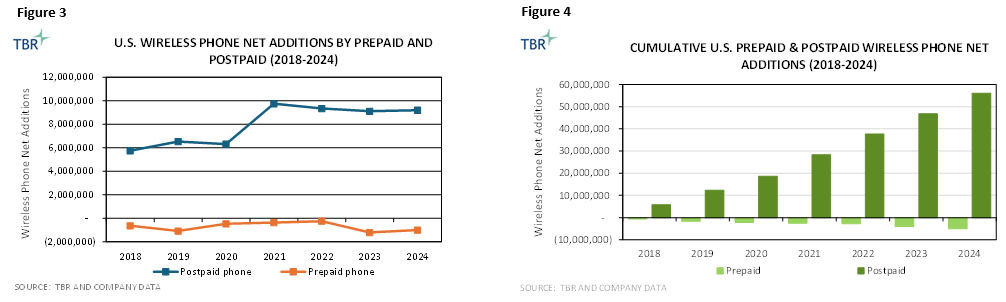

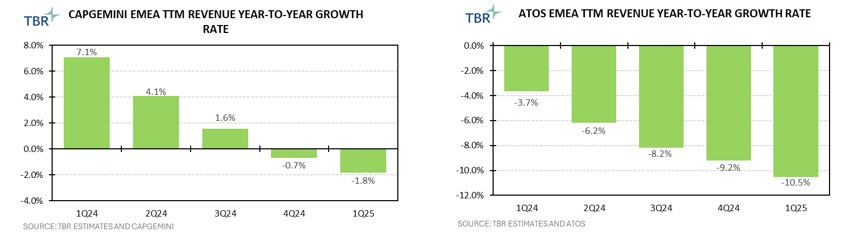

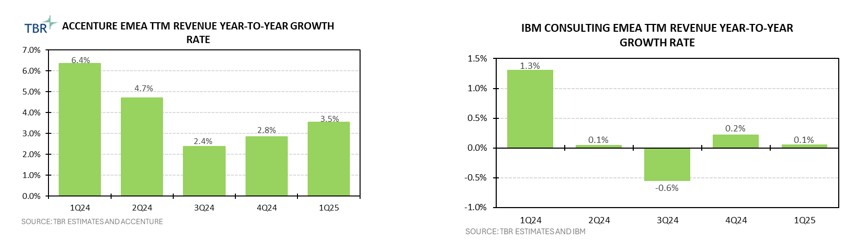

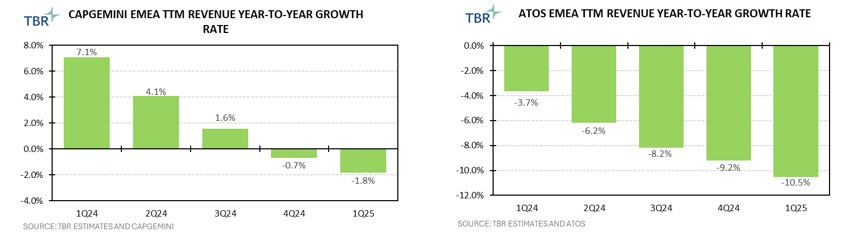

TBR FourCast is a quarterly blog series examining and comparing the performance, strategies and industry standing of four IT services companies. The series also highlights standouts and laggards, according to TBR’s quarterly revenue projections and geography estimates. This quarter, we look at Accenture, Atos, Capgemini and IBM Consulting in the Europe, Middle East and Africa (EMEA) market, and compare how their industry diversification, portfolios and localization strategies position them for revenue growth. Atos and Capgemini, the two IT services companies whose EMEA revenue makes up over half of total revenue, experienced a steady decline in trailing 12-month (TTM) year-to-year revenue growth in recent quarters. Yet, Accenture and IBM were better able to maintain growth as macroeconomic conditions deteriorated in recent quarters.

