Partnerships, Not Products, Will Define How Consultancies and Native AI Companies Share Value in Agentic AI Era

Services regain strategic importance

Services are cool again. Native AI companies are embedding services offerings around their products and thinking about services as part of their long-term strategy — well, not too long-term, as how long can a strategy remain the same?

Suppose native AI companies want to deliver services. How will they compete, or perhaps even partner, with traditional IT services companies and management consultancies, which are pursuing their own AI opportunities? These assertions and questions came up repeatedly this summer, and as 2025 winds down, we are starting to see some outcomes and answers.

TBR attended several tech conferences and analyst events in recent months, and AI was the inescapable topic at each one. In particular, KPMG’s Technology and Innovation Symposium in Deer Valley, Utah, stands out, in part because of the sheer breadth of opportunities discussed, use cases highlighted, and future hopes and fears laid out in stark detail.

In our latest blog series, TBR on AI in 2025, we intend to connect those ideas with research and analysis conducted by TBR over the last few years to highlight implications for the companies we cover across the technology ecosystem. Previous topics about the agentic AI age have included human resources management and expectations for enterprise IT architecture. Future posts will discuss who gets first and consistent access to limited resources like energy.

Watch now: The Good, the Bad and the GenAI Opportunity in Cloud Ecosystems

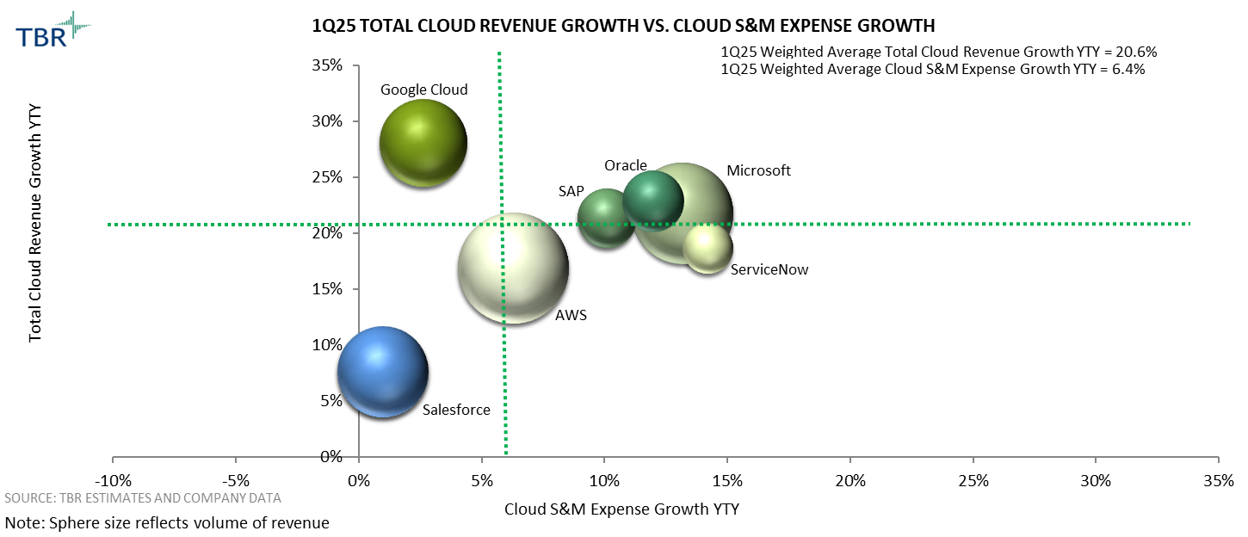

AI-native platforms disrupt the people-dependent services model, forcing incumbents to rethink partnerships

Native AI companies folding services offerings into their products and platforms follow in the large footsteps of the cloud and ERP vendors that persistently maintain professional services offerings to complement their cloud infrastructure and software money-making machines. As these giants have learned, success in services is harder than it looks and requires, at minimum, people and permission. Services are inherently a people business, and delivering consistently, with quality and at scale demands teams of people and staff to support them. No clients buys services without first being certain the provider can deliver (i.e., permission). Cloud and software companies have always had the latter locked up. Who knows SAP better than SAP professionals, and who can deliver Azure better than Microsoft? But the people part continually presents a stumbling block, or at least a check on scale and growth.

