Transforming the employee experience for EY and its clients

In late October 2021, TBR met with senior partners from EY’s People Advisory Services, including Kim Billeter, principal, Americas People Advisory Services leader; Jonathan Sears, principal, Americas Organization and People leader; Gerard Osei-Bonsu, EMEIA Integrated Mobility leader; and Agi Donnithorne, associate director of Global Analyst Relations, to discuss their firm’s ambition, investments, people and place within the broader people advisory market. The following reflects that discussion and TBR’s overall research and analysis of the current human management consulting market.

Throughout the entire discussion with TBR, EY’s People Advisory Services leaders emphasized that their whole practice revolved around placing “humans at the center,” an approach that has been embedded natively into every EY service line, including Consulting, Tax, Strategy & Transactions, and Assurance, reflecting EY’s firmwide and global approach to talent issues. EY’s leaders also emphasized deploying and testing solutions internally before introducing them to clients and continually working to “simplify complexity” across every element of the hire-to-retire people advisory spectrum.

Notably, the EY leaders said their main clients have expanded beyond the chief human resources officer to now include chief operating officers, chief financial officers, and line-of-business leaders more attuned — possibly due to the pandemic — to the vast array of human capital management challenges, including office space, productivity tools, immigration, and risk management. While human capital management consulting includes, potentially, an impossibly diverse and almost unmanageable set of capabilities, offerings and consulting services, Billeter and the rest of the EY team kept the discussion focused on two key components: prioritizing a “humans at the center” approach and transforming the employee experience, starting with a reimagining of EY’s and its clients’ workforce agendas.

In TBR’s view, every company has faced human capital management challenges during the pandemic and some lessons have spread quickly (for better or worse). As spiking attrition, return-to-workplace issues and the war for talent all heat up across professional services and the broader workforce, EY’s decision to ground humans at the center while thinking about how long-term transformation should resonate with clients while helping the firm maintain its own employee morale and culture.

EY Skills Foundry designed to meet upskilling and reskilling demands for digital transformation

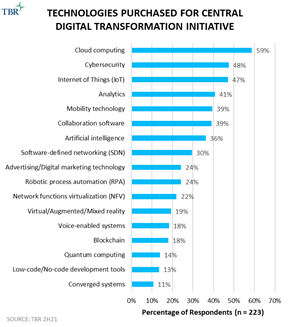

In briefing TBR on the full scope of EY’s People Advisory Services Practice, the EY leaders described transformation solutions; capabilities including talent management, workforce planning, HR transactions, and digital assets such as the Learning Experience Platform and EY Mobility Pathway; and strategic alliances with IBM, Microsoft, SAP and ServiceNow. Turning to the EY Skills Foundry, the EY team reiterated that the seemingly relentless need for digital transformation (DT) among all enterprises drives upskilling and reskilling talent among professional services and technology firms. Clients’ workforces must change as well, and clients, according to EY, are not prepared and lack skills, capabilities and scale.

The EY Skills Foundry, which the firm initially deployed and refined internally, includes three components: a live heat map of skills across an organization, showing both supply and demand and allowing for more rapid decision-making around reskilling investments; a content aggregator EY described as “learning intelligence” designed to add speed and scale to training; and “a validated, secure digital record of employees’ skills and experiences,” which can help clients more rapidly deploy the right person to the right opportunity. The EY team stressed that the firm tested the foundry platform over the last couple of years, applying automation when possible and seeking input and refinements from clients.

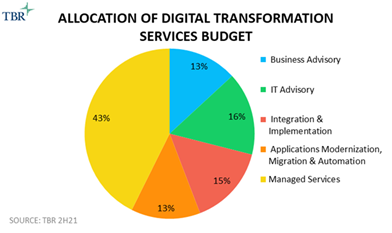

While still nascent, with fewer than 10 live clients, TBR believes the EY Skills Foundry has two key attributes likely to separate EY’s offering from that of its competitors in the crowded human capital consulting field. First, the firm can prove the business case and almost ensure success by pointing to EY’s own internal results across a global firm with nearly 300,000 professionals. This “customer zero” use case resonates with clients, particularly for offerings blending technology and change management. Second, EY has prepared itself to sell, deploy and support the EY Skills Foundry through multiple business models, including traditional consulting engagements, SaaS and managed services.

Expanding how EY engages with clients extends the firm’s reach within clients and enlarges the potential market EY can serve. TBR’s November 2021 Digital Transformation: Voice of the Customer Research includes the following analysis: “Improving HR operations and employee efficiency slid to the bottom of the objective list in 2021 — down from No. 3 about 18 months ago, just after the pandemic began — confirming that the emphasis on employee experience was short-lived and buyers quickly reshuffled priorities to ensure shareholders’ expectations are met.