On April 15 and 16, PwC Japan hosted over 20 analysts, a partner and PwC executives for a day and a half summit at the company’s Technology Laboratory in Tokyo. Chief Strategy Officer and Chief Innovation Officer Kenji Katsura set the tone when opening the meeting by explaining that over the course of the event attendees would be hearing from leaders across PwC’s businesses — including audit, tax, deals and consulting — highlighting the importance of PwC’s strategy to deliver the full range of the firm’s expertise to clients. While ensuring that PwC’s services remain highly relevant to clients in Japan, the firm’s GTM strategy is closely aligned with its global network. This alignment allows PwC Japan to leverage the best practices and innovations from across the network while also contributing homegrown insights and advancements that can benefit clients worldwide.

The event included demos, presentations and one-on-one breakouts that allowed analysts to gain firsthand knowledge of PwC Japan’s evolving strategy. Demonstrating culture and an understanding of local business dynamics still provides an important nuance that allows PwC to elevate the value of its services, especially in the current uncertain geopolitical environment, as having highly country-specific capabilities and dedicated staff may become a greater asset than more explicitly globalized organizations. The following write-up summarizes TBR’s takeaways from the event and provides a glimpse into what we believe will set the next chapter of PwC’s business.

As a node in PwC’s ever-expanding ecosystem, Technology Laboratory brings art and science together through physical assets

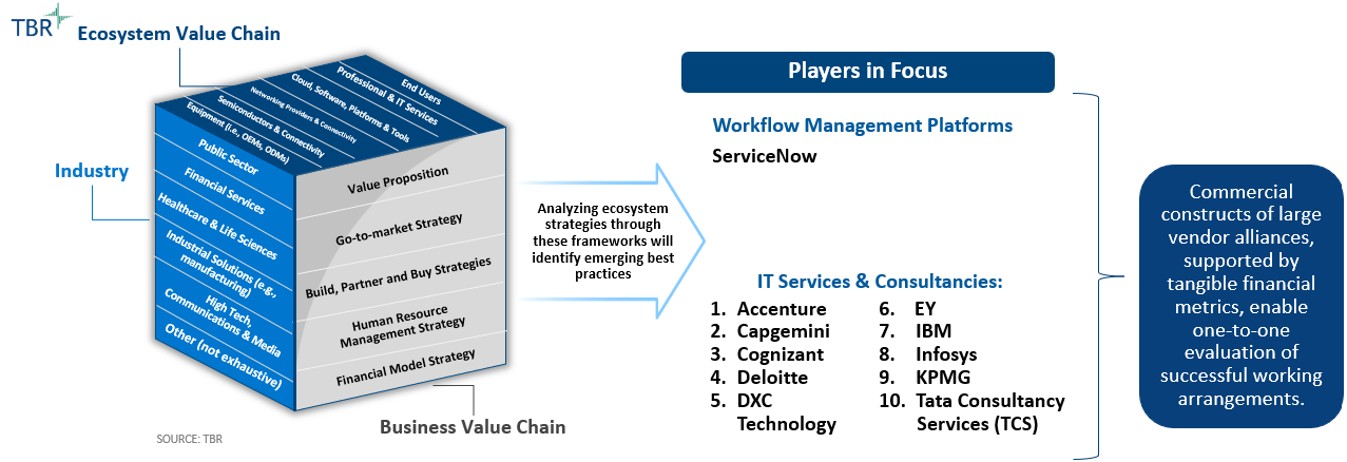

Starting with a hands-on demo led by Technology Laboratory lead Shinichiro Sanji, PwC’s Technology Laboratory team demonstrated the pivot the firm has begun making in its interactions with clients, where the outcome of workshops has evolved beyond the art of the possible and into tangible solutions backed by the use of physical assets. Responsible for PwC’s tech-driven go-to-market strategy, which builds a business pipeline through cross-industry collaboration, Technology Laboratory in Tokyo is a first of its kind and enables the firm to demonstrate how it can interlink buyers beyond the traditional IT and/or finance functions into operational technology.

The cocreation of assets with commercial and public clients as well as academia will also help PwC demonstrate understanding and connectivity of physical AI and revamp industries where industrialized robotics are heavily in use. The Experience Center also remains an integral part of the Technology Laboratory’s success as creating future scenarios based on market and industry trends necessitates market insights delivered through multidisciplinary skills teams. With the Technology Laboratory and Experience Center housed adjacent to each other, it streamlines collaboration and interaction between teams when needed, while maintaining enough separation to enhance the unique value each team contributes during client workshops.

Meanwhile, as PwC strengthens its local relationships, it also continues to build nodes across its member firms that demonstrate an appetite for innovation and support client needs. For example, the firm recently announced the opening of the OT Cyber Lab in Dubai, United Arab Emirates (UAE) and the expansion of PwC’s Reinvention Lab in Australia, where it added hands-on capabilities for clients to test out advanced technologies.

We see PwC’s Business Experience Technology (BXT) and Business Model Reinvention (BMR) frameworks as the connecting glue between the various labs across PwC member firms, especially as the BXT raised the bar high for the firm’s consultants to drive outcomes. Now BMR provides a structured approach for the labs to have guided conversations with clients around their functional technology needs.

Maintaining continuity in executing against strategic priorities brings PwC closer, one member firm at a time

Following the Technology Laboratory demo, Masataka Kubota, Chair and Territory Senior Partner, PwC Japan Group CEO, kicked off the event by setting a high-level agenda centered on five megatrends: Climate Change, Tech Disruption, Demographic Shift, Fracturing World and Social Instability. These themes guided PwC’s presentations across its Assurance, Tax, Advisory and Consulting practices, with each area exploring or delving deeper into these trends.

PwC executives’ emphasis on reinforcing the alignment of PwC Japan and PwC Global strategies around BMR, trust, sustainability, and AI and data closely resonated with what TBR heard in a pair of similar events in the fall of 2024 in EMEA and the U.S. Kubota further amplified PwC member firms’ efforts around unity. PwC Japan’s regional customization and diversity remain vital to the firm’s success, especially as local clients lean on the company’s expertise and guidance to navigate choppy international market conditions.

Masaki Yasui, PwC Japan Group’s Consulting leader, continued the discussion, providing an update and insights into the firm’s line of business. Doubling in size in terms of people since late 2018, PwC Japan’s Consulting practice now houses 5,130 of the firm’s more than 12,700 employees in Japan and has grown at a double-digit rate for around 10 years — a pace that is expected to be sustained through 2030, according to Yasui. This will be an impressive achievement for PwC Japan’s consulting business, given the macroeconomic headwinds and impact on discretionary spending and consequently on consulting opportunities.

According to TBR’s management consulting research, consulting revenue experienced a deceleration in 2024 of 3.1% year-to-year, down from 8.1% in 2023, a trend we expect to continue throughout 2025.

Deploying tech-enabled arbitrage model will test PwC’s readiness to transform its professional services model, with consulting being most ripe for it

Leaning on the firm’s ongoing success rooted in its client-centric approach, focus on priority accounts, portfolio expansion and investment in growth areas provided a strong foundation for PwC Japan’s consulting growth. While these efforts are not unique to PwC, we believe what has helped the firm thus far is its collaborative culture across lines of business, making it appealing for partners to be part of. Growth will likely come from PwC Japan investing in new services to meet demand with BMR, strengthening its digital core, and front-office transformation serving as the lead in parts of the clients’ discussions.

Meanwhile, focusing on multinational clients while tapping into the power of PwC Japan’s Business Network will help the firm bridge opportunities with global clients in and outside Japan, further amplifying the need for better member firm collaboration. PwC Japan recognizes the evolving professional service market dynamics and has built out a new three-layer model for sustainable growth, with the key separation between the first and second layers being less human-dependent. Executing on the second and third layers, which are largely focused on accounting for changes in staffing and commercial models enabled through data intelligence and data monetization, will once again test PwC Japan’s collaborative culture, as often such initiatives are more challenging to be sold and managed internally than to bring externally with clients.

Many professional services companies grapple with similar challenges largely because of the time and materials (T&M) commercial model that consulting companies typically employ for such services. Developing data monetization and a fee-for-service type of model essentially requires companies like PwC to depart from the T&M model. We believe PwC Japan is one step ahead of many of its competitors in that regard as its consulting business has largely been driven by fixed-price engagements, making it easier to bridge into the fee-for-service setup it is looking to pursue as part of its layers two and three strategies.

The challenge for PwC Japan will be to educate other member firms on how to approach the opportunities, as elsewhere T&M remains the predominant commercial model. Further, PwC Japan, just like other member firms, sees managed services as part of its ability to continue to grow its business. While it is still a small portion of the current revenue composition (about 4% to 6% at the global level, according to TBR estimates), the firm continues to explore avenues to augment that gap, with leaning on its tax and cyber practice capabilities, delivery partners, and acquisitions among its top choices.

PwC’s Industrial Structural Transformation framework: A road map to the firm’s ability to execute through integrated scale and packaged services

Here lies the opportunity for PwC: developing a framework that demonstrates unity and focus while relying on its core success around trust. During the event, PwC unveiled an Industrial Structural Transformation (IST) framework, which we believe provides the necessary road map to execute against the firm’s aspiration of what the next chapter of the firm might look like. Bringing together all parts of the business — Assurance, Tax, Advisory and Consulting — and replicating them across industries while using data intelligence and a fee-for-service commercial model can help PwC build a foundation that resonates across all member firms.

Starting with use cases in Japan across segments like mobility provides a glimpse into how the framework can be applied as the evolution of AI extends into the physical world, and how the architecture of the entire industry can be transformed beyond the use of the software to include the business and social rules. Developing the backbone of going to market through integrated scale is the first step. Executing against it, especially bringing use cases outside of Japan to other member firms, which often deal with their local client issues, can prove to be a rewarding challenge.

Three key areas which PwC Japan discussed at length during the event — sustainability, risk management and tax — brought to light the closer collaboration and applicability of the framework at scale between the various parts of PwC’s portfolio. Sustainability and risk management bring together assurance and consulting while tax provides a conduit for closer collaboration with consulting.

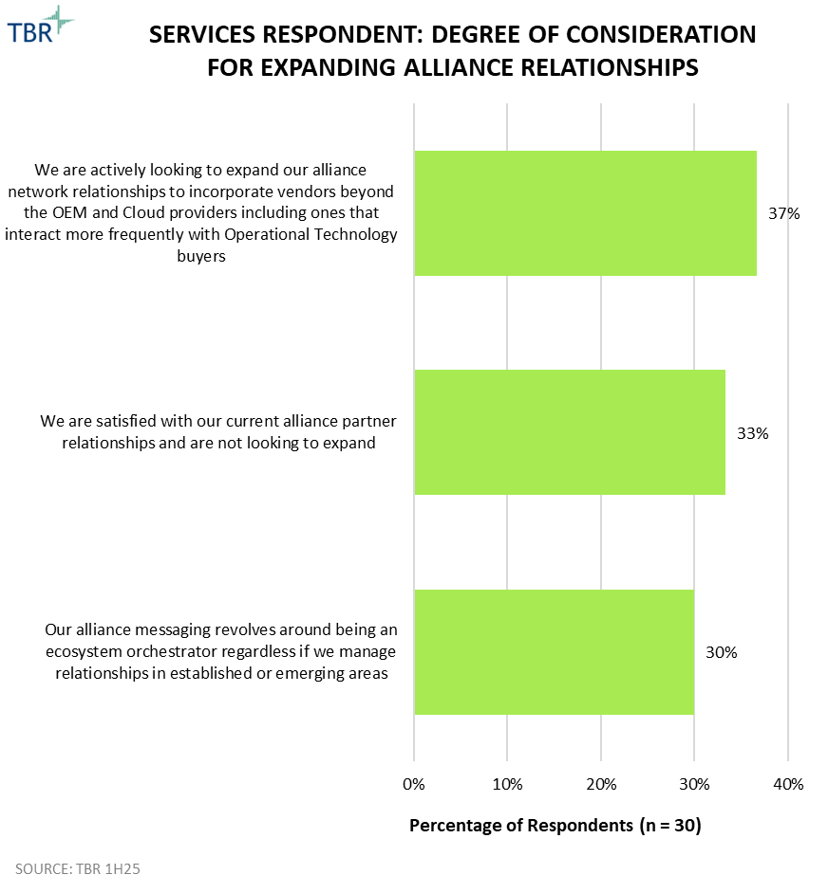

Developing solutions that are function-specific provides the necessary horizontal connection across these areas while relying on the firm’s industry knowledge to demonstrate value and deliver outcomes. We believe a large portion of PwC’s success will come from including its technology partners at every step of development, deployment and management of its IST framework as partner feedback and knowledge management have become as critical as ever to understand how professional services companies go to market.

