Fujitsu Eyes Americas Growth with Alliances and Innovation

On June 5 and 6, 2025, Fujitsu hosted around 25 analysts and advisers for an Executive Analyst Day event in Santa Clara, Calif. Fujitsu leaders from across the globe spoke on various parts of the company’s business and Fujitsu subject matter experts demonstrated solutions currently in research development or recently piloted with a few Fujitsu clients. The following includes insights from the event and analysis based on TBR’s ongoing research around Fujitsu and the broader IT services sector.

Fujitsu is putting the pieces together

The Fujitsu story keeps getting better. A year ago, TBR was struck by Fujitsu’s grounded and comprehensive approach to artificial intelligence. Later in 2024, Fujitsu’s Uvance initiative led TBR to conclude that the company had “the right vision, strategy and approach. We will continue to monitor the company’s ability to execute.” And this June Fujitsu extended a few more pieces, continuing to demonstrate capabilities, vision and a grounded approach that should garner steadily improving results, especially in the Americas. Those pieces? An enhanced alliances strategy and organization, ambitious and well-supported acquisition and investment capabilities, and an improving story around Uvance. Key components continue to evolve, such as Fujitsu’s AI offerings and global delivery operations, both of which support success in the Americas and contribute to a strengthening brand. In TBR’s view, Fujitsu has positioned itself, perhaps quietly compared to larger peers in the Americas, as a potentially disruptive force in those arenas where it chooses to compete.

Fujitsu positions its Americas practice and startup strategy as growth pillars

Speaking specifically about the Americas practice, Fujitsu leaders noted a strong performance in 2024 (a 7% profit, the highest among Fujitsu’s international regions), intentions to partner and acquire more aggressively, and a sustained focus on seven countries and specific U.S. states. Asked how Fujitsu Americas keeps up with quickly changing market conditions, Fujitsu leaders mentioned quantum capabilities, innovation, and partnering with ServiceNow while keeping the company focused entirely on services.

Breaking down various revenue streams, Fujitsu leaders said roughly 40% of revenue comes from Application Development Management and Application Solutions; 30% from partnering with SAP, ServiceNow and Oracle; 20% from workplace solutions and cloud migrations; and 10% from data and AI. In TBR’s view, Fujitsu Americas has built the solid foundation needed to outpace the overall company in terms of growth, provided the Wayfinders initiative gains traction and Fujitsu Americas stays focused on core industries in which Fujitsu has permission to play. Acquisitions and increased investments in alliance partnerships should be fuel added to a well-built fire.

Fujitsu executives highlighted the company’s startup strategy and some recent success stories, including a Japan-based AI biopharma company and an Italy-based AI governance company. Overall, Fujitsu’s startup strategy follows one of two paths: Either Fujitsu takes its own IP and licenses it to a startup (or invests in a startup rather than collecting a licensing fee), allowing the startup to test the market, likely reaching clients not typically within Fujitsu’s target market; or Fujitsu partners with a startup, providing funding, tools, platforms and entrée to Fujitsu’s client base. The second approach, according to Fujitsu, is utilized when the company comes across a technology and thinks, “Fujitsu would not have thought of this.”

In TBR’s view, both approaches reflect Fujitsu’s starting point with startups: R&D. In contrast to peers, which attempt to read market trends, capture emerging customer sentiment or conduct intensive gap analysis, Fujitsu relies on its deep R&D experience and extensive research and technology network to uncover startups well-suited and complementary to Fujitsu’s offerings or doing something unique and worthy of Fujitsu’s investment. Or, one suspects, both.

Advise, design, implement, support

First, the hard truth: In TBR’s view, Fujitsu needs a cleaner, more compelling Uvance story, at least in the Americas. Fujitsu executives said the Uvance percentage of the company’s Service Solution business increased from 10% to 30% from 2022 to 2025, so Uvance is resonating in the market and is increasingly a critical part of Fujitsu’s overall business. Challenging more accelerated growth in the Americas, in TBR’s view, is the mixed messaging about what Uvance is and what it brings Fujitsu’s clients. At various times over two days, Uvance was described as:

- “solving cross-industry issues, filling in the white spaces”;

- a “product and an accelerator” taking “proof of concepts to commercialization”;

- as a means to “address social challenges” not just “solving business problems”; and

- and “the center of our business.”

