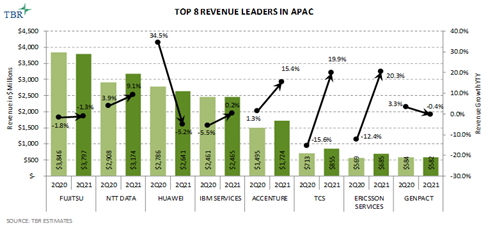

TBR estimates Accenture’s IT consulting revenue, which we believe largely maps to the TS&A practice portfolio, grew 30% year-to-year to $4.7 billion in 2021. Backed by over 4,000 dedicated practitioners across seven capability groups — Cloud Acceleration and Innovation, Data-led Transformation, Enterprise Agility, Future Tech, Technology Value Realization, Trust and Security, and Tech Mergers and Acquisitions. Accenture Cloud First is a significant contributor in the TS&A’s performance.

With tools such myNav, myDiagnostic and Transformation Office at its disposal, TS&A, in TBR’s view, has an opportunity to further accelerate its performance, provided the practice’s account management does not overlap with that of other parts of Accenture’s business, especially as the unit also targets Accenture’s traditional buyer personas, including the CIO and chief technology officer (CTO). Accenture sees CIOs and CTOs as the “new corporate rock stars,” which is a logical position considering Accenture’s established enterprise footprint and decades-long relationships with these personas.

TS&A strives to elevate the value of Accenture’s portfolio around its ability to include innovation while also supporting CIOs and CTOs in, as Accenture calls them, the “5Rs”: Resilience, Restructuring, Reinvention, Reskilling and Reduction. We see Accenture bringing innovation into these discussions in two ways: by embedding and relying on its network of luminaries, who can infuse cross-industry use cases to support engagements; and by utilizing its global network of innovation hubs.

With Accenture again investing in physical centers, including the recent openings of a smart-city-centric hub in Singapore; Innovation Center for Cloud in Indonesia; Advanced Technology Center in Thailand; Innovation Showcase at Expo 2020 in Dubai, United Arab Emirates; and Interactive Studio in Munich, Germany, we believe TS&A has a new set of opportunities to increase awareness of the practice across the company’s broader portfolio, especially as the practice seems to have been withstanding the industry trend of increased employee turnover, with flat attrition over the past year. (See TBR’s Innovation and Transformation Centers Market Landscape for additional details.)

TBR views Deloitte Digital as the most direct competitor to TS&A; however, Deloitte’s member firm structure often challenges Deloitte Digital to execute on a cohesive strategy, creating an opening for TS&A. [Tweet this!] Relying on industry- and function-specific playbooks, which Accenture updates as often as every six months, also helps the company stay abreast of new trends and support clients through their transformation agendas. Additionally, the exclusive alignment of TS&A’s portfolio capabilities with partner offerings enhances the practice’s value proposition.

For example, TS&A aligns with Amazon Web Services, Google Cloud and Microsoft Azure for industry solutions; with Atlassian for enterprise agility; with Celonis, ServiceNow and Splunk for data-driven transformation (since we spoke with TS&A’s leadership, Accenture has expanded its relationships with Celonis and Splunk and recently launched the Accenture Splunk Business Group); and Apptio for technology value. This strategy could disrupt Accenture’s partner model if it scales up, especially as the company continues to tout vendor agnosticism. In the long term, though, we believe as services vendors retune their partner messaging and go-to-market efforts to meet enterprise buyers’ expectations, pivoting from being vendor agnostic to capability aligned will help separate winning vendors from laggards. Accenture is in its typical market-making position, and the TS&A practice could signal the company’s plans to make a market-leading change once again.