IT vendors ‘patently’ sharpening focus on developing newer technologies

IBM has a unique position as a software, hardware and services vendor. — Bozhidar Hristov, Senior Analyst

IBM has a unique position as a software, hardware and services vendor. — Bozhidar Hristov, Senior Analyst

Internet of Things (IoT) hesitation in the healthcare vertical stems from the industry’s complexity, as it is chained by liability and privacy issues, a general unease about change, legacy equipment, and unevolved processes. These complexities are all rooted in real concerns of customers and vendors in the healthcare space. However, the “Industrial IoT Analytics for the Healthcare Industry” presentation by Glassbeam employees Gopal Sundaramoorthy and Puneet Pandit at PTC’s LiveWorx event highlighted that it is time to shift how vendors go to market within the healthcare industry.

Sundaramoorthy indicated there are not a lot of high-level analytics, or grand-scheme IoT implementations, in healthcare. The challenges mentioned above, especially privacy issues, including healthcare organizations’ desire to keep data internal, prevent it. Instead, Sundaramoorthy explained vendors need to talk to healthcare organizations like they talk to manufacturers, focusing on how healthcare organizations can connect equipment to improve asset utilization, save costs and increase efficiencies. This is the operational technology (OT) discussion instead of the IT discussion.

With asset utilization, for example, how is a medical scanning device being used? How many scans are being done and in how much time, what types of scans are being done, and when are the scans happening? Or, a conversation around operator utilization could include aspects such as determining whether operators are fully trained by measuring what functions they are using and how long they take compared to average or trained users. Likewise, predictive maintenance, such as noting when a bulb needs to be replaced in an MRI machine, helps avoid costly or dangerous downtime. These simpler-to-implement OT-based measurements will help hospitals run more efficiently and save money just through connecting machines and adding straightforward analytics. It also helps medical device manufacturers better understand why things are going wrong and how to best improve diagnostic time, shorten repair time and relieve frustration for medical professionals.

Sundaramoorthy indicated that simple connectivity is healthcare’s biggest problem. To break the hesitation barrier, vendors should focus on solving the first step in IoT: connecting the often woefully out-of-date machinery and building in IoT, in the spirit of OT, to prove ROI to medical organizations. After machines are connected and OT-based IoT is proving consistent ROI, the discussion to move to more transformative IT use cases will be a much easier sell.

The “Connecting Your Business to the Smart Cities We All Live In” panel during PTC’s LiveWorx event included ideas consistent with TBR’s previous views on smart cities. One of the most interesting speakers was Nigel Jacob, the co-founder of the Mayor’s Office of New Urban Mechanics, an R&D organization within Boston’s City Hall. Jacob gave a presentation on the “Boston Smart City Playbook,” compiled by his organization, which lists the following rules for vendor engagement:

All of these points align well with TBR’s view of how vendors need to improve their go-to-market strategy, but a few stood out. “Stop sending sales people” translates well inside and outside smart city applications. Internet of Things (IoT) is a complex technology, and it is difficult for end users to really understand what IoT can do for them. Public sector officials, just like the CEO, CIO or CTO of any private organization, do not want to listen to a sales pitch about why a technology is great. Instead, in the example of Boston, decision makers desire vendor engineers or consultants to be on-site to explain why IoT is good for their city’s particular challenges, how it can be implemented and how it has worked for others, as well as to provide concrete evidence of what Boston can expect to gain in the long run. Only then will a vendor’s solution be taken seriously.

“Better decisions, not (just) better data” is a point TBR believes vendors should take to heart. Data is a building block to insight, but piles of data with no feasible way to turn the data into actionable insight is little more useful than no data at all. Customers seek insight through data, but if there is not an easy path to achieving insight, its value is significantly reduced. Customers believe that to get value out of IoT, they need to bolster their IT, operational technology (OT) and data scientist staff. TBR believes incorporating artificial intelligence and improving user interfaces to simplify IoT products is a path to unlocking value for business decision makers, enabling them to make better decisions without incurring huge selling, general and administrative expenses.

“Platforms make us go ¯\_(ツ)_/¯” is also parallel to customer concerns recorded by TBR. Platforms are exciting to techies, but they do not mean much to customers. Instead, they generally raise fears of platform lock-in, where customers will be unable to access outside technologies or risk becoming a member of a dying standard. Also, the platform level is often too high for customers to understand how IoT will benefit them. Vendors must continue to boast interoperability and focus on use cases or small deployments. Small deployments that solve immediate problems — not technical and platform-based discussions — will be vendors’ gateways to customers. After a few successful small projects, vendors can introduce customers to the grander view centered on a wide platform.

Bigbelly vice president of North American Distribution and Global Marketing Leila Dillon, another presenter during the panel, explained how Bigbelly solved multiple problems for individual cities by thinking outside the box. The company sells solar-powered waste systems, mostly bins, that automatically compact trash and alert waste management when they need to be picked up. This granted cities substantially increased efficiency not only because automatic compacting eliminated waste buildup but also because the alert system saved wasted time having trucks on routes checking all bins instead of only those that are full. Additionally, Bigbelly observed that by thinking creatively, it could further cities’ smart city goals. It started working with cities to equip waste bins with small-cell technology to enable ubiquitous citizen connectivity. In other cases, the company equipped cameras or sensors to track foot or street traffic to help cities understand congestion. Bigbelly is a great example of a company helping to solve a pointed problem — in this case, making waste collection more efficient — and then working with the cities to build additional IoT use cases one success at a time.

Observers of emerging tech trends often seek the “hockey stick” moment, or that period when the market takes off following an explosion of activity. However, as TBR Principal Analyst Ezra Gottheil explains in his special report ‘Shrink-wrapped’ IoT will drive accelerating growth; an explosion of activity, or huge moment of growth, will likely never occur in the overall commercial IoT market. Gottheil writes:

Each IoT [Internet of Things] solution comes to market at a different time, meaning that as more packaged solutions become available and as some experience rapid growth, the total growth accelerates. The IoT market has been described as a “popcorn” market, in which each submarket “pops” at its own pace — some smaller markets grow explosively, but the total market (the “pot of popcorn”) expands more uniformly.

A popcorn market leads to slowly accelerating overall growth, generating frustration for companies that had anticipated rapid adoption. This is especially true in the IoT market for horizontal IT companies such as Hewlett Packard Enterprise (HPE) and Dell EMC that are finding themselves selling into new markets, including product development, operational technology (OT) and data science organizations, instead of traditional IT department constituencies. Gottheil notes that for organizations that are seeking to benefit from IoT, the key to accelerating growth is developing packaged “off the shelf” — or “shrink-wrapped” — IoT solutions. The increased availability of IoT solutions targeting specific use cases and business processes in industry subverticals will be key to generating IoT-driven vendor revenue for the foreseeable future.

In the relationship between customer and business, expectations are everything. In a lot of ways, the shift to cloud computing has evened the playing field for what is expected in terms of cost, responsibilities, and the services exchanged between IT customers and providers. With cloud services, customers can experience far more of a service before buying it, see a clear unit price from the outset and understand the constraints of the service-level agreements. However, uncertainty still lingers in the exact specifications for many solutions, as the complexity of the design and variability of the actual utilization continue to make accurately predicting real-world cost for cloud solutions difficult for many customers. — Allan Krans, Practice Manager and Principal Analyst

HAMPTON, N.H. (July 3, 2018) — Commercial deployments of NFV and SDN are aggressively moving forward, with nearly all leading Tier 1 operators having adopted or planning to adopt NFV and/or SDN by the end of this year, according to Technology Business Research Inc.’s (TBR) 1H18 Telecom Software Mediated Networks (NFV/SDN) Customer Adoption Study.

“The cost savings of network virtualization and automation is becoming more evident,” said TBR Telecom Senior Analyst Michael Soper. “Carriers are leveraging NFV and SDN capabilities, as well as integrating cognitive technologies such as artificial intelligence (AI) and machine learning (ML) to evolve to a zero-touch network that can automate performance management and maintenance functions to prevent network faults and reduce expenses. The industry is in the very early stages of this trend.”

WAN virtualization is a top priority for service providers as they implement solutions including SD-WAN and WAN optimization into their portfolios. Service provider revenue growth from software-mediated network services, particularly SD-WAN, is accelerating, but the lion’s share of WAN revenue continues to stem from traditional services such as MPLS.

