Oracle Is Charting a Path for Unprecedented Growth with Its ‘Infrastructure Anywhere’ Vision

Oracle has among the most complete, full-stack cloud portfolios, from infrastructure to database to applications. While Oracle Cloud World 2024 covered a sizable landscape, one theme stuck out during the four-day event: deployment flexibility. This theme reflects how much Oracle has changed compared to 2016, when Gen2 OCI (Oracle Cloud Infrastructure) launched.

With multitenant OCI, Dedicated Regions, Cloud@Customer and Oracle Alloy, a specialized service where customers white label OCI services inside their own data centers, Oracle has quickly emerged as one of the most flexible, delivery-agnostic IaaS vendors on the market. Of course, the other big component of Oracle’s “infrastructure anywhere” vision is multicloud, in which customers can run Oracle databases as native services hosted in the data centers of Oracle’s biggest hyperscaler competitors.

Not only does this move reflect a major maturity leap for Oracle, in which Oracle cozies up to its rivals to better address the needs of the customer, but it is also critical to the company’s financial strategy. In addition to giving Oracle the flexibility to allocate more capex dollars toward strategic compute and storage resources as opposed to land and buildings, this strategy will help Oracle get its on-premises database support base to the cloud faster. In doing so, Oracle may forfeit lucrative support and license contracts, but the company reports that for every $1 in lost license and support gross profit it could realize as much as $5 in gross profit in the cloud, which is a testament to how quickly the cloud business is growing.

The multicloud strategy is also one of the reasons Oracle awed financial analysts not only by raising its FY26 revenue targets by $1 billion, to $66 billion, but also by setting a FY29 goal of $104 billion. This target, backed by Oracle’s $99 billion RPO (remaining performance obligation) balance, implies an average corporate revenue growth rate of roughly 16% over the next five years. This kind of growth was once unheard of for Oracle, but with cloud now overtaking support as the biggest business, Oracle is a different company, and the OCI growth trajectory instills a degree of optimism in Oracle’s ability to disrupt a highly saturated market in the years to come.

Announcing Oracle Database@AWS

Based on interactions at Cloud World, it is clear the Oracle Database@AWS announcement was the most noteworthy. In our view, given Oracle already launched Oracle Database@Azure, and more recently Oracle Database@Google Cloud, which is now live in four regions, it was only a question of when, not if, Amazon Web Services (AWS) would partner with Oracle.

With this announcement, Oracle officially saved the biggest hyperscaler for last, onboarding all the critical partners it needs to migrate legacy database customers and accelerate cloud revenue growth. In terms of how this alliance will work, it is no different than the approach Oracle takes with Microsoft Azure and Google Cloud; Oracle will deliver the hardware and networking inside AWS data centers so customers can provision Oracle database services natively from the AWS console and have the system run in AWS, just as it would if it was hosted in OCI.

The approach of physically embedding OCI within other clouds as opposed to just bolting Oracle Database on to other infrastructure through a standard interconnection is important as it will not only give customers the native AWS, Azure and Google Cloud Platform (GCP) experiences they are used to, but also limit latency as the Oracle Exadata hardware is physically located with the appropriate hyperscaler.

One could argue Oracle is taking a lot of risk with this strategy, as it is essentially bringing customers and their data closer to AWS, Azure and GCP. But in the age of mounting competition, not to mention generative AI (GenAI), it is a risk worth taking. As one customer at a major financial services firm recently told us, “The GenAI decision makers will not be the old world relational database experts,” and these alliances could help ensure Oracle stays relevant in cloud GenAI discussions by making it easier for customers to use the data within Oracle Database for RAG (retrieval augmented generation), to fine-tune foundation models and build new applications using tools many customers are likely already using, like Amazon SageMaker.

We should also point out the concept of data gravity. Customers leveraging these multicloud services will still be established Oracle Database customers with some Oracle SaaS presence, and therefore the bulk of their business data gravity will naturally reside within OCI. Those customers may still be inclined to keep their databases within OCI and not extend to other clouds, but with this strategy, Oracle is at least giving them the option to do so. We expect that these multicloud offerings will gain a lot of traction among Oracle Database customers that have big application footprints on other clouds.

Oracle Analytics Is the Glue Between IaaS and SaaS

Analytics, and the ability to turn data into business insight, is the ultimate objective for nearly every organization. With popular tools like Power BI and Tableau as well as neutral data platforms like Snowflake on the market, customers have a lot of choices when crafting the analytics stack.

But customers have also made it clear they want to limit the integration burden, and one of the compelling things about Oracle’s approach to analytics is how it can store customers’ operational data from Fusion applications in the Autonomous Data Warehouse (ADW) for analytics as part of a single SKU. This approach, productized as Fusion Data Intelligence (FDI), reinforces the value of Oracle playing in both the SaaS and IaaS markets and its ability to deliver a unified solution.

