India-centric IT Vendors Leverage Partnerships for Technology Expansion and Market Reach

Expanding through partnerships

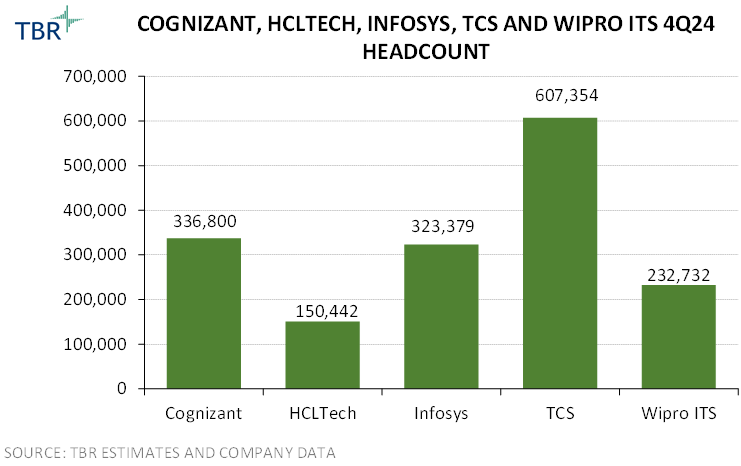

The India-centric vendors, which include Cognizant, HCLTech, Infosys, Tata Consultancy Services (TCS) and Wipro, leverage partnerships to expand their technology capabilities and scale while also bringing in industry knowledge to strengthen the value of their portfolios. Although these partnerships do not vary significantly from those of other IT services vendors, the India-centric vendors each bring different benefits, such as price competitiveness and low cost of scale, that can enhance other vendors’ go-to-market strategies and ability to reach underpenetrated markets while also bringing in portfolio expertise.

Understanding how similar companies bring different capabilities and strengths to their technology alliance partners highlights opportunities for other ecosystem players, such as smaller software companies, OEMs and niche consultancies, that are looking to expand with the India-centric vendors.

Cognizant

Cognizant forges partnerships with industry-oriented vendors and expands its security and digital capabilities. During 4Q24 and early 2025, Cognizant looked to relationships with key partners such as Salesforce and ServiceNow to enhance the company’s positioning around transformation and software development as well as create opportunities around migration and managed services.

As transformation projects increasingly center on AI, developing a suite of offerings that streamline the use of data and analytics, security and managed services helps Cognizant strengthen client relationships and drive new projects. Working with security vendors to deepen its security capabilities and protect digital environments will lead to additional services engagements for Cognizant. Further, partnering around industry expertise is enabling Cognizant to improve its performance in certain verticals, such as recently landing modernization and digitization projects with life sciences clients.

Cognizant manages an ecosystem to drive innovation both internally as well as with clients to drive value across industries. In April 2023 Cognizant launched Bluebolt, an innovation program that seeks to develop new ways to address clients’ business challenges. Since the launch, more than 115,000 ideas have been developed, of which 22,000 have been implemented, increasing client engagement. Additionally, Cognizant worked with Microsoft to create the Innovative Assistant, a tool that supports idea generation for Microsoft employees. The tool is something that Cognizant could replicate with other partners.

In 2014 Cognizant acquired TriZetto, a healthcare IT software and solutions provider, which added healthcare clients and specialized employees and offerings, creating new opportunities for Cognizant across the healthcare space. Cognizant continues to invest in the platform, offering back- and front-office solutions for payers, providers and patients, as well as care management and connected solutions to transform the patient and physician experience. The acquisition and Cognizant’s continued investments in healthcare offerings resulted in the vertical overtaking financial services as the company’s top revenue generator in 2024.

Cognizant’s active acquisition pace brings in a variety of new skills and capabilities to supplement existing areas and enable the company to expand transformation contracts with clients. For example, Cognizant acquired ServiceNow partner Thirdera in December 2023, strengthening its consulting and implementation services. Through the acquisitions, Cognizant has quickly developed its engineering, software and advisory services, enhancing its positioning with clients.

