Acquisitions, being attentive to clients’ bottom-line demands, and implementing AI into IP are backbone of CGI’s “built to grow and last” strategy

On June 5, CGI hosted its Industry Analyst Summit. CEO Francois Boulanger and CGI Board of Directors Executive Chair Julie Godin commenced the meeting, detailing how CGI’s business culture, proximity model and decentralized approach, acquisitions and cocreation with clients are key to the company’s growth strategy. Throughout each session CGI leaders highlighted the company’s emphasis on meeting client objectives, providing flexibility and codeveloping solutions as necessary. Cocreating on projects not only delivers more relevant solutions to the client but also provides CGI with new intellectual property (IP) that it can bring to other clients.

Notably, CGI is leaning into its proximity model by acquiring more companies that build out the company’s footprint in metro markets. This is particularly evident with the purchases of U.S.-based Daugherty and Novatec. Other acquisitions such as Momentum Technologies and Apside expand the company’s local presence in Canada. Access to more markets across the U.S., Canada and Europe, alongside new client-led solutions, is broadening the company’s opportunities, particularly around AI-related projects. CGI has also enhanced its data and AI capabilities through the strategic acquisitions of Apside, Novatec and Aeyon.

CGI shared insights into its recent AI endeavors, including an example involving the deployment of an air gap solution for the North Atlantic Treaty Organization (NATO). For this project, CGI collaborated with NATO’s Allied Command Transformation in Norfolk, Va., to construct and tune models that accelerate the classification, editing and analysis of documents using the knowledge agent AI Felix. Outside client-led solutions, CGI is embedding AI across its existing portfolio to enhance delivery to clients across industries.

As CGI remains largely unaffected by DOGE, enhancements across the company’s public sector portfolio allow it to dig deep on federal deals

Stephanie Mango, president of CGI Federal, led an hourlong panel discussion with executives representing CGI’s U.S. Federal, Canadian and European public sector operations. Globally, CGI’s various government clients are encountering similar challenges associated with rising levels of economic and geopolitical uncertainties and governmentwide changes. Common across the company’s roster of government customers is the enduring demand for IT modernization. CGI is currently helping governments transform outdated legacy IT infrastructures, prioritize digital transformation initiatives, address talent shortages in cybersecurity and AI, adopt zero-trust security architectures, implement sovereign AI and cloud solutions, enhance the security and resilience of government supply chains, and protect critical public sector infrastructure.

TBR believes having such a broad swath of activities provides CGI’s public sector practices globally with case studies and success stories to showcase when pursuing new opportunities, talent with relevant experience that can be redeployed to new government markets, and solutions codeveloped with government clients highly relevant to public sector agencies elsewhere. A common go-to-market approach CGI employs across all public sector markets is to help government IT departments and IT decision makers retain a modernization mindset as the company firmly believes governments must view digital transformation as a long-term, multiyear strategy. TBR believes CGI also effectively leverages its client proximity approach to codevelop solutions with government clients and to optimize its agility in responding to fast-changing market dynamics.

In the U.S. federal market, where the arrival of the Trump administration and its Department of Government Efficiency (DOGE) has caused sectorwide upheaval, TBR believes CGI Federal is well positioned to capture a growing share of digital modernization work that we expect to accelerate, after the initial shock of billions of dollars in budget cuts and reallocations. Although CGI was included on DOGE’s initial hit list of consultancies under scrutiny, CGI Federal only generates 2% of its sales from “discrete consulting services,” which TBR assumes is a reference to the type of management or strategic consulting services most vulnerable to DOGE.

CGI Federal generates over 50% of its revenue from outcome-focused engagements, which are typically structured as fixed-price contracts. According to TBR’s Federal IT Services research practice, federal IT contractors can expect a general shift from cost-plus to fixed-price arrangements as agencies adopt a more outcome-focused mindset regarding new IT outlays. When the federal IT procurement environment begins focusing more on outcome-based contracting, it will shift more risk of cost-overruns or delivery delays to the vendors — a potentially margin-erosive scenario for federal system integrators (FSIs) that fail to maintain strong program execution.