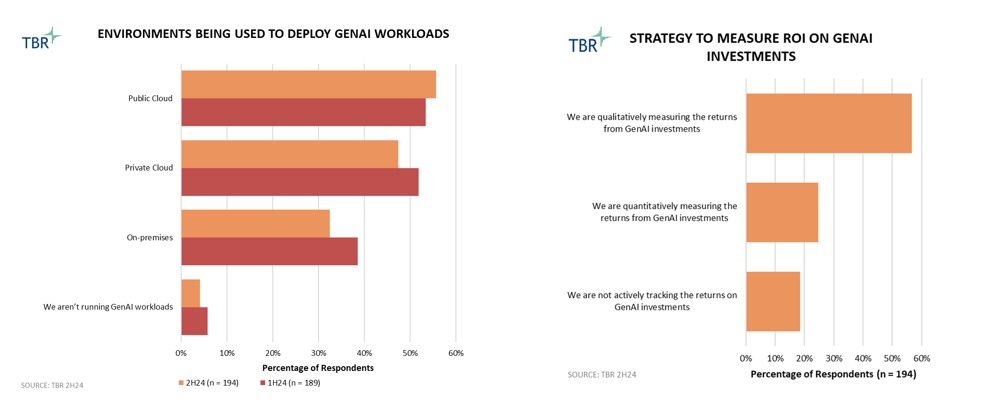

Application of technology solutions beyond the marketing hype elevates PwC Japan’s soberness and readiness to support the global network in handling macro disruptors

Virtually no market discussions today exclude data and AI. Takuya Fujikawa, PwC Japan Group Chief AI Officer, Data and AI Leader, took the opportunity to provide an update on the firm’s data and AI practice at the onset of the second day of the event. One important nuance struck TBR about PwC Japan’s portfolio: its applicability of AI across multiple domain areas, rather than simply drilling down on generative AI or agentic AI, which have been the predominant focus in similar settings. Adhering to open data principles while relying on its industry and functional expertise provides a strong foundation for the firm’s data and AI portfolio with examples around threat intelligence, intelligent business analytics or power market analytics highlighting various use cases.

With PwC US recently launching the Agentic Operating System, we expect PwC Japan to lean on these experiences and capabilities and follow suit with agentic AI solutions that meet local client needs for driving efficient operations. We expect the rollout to be bidirectional and other member firms to look to collaborate with PwC Japan on emulating its portfolio offerings. Scaling the use of such solutions will fit nicely and support PwC Japan consulting’s three-layer growth model, especially around the data intelligence and data monetization opportunities and the tech-enabled arbitrage model.

Additionally, discussions throughout the second day provided deeper insights into other strategic domains of PwC Japan’s portfolio, such as sustainability and trust, including cybersecurity. Common themes across value creation enabled through technology amplified the need for better alignment among practice areas within PwC Japan, especially as buyers’ focus in each area has shifted toward translating respective market challenges to business implications.

Within sustainability, PwC remains focused on creating customer value by emphasizing cross-business themes, including decarbonization and biodiversity, with most of the opportunities centered on government reporting mandates, further demonstrating the need for collaboration between audit and consulting services.

Withing trust, leadership highlighted cybersecurity and cyber intelligence services – both important elements of PwC Japan’s strategy – including its collaboration with delivery partners, such as with TIS Inc. for use of remote monitoring, alert responses and emergency interventions, among other security services.

Enabled by a humble and gracious culture, PwC Japan sets the bar high for what’s next in the firm’s strategy evolution

Just as technologies arm PwC consultants with tools to solve complex business challenges, the Technology Laboratory provides the enabling environment for all presentations, as regardless if executives spoke about audit and assurance, tax, advisory or consulting, they all leaned on a piece of technology that helped them connect the dots between art of the possible and the answer through the tangible.

As macroeconomic uncertainty persists, PwC has realized that instead of trying to fix issues outside its control, it is better to focus on its own transformation to prepare for addressing client challenges. We recognize there is still an opportunity for the firm to strengthen relationships with both internal and external stakeholders, including its alliance partners. Building a strong, common foundation for member firms is a crucial first step for integrated scaling. This involves connecting the Technology Laboratory and Experience Centers to deploy BXT and BMR at scale. Leveraging their experience with fixed-price contracts, they can then pivot toward fee-for-service models, providing the necessary frameworks for collaboration.

PwC Japan Group and its leadership set the bar high for its member firm counterparts in what it would take for the firms to work together more closely. Starting with better service line collaboration and portfolio offerings rollouts to establishing common KPIs and shared services are some of the prerequisites, and PwC Japan seems to have the ingredients to make it work all together. And while clients are less worried about how a firm operates and are more focused on solving their business and technology problems, working with a vendor that has its own house in order certainly makes it an easier partnership.