The supplier landscape shows incumbent vendors, particularly hardware suppliers, remain entrenched with service providers, but face disruption within certain use cases and with respect to commoditization. The study indicates incumbent hardware providers are best-positioned for providing NFV and SDN solutions across domains, with startups, open source players and cloud-centric vendors infrequently mentioned by respondents. Still, incumbents will face disruption with respect to certain VNFs, such as vEPC and vRAN, and the most significant threat remains hardware pricing, the area in which the overwhelming majority of respondents expect to see cost savings due to commoditization and the shift in spend to the software layer.

As the software-mediated market matures, software-centric vendors will be better-positioned than hardware-focused competitors. Additionally, vendors with highly automated service delivery and remote delivery capabilities can help service providers reduce opex tied to NFV and SDN.

TBR’s Telecom Software Mediated Networks (NFV/SDN) Customer Adoption Study provides an in-depth examination of how operators are planning, preparing and executing to succeed in the NFV and SDN market. TBR surveyed 25 of the leading Tier 1 telecom service providers worldwide to gain insight into their NFV and SDN adoption plans. The study includes insight into service provider strategy, as well as service providers’ perceptions of supplier positioning and key benefits and obstacles.

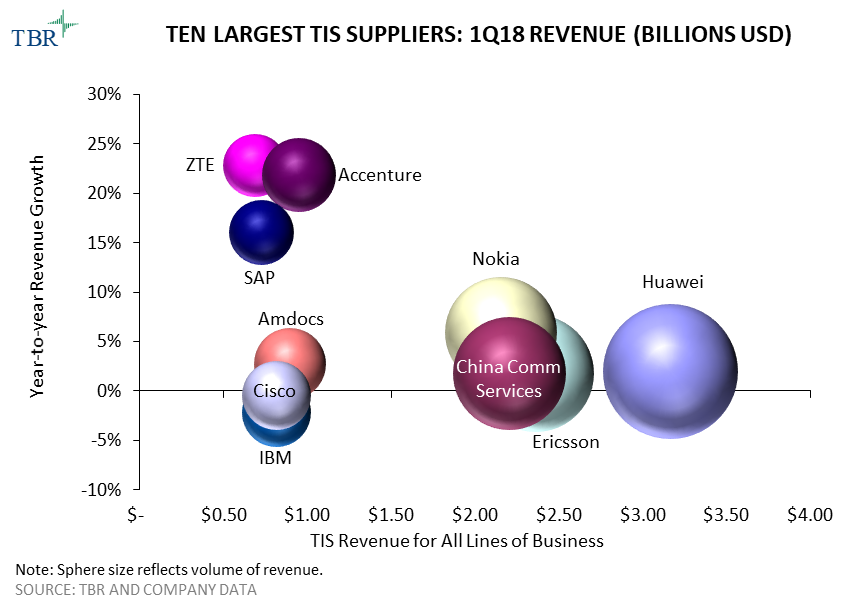

HAMPTON, N.H. (June 29, 2018) — According to Technology Business Research, Inc.’s (TBR) 1Q18 Telecom Vendor Benchmark, the conclusion of LTE coverage projects in China hampered revenue for the largest vendors. A reduction in demand from telecom operators for routing and switching products also caused revenue to decline for Cisco, Juniper and Nokia. In this market downturn, vendors are employing various strategies to maintain margins and mitigate revenue declines while eyeing initial commercial 5G rollouts, which are set to begin in the U.S. in 2H18.

“Suppliers are trying to sell into the IT environments of operators, engaging with the webscale customer segment, and expanding software portfolios to partially offset falling telecom operator capex,” said TBR Telecom Senior Analyst Michael Soper. “The shift in the revenue mix toward software is also helping vendors maintain operating margins in spite of lower hardware volume. Vendors are also growing their use of automation and artificial intelligence in service delivery to improve profitability by reducing their reliance on human resources.”

Western-based vendors are preparing their portfolios to build out 5G for U.S.-based operators in 2H18. Several operators have aggressive 5G rollout timetables and intend to leverage the technology for fixed wireless broadband and/or to support their mobile broadband densification initiatives. Vendors that have high exposure to the U.S. and are well aligned with market trends such as 5G, media convergence and digital transformation will likely increase market share over the next two years as operators in the region are expected to aggressively invest in these areas starting in 2H18.