CGI Federal is confident it can adapt to outcome-focused contracting in federal IT but is uncertain how quickly the transition can be completed. CGI Federal has been a perennial margin leader in TBR’s Federal IT Services Benchmark due to its traction with its ever-expanding suite of homespun IP-based offerings like Sunflower and Momentum, and demand for these offerings will at least endure, but likely increase, under DOGE.

TBR anticipates additional opportunities for CGI Federal will stem from its proprietary Sunflower (cloud-based asset management) and Momentum (financial management) solutions, as improving asset and financial management are among DOGE’s chief objectives and are in high demand by civilian and defense agencies looking to enhance fiscal and supply chain management, especially to comply with DOGE-related mandates.

CGI Federal has ongoing engagements that the company will showcase to win future federal work. For example, CGI Federal is implementing a cybersecurity shared services platform for the Department of Homeland Security (DHS), while the Department of Transportation’s use of the Momentum platform will serve as the case study for similar engagements across the federal civilian market.

In the Department of Defense, CGI Federal expects to leverage its fiscal and asset management offerings to capitalize on the recent mandate from Secretary of Defense Pete Hegseth that all U.S. service branches pass financial audits, and the company will cite its recent success on the U.S. Marine Corps Platform Integration Center (MCPIC) engagement to illustrate the full range of its capabilities. In the U.S. state government market, CGI leaders also mentioned that an unnamed state government had established its own version of DOGE with similar efficiency objectives and noted that other states are likely to follow suit, creating an expanding addressable market for the company’s asset and fiscal management platforms to prevent fraud, waste and abuse and to maximize operational transparency.

CGI Federal’s 2024 acquisition of Aeyon added process automation and AI capabilities that TBR believes will have high relevance for not only U.S. federal agencies but also state governments. The company also provides low-cost onshore managed services in the U.S. from delivery centers in Lebanon, Va., and Lafayette, La., staffed by 2,000 CGI professionals. Low-cost onshore delivery is also common across CGI’s public sector operations in Canada, but less so in Europe.

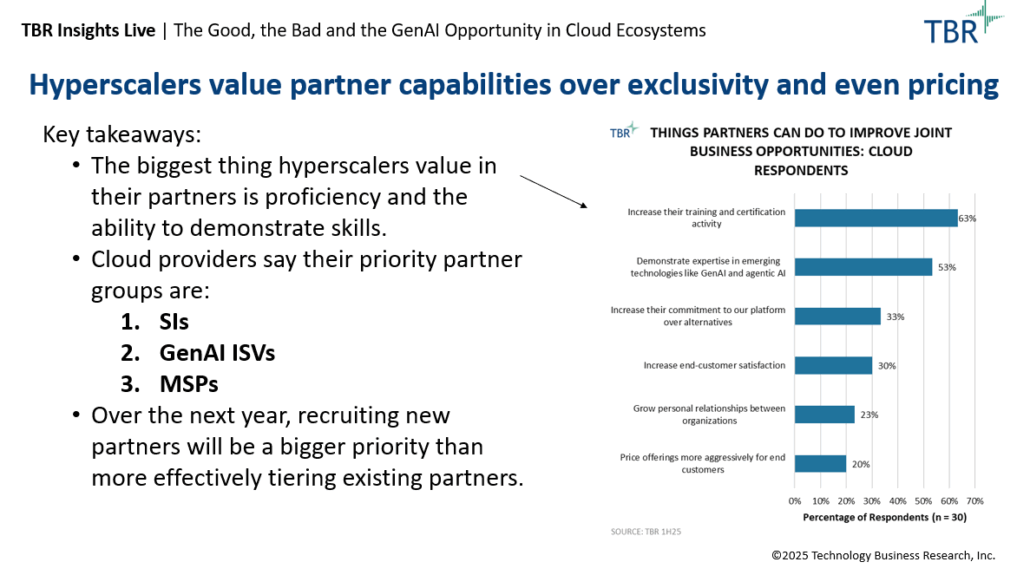

TBR believes CGI’s alliances with cloud hyperscalers (Amazon Web Services, Google and Microsoft), platform providers (Salesforce, SAP and ServiceNow) and others (UiPath, TrackLight and NetApp) will be key to its future success in not only the U.S. federal market but also public sector markets globally. These partners are also enablers of the company’s IP-focused solution strategy — as important as client-partners in developing new technologies and solutions.

CGI does not believe the advent of generative AI (GenAI) marks the beginning of the end for traditional IT services. Rather, CGI intends to leverage its expanding GenAI capabilities to migrate its public sector portfolio of offerings away from lower-value services and embrace higher-value offerings designed to maximize the value and potential of GenAI for public sector agencies. Higher-value services will require CGI to lean more heavily into its well-established proximity model as clients may need more guidance to fully reap the benefits of new offerings as capabilities become increasingly complex. In the long term, CGI may turn to more offshore resources as clients demand greater support.

BJSS provides short-run revenue relief but demonstrating AI competency to clients will be key

Vijay Srinivasan, president of U.S. Commercial and State Government operations, led the session on CGI’s banking segment by highlighting the company’s dedication to servicing clients long-term and holistically, providing flexibility to address clients’ objectives rather than focusing only on selling financial services solutions. Following opening remarks, CGI discussed recent trends and concerns in the sector supported by annual interviews of business and IT executives. First, as many banks strive for increased personalization, they demand AI and real-time capabilities on mobile applications. Unsurprisingly, banking clients are facing challenges deciphering market expectations, given the unpredictable nature of ongoing tariffs. In turn, banking clients are looking for new ways to generate revenue and maintain profitability. The banking industry, alongside many others, is experiencing a deterioration of institutional knowledge with retirements, fueling demand for AI tools.

As banks demand more AI tools and other new technologies, they need to modernize legacy IT systems, migration support, and application modernization. These modernization efforts also help banks execute on their cost-cutting initiatives. During the second half of 2024, CGI modernized a U.S. financial services company’s loan origination system with CGI Credit Studio and implemented its Trade360 platform for Bladex.

Despite the recent interest rate cuts made by the European Central Bank (four reductions thus far in 2025) and by the U.S. Federal Reserve (three reductions in 2H24), ongoing uncertainty is driving the need for streamlined processes enabling cost efficiency. CGI shared an example where the company supported a Canadian bank to optimize over 110 core applications, many of which were running on legacy systems. CGI was able to reduce the bank’s run costs by more than 35% year-to-year. Although the transformation began eight years ago, CGI has a long-standing relationship with the client, and the deal serves as a blueprint for similar contracts in the industry. Leading digital transformation efforts that support bottom-line initiatives is particularly important in the current environment.

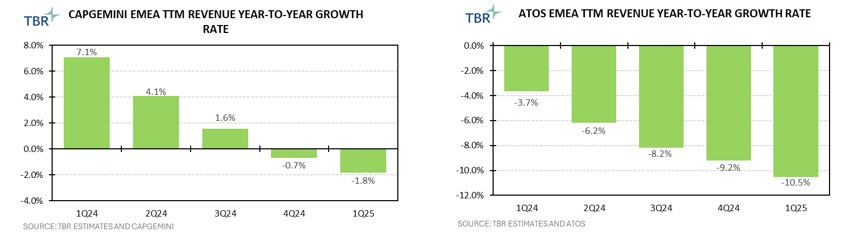

Although the financial services sector is experiencing ongoing volatility, the sector and the manufacturing, retail and distribution sector are roughly equal contributors to CGI’s overall revenue. Finding new revenue opportunities and honing strategy within the segment will be vital to sustaining growth. Many IT services companies, including CGI, experienced revenue decline in their financial services sector in 2024, CGI’s financial services revenue declined in 1Q24, 2Q24 and 3Q24 before increasing by low-single digits in 4Q24.

In January 2025 CGI completed the acquisition of BJSS, a U.K.-based engineering and technology consultancy with industry expertise in financial services. The acquisition contributed to 8.6% year-to-year growth in the sector. CGI is not the only company prioritizing acquisitions that boost struggling verticals. Accenture recently purchased U.K.-based Altus Consulting, which will improve digital transformation capabilities in the financial services and insurance industries. Accenture experienced similar segment revenue growth declines as CGI in the first half of 2024. TBR believes BJSS will have a meaningful impact on revenue in the short run, but CGI may need to be more persistent with adding new solutions. Although introducing AI capabilities enhances client experience, it may not signal AI competency in the same way as new solutions. CGI may benefit from using acquisitions and more portfolio investments, similar to its investments in the public sector, to foster organic growth.

TBR believes CGI’s coinnovation with clients will create new opportunities tailored to industry needs; however, at the same time, other vendors in the past year have been leveraging partnerships to expand market share and provide industry-specific solutions. For example, Cognizant and ServiceNow expanded their partnership to reach midmarket banking clients, and Accenture is collaborating with S&P Global to jointly pursue financial services clients. Joint offerings may motivate clients to invest in these solutions rather than only implementing AI into existing solutions.

CGI illustrated how BJSS adds value to the company’s capabilities in its banking vertical in the U.K., specifically related to end-to-end services and product deployment. BJSS’ emphasis on meeting client goals made it a strong cultural fit for CGI. The acquisition came six months after the purchase of Celero’s Canadian credit union servicing business, which deepened CGI’s reach in Canada. These recent acquisitions, alongside recent interest rate cuts and continued additions of AI capabilities in banking solutions, position CGI well for strong performance in the sector. Further, in the company’s most recent earnings call, Boulanger announced the company is seeing “early signs in quarter two of renewed client spending in the banking sector.”

Adaptability with manufacturing clients provides deal opportunities even in a challenging environment

After the public sector, the financial services and the manufacturing, retail and distribution sectors are CGI’s next-largest revenue contributors, according to company-reported data. Similar to financial services, revenue growth in the manufacturing, retail and distribution sector was also volatile throughout 2024. Manufacturing clients will continue to experience a challenging environment with tariffs also contributing to uncertainty. During the industry session, CGI leaders discussed the increased importance of supply chain resiliency, stating that clients are seeking alignment with the company’s talent, data and technology. Investments to improve resiliency, such as in data-sharing ecosystems and capacity management, will be vital for clients, serving as a revenue opportunity for CGI.

To capture more revenue opportunities, CGI is completing acquisitions that bolster its standing in manufacturing, similar to recent purchases made to expand in financial services. Although CGI leaders did not directly discuss it during the session, the company’s recent purchase of Novatec expands CGI’s reach into the manufacturing sector in Germany and Spain, specifically in the automotive industry. The acquisition brings capabilities in digital strategy, digital product development and cloud-based solutions, which will help CGI with growing demand for supply chain resiliency. Further, manufacturing sectors are beginning to experience the effects of knowledge loss associated with large numbers of retirements. Increased automation in the sector will help close gaps. CGI is investing in implementing AI across its manufacturing portfolio, as well as the entirety of the business.

CGI is finding its clients are at different places in their digital journey, and the divide is only increasing. To address this gap, CGI will need to lean into its adaptable nature to meet each client’s needs. CGI included two examples to demonstrate the company’s approach. CGI highlighted a key deal with the Volkswagen Group around digitization, where the two companies jointly created a governance model and collaborated on Agile DevOps. The two formed a new entity, known as MARV1N, a unit that will provide the group with the necessary development support for digitalization projects. Additionally, CGI modernized the group’s legacy systems while developing new IT systems designed to cut operation expenses. The example from the session emphasizes one of CGI’s main themes of the summit: helping clients holistically, specifically around providing meaningful outcomes that improve clients’ bottom line.

Similarly, CGI developed and is managing Michelin’s supply chain and planning production manufacturing, underpinning the client’s Customer Experience and Services & Solutions focus areas. CGI was able to increase supply chain resiliency by enabling inventory prediction and implementing AI and business performance monitoring. CGI also supported Michelin with a machine learning project. The collaboration reflects CGI’s mission to increase automation to improve productivity and enhance supply chain resiliency. In contrast, the demand for AI comes mainly from intrigue in manufacturing, rather than leveraging it to boost productivity. TBR believes it will become important for CGI to signal to manufacturing clients how AI tools can help boost productivity, which is what CGI did recently in an engagement with Rio Tinto. CGI deployed AI tools to help Rio Tinto reduce production breakdowns, helping the client capture additional revenue.

As CGI’s proximity model and ideology provide longevity, investing in the right next-generation technology will position the company competitively

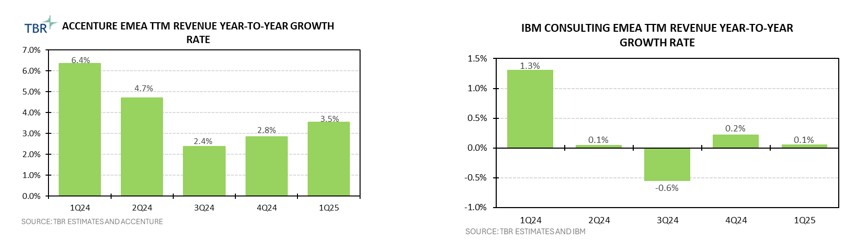

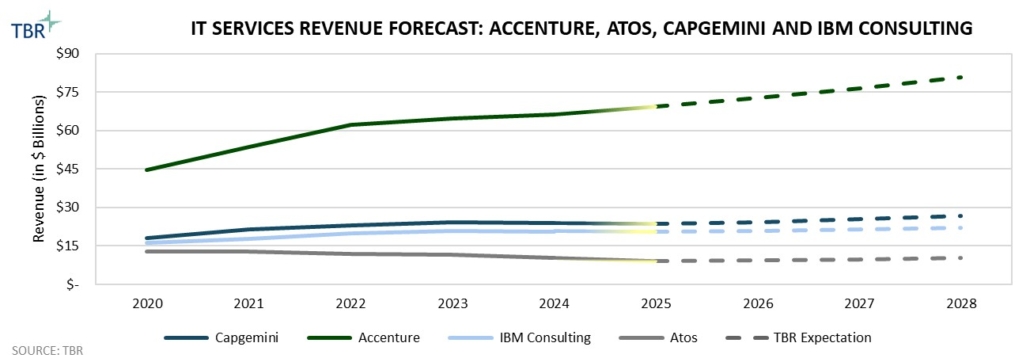

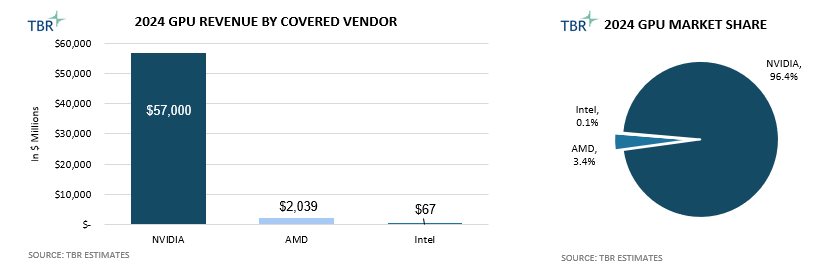

CGI’s focus on cocreation, infusing AI into its IP, and recent acquisitions has fueled revenue growth that is currently outpacing most other IT service vendors, largely due to its robust acquisition pace that is surpassing that of its peers, many of which are prioritizing smaller acquisitions with specialized capabilities. Additionally, as concerns of a recession rise, other IT service companies are turning their attention to startups. For example, Accenture has been ramping up its investments in startups, recently investing in AI prediction company Aaru and Voltron Data, which has GPU-powered data processing capabilities.

Similarly, Capgemini is collaborating with ISAI, a France-based tech entrepreneurs’ fund, launching ISAI Cap Venture II centered on investing in B2B startups. Although CGI made brief mentions of its startup framework, CGI Unicorn Academy, and discussed its AI-powered service delivery approach, CGI DigiOps, the company has not made many public announcements about investments or new initiatives. Capturing new technology, especially amid economic uncertainty, could help CGI secure a competitive edge on future revenue opportunities.

In CGI’s FY2025, which ends in September, CGI is likely to maintain its M&A pace. Although acquisitions may help CGI gain an edge over its peers, especially if the targets are well aligned culturally and able to significantly widen CGI’s reach into metro markets, the accelerated revenue growth will need to be coupled with AI investments that signal productivity improvements to maintain momentum in the long term so that CGI can attract more clients based on its innovation capabilities. However, TBR anticipates CGI will continue to expand revenue faster than its peers during its fiscal year, likely growing 5.0% in Canadian dollars and 1.2% in U.S. dollars. Nevertheless, the event reinforced CGI’s reputable strength: forming strong, in-depth, long-term relationships with its clients.