IT services revenue in EMEA has experienced slow expansion rates for several quarters, with trailing 12-month (TTM) revenue growth at only 0.8% to 0.9% year-to-year in 3Q24, 4Q24 and 1Q25, according to TBR estimates provided in our IT Services Vendor Benchmark, which tracks 31 companies. In the most recent quarter, EMEA experienced the slowest growth among all geographies due to ongoing challenges in the manufacturing sector. At the same time, IT services companies were able to capture more deals in financial services and the public sector, as the European Central Bank (ECB) cut rates in 4Q24 and 1Q25 and the European Union (EU) increased defense and modernization spending. Companies’ successes in recent quarters were dependent on their ability to diversify revenue, but, as always, their portfolio investments and localization and acquisition strategies will determine growth long-term.

Aligning portfolios and resources to demand in the public sector is vital to capturing revenue growth opportunities

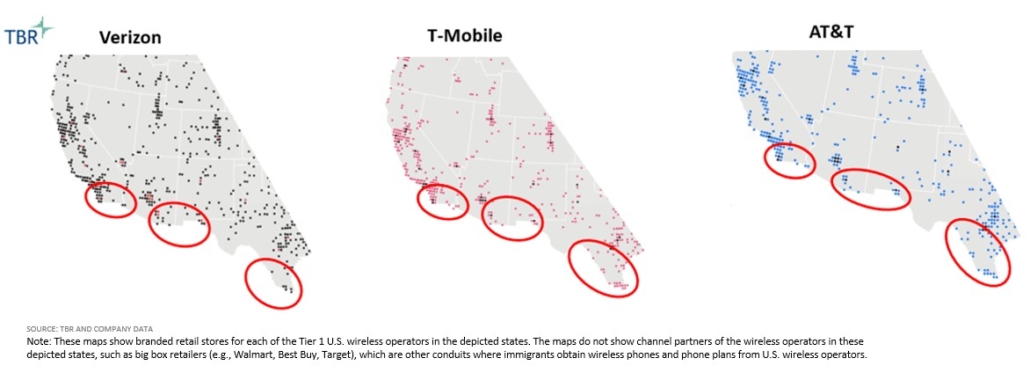

Accenture, Atos, Capgemini and IBM Consulting are focusing more on opportunities in the public sector in EMEA, especially as manufacturing faces persistent challenges and the Department of Government Efficiency (DOGE) is causing some revenue loss in the U.S. public sector. For example, Capgemini’s largest vertical is manufacturing, but the company is capitalizing on more deals in the public sector. According to TBR’s 1Q25 Capgemini report, the company “is combining capabilities around digital engineering, data and AI, cybersecurity and digital transformation to enable activities such as around military transformation, improving supplier networks, delivering production management and ensuring quality standards. The company is also working with defense organizations around integrating workforce management and data and AI technologies.” With the U.K.’s Department for Business and Trade, Capgemini is delivering data and product services to support the department with digital, data and technology related to trade and regulation.

Historically, Atos has been very involved in the European public sector, which we believe accounts for about 20% of the company’s revenue. However, client trust has wavered due to Atos’ most recent financial restructuring, which was completed in December, in addition to the company’s frequent CEO turnover in recent quarters. The company nevertheless secured deals with Serbia’s Office for IT and eGovernment and the U.K.’s Department for Environment, Food and Rural Affairs (DEFRA) and National Savings and Investments bank. The European public sector presents an interesting opportunity for other vendors, notably IBM, as Atos fails to entirely capture its usual market share.

IBM, along with Accenture Federal Services (AFS), has experienced DOGE-related pressures. According to TBR’s 1Q25 IBM Consulting report, “TBR expects IBM Consulting’s 2025 revenue in the U.S. federal sector, which accounts for less than 10% of the business’s revenue, to be negatively affected by DOGE initiatives as IBM stated during its earnings call that two contracts were negatively impacted by DOGE in 1Q25.” In January, IBM completed layoffs in its public sector headcount in Raleigh, N.C.; Dallas; New York; and California. IBM is turning to new markets to bolster its public sector revenue segment. For example, IBM recently secured a deal with the U.K.’s Home Office to design, build and integrate an Emergency Services Network and deliver IT infrastructure. As IBM already seems to be rebalancing its resources, TBR anticipates the company will capture more public sector deals across Europe, which will help recover some revenue recently lost due to DOGE cuts.

Capgemini EMEA and Atos EMEA TTM Revenues and Growth Rates (SOURCE: TBR)

Accenture also suffered DOGE-related setbacks and is taking a similar approach. Accenture’s health and public service sector revenue is up 8.2% year-to-year. TBR anticipates the sector’s performance will continue to improve with Accenture’s recent investments in sovereign cloud offerings with Amazon Web Services (AWS) and Google Cloud, complementing the EU’s efforts to strengthen defense and security. Further, Accenture is leveraging its partnership with Google Cloud to drive cloud adoption by developing sovereign cloud offerings and a Center of Excellence (CoE) in Saudi Arabia, supporting its ability to capture local clients. Accenture is not the only company to be diligent in expanding its portfolio to cater to governments in EMEA.

Although Atos’ public sector revenue has faced many challenging quarters, most recently declining 16.4% year-to-year in 1Q25, the company is leaning into its strengths. Atos is focused on the expansion of its security portfolio, especially after the sale of its Advanced Computing, Mission-Critical Systems and Cybersecurity Products division to the French government fell through. Although Atos has received a new confirmatory offer from the French government, it is only for the company’s advanced computing business. In April Eviden formed a partnership with Cosmian to release a joint sovereign encryption key management solution, which is supported by the integration of Eviden’s Hardware Security Modules and Cosmian’s crypto agile key management system, aligning with increased demand among countries in Europe for more sovereign solution. If Atos is able to regain and maintain client trust with its renewed liquidity and financial stability, the company may be able to capture more deals in security, supporting growth across its largest geography.

Strategically adding onshore skills and local centers enables clients to provide more in-depth value

IT services companies are focused on balancing onshore skills, as evidenced by Accenture’s recent launch of a CoE in Saudi Arabia. IBM leverages its proximity to clients to deliver value. In March IBM announced it will deploy the IBM Quantum System Two in San Sebastian, Spain, at the IBM-Euskadi Quantum Computational Center at the Ikerbasque Foundation for the Basque government. The joint center will serve members as well as academics, research institutions and industry experts. Additionally, Accenture launched a National Security Operation Center in Kuwait to provide local cybersecurity services for the Kuwait government’s Central Agency for Information Technology.

Accenture EMEA and IBM Consulting EMEA Revenues and Growth Rates (SOURCE: TBR)

In addition to leveraging localization strategies, IT services companies still use EMEA locations to grow AI. Capgemini announced it will open an AI CoE in Cairo focused on supporting clients across the globe with adoption of generative AI (GenAI) and agentic AI, particularly through creating industry-specific use cases for life science, aerospace and energy verticals. Although Capgemini’s offshore resources remain largely India-based, the company is strengthening relations with Egypt. Capgemini’s CEO of Egypt, Hossam Seifeldin, was appointed a member of Egypt’s Advisory Committee on Digital Economy and Entrepreneurship to facilitate economic growth and digitalization within the country. Similarly, Capgemini CEO Aiman Ezzat was appointed chair of the France-Egypt Business Council in France. The two additions will likely provide Capgemini with better access to resources in the country.

Meanwhile, Atos continues to rotate its top leadership to strengthen its direction in EMEA. Atos appointed Merecedes Paya as head of Iberia with the intention of capitalizing on opportunities in cloud, supercomputing and cybersecurity. Also, Atos appointed Rama El Safty as general manager of its Egypt business to capture opportunities in services and AI and for digital transformation in the public sector. Atos initiatives may help these areas, but continuous new appointments create uncertainty among clients. Unlike the other three selected vendors, TBR estimates Atos already has approximately half of its resources in EMEA, positioning it well to deliver better value with proximity.