HCLTech

HCLTech’s partner network encompasses technology vendors, industry experts, and research and learning institutions, allowing the company to develop a wider set of in-house expertise and offerings. Adding new hyperscaler partners to expand its capabilities and scale enables HCLTech to deliver a wider range of AI offerings and guide technology services clients’ efficiency-related and insight-driven transformation projects. Further, integrating industry expertise within its technology portfolio improves HCLTech’s ability to address clients’ specific transformation needs.

Pursuing solution codevelopment partnerships helps HCLTech leverage internal expertise alongside that of its partners to align its portfolio with emerging pain points resulting from heightened AI, cloud and digital usage. HCLTech will strengthen its relationships with key partners such as Microsoft, Google Cloud, Amazon Web Services (AWS) and IBM to enhance its positioning around AI. In addition, HCLTech will enhance its industry positioning through partners and acquisitions to better tailor its offerings and deepen relationships in the telecom, financial services and manufacturing industries.

HCLTech’s ongoing investments in engineering capabilities have deepened the vendor’s expertise, allowing it to offer semiconductor design, manufacturing and validation services. Through acquisitions, HCLTech has added new experience and solutions and strengthened its manufacturing relationships. The integration of Engineering and R&D Services (ERS) sales and go-to-market motions with IT and business services sales will help HCLTech extend the reach of its portfolio, generating new segment opportunities and expanding the company’s reach outside its more mature areas such as manufacturing and automotive.

HCLTech leads with its Relationship Beyond the Contract (RBTC) approach, which allows the company to deepen client relationships, better address challenges, and future-proof organizations for disruption and threats. With the heightened demand and interest around generative AI (GenAI), HCLTech’s development of applications, infrastructure, semiconductor offerings and business process solutions underpinned by its GenAI Labs enables the company to secure its relationships.

Infosys

Infosys’ alliance partner strategy mirrors that of many of its competitors as the company seeks to secure foundational revenue opportunities while pursuing innovation through a measured risk approach. The company strives to differentiate by sticking to its strengths rather than branching too far into partners’ territory, which enterprise buyers strongly appreciate. Recent partnerships centered on GenAI also provide a glimpse into Infosys’ efforts to establish a beachhead in the emerging market as the company navigates choppy market demand and increases its efforts to expand margins.

Infosys’ three talent categories — traditional software engineers; digital specialists focused on digital transformation (DT) and ongoing support; and power programmers — allow the company to balance innovation and growth as it calibrates its business and commercial models. To support these categories, Infosys executes on aggressive hiring, particularly for 2025. In January Infosys announced it was planning to expand its Hyderabad, India, operations, adding 17,000 people for a total of 50,000 employees in the region. Although no time frame was outlined for this increase, during the company’s 4Q24 earnings call Infosys’ executives shared the company is planning to hire 20,000 freshers in FY26, up from 15,000 in FY25.

Infosys’ broad-based GenAI investments centered on the development of industry-aligned solutions and small language models, largely enabled through collaborations with NVIDIA, Microsoft and Meta, enhance the company’s value proposition when competing for custom model development engagements. In addition to driving opportunities within the telco vertical, we believe Infosys’ collaboration with NVIDIA will also help the company enhance the recently launched Infosys Aster — a set of AI-driven marketing services, solutions and platforms — as Infosys looks to develop a comprehensive strategy for its digital marketing offerings. Supporting clients seeking to enhance contact center operations through the use of AI and GenAI could backfire if technology and business priorities are misaligned, as chatbots have been around for a long time but have had only minimal positive impact on customer services.

Watch on demand: $130+ Billion Emerging India Opportunity – India-centric vs. Global IT Services Firms: Who Wins and Why

TCS

TCS has dedicated business units for its three largest technology partners, fostering deep expertise and enabling the development of specialized solutions. These units leverage a comprehensive approach, including certified talent, Centers of Excellence, migration factories and innovation garages, to deliver superior cloud services. This approach allows TCS to effectively guide clients through their cloud migrations, codevelop industry-specific solutions and ultimately drive successful cloud transformations.

