Converging trends enable software and IT services firms to continue to grow despite lower operator capex

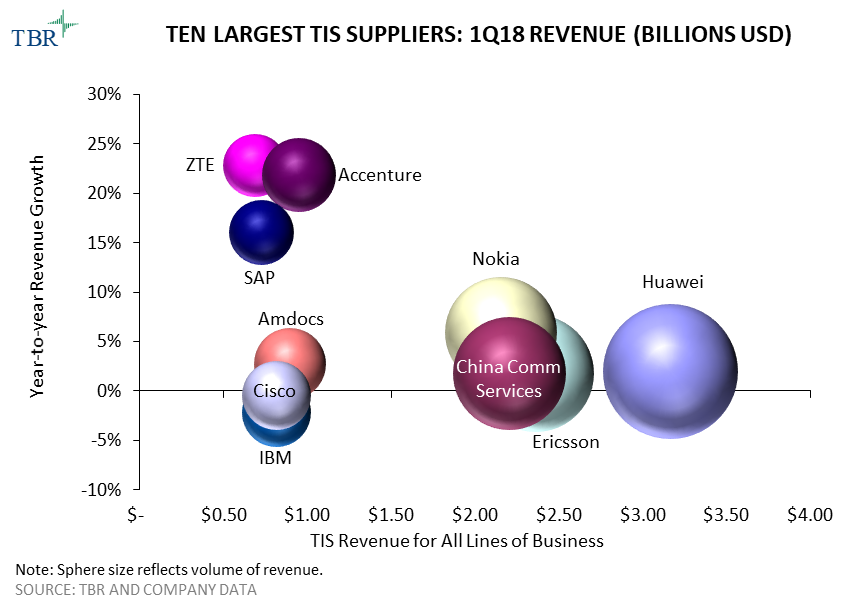

HAMPTON, N.H. (June 27, 2018) — According to Technology Business Research, Inc.’s (TBR) 1Q18 Telecom Infrastructure Services Benchmark, post-peak RAN spend drove down telecom infrastructure services (TIS) revenue in local currency terms at some of the largest vendors including Ericsson, Huawei and Nokia. Meanwhile, software- and services-centric firms grew revenue as they capitalized on digitalization trends and/or provided outsourcing and C&SI to operators and webscales alike.

“Operators’ push toward ICT convergence and digitalization sets IT services firms up for continued growth,” said TBR Telecom Senior Analyst Michael Soper. “IT services firms are able to help telecom and webscale customers migrate to new technologies and implement new business models, both of which are in high demand as these companies pursue digital transformation.”

Webscale spend remains robust, but TIS work is confined to certain segments of vendors. Webscales seek out cutting-edge technology and typically contract with the OEM for product-attached services. Companies benefitting from this process include Ciena, which is providing optical equipment to webscales, and Nokia, which has many opportunities to sell into webscales with its end-to-end optical portfolio, premium IP routing and switching products. IT services firms, particularly Accenture, are providing back-office outsourcing and software SI.

Vendors with high exposure to the U.S. market and those that are well-aligned with market trends such as 5G, media convergence and digital transformation will likely increase their share of the TIS market over the next two years, as TBR expects operators in the region to aggressively invest in these areas starting in 2H18.

TBR’s Telecom Infrastructure Services Benchmark provides quarterly analysis of the deployment, maintenance, professional services and managed services markets for network and IT suppliers. Suppliers covered include Accenture, Amdocs, Atos, Capgemini, CGI, China Communications Services, Ciena, Cisco, CommScope, CSG International, Ericsson, Fujitsu, Hewlett Packard Enterprise, Huawei, IBM, Infosys, Juniper Networks, NEC, Nokia, Oracle, Samsung, SAP, Tata Consultancy Services, Tech Mahindra, Wipro and ZTE.

Leave a Reply

Want to join the discussion?Feel free to contribute!