Investing in more Europe-based innovation to enhance portfolios helps vendors differentiate

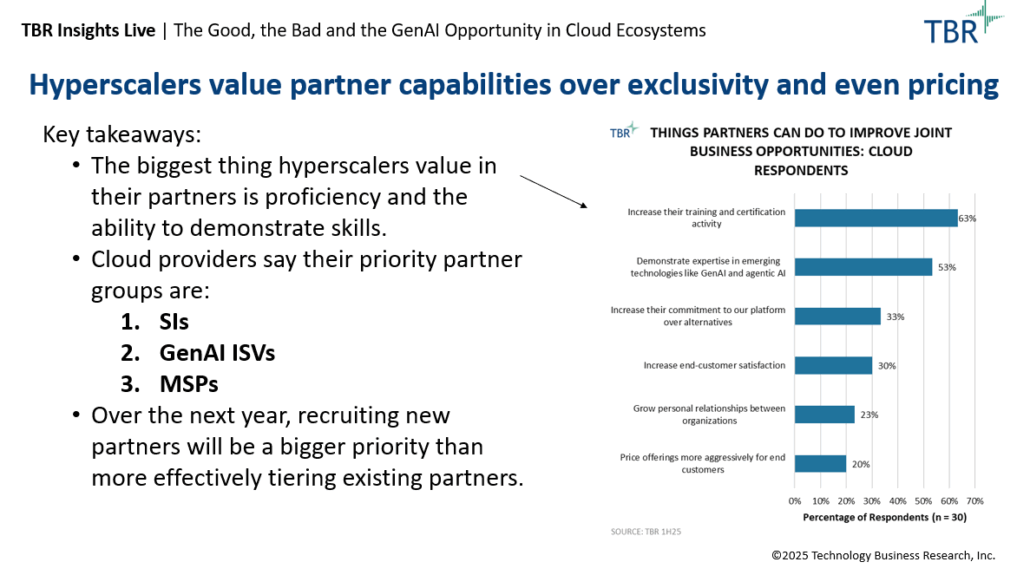

Of the four companies covered in this blog, only Accenture and Capgemini have completed acquisitions in Europe within the past calendar year. Accenture is moving away from large acquisitions and instead using its purchases to boost struggling verticals and expand specialized capabilities. This is evident in Accenture’s acquisition of U.K.-based Altus Consulting, which helps the company’s position in financial services and insurance and in product design, customer experience and administration. Additionally, Accenture’s acquisition of Staufen AG augments Accenture’s manufacturing vertical with supply chain and operations professionals. Capgemini is continuing to pursue targets that have niche capabilities, most recently acquiring Delta Capital BV, which will enhance Capgemini’s financial crime, risk management and regulation compliance offerings within the financial services industry in Europe. In addition, financial services was also a struggling vertical for Capgemini, with revenue contracting during most of 2024.

As Accenture and Capgemini continue to engage in small, strategic acquisitions, they are becoming much more active in startup investments. Capgemini has launched an investment fund with ISAI, ISAI Cap Venture II. The fund will focus on B2B startups and scaleups in the U.S. and Europe and will provide Capgemini with new revenue opportunities with companies that reach maturity. Accenture is also increasing its investments but is focused on the U.S. market. For example, Accenture Ventures recently invested in Voltron Data, Auru, Workhelix AI, QuSecure and Workera, spanning different technologies such as AI post-quantum cryptography. Although the regional focus is not surprising as the U.S. has a multitude of startups based in Silicon Valley, investing in Europe first when applicable could help firms better compete in the market.

IBM, on the other hand, has focused on larger acquisitions in the U.S. in AI, cloud and data. The last acquisition completed in Europe was Bulgaria-based Pliant in March 2024. As IBM remains a U.S.-based company, TBR does not anticipate that IBM will start prioritizing acquisitions across EMEA as the company’s innovation tends to be developed in its Americas region first. IBM seems to be leaning more into its Americas presence as the company announced at the end of April that it will be investing $150 billion in the region over the next five years. The investment includes $30 billion allocated to research and development of new mainframe and quantum computers. However, as IBM executes on its Americas-focused innovation strategy, it may miss innovation opportunities with European clients.

