PCN vendors poised for rapid growth as 5G ecosystem is built out

5G represented a small portion of the overall PCN market in 2020, but is poised to rapidly scale in coming years

According to TBR’s estimates, 5G represented 8%, on average, of benchmarked companies’ private cellular network (PCN) revenue in 2020, with the rest being LTE. LTE remains the de facto technology for PCN, thanks to its maturity and vibrant ecosystem, which has been developed over the past decade. 5G for private networks, on the other hand, remains in its infancy, with key 3GPP Release 16 standards recently ratified, 5G spectrum gradually coming to market, compatible infrastructure commercialized and endpoint devices becoming available in the past year.

The endpoint device aspect of the nascent 5G ecosystem will begin to proliferate over the next couple of years, at which point 5G PCN implementations can be scaled commercially. In the meantime, most of the 5G engagements that occurred in 2020, with the notable exception of those in China, were focused on experiments and pilots, pending the commercial availability of compatible endpoint devices.

China has a significant head start with private 5G, with Huawei and ZTE equipping leading entities in the country, particularly the government, with the technology as part of national digitalization-related initiatives. Other developed APAC countries, namely South Korea, Japan, Taiwan and Singapore, are following closely behind China in 5G readiness.

Vendors’ PCN sales funnels are burgeoning

Vendors are experiencing significant and broad interest from enterprises and governments for how to leverage PCN for digital transformation-related initiatives. 5G is of particular interest, portending a strong growth profile through this decade.

Though 5G remains primarily in the exploratory phase, many of these engagements are likely to convert into commercial contracts over the next couple of years. In the interim, the bulk of PCN deal wins will be for private LTE networks.

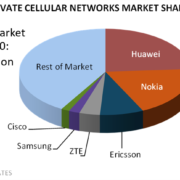

TBR’s Private Cellular Networks Vendor Benchmark tracks the revenue key vendors obtain from the sale of LTE- and 5G-related infrastructure (includes RAN, core, transport and services provided for that infrastructure) to governments and enterprises, including large, medium and small non-CSP (telco, cableco, webscale) businesses. The benchmark ranks key private cellular networks vendors by overall revenue and by segment. Global market share and regional data and analysis are also provided.

Leave a Reply

Want to join the discussion?Feel free to contribute!