Beyond its core cloud partnerships, TCS actively cultivates a diverse ecosystem of technology alliances. These partnerships extend beyond the traditional cloud providers, enabling TCS to enhance its own offerings, strengthen partner capabilities and collectively expand market reach. This collaborative approach fosters mutual growth and enables TCS to deliver more comprehensive and innovative solutions to clients.

TCS emphasizes its deep expertise in enterprise application deployment and management, combined with its scale and cost-effective resources, to position as a valuable partner within the technology ecosystem. The company is actively investing in talent development and AI-driven solutions to meet surging client demand around GenAI. By leveraging strong industry relationships and strategic partnerships with leading technology providers, TCS delivers a comprehensive range of digital services such as AI. Collaboration helps TCS enhance its value proposition for clients.

TCS stands out among its India-based peers due to its impressive scale, cost-effective labor force, well-balanced portfolio, robust automation framework, in-depth understanding of legacy IT systems and vast expertise in DT. The company’s scale allows it to work across a wider range of client needs and challenges that can be addressed through its DT and application portfolio. Despite TCS’ larger scale relative to peers, the company maintains roughly 75% of its headcount in offshore locations.

Wipro

Wipro continues to expand its partner ecosystem, including incorporating security and enablement services, to ensure the company can provide a wider range of technology solutions. For example, during 4Q24, Wipro partnered with multiple vendors to grow its security services offerings. Working with Netskope and Lineaje helps address risk and vulnerabilities across the technology landscape to drive additional value and strengthen client relationships.

In addition to technology development, Wipro looks to deepen its industry expertise through partners, advancing its healthcare and financial services portfolio. Through 2025, Wipro will grow its partner ecosystem to include additional technology capabilities and security services to guide clients’ modernization and efficiency transformations while also maintaining a portfolio that rivals those of its peers.

Relative to its India-centric peers, Wipro finds itself in a more precarious position with slower revenue growth and a smaller profit. During 2024 Wipro IT Services (ITS) was able to increase its operating profit, owing to improved internal management, the use of AI and automation tools, as well as a streamlined talent structure. Wipro ITS’ revenue generation slowed in 2023 and 2024, resulting in a year-to-year decline in 2024 in both local currency and U.S. dollars due to ongoing execution challenges in APMEA and Europe and limited interactions with clients. Capco, a financial services consulting firm Wipro acquired in 2021, remains a bright spot for Wipro, as it added a new approach to industry clients in Europe.

Conclusion

Each of the India-centric vendor brings its own strengths and weaknesses that can help enhance partners’ go-to-market strategies and deliver on emerging technologies. The composition of talent varies across the vendors, with some benefiting from technical expertise such as engineering whereas others have a greater bench of consulting and delivery staff. As AI permeates client engagements, developing a larger partner ecosystem that encompasses multiple different business models, talent and portfolio strengths as well as offshore delivery leverage will enable IT services vendors to compete more effectively for limited client spend.

Further, internal innovation with partners, including around AI tools that are tested internally before coming to market strengthens portfolio value and trust with clients. Partnering outside of typical partner parameters will bring in much-needed innovation, refreshed talent as well as enhanced delivery resources to secure client trust and engagement.

TBR’s ongoing research and company coverage includes regular analysis of alliances between the leading global systems integrators, including the companies outlined in this report. In addition, we publish the Cloud Ecosystem Report semiannually and the Adobe & Salesforce Ecosystem Report, the SAP, Oracle and Workday Ecosystem Report, the U.S. Federal Cloud Ecosystem Report and the Voice of the Partner Ecosystem Report annually. Access the data and analysis in each of these reports with a TBR Insight Center™ free trial. Sign up today!

Technology Business Research, Inc..

Technology Business Research, Inc.. Anyaberkut, Getty Images Pro

Anyaberkut, Getty Images Pro