Playing to strengths while enhancing client value through increased proximity and innovation will boost vendors’ positioning in EMEA

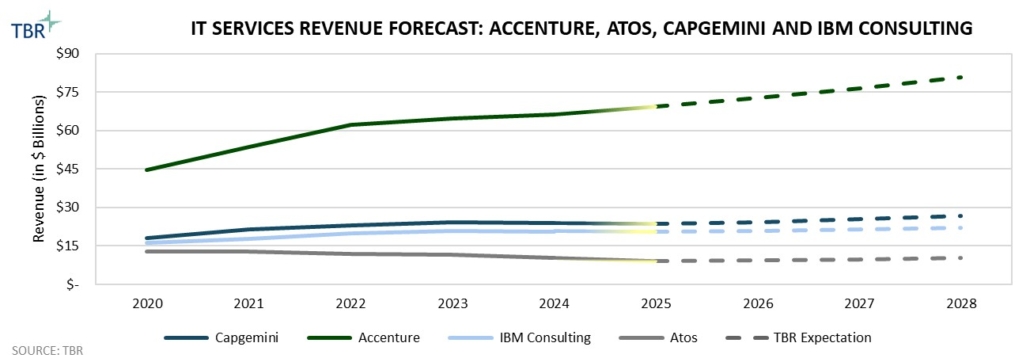

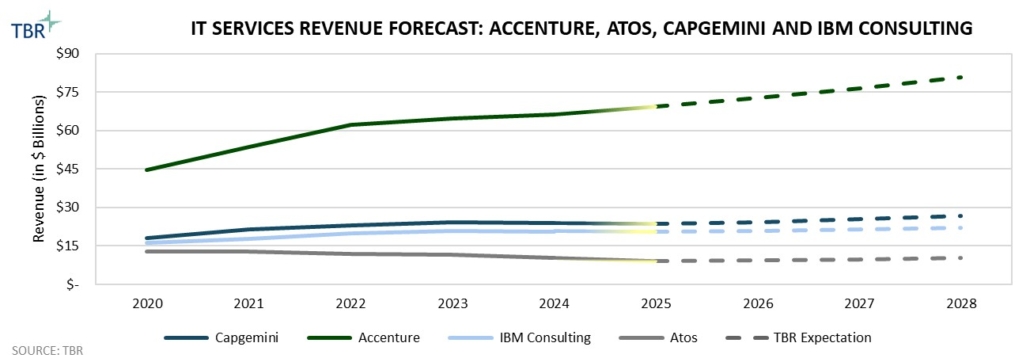

When comparing TBR’s revenue projections for the four selected companies, Accenture has had the fastest revenue growth with the highest projections. Accenture’s unique acquisition pace is responsible for the acceleration and will help propel the company forward. For example, the company’s TTM year-to-year organic growth from 1Q25 was 0.7%, but this figure rose to 4.1% when including inorganic growth. Its acquisitions in EMEA have undoubtedly contributed to the company’s growth with increased access to innovation as well as in support of volatile verticals. Further, the company’s careful bets in localization have improved ties across EMEA.

IT Services Revenue Forecast for Accenture, Atos, Capgemini and IBM Consulting (SOURCE: TBR)

Capgemini continues to rely on its offshore resources, but a bit more emphasis on localization, often preferred by public sector clients, may help Capgemini be even better positioned for deals in the sector. Capgemini’s stronger emphasis in Europe-based innovation differentiates the company from the other selected vendors. This may help the company deliver new innovation to EMEA clients, especially given that Capgemini’s presence in EMEA is larger proportionally compared to Accenture and IBM. On the other hand, IBM’s investments in innovation continue to be based in the U.S., which will likely lead to a delay in delivery in its EMEA market. However, if IBM prioritizes working with clients closely as it has recently done recently with the Basque government, this will help the company maintain its growth trajectory.

Atos’ revenue has been continuously declining for the past 13 consecutive quarters, and its performance in EMEA has been no outlier to its struggles. Yet, continued strategic investments in areas of strength such as security would help Atos win back some public sector revenue. As the company has struggled with debt and profitability, Atos is in an unfavorable position to compete with acquisitions, particularly as it is focused on divestments. Doubling down on the company’s strengths could help restore performance.

The selected four companies all have a strong foothold in the EMEA market, but balancing investments in innovation, such as through startup investments and skills development, with close client relations, through releasing relevant portfolio offerings and localization efforts will be key in competing for market share. Adapting to demand changes in the public sector and in recently underperforming verticals, such as financial services and manufacturing, have enabled Accenture, Atos, Capgemini and IBM Consulting to capture some growth but balancing resources with innovation will promise stronger performance.