Comcast Business Accelerates Focus on Global Enterprise and U.S. Public Sector

TBR perspective

Comcast Business (Nasdaq: CMCSA) is entering a new phase of evolution as the unit aims to extend its enviable 18-year track record of consistent, steady revenue growth in the face of new competitive threats and market maturity. Since its formation, Comcast Business has increased revenue from $256 million in 2006 to $9.3 billion in 2023, a CAGR of nearly 24%, and is on a path to achieve $10 billion in revenue in 2024.

Most of this growth over the past 18 years stemmed from the SMB segments, where Comcast Business’ superior DOCSIS-based, hybrid-fiber coax (HFC) fixed broadband offerings were priced right compared to non-fiber-to-the-premises (FTTP) telco offerings and met a market need for more bandwidth. This strong competitive advantage enabled the company to take a commanding market share lead (i.e., Comcast Business now has over 50% market share in the small business segment in its network footprint markets).

However, the broad prevalence of 5G fixed wireless access (FWA), which Verizon (NYSE: VZ), T-Mobile (Nasdaq: TMUS) and a range of other mobile network operators across the U.S. market are actively promoting, has created a strong competitor to Comcast Business’ fixed broadband offerings, especially in the small business segment, which tends to include businesses with fewer than 25 employees.

This headwind, in addition to overall market maturity in the SMB domain for network services (e.g., internet access and VoIP) and the sustained decline in pay-TV subscriptions, has prompted Comcast Business to focus on selling small businesses value-added services and solutions, such as mobile broadband (via its MVNO offering) and internet failover services (using cellular technologies) as well as network security, such as SD-WAN.

Additionally, from a global enterprise and U.S. public sector perspective, Comcast Business has been driving growth from these higher-end segments, thanks to acquisitions and organic growth, but the unit is encountering stiff competition from entrenched incumbents, notably AT&T (NYSE: T) and Verizon.

Impact and opportunities

Solution sales approach is winning formula for larger customers

Comcast Business’ sales approach is evolving, especially as it pertains to its larger customers. Leveraging best practices from Masergy (such as orienting salespeople to sell solutions versus point connectivity services, and fine-tuning how to assemble solutions with out-of-footprint aspects) has enabled Comcast Business to broaden the scope of its deals and embed itself deeper into its customers’ operations, which reduces churn and drives more favorable outcomes for both sides. Masergy has also helped Comcast Business better understand the SLA requirements of larger entities, preparing Comcast Business to be more relevant to a broader swath of customers.

Mobility stabilizes SMB revenue amid FWA threat

Comcast Business’ cellular MVNO offering has enabled the unit to offset (or prevent via bundling) revenue erosion in fixed broadband and pay-TV, but there are limitations to how much this service can contribute because Comcast’s arrangement with Verizon restricts customers to 20 lines per account.

Comcast Business has also been cross-selling network security products (such as SD-WAN and SASE-based solutions) to SMB customers in a bid to capture more share of wallet.

AI is not new for Comcast

Comcast Business leaders outlined several ways the unit has been part of the AI revolution since the technology entered the scene in the early 2010s. Specifically, Comcast has been using “traditional AI,” also known as predictive AI, for its TV remotes (i.e., built-in voice search function), customer care operations (i.e., chatbots) and network operations (e.g., anomaly detection and preventive maintenance), and the company claims it has 250 people on its AI team, including 35 employees who have PhDs.

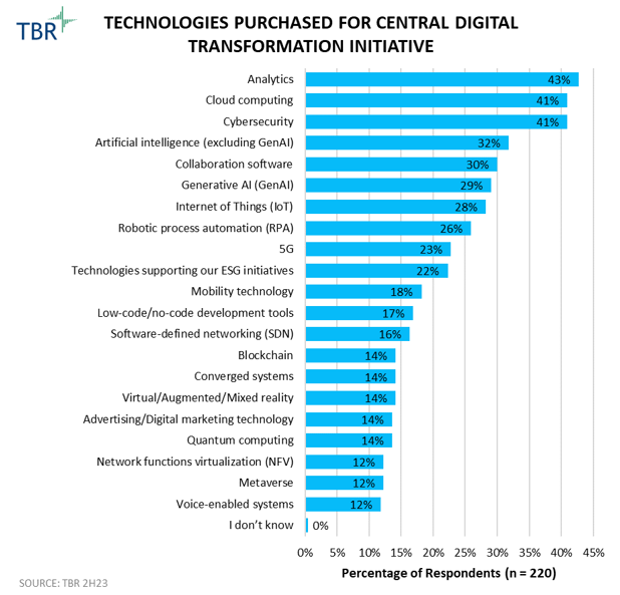

The next phase of AI embedment into Comcast Business’s operations pertains to GenAI, which is likely to be leveraged in customer care and sales domains initially. Comcast Business is also leveraging data and automation to provide key insights and tools to help customers make decisions as well as increase analytics and remediation capabilities.