The Telecom Vendor Benchmark details and compares the initiatives and tracks the revenue and performance of the largest telecom vendors in segments including infrastructure, services and applications and in geographies including the Americas, EMEA and APAC. The report includes information on market leaders, vendor positioning, vendor market share, key deals, acquisitions, alliances, go-to-market strategies and personnel developments.

s

For additional information about this research or to arrange a one-on-one analyst briefing, please contact Dan Demers at +1 603.929.1166 or [email protected].

ABOUT TBR

Technology Business Research, Inc. is a leading independent technology market research and consulting firm specializing in the business and financial analyses of hardware, software, professional services, and telecom vendors and operators. Serving a global clientele, TBR provides timely and actionable market research and business intelligence in a format that is uniquely tailored to clients’ needs. Our analysts are available to address client-specific issues further or information needs on an inquiry or proprietary consulting basis.

TBR has been empowering corporate decision makers since 1996. For more information please visit www.tbri.com.

Start with a new space, furnish it with funky chairs, nontraditional work spaces and all the latest technologies. Recruit creative talent, mixed with some data scientists and wonder-tech folks, plus seasoned strategists. Bring in current clients and consult on digital transformation.

As companies implement this playbook, a couple of common themes and challenges are emerging, mostly around client selection, talent management and technology partner cooperation. (Look for future blog posts on all three of these.) We had the pleasure of meeting many of the leaders at these new digital transformation centers (in Miami, Dublin, Frankfurt, Dallas, New York City and more), and I noticed common traits among the people charged with running these new places: passionate, invested, visionary. Some places took a kind of “buddy cop” approach, pairing a creative with an executioner (in a good way, for both). Some bolted long-standing capabilities onto an acquisition. The real kicker: these centers need nonstandard leaders, even as the larger firm — the board that just invested $20 million in a new space and new talent — wants to ensure the investment pays off and puts a trusted, almost always longtime company professional in charge. And that makes leadership more critical than ever.

The best we’ve met (a highly subjective and personal assessment) echoed lessons I learned during my brief time in the U.S. Army and my long exposure to U.S. military culture: train everyone, especially the leaders, and train them for their next job; promote them when they’re ready and support them with more training as their responsibilities evolve. One center leader described to me how her company invested in her management skills, ensuring she could handle the diverse set of backgrounds, skills, expectations, and corporate cultural mindsets she would be leading at the new center. Longtime professionals who grew up within a firm might be able to manage teams mixed with experienced and new hires. But leading such a team requires skills not typically gained from serving only in one organization or growing professionally mostly through similar roles.

As much as I’ve enjoyed digging deeper into the substance behind the hype of these centers — the funky chairs and bleeding-edge tech and clients taking journeys to digital transformations — we still want to understand the business case, the strategies and the metrics that determine whether these substantial investments of money and brand are beginning to pay off. From what we can see to date, success still relies on what it always has: leadership and teamwork. Companies recognizing this lead the pack right now, especially as that pack becomes crowded with cloud, network and legacy IT vendors all looking to play in the digital transformation space.

HAMPTON, N.H. (June 27, 2018) — According to Technology Business Research, Inc.’s (TBR) 1Q18 Telecom Infrastructure Services Benchmark, post-peak RAN spend drove down telecom infrastructure services (TIS) revenue in local currency terms at some of the largest vendors including Ericsson, Huawei and Nokia. Meanwhile, software- and services-centric firms grew revenue as they capitalized on digitalization trends and/or provided outsourcing and C&SI to operators and webscales alike.

“Operators’ push toward ICT convergence and digitalization sets IT services firms up for continued growth,” said TBR Telecom Senior Analyst Michael Soper. “IT services firms are able to help telecom and webscale customers migrate to new technologies and implement new business models, both of which are in high demand as these companies pursue digital transformation.”

Webscale spend remains robust, but TIS work is confined to certain segments of vendors. Webscales seek out cutting-edge technology and typically contract with the OEM for product-attached services. Companies benefitting from this process include Ciena, which is providing optical equipment to webscales, and Nokia, which has many opportunities to sell into webscales with its end-to-end optical portfolio, premium IP routing and switching products. IT services firms, particularly Accenture, are providing back-office outsourcing and software SI.