Evolving the Data Lake Strategy and Competing as a Unified Solution

Access to operational data in the Fusion suite will remain the hallmark differentiator for FDI, but it is on the infrastructure side where Oracle took a big leap forward with the launch of Intelligent Data Lake. Oracle has been elevating its data lake strategy and positioning for some time, but this announcement puts Oracle more squarely into the space.

At its core, Intelligent Data Lake is a reworking of existing OCI capabilities, such as cataloging and integration, to create a single abstraction layer that in true data lake fashion, allows customers to query data on object storage, such as Amazon S3 or Microsoft OneLake, with support for the popular Apache Iceberg and Delta Lake frameworks.

To be fair, with Fabric and BigLake, Microsoft and Google Cloud, respectively, have been similarly making advancements with the data lake architecture to better address analytics workloads. However, Oracle is not only adding the simplicity and performance benefits of the data lake but also delivering the architecture in a way in which customers can run the entire data pipeline and still have all the analytics components in a single SKU.

With Oracle’s launch of a native Salesforce integration with FDI, which allows customers to combine their CRM and Fusion data within the lakehouse architecture, Oracle’s vision of embedded clouds at the database layer is extending to analytics.

Though FDI’s draw will still be primarily with existing Oracle customers, the company is clearly taking steps to help combine Fusion with non-Fusion data and make its platform more relevant within the cloud ecosystem. While FDI may not rip and replace the analytics footprint within any particular account, we could see scenarios where FDI displaces some components of the stack, such as Snowflake at the infrastructure layer, or on the analytics side, PowerBI in Microsoft Fabric.

New Applications Are Being Built on the Analytics Stack

In general, scaling the existing platform components of Oracle Analytics is a top priority for the company, but there is another emerging piece of the analytics vision: Intelligent Applications. Coming soon, Oracle will offer applications — People Leader Workbench for HCM and Supply Chain Command Center for SCM — that sit on top of the Fusion system of record, within the FDI platform.

This approach should allow Oracle to target a broader set of personas. For example, in People Leader Workbench, it is not necessarily about reaching only the C-Suite but rather anyone who manages people and can benefit from data-driven insights on their people, and most notably, take action on that insight by connecting back to the Fusion HCM system of record.

What About GenAI?

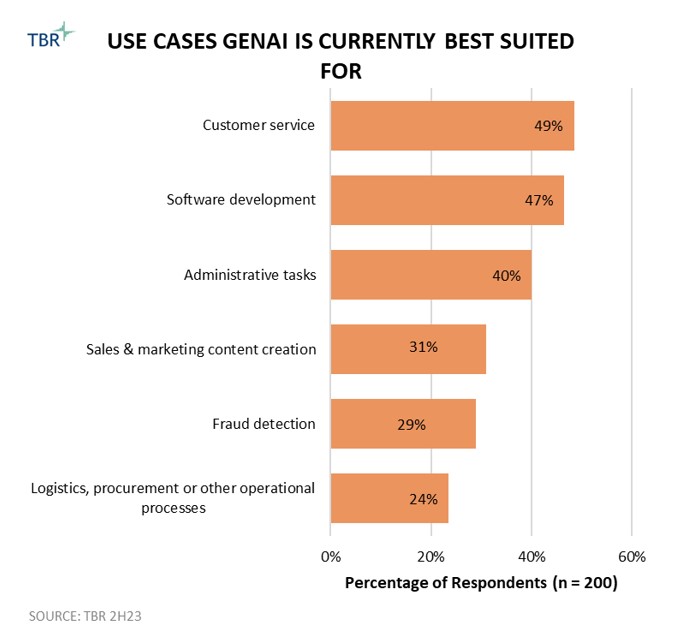

GenAI has officially exited the hype cycle and is being widely deployed within the enterprise, but when it comes to analytics, capabilities like dashboarding, semantic models and visualization are still taking precedence It is still early, but customer feedback suggests that if data is properly configured and there are guardrails in place, GenAI in analytics has a lot of potential.