Yes, Uvance can be all those things, but the message then gets muddled.

Second, the rest of the truth: In TBR’s view, Fujitsu’s strategy around Uvance, Wayfinders and consulting writ large positions the company well, given Fujitsu’s strengths, accelerating change in the overall consulting business model, and market opportunities. Fujitsu positions Uvance Wayfinders as engaging clients “before implementation,” reflecting the company’s technology-centric value proposition. Fujitsu is not proposing business strategies or solving business problems but is instead applying its core technology strengths to a defined client technology environment and bringing efficiencies and improvements. As one Fujitsu executive said, “Like Accenture, not McKinsey.”

In TBR’s research, clients appreciate IT services companies and consultancies that stay within their own lane, doing what they do well and not persistently looking to upsell or increase their footprint. As management consultancies face the existential disruption of AI on their business models, Fujitsu’s Uvance neatly complements the company’s extensive AI-enabled offerings and capabilities. Fujitsu can advise — and, more importantly, implement — based on experience and talent at scale, harnessing AI disruption rather than being upended by it. Lastly, Fujitsu’s focus on three specific industries in the Americas — public sector, manufacturing and retail — helps tremendously. No company has deep expertise in every industry, so delivering a message that Fujitsu excels in three specific areas builds credibility in a market where Fujitsu does not have a large-scale footprint or presence. In TBR’s view, this strategic decision to stay focused will be critical to Fujitsu’s continued growth in the Americas.

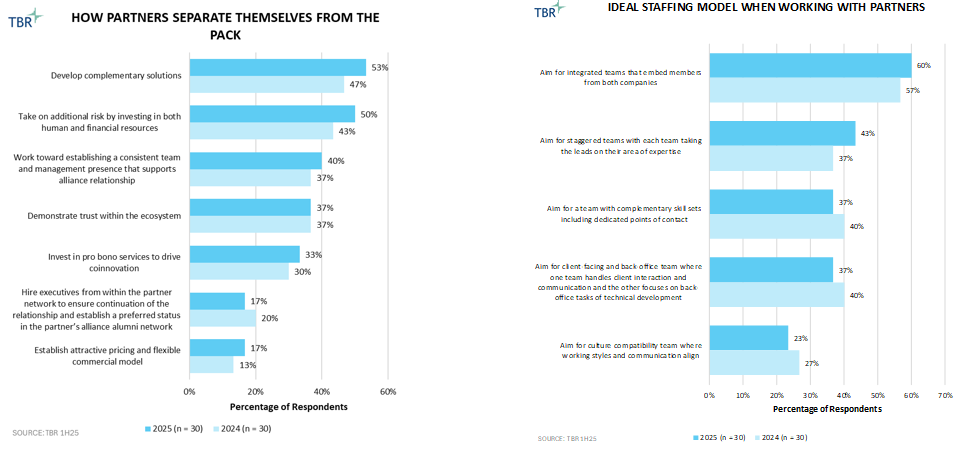

Deepening ServiceNow partnership

In a session dedicated to Fujitsu’s global alliances, the company brought in an executive from ServiceNow, complementing the Fujitsu presentation with specific examples of the two companies’ strategies and partnership. Fujitsu’s global alliances lead, Fleur Copping, noted that technology alliance partners provide entrée to new customers or position Fujitsu differently in the market, essentially amplifying the Fujitsu brand. Notably, every IT services company partners with nearly every technology partner, and differences in technology capabilities barely register, compelling Fujitsu — like other IT services companies — to differentiate in how they partner.

Copping said Fujitsu had professionalized its alliances organization and go-to-market efforts in recognition of the criticality of alliances in the emerging IT services ecosystem. Fujitsu has designated strategic partners —Amazon Web Services (AWS), SAP, ServiceNow, Microsoft and Salesforce — with an intent to develop and deploy scale around all five without becoming siloed around a specific partner. Copping adding that co-selling with these partners means being “coherent in front of the clients.” In TBR’s view, keeping the alliance focus on clients and their outcomes, rather than the commercial models or specific go-to-market motions, is an ideal strategy but is difficult to execute, in part because it is a break from previous practice.