Additionally, Comcast Business is increasing the number of AIOps use cases and applying AI and machine learning (ML) across its managed solutions platform to improve service delivery, assurance and management, both for customers and the internal teams that support customers (e.g., network operations center [NOC] and security operations center [SOC], help desk).

Comcast Business intends to balance AI and automation with the “human touch”

Comcast Business leaders believe keeping humans in the loop is a differentiator in an AI-infused world and emphasized the need to balance AI and automation with human involvement in the unit’s customer interactions.

One key way to achieve this balance is to keep a human in the loop and leverage AI and automation to augment and make existing salespeople and customer care agents more productive. Ultimately, business customers expect to be able to pick up the phone and talk to a real person in a quick and effective manner. AI and automation can help staff be more efficient in preparing sales proposals and resolving customer issues.

International business strategy remains unclear

Though Comcast Business’ domestic U.S. strategy and value proposition are clear and fine-tuned, the unit’s international strategy still seems disjointed, consisting of a patchwork of various acquisitions (e.g., Sky, Deep Blue Communications, Blueface, iTel, Masergy) and off-net partnerships with a range of service providers and vendors that seem to lack a clear and coordinated plan for growing revenue in the international business sector.

Opportunities since the Masergy acquisition remain the strongest component of Comcast Business’ international approach, but much of this traction is driven by Comcast Business working with its U.S.-headquartered customers in their locations outside the U.S. rather than securing significant net-new organic customers from international markets.

To leverage its international assets and drive sustainable growth, Comcast needs to formulate a cohesive strategy and competitive value proposition for non-U.S. markets, similar to the approach it has taken in the U.S. Focusing on specific countries and/or industries may be a prudent approach, at least initially.

Nascent growth areas remain experimental and ad hoc

Though Comcast Business continues to explore opportunities and be pragmatic in private cellular networks, edge computing and network APIs, the company acknowledged that sustained market development in these areas is lacking but that nascent opportunities may gain traction over time.

Comcast Business is specifically focused on scalable use cases in which 5G is superior to Wi-Fi, such as computer vision and autonomous guided vehicles (AGVs), and on edge computing-related use cases where low latency is a requirement. Comcast Business is also focused on leveraging edge computing to make its internal network operations better, such as for localized content caching or for enhanced cybersecurity offerings.

Do customers really need multi-gig symmetrical bandwidth?

Comcast Business continues to trumpet the strength of its DOCSIS-based, HFC network platform, with multi-gig (up to 10Gbps) symmetrical bandwidth now heralded as the newest and best offering on the market.

While this claim may be true, most businesses do not need that much bandwidth at one location. Therefore, Comcast Business’ claim could create a disconnect between what marketing is pushing and what customers actually need. As evidenced by the robust uptake of FWA, small businesses especially are more concerned with the value they are getting for the price paid, and they are migrating to lower-cost broadband offerings to obtain internet access that more closely meets their needs and aligns with what they are willing to pay.

T-Mobile and Verizon are feeding this market shift to “rightsized bandwidth” through clever marketing and customer education about what businesses actually need. Comcast Business will need to demonstrate why its cutting-edge broadband offerings are necessary for its customers in order to justify the premium pricing.

Conclusion

Comcast Business remains a dominant competitor in the U.S. SMB market and a credible challenger in the U.S. enterprise and public sector segments. As FWA and market maturity challenge Comcast Business’ SMB segment, the company is preparing to offset this impact via stronger traction with larger entities. A more cohesive international strategy will strengthen Comcast Business’ growth profile, and TBR projects the unit has more years of steady growth on the horizon.

Unlocking Competitive Insights: Beginner’s Guide

/by Allan Krans, Practice Manager and Principal AnalystDiscover the unique facets of competitive intelligence – competitors, customers, partnerships. Read this guide today to learn more!