Analyst Summit Boston: PwC positions trust and cybersecurity as pillars for success in AI and business transformation

PwC has unquestionably built a brand around trust, as reflected in the two main themes woven throughout the Boston PwC Analyst Summit: risk and cybersecurity. In TBR’s view, PwC’s fundamental value proposition around trust and client intimacy reflects the firm’s strong governance, risk and compliance (GRC), cybersecurity and technology capabilities. TBR views risk and cybersecurity offerings as natural enablers for client discussions around business model reinvention and — when complemented by credible customer zero use cases across multiple domains, including AI — an extension of trust throughout a client’s ecosystem.

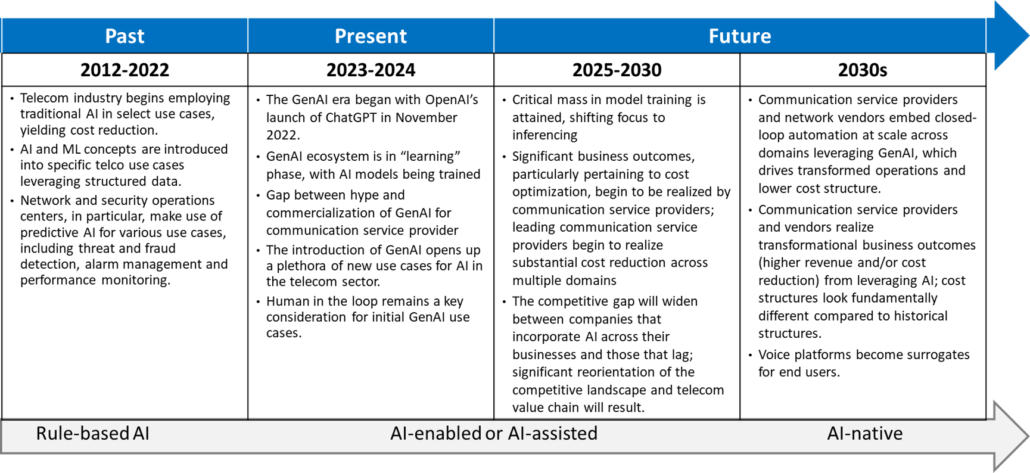

Despite its traditionally risk-averse culture, PwC was relatively quick to roll out an internal version of ChatGPT to all employees, and TBR believes the firm likely uncovered substantial best practices in how to manage change and limit downside risk associated with generative AI (GenAI).

Recognizing that cyber risk is no longer solely a technology issue but also a businesswide concern with financial and reputational consequences, PwC leaders repeatedly stressed that governance, not technology, must take the lead in ensuring robust cybersecurity strategies, supported by an ecosystem of partners. During a managed services use-case discussion, a client noted that PwC brought specific technology expertise and experience working with other business customers on this client’s specific problem. PwC’s relevant experience offered the client distinct benefits around risk mitigation, as part of their larger managed services engagement.

Additional highlights from PwC’s Boston event:

- An emphasis on data sustainability and GenAI is central to PwC’s long-term investment strategy, forming the foundation of every business line. PwC’s role as what TBR calls a “technology orchestrator” reflects the firm’s commitment to navigating the intersection of renewable energy, AI and other emerging technologies to help clients adapt and grow.

- Geopolitical tensions, particularly between the U.S. and China, remain a critical concern, with bipartisan consensus in the U.S. about addressing these issues underscoring the urgency. Despite challenges with R&D expense rules and state-level regulatory complexities, PwC has been advising clients to embrace sustainability and prepare for scenario planning.

- Mike Thiessen, PwC’s U.S. Chief Clients and Markets leader, noted that PwC’s approach to GenAI focuses on building bespoke workflows, integrating technical development with legal safeguards, and prioritizing user-driven curation. PwC recognizes that each GenAI project is unique, requiring tailored approaches and experience in addition to technical features. Under these conditions, PwC ensures AI implementation is secure and effective, aligning with the firm’s broader AI strategy.

- C. Lapierre, one of PwC’s U.S. Sustainability leaders, noted that mandatory reporting on climate action can serve as a catalyst for enterprises to get their data and sustainability strategy in order. Many companies now understand the scope and depth of the work needed to meet net-zero commitments, which were often made before the necessary parties had a full understanding of the difficulties and opportunities involved.

Artificial intelligence: Big bets, massive change, and all comes back to trust

On artificial intelligence (AI), PwC leaders during the Boston event noted that AI is reshaping everything, from brand and market positioning to operational strategy. PwC committed to a $1.5 billion investment in AI, an increase from its original announcement of $1 billion, underscoring the technology’s importance to the firm’s future.

The vendor is also focused on delivery excellence, specifically enhancing systems like SBLC to make them more intelligent and efficient. PwC noted that the U.S. firm spends 17 million hours annually bringing ISV partners into the production stage of engagements, clearly an area ripe for AI-driven optimization. Additionally, PwC leaders said that new partnerships around developing language models are revolutionizing SBLC, creating a new foundation while refactoring older offerings. According to PwC, this shift reflects the broader evolution of AI from an emerging technology to a general-purpose one that is now central to business strategies.

PwC leaders elaborated on potential business model implications of wider AI adoption, including the erosion of scale as a differentiator as AI-driven agentic workflows allow small companies to simulate large-scale operations. In addition, faster adoption rates help businesses more quickly realize the efficiency AI brings to back-office operations.