The last two years have seen a “massive uptick in how Fujitsu shows up in the ecosystem,” according to the ServiceNow executive. A few highlights:

- Fujitsu acquired a ServiceNow boutique consultancy in the APAC region.

- ServiceNow’s “mature rigor” in its process of evaluating partners and offering expanded incentives to drive partner behavior spotlight Fujitsu’s higher ranking across the pre-sales to post-sales spectrum.

- Fujitsu has been an early participant in ServiceNow’s Enterprise Training Agreement program.

Fujitsu and ServiceNow have invested in training their sellers on each other’s portfolios.

Highlighting the third bullet, the ServiceNow executive said, “What does good look like in building talent [around ServiceNow’s portfolio]? Fujitsu is the partner I point to.” In TBR’s view, having a clearly defined and easily understood differentiating quality — that is clearly tied to the partnership and not an attribute applicable to the company as a whole — is critical to helping technology alliance partners and clients understand what added value an IT services company brings. TBR also noted that ServiceNow uses net-new annual contract value as an incentive for sales staff; in contrast, Fujitsu’s revenues depend on client retention and managed services contracts. Innovation, according to both companies, serves as bridge between the divergent sales incentive structures. TBR notes that innovation remains difficult to measure, but we see the evident alignment of ServiceNow’s and Fujitsu’s strategy and leadership approaches as perhaps more consequential for the long-term alliance. In sum, Fujitsu and ServiceNow presented a compelling partnership story — one that bears close scrutiny as the broader technology ecosystem evolves.

“In terms of the services, kind of scoping and bundling, that was typically a black-box process. So, we bring each other in at the right times, but they [services partners] never included us in terms of the actual kind of creation of the services offerings and the margins and the profitability, etc. So, we were only kind of aware of that, on a very macro level. It was just the solutioning part of it, saying, ‘OK, we know that this is the top-line business initiative that we’re solving for. And then we need to create the underlying products and services around that to create the recording of the product.’ So that’s the way that we typically work with them.” — Senior Manager of Global Channels and Alliances, Cloud

What peers can learn from Fujitsu

Competitors and technology alliance partners should keep an eye on Fujitsu’s acquisitions, investments in startups and new partnerships. Fujitsu’s investment portfolio has a mandate to invest for accelerated growth, has leadership support at the highest level, and has experience that has been built over the last few years. In TBR’s view, all three of those elements — a mission, leadership, and the muscle memory around acquiring, investing and partnering — are essential. Further, when a Fujitsu executive said the company’s CEO starts every acquisition discussion with questions around the technology and the customers, TBR saw a perfect reflection of the company’s overall culture and value proposition: take technology and solve customers’ (and societal) problems. Fujitsu executives did note concern that the market has been changing so rapidly that acquisitions made today may become less valuable by the time they are absorbed into the company. Overall, TBR believes Fujitsu will invest more in partnering (traditional alliances and corporate venture capital) more because of the current market dynamics and not because of a lack of appetite for acquisitions. Circling back to the competitive and alliances implications: be wary of — or partner with — a company that knows how to execute on M&A.

Final thoughts

So, what comes next? In TBR’s view, Fujitsu has the opportunity to expand its market presence and success in the Americas, particularly if the company can leverage three advantages and strengths it enjoys right now. First, technology alliance partners, such as ServiceNow, Salesforce and AWS, are aggressively partnering with IT services companies and consultancies that can show flexible commercial arrangements, bring new clients and coinnovate. Second, Fujitsu has the resources and resolve to aggressively acquire, partner or invest. TBR has not seen an IT services company or consultancy grow without attitude and resources. Third, across all the company’s recent analyst events and briefings, Fujitsu’s core culture has remained focused on bringing technology solutions to clients.

Focus and staying within a company’s strengths, in TBR’s view, separate well-run, high-performing consultancies and IT services vendors from peers. TBR does not anticipate that Fujitsu will wander from its path but does expect that analyst events in 2026 will bring additional Fujitsu strengths to the forefront.

Getty Images

Getty Images Technology Business Research, Inc.

Technology Business Research, Inc.