GenAI Expectations for Enterprise Buyers in 2024

GenAI and Enterprise Buyers

In 2023 we wrote: “Automation will lower costs and AI will transform businesses.” A year later, this trend is even more pronounced, largely accelerated by the advent of generative AI (GenAI).

GenAI is new and exciting, but buyers’ realities and priorities did not change just because GenAI came along, which will force vendors to cite tangible use cases that minimize disruption and maximize ROI.

We did not see GenAI disrupting the technology and services market to the extent it did in 2023, and we do not recall a single conversation with vendors and enterprise buyers prior to November 2022 in which the term GenAI was even mentioned. However, the increase in macroeconomic headwinds is forcing market participants to rethink how to best position their portfolios, go-to-market strategies and commercial models.

Watch 2024 Digital Transformation Predictions session: Navigating GenAI in Digital Transformation in 2024

2024 GenAI Outlook for Enterprise Buyers

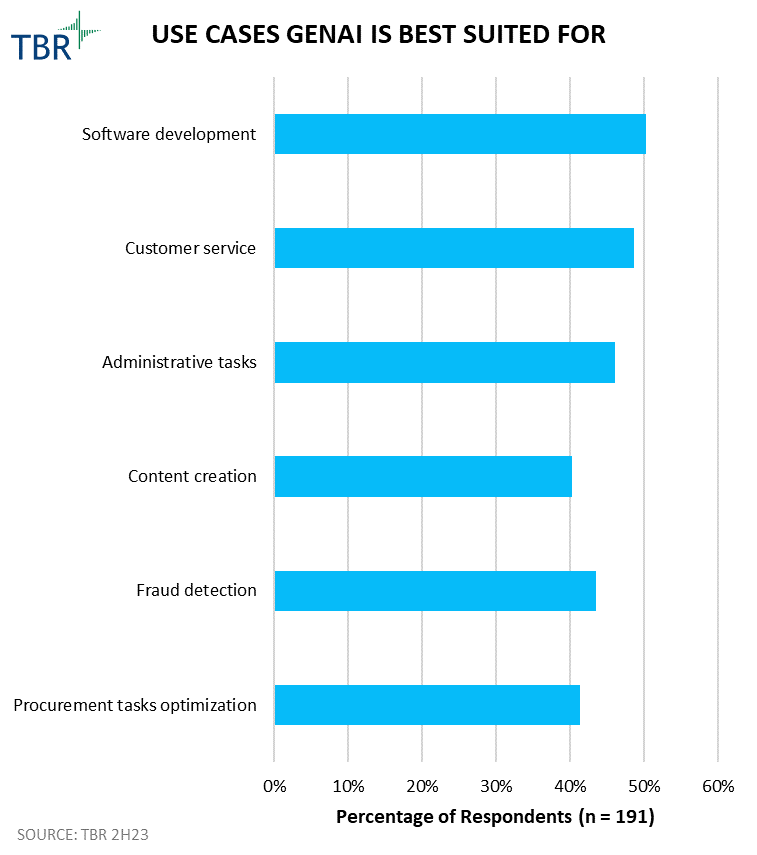

The GenAI hype has raised buyers’ expectations that the implications of the technology have become more clear, increasing pressure on technology and services vendors to deliver value — starting with use cases and rapidly pivoting toward outcomes.

Of course, for any of these aspirations to happen at scale, one must take a closer look at how well prepared enterprise buyers are in their data architectures, IT stacks and, most importantly, their people. Buyers are somewhat conditioned that their third-party services and technology providers will constantly try to nudge them and introduce new technologies. The current environment is no different, but what makes GenAI more special is the hype that GenAI can optimize costs while driving new growth areas.

However, simply adding GenAI to IT modernization and/or cloud migration projects does not serve everyone well and really just prepares them for the long play. And it is certainly a long play, especially as less than 10% of global enterprises have a defined data strategy, according to industry reports.

But vendors must act now, as discretionary spending has stalled and enterprise buyers are spending only on projects that have greater organizational impact — if at all — rather than testing new frameworks or experimenting with proof-of-concept innovation-wrapped discussions. So, the most immediate opportunity for GenAI to make an impact is for vendors developing function- and/or department-specific models.

Developing large language models (LLMs) is not cheap, and organizational data typically lives in silos — departmental or functional. We see vendors starting to dabble with the idea of introducing “narrow” language models that are built off the same departmental data that for decades vendors and enterprises have aspired to make interoperable. It is possible that GenAI could force enterprises to raise their organizational walls even taller, which would necessitate different commercial and partner models.

Conclusion

Vendors must act now. Establishing more defined use cases around function- and/or department-aligned data will pave the way for the technology as vendors seek to scale adoption across industries. Even if adoption cannot be scaled in the near term, being entrenched early in a client’s GenAI journey should lead to long-tail revenue.

To learn more about TBR’s predictions for digital transformation in 2024, download your free copy of Top Predictions for Digital Transformation in 2024, featuring a look at the path to GenAI-enabled growth in this new year.