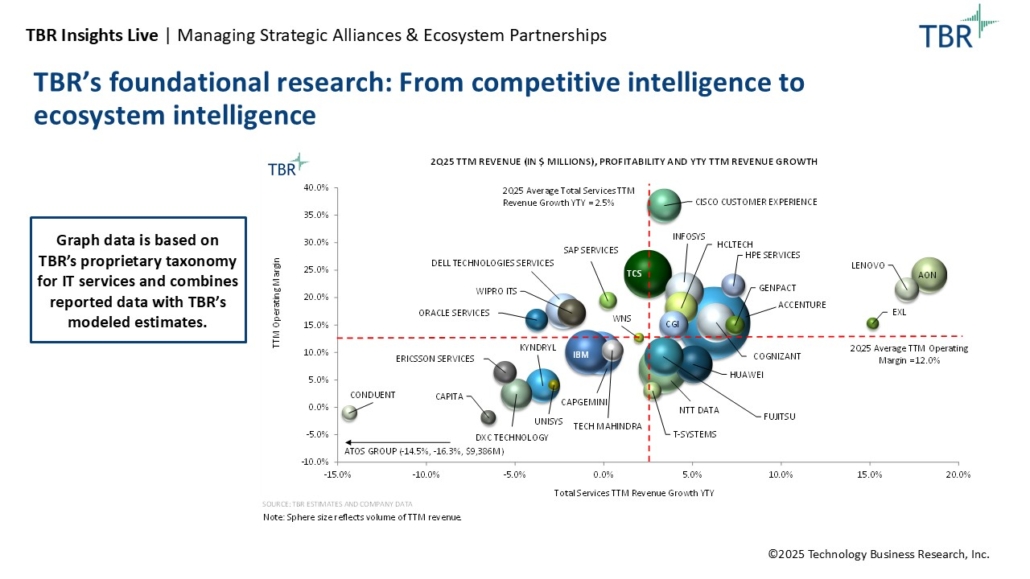

Why does all this framing around the cloud and software giants matter to native AI companies with their products and platforms? It doesn’t. However, it’s the world in which IT services companies and consultancies have been operating. Partnering with native AI companies looking to expand their services offerings will not be the same as fending off Microsoft Professional Services or SAP Services. At TBR, we constantly examine the largest IT services companies and consultancies, studying how they operate, partner, go to market and generate revenue. All of these aspects are changing rapidly in the agentic AI age, allowing us to bring that research to this developing space.

What roles will traditional IT services companies and management consultancies play, particularly as AI companies’ products permeate enterprise clients?

TBR sees three, not mutually exclusive, roles for traditional IT services companies and management consultancies: venturer, concierge and rival.

Most IT services companies and consultancies lack an impressive track record of investing early in startups, often acting more like traditional service providers than venture capital firms. At traditional IT services companies, the quarterly earnings clock, management and oversight layers, and competing offerings typically keep startup incubator programs relatively small (and too frequently underfunded).

Why does the people challenge not apply to native AI companies in the ways we have seen with traditional cloud and ERP players?

Solving the people problem is, inherently, part of AI, no matter how often one hears the “human in the loop” chorus. Services offerings folded into native AI companies’ products start optimized for minimal human touch. IT support through a chatbot? Built-in. FinOps solutions? Native.

Yes, services at scale has always demanded people and support staff, but that imperative is fading fast and will not apply to native AI companies.

Consulting firms have not fared much better, given the need for consensus around strategy and investment. Notably, some of the Big Four firms have become more adept at making small investments, capturing enough of a stake to influence without owning. KPMG, in particular, has developed a consistently funded, well-managed startup support program that has seen success in the last couple of years.

Consultancies’ change management expertise positions them as vital partners to emerging AI vendors

Investing can be the gateway into a concierge-like relationship between these giant companies and firms and the relatively small native AI companies. Most commonly, these relationships focus on making introductions to enterprise clients, providing strategic counsel, offering financial and tax advice, and mentoring leaders. TBR sees a critical new opportunity, expressed clearly at the KPMG Technology and Innovation Symposium: change management.