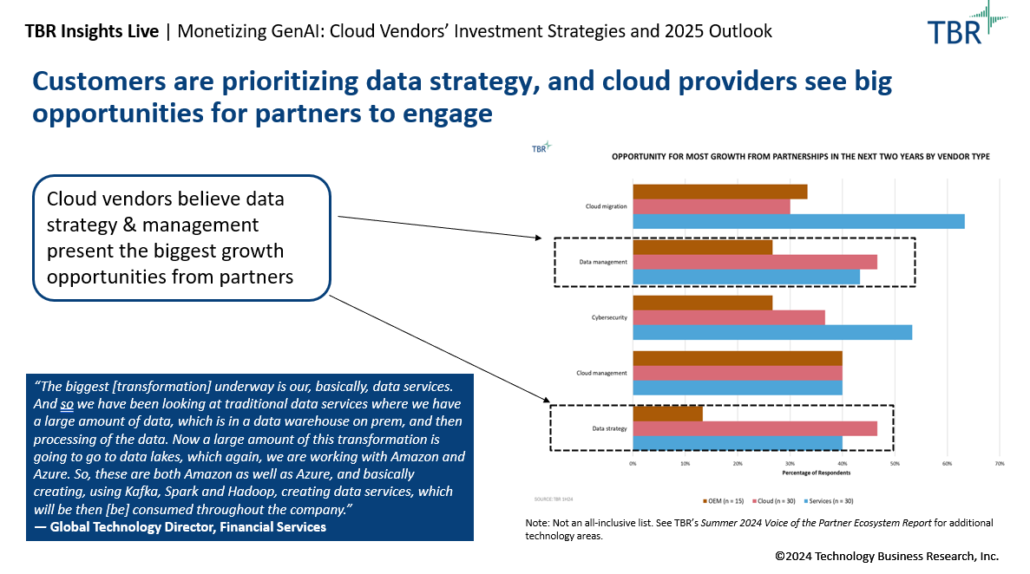

Dive into the complexities of vendor partnerships in this recent TBR Insights Live session — Click the image below to watch on demand today!

One of the key announcements at the event was the general availability of Analytics Cloud AI Assistant in Oracle Analytics Cloud (OAC), which is based on a large language model (LLM) so customers can ask questions about their data. Staying in line with the rest of the Oracle strategy, where GenAI is fully embedded into the portfolio and available to customers at no added cost, the analytics assistant will be available to OAC customers for free as part of their existing instances.

Speaking of SaaS and IaaS

From database alliances to the data lake architecture, Oracle has made many calculated moves at the PaaS layer to better compete for strategic workloads. But there are other innovations and key developments in the upper and lower rungs of Oracle’s cloud portfolio.

Oracle Targets Complete End-to-end Process Automation with AI Agents in Fusion Suite

Since it first entered the GenAI game in late 2023, Oracle stood out in the SaaS market for not upcharging customers for GenAI in their SaaS applications. This speaks to Oracle’s play at the IaaS layer with the OCI GenAI Service, which is native to the same infrastructure where all Oracle’s SaaS applications live.

Logically, this approach means that as Oracle’s LLM partners, which host in OCI, push the boundaries of their models, Fusion customers stand to benefit in not just using GenAI for basic assisted authoring and summarization use cases (e.g., writing a job description in Fusion HCM or summarizing customer calls in CX), but actually contextualizing data. In the long term, this could mean providing reasoning on that data to manage more complex workflows and deliver business recommendations.

At this time last year, Oracle announced 50 GenAI use cases in the SaaS suite. This year, the applications team announced the number of use cases has grown to over 100, while there are now more than 50 AI agents within the Fusion suite. This announcement marks a progression in how Oracle is moving from more generic prompt-and-response use cases in Fusion to actual contextualization use cases, by applying LLM-based RAG agents to address specific goals and roles within a particular business function. In Fusion HCM, this could include a benefits analyst agent, offering users the ability to ask questions, such as which health plan features are available, based on the enrollment data contained in Fusion HCM and the health plan document specific to the company.

But the most commonly cited example throughout the event was the Document IO agent in Fusion ERP, which can convert a picture of a quote in a particular currency into U.S. dollars and automatically create and load a purchase order (PO) within the system. With these AI agents, we see Oracle taking the next big step in addressing more complete process automation and productivity enhancements within its SaaS portfolio, and ultimately a shift in mindset where it is less about delivering an ERP system or an HCM system but more about completing end-to-end business process and experience.

OCI Strategy Centers on Growing Within the Large Enterprise and Attracting Cloud-natives

Oracle’s ability to offer among the most flexible cloud delivery methods is the focus of the OCI strategy and strategic road map, led by high-profile partnerships with AWS and others. But Oracle’s strategy is about being agnostic to not only where customers run OCI but also how they run OCI.

For example, at Cloud World Oracle announced Dedicated Region 25, a longtime investment and feat of engineering that essentially consolidates a standard Oracle Cloud region into just three racks, which we physically saw on the keynote stage. This configuration extends the value proposition of Dedicated Region, where customers can get the scale and economics of the public cloud inside their own data centers.

Dedicated Region 25 could also play a big role in helping Oracle reach new customers. Oracle’s multicloud alliances will undoubtedly be appealing to the large enterprise customer base, but offerings like Dedicated Region 25 could help Oracle attract cloud-native and AI companies looking for a more compact footprint that can still scale to support critical workloads.

Conclusion

Led by its partnership with AWS, Oracle Cloud World 2024 told a story of a maturing business that is turning competitors into partners to better address the needs of the customer. By keeping the lifeblood of the cloud stack, the database, relevant in customers’ cloud transformations, Oracle also ensures it remains competitive in GenAI scenarios, which aligns with the GenAI investments the company is making in other areas of the stack, from analytics to Fusion applications.

As the company continues to navigate as a full-stack vendor catering to the existing Oracle base, while simultaneously gaining relevance in the broader cloud ecosystem, there is a lot of potential ahead, and Oracle is well on its way to becoming a $100-plus billion company.