Implementing the ‘Oracle Playbook’ Could Yield Billions in Salesforce Profit

Salesforce has shifted its focus from revenue growth to profitability, with pressure from activist investors. The company aims to exceed 10% operating margin in fiscal 2024, a threefold increase from the previous fiscal year. By following the “Oracle playbook” and reducing costs, Salesforce could make billions in profit, leading to a change in financial focus across the industry, with revenue growth becoming a metric, rather than the only metric.

Profit is replacing growth as Salesforce’s key financial metric

Since the inception of the cloud market more than 10 years ago, subscription contract value and revenue growth have been the key metrics used to determine vendors’ success and leaders in the space. That focus on growth and the top line was important for good reason, as there was fierce competition between vendors of different backgrounds and sizes to establish and protect their position in the market. Without a sizable business and base of customers, there could be no stability in the revenue streams and business models vendors were looking to establish.

The shift from high growth rates in subscriptions to a sustainable business model was always expected at some point, and the current economic environment is accelerating that shift. The pace of growth is slowing for most vendors in the cloud space, as illustrated by Salesforce’s (NYSE: CRM) recent performance.

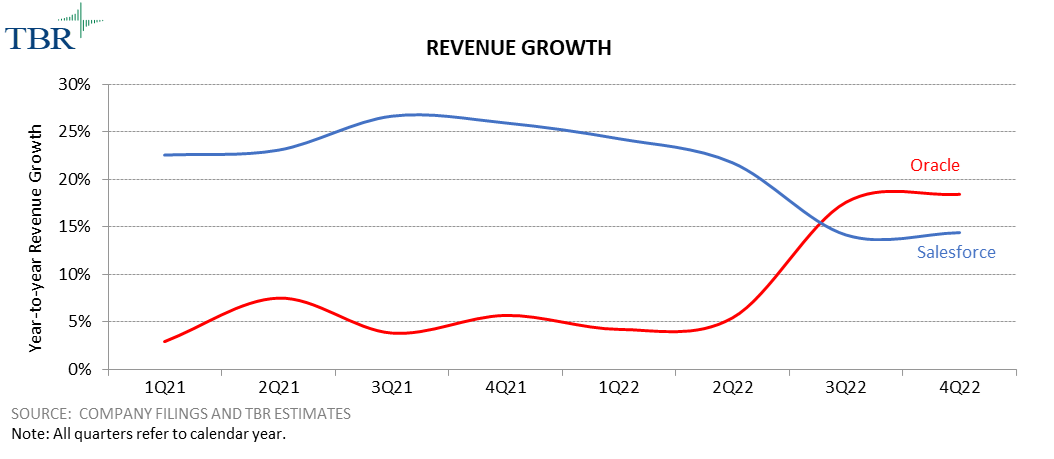

Despite Salesforce’s significant size and milestone of recently becoming the largest enterprise applications provider globally, the company’s revenue growth has remained above 20% for most of its history. However, Salesforce’s pace of expansion has been 14% in the last two quarters, with projections for coming quarters closer to 10%. The slