Who is going to want Boomi?

In TBR’s newest blog series, What Do You Think?, we’re sharing questions our subject-matter experts have been asking each other lately, as well as posing the question to our readers. If you’d like to discuss this edition’s topic further, contact Geoff Woollacott at [email protected].

What Happened

Boomi will be sold to Francisco Partners and TPG for $4 billion in yet another in a series of asset sales, spinoffs and engineering measures Dell EMC has been making to cover the debt load from Dell’s acquisition of EMC in 2016. But this is not about Dell and the efficacy of its strategic actions. This is about Boomi. Who is going to want Boomi?

It is a broad question in terms of customers and potential buyers. Ultimately, the acquiring equity firms that shelled out $4 billion for the assets will want to “optimize” Boomi to resell the operation in whole or in part for more than $4 billion after having added their “value.” Rarely are these equity firms eager to sink money into long-overdue R&D to align an aging portfolio to the current market situation. If they were home flippers, they would want to put a fresh coat of paint on the clapboards for a five-year fix, not strip the bottom four rows of siding, replace the sill damage, reside it and paint it for a 15-year fix.

Customer Situation

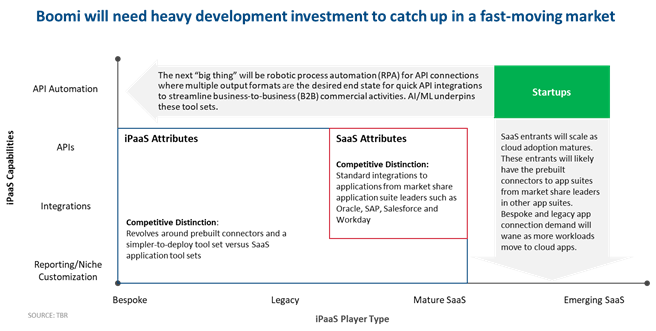

Boomi lags with API tool sets in an era often called the API economy. Even those with sound API management capabilities such as MuleSoft are now being called into question for not having API automation for push-button development capabilities. There are a lot of emerging companies, such as Entefy and Kong, getting serious evaluation in early adopter enterprises as the next leap forward in the iPaaS tool set space while UiPath receives mention in TBR’s discussions with customers as having the capabilities to swing into this space as well.

Boomi’s sweet spot seems to be the late majority large and midsize enterprises, with most of these customer applications residing on premises and many of them bespoke or highly customized. These data transport vessels are like the African Queen steamboat chugging along in the data river. These data center leaders will not find out-of-the-box API integrations into their bespoke applications from the leading SaaS apps they may be adopting at the start of their slow roll to native-cloud applications and data center consolidations that are a threat to Boomi as well as the traditional hardware manufacturers such as Dell, Hewlett Packard Enterprise and Lenovo.

Those are the customers that will likely want Boomi, but the number of potential buyers will rapidly dwindle as the market trends that threaten that sweet spot support the continued acceleration of cloud migration, sparked by the pandemic. Specifically, Salesforce’s 2018 acquisition of MuleSoft provided the SaaS front-office leader with an integration layer to tie together its proprietary solutions, in addition to integrations with AppExchange, its app partner ecosystem. While MuleSoft was born in legacy IT, its combination with Salesforce provides MuleSoft with substantial capital to innovate and evolve its offerings for better alignment with Salesforce by enhancing its tool sets for cloud application integration. Boomi’s challenge is to take these core strengths for business-to-business/EDI management and easy self-service reporting and integrations and build out the API and AI/machine learning capabilities sooner rather than later.

Buyer situation

In terms of who may want Boomi in their portfolio, the current owners likely eye Salesforce’s $6.5 billion acquisition of MuleSoft as the kind of pinata they hope to crack open with this $4 billion swing at a payoff. To TBR, that is likely a swing and a miss due to the aging portfolio issues referenced. Yes, SaaS players will increasingly bake in iPaaS tool sets, but emerging SaaS players will be less inclined to worry about on-premises and bespoke integrations where Boomi excels as they will be to have out-of-the-box connectors to market-share-leading SaaS apps in other segments.

This leaves buyers looking to consolidate aging assets to profitably manage opportunity in declining markets. A sound firm such as Informatica can follow the acquisition strategy deployed to great success by Computer Associates (CA) in the late ’80s and the ’90s as minicomputer consolidation started. In essence, CA became a software distributor of disparate, stand-alone utilities and tools for the various proprietary install bases that started their slow decline into irrelevance as Intel/Microsoft ate the data center. The CA acquisitions in that era were often asset sales, however. Ultimately, that consolidation caught up to both CA and BMC. While they are in operation, they likely lack the cash flow to justify adding Boomi to their boneyard — unless, of course, the equity partners decide to cut their losses if the financial pinata fails to crack open.

So, what do you think? Who is going to want Boomi?

Leave a Reply

Want to join the discussion?Feel free to contribute!