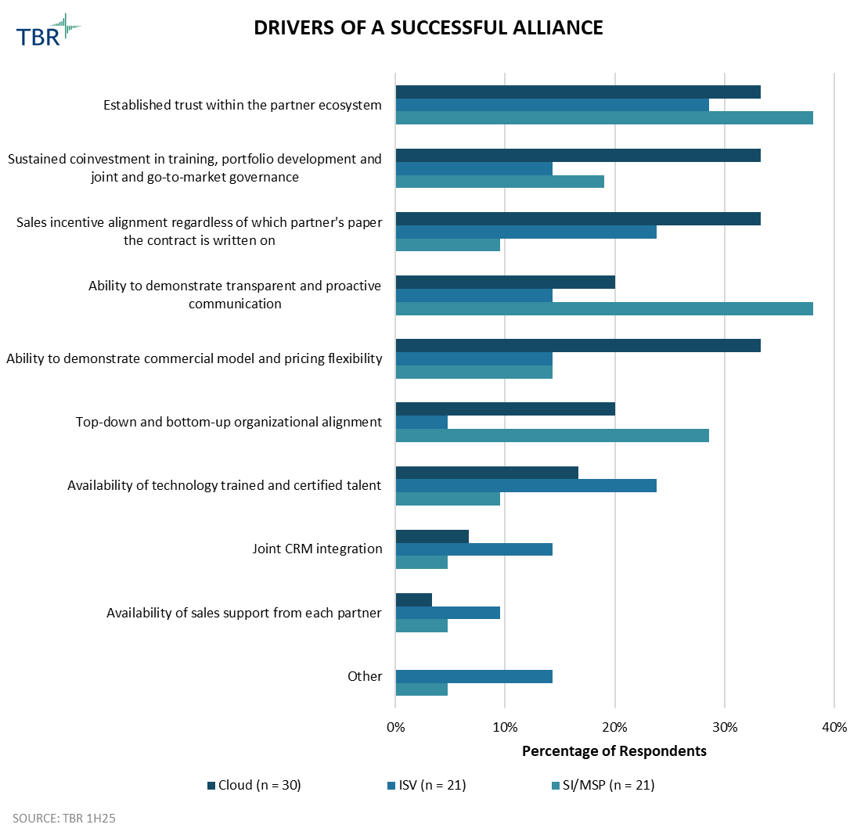

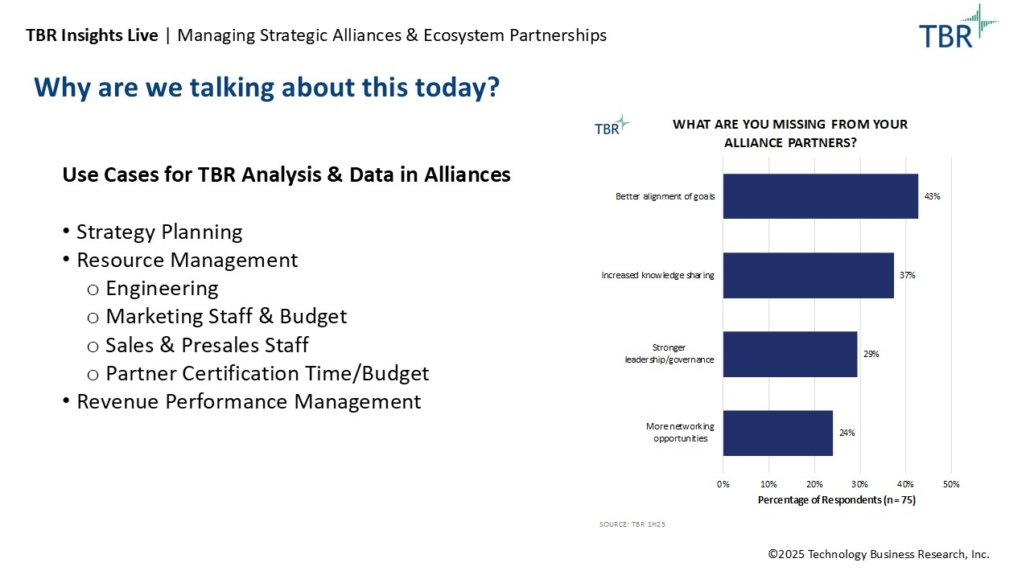

Speakers at that event and professionals across the AI and consulting space in subsequent discussions noted that most native AI companies have not worked out the potentially massive change management requirements and implications of adopting their products. Many IT services companies and all management consultancies excel at change management and could be well positioned to provide clients consulting services entwined with a native AI companies’ product, provided all parties understand both the complementary offerings and the commercial models. And these elements echo TBR’s ecosystem research, which has repeatedly shown that leading companies invest in understanding their alliance partners’ offerings and sales structures.

Just like supporting startup programs, many traditional IT services companies and consultancies have struggled to adequately put themselves in their alliance partners’ shoes. And when those partners are startups or immature native AI companies, that struggle will be harder in the absence of leadership, strategic direction and sustained investment. But that’s the potential downside. The upside is that consultancies are perfectly positioned to be change management specialists, helping their largest clients adopt the best new AI.

“When I think of knowledge, there are two pieces. One is, what are the insights to build the product? That’s where our people come in, because we have practitioners who are working with clients on this product, using the right insights to build the right product. That’s Part 1. And second is, do your salespeople know those product features to help go sell? And I think the second part, I definitely see opportunity. There’s a little bit of upscaling and change management required for a lot of these sales folks across the board on how to sell these modern version of their software in the agentic world.”

– AI professional speaking to TBR about knowledge management, sales and AI

And then, there is always the possibility of rivalry

Every traditional IT services company and management consultancy that TBR covers, including Tier 2 companies (enterprise systems integrators, in TBR’s terms), has its own products, and most have platforms. Although not all vendors sell products as stand-alone offerings, they all have accelerators and AI-enabled solutions — quite a few acquired over the last couple of years.

At a technology level, these solutions and AI native companies’ products may compete or complement, but at a business-model level, what matters are the attached services. The traditional IT services companies and consultancies have relied on client intimacy, scale and industry knowledge to stay sticky with their clients, holding off challengers. AI becomes intimate more quickly than traditional ERP. Industry-specific AI is coming fast, so traditional companies and firms will need to rely on scale, for now, to keep native AI companies’ services offerings at bay, at least with enterprise clients. As many traditional companies and firms seek new markets among smaller clients, focusing on investing and partnering will become the only path to sustained success. Or simply acquire, of course.

What comes next for traditional IT services companies and consultancies?

History keeps rhyming. Native AI companies understand that the services business model often clashes with product and platform strategies. As a result, their investment in services will rise and fall with client demands, leadership changes, market opportunities, and the successful moves of the smartest traditional IT services companies and consultancies.