Cloud Components Market 2024: AI, Hybrid Solutions and Key Acquisitions

The cloud components market is undergoing transformations driven by acquisitions, the rise of AI and the growing demand for AI-optimized infrastructure. Acquisitions by both software- and hardware-centric vendors are shaping the market landscape, with Dell Technologies, Cisco and Hewlett Packard Enterprise making strategic moves to strengthen their positions. Download your free copy of TBR’s Cloud Components Spotlight Report to read more vendor analysis from our recently published research.

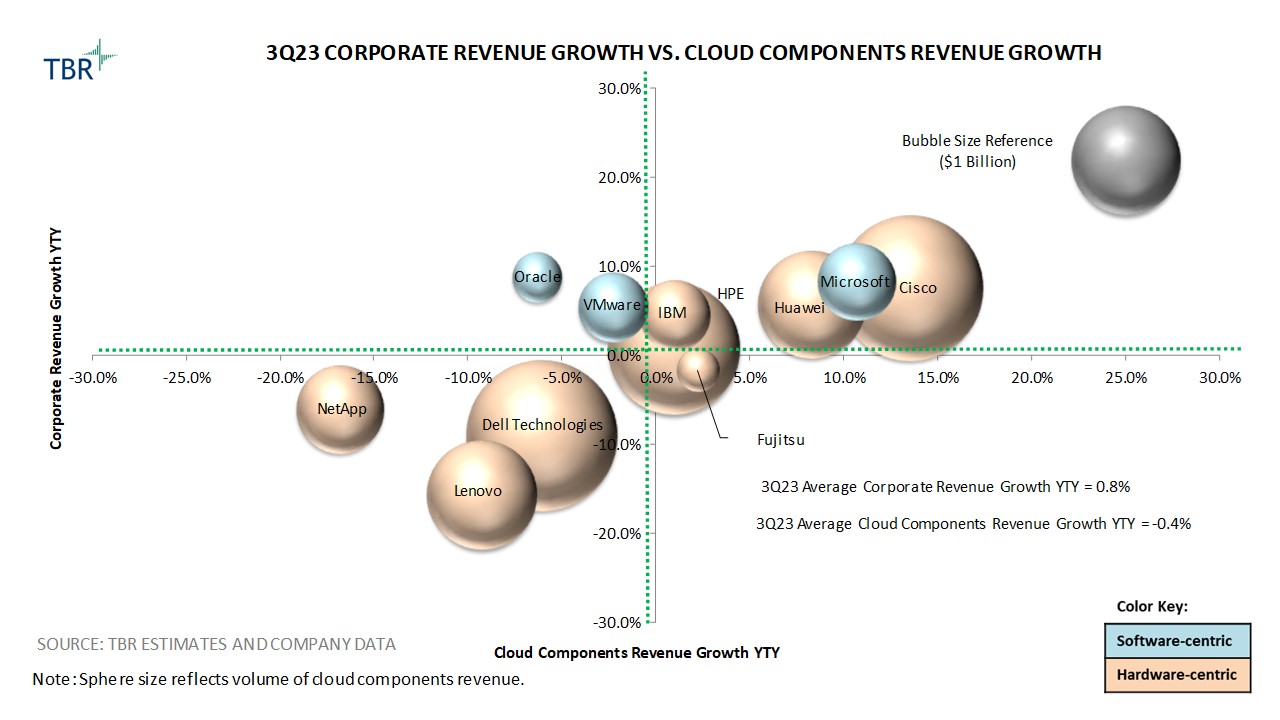

Average cloud components revenue among vendors covered in TBR’s Cloud Components Benchmark was flat year-to-year in 3Q23. Market leaders continued to grapple with sluggish demand in certain hardware markets, namely storage, but reported strong interest in AI servers, which will flow through vendor financials in 2024. On the software side, acquisitions, including Cisco’s pending purchase of Splunk, will shape the market. Cisco will rise on the cloud software components leaderboards once the deal closes.

How AI, Hybrid Solutions and Acquisitions Are Shaping the 2024 Cloud Components Market

Acquisitions by Software- and Hardware-centric Vendors Are Shaping the Cloud Components Market

Acquisition activity among TBR-benchmarked leaders accelerated in 2023, and recently closed deals will drive vendor growth through 2024. As evidenced by Dell Technologies’ acquisition of Moogsoft, hardware-centric vendors continue to buy niche software IP that can be bundled with their trusted infrastructure and sold “as a Service.”

Meanwhile, software vendors are acquiring to push into high-growth markets, such as observability and security, while shifting their revenue mixes in favor of subscriptions. For example, Broadcom suspended all VMware perpetual license sales in December, while Cisco’s pending acquisition of Splunk is expected to add $4 billion in annualized recurring revenue. Hewlett Packard Enterprise’s (HPE) proposed acquisition of Juniper Networks will also shape the cloud components market, helping HPE extend its lead in networking “as a Service.”

Cloud Repatriation Activity Could Pick Up Amid AI Boom

According to TBR’s 2H23 Cloud Infrastructure & Platforms Customer Research, many customers that have migrated to the cloud are surprised by the cost of their monthly cloud bills. While we do not believe this dynamic is driving customers to move their workloads back to the traditional data center — at least not in significant numbers — the rise of AI could accelerate the shift away from the cloud.

Due to the vast complexity of AI solutions, particularly generative AI (GenAI) due to the tech’s use of large language models, customers prefer the simplicity and breadth of tools the cloud providers offer, but some customers may not view the public cloud as a sustainable deployment method for their AI workloads from a cost and performance perspective. We suspect this trend will draw awareness to hybrid cloud alternatives and lead customers to explore AI-rich on-premises solutions.

Demand for AI-optimized Infrastructure Is Poised to Drive Vendor Performance in 2024

Demand for cloud server and storage infrastructure has trended downward in parallel with the enterprise market, primarily due to customers’ ongoing digestion of inventory. However, the rise of GenAI is shifting paradigms in the cloud hardware market as adoption of accelerated computing continues to rapidly gain momentum.

As evidenced by 15% aggregate year-to-year growth in network components revenue for 3Q23, performance in this segment is improving, and TBR predicts cloud server and storage demand will rebound later in 2024.

Conclusion

The cloud components market is undergoing transformations driven by acquisitions, the rise of AI and the growing demand for AI-optimized infrastructure. Acquisitions by both software- and hardware-centric vendors are shaping the market landscape, with Dell Technologies, Cisco and HPE making strategic moves to strengthen their positions.

The cloud repatriation trend, while not yet significant, could gain momentum, especially with the increasing complexity and cost of AI workloads. This could lead to renewed interest in hybrid cloud solutions and on-premises AI-rich infrastructure. Despite a recent decline in demand for cloud server and storage infrastructure, the rise of GenAI and accelerated computing is expected to drive a rebound in demand later in 2024.

Stay ahead of the curve with our latest insights and updates. Subscribe to Insights Flight now to receive exclusive content, expert tips, Q&A invitations and industry analysis straight to your inbox. Don’t miss out on the opportunity to elevate your knowledge and stay informed!

Technology Business Research, Inc.

Technology Business Research, Inc.