Vendors with high exposure to the U.S. market and those that are well-aligned with market trends such as 5G, media convergence and digital transformation will likely increase their share of the TIS market over the next two years, as TBR expects operators in the region to aggressively invest in these areas starting in 2H18.

TBR’s Telecom Infrastructure Services Benchmark provides quarterly analysis of the deployment, maintenance, professional services and managed services markets for network and IT suppliers. Suppliers covered include Accenture, Amdocs, Atos, Capgemini, CGI, China Communications Services, Ciena, Cisco, CommScope, CSG International, Ericsson, Fujitsu, Hewlett Packard Enterprise, Huawei, IBM, Infosys, Juniper Networks, NEC, Nokia, Oracle, Samsung, SAP, Tata Consultancy Services, Tech Mahindra, Wipro and ZTE.

Every day I find myself reading about the developments happening in business-to-consumer (B2C) pricing.

Here’s a sample of those that jumped out recently:

These developments highlight the growing momentum behind providing dynamic, value-based and outcome-based pricing models, a movement being driven by companies’ desires to provide personalized customer experiences at scale.

While this push has been most publicized and noteworthy in the B2C world, driven by the likes of Uber, Netflix and MoviePass, it also consistently permeates the complex business-to-business (B2B) IT products and services world that we focus on. “How do we shift from a cost-plus to value-based pricing model? Are companies really doing outcome-based pricing? Who is doing it well, and for what types of customers? How?” These are common questions vendors are trying to sort through as they change their businesses.

Often, we’ve heard that IT vendors are serious about making outcome-based pricing models work, but the customers are putting the brakes on these types of arrangements. Customers will ultimately balk at the variability and risk of an outcome-based arrangement at some stage of a deal negotiation and push vendors to offer predictable fixed-price engagements. Customers like the idea of not paying when an outcome is not achieved more than sharing the benefit of an outcome that is met, and somewhere in that trade-off the fallback becomes a traditional contractual arrangement.

What’s interesting is that based on recent research, this customer hesitance seems to be abating. In our 2H17 Digital Transformation Customer Research, we asked 165 global enterprises that are undertaking digital transformation initiatives to identify the pricing structures they’ve experienced, and outcome-based pricing emerged as the most common model globally.

As my colleague Jen Hamel points out in the report, “This indicates vendors have become more flexible and creative with pricing to convince clients to take the DT [digital transformation] leap but may see delayed ROI from DT skill investments as revenue depends on project success.”

As digital transformation continues to take root, the question of how vendors can shift to outcome-based pricing will only be asked more frequently, particularly as changes in the timing of revenue recognition from engagements impact vendors’ flexibility around resource investments. We are eager to watch (and to report) as best practices develop and new models emerge and would love to hear about what others think on this topic.

Drop a comment here or email me at [email protected].

This site uses cookies. By continuing to browse the site, you are agreeing to our use of cookies.

Accept settingsHide notification onlySettingsWe may request cookies to be set on your device. We use cookies to let us know when you visit our websites, how you interact with us, to enrich your user experience, and to customize your relationship with our website.

Click on the different category headings to find out more. You can also change some of your preferences. Note that blocking some types of cookies may impact your experience on our websites and the services we are able to offer.

These cookies are strictly necessary to provide you with services available through our website and to use some of its features.

Because these cookies are strictly necessary to deliver the website, refusing them will have impact how our site functions. You always can block or delete cookies by changing your browser settings and force blocking all cookies on this website. But this will always prompt you to accept/refuse cookies when revisiting our site.

We fully respect if you want to refuse cookies but to avoid asking you again and again kindly allow us to store a cookie for that. You are free to opt out any time or opt in for other cookies to get a better experience. If you refuse cookies we will remove all set cookies in our domain.

We provide you with a list of stored cookies on your computer in our domain so you can check what we stored. Due to security reasons we are not able to show or modify cookies from other domains. You can check these in your browser security settings.

We also use different external services like Google Webfonts, Google Maps, and external Video providers. Since these providers may collect personal data like your IP address we allow you to block them here. Please be aware that this might heavily reduce the functionality and appearance of our site. Changes will take effect once you reload the page.

Google Webfont Settings:

Google Map Settings:

Google reCaptcha Settings:

Vimeo and Youtube video embeds:

You can read about our cookies and privacy settings in detail on our Privacy Policy Page.

Privacy Policy