In TBR’s view, trust continues to be the linchpin for AI’s success; absent trust, AI’s potential will remain unrealized. As noted above, in previous TBR reports, and by PwC leaders repeatedly during the Boston event, PwC’s brand is built around trust.

Demonstrating the criticality of AI to PwC, firm leaders noted nine high-stakes AI investments, each worth $50 million, aimed at driving either top-line growth or cost reduction. One of the standout initiatives is Elly, an AI-powered system with a digital worker equivalent (DWE) of 2,500 — with each DWE representing 2,000 hours of work. This demonstrates the firm’s bullish outlook on AI’s return on investment.

Further, PwC leaders believe AI’s impact extends to enterprise resource planning (ERP) systems. While earlier designs emphasized efficiency, the focus has now shifted to functionality and achieving the best outcomes. In building these systems, PwC is ensuring that both design and implementation align with the firm’s strategic objectives. TBR agrees with PwC’s assessment of the potential for AI to massively improve ERP systems, provided enterprises fully trust their AI platform to handle mission-critical and proprietary data. Again, the emphasis is on trust.

Analyst Summit London: PwC leaders highlight megatrends and business model reinvention in effort to navigate transformation

In London, PwC leaders shared the following megatrends and commentary from the firm’s perspective:

- Climate change is negatively affecting social stability.

- Increasing demand for silicon chips and power, combined with a limited supply of chips and GenAI, is compounding clients’ risk factors.

- There is a global need to rethink power, global food supplies, demographics and migration, and industrial processes.

- Increase for on-demand mobility is quickening the pace of change in the automotive and oil & gas verticals.

To address the megatrends and capture opportunities, PwC is investing in three key areas both globally and in EMEA: sustainability, trust and business model reinvention (BMR). BMR requires helping clients operate in new ecosystems to find future areas of growth and reconsider how products and services will change. According to PwC EMEA leaders, AI, data and technology cut across all three, and every enterprise must be able to operate and be successful in these areas.

Going deeper on BMR, PwC EMEA leaders noted that, according to PwC’s most recent Global CEO Survey, approximately 45% of CEOs do not believe their business will be viable in the next 10 years without reinvention, up from 39% of respondents in 2023. Not surprisingly, clients are asking for PwC’s advice on strategic planning and how to invest today to be successful tomorrow. PwC has a methodology to assist clients with their transformations, starting by sitting with clients and discussing their needs to gain a deep understanding of their design and implementation abilities and industry knowledge and co-creating an approach that is industry-led and industry-focused.

According to PwC EMEA leaders, the PwC BMR framework helps clients identify business growth areas, such as the development of new ecosystems and the creation of new products and services to pursue value and underpenetrated areas of revenue. For example, through a client session, PwC walked through a BMR transformation in which PwC helped create a new company from scratch following a sale of the business. Through the new business, the client sought to overcome rising cost pressures as well as crop and agricultural challenges that were disrupting its ability to deliver its products. Additionally, changing its primary delivery method to include a different product allowed the new company to focus on driving value and creating new revenue streams.

In a separate client example, PwC created a new platform to transform how a university engaged with prospective students. Through the platform, the university sought to advance its technology, position for the future, strengthen trust, and improve online engagement and opportunities. PwC used its BMR framework in both of these client examples, guiding the evolution of existing business environments to identify needs and pursue next steps to future-proof operations.

On a technology-specific note, PwC EMEA leaders highlighted the firm’s Industry Edge approach, explaining that PwC’s first step is building a differentiated way to enable transformation outcomes tailored for each industry. PwC applies data and tech assets, gathers use cases to understand the best way to make decisions, and establishes preconfigured solutions that support business transformation, all while leveraging technology alliances.

The key, according to PwC EMEA leaders, is that the firm provides not only a consulting approach but also all of PwC’s capabilities, including technology, regulatory, risk and even tax services. Critically, in TBR’s view, PwC is not going to clients and selling Industry Edge; instead, the firm is adapting elements of Industry Edge that are applicable to specific clients.

PwC EMEA leaders noted that “every day PwC follows two principles”: 1) emphasizing client centricity, which PwC and TBR both recognize sounds obvious and is not differentiating but, according to PwC, is a key to success; and 2) a one-firm approach: a global network of firms that come together to seamlessly deliver services to clients. Pursuing these initiatives enables PwC to deliver reinvention and transformation services through an industry play, leading with the right approach to drive value, cocreation and evolution services.

TBR’s expectations for PwC in 2025

In TBR’s view, PwC’s twin analyst events at the end of 2024 showed a firm shifting into a new gear, perhaps reflecting leadership changes or the changing environment for professional services as the GenAI age begins to mature and PwC’s strategic investments and its own business model reinvention begin to take shape.

PwC’s early epiphany around artificial intelligence centered on understanding both the necessity of accessing client data and the implication that if a client’s data were a mess, AI would be useless. The firm steadily invested in the expertise and capabilities needed to assist clients with their AI journeys, accelerating that investment when GenAI hit the market. Notably, PwC continued its deeply ingrained practice of investing substantially in its own people, bringing AI and then GenAI solutions to the firm’s professionals and leaning into the customer zero approach.

Now PwC is fine-tuning its own business model and looking to accelerate technology adoption, redefine (or at least continually improve) global operations and grow its Managed Services business. In TBR’s view, it is not a reinvention … yet. Critically, as PwC transforms itself the firm remains grounded in its core value to clients: trust.