Four by four by four equals four

Four straight weeks of traveling for work, to four different cities to meet with four different clients, brought out four thoughts about where the IT services and consulting markets stand as we move into the autumn rush of 2018.

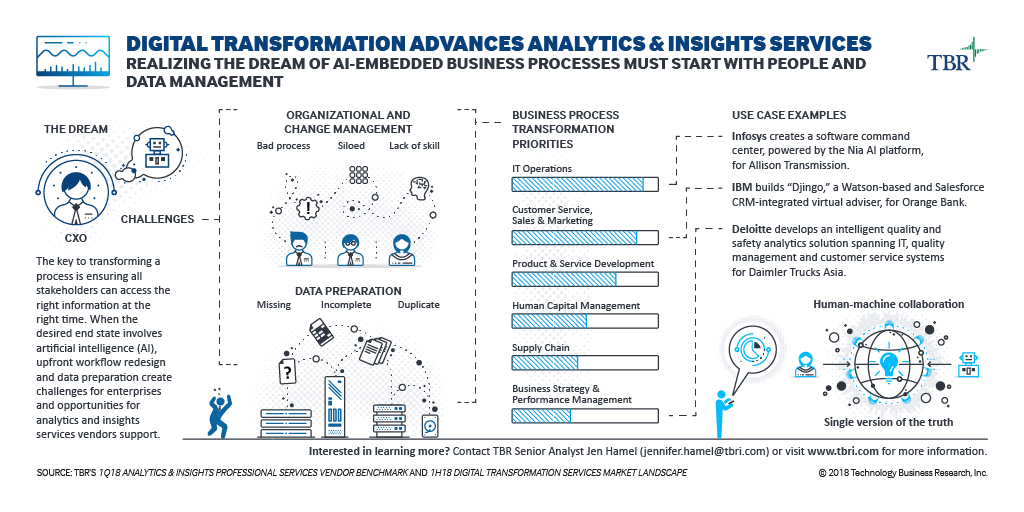

First, the next few years will finally bring the shift in the consulting model that we’ve been anticipating for the last decade (when I worked Deloitte and the partners tasked our team with understanding the other Big Four firms’ moves back into consulting). Outcomes-based pricing won’t become the norm because clients want transparency or because consultancies readily put their own fees and reputations at risk, but because the technology around assessing, measuring and even metering outcomes has improved dramatically in the last couple of years. And asset-based consulting will become the norm because consultancies can finally fully marry their intellectual talent to repeatable, scalable, configurable solutions infused with more than just methodologies and industry knowledge.

Second, the word “maturity” has started creeping into conversations about emerging technologies such as artificial intelligence, enhanced analytics, Internet of Things and even blockchain. The smart consultancies have recognized the buzz around emerging tech has produced clients that have enough experience, both good and bad, to think of themselves as more than just novices needing consulting help to understand the emerging new-world customer and employee. These clients don’t want to be amazed by cool tech. They want their experience to be acknowledged and built upon, and they want to move faster. Recognizing maturity means talking about deeper, more lasting — and more expensive — engagements, much to the benefit of consultancies.

Third, I anticipate an era of internally splintered consultancies competing with globally managed firms, creating a weird market with nominally global players drifting toward highly localized operations, while a couple of large consultancies maintain centralized, uniform cultures and organizations. Mirroring the political, economic and demographic forces behind the recent rise of populism and nationalism, some global consultancies could see local and regional practices pressured by trends in data sovereignty and cybersecurity, combined with a spillover from political populism and accelerated by agile technologies that can be spread rapidly and customized for micro-differences more quickly than before. If this trend develops, the consultancies opting to go all-in on one approach or the other will succeed. Those slow to decide or trying to muddle through a middle-ground arrangement will see the market surpass them.

And fourth, I come back repeatedly to leadership, a topic I’ve written about extensively in our analysis and in a couple of blog posts and special reports. Leading a consulting or IT innovation or systems implementation team today requires mastering new technologies, understanding a client’s industry and their position within it, and navigating shifting centers of budget and decision making. None of that differs greatly from previous generations of IT, except that today the diversity of talent demands more capable leaders and the speed of technological change demands increased humility and adaptability, plus a greater willingness to form, manage and lead flexible teams. Companies I see that recognize the talent shift, including changes brought on by millennials, and understand the impact on their leaders — and the company’s imperative to train and equip those leaders — repeatedly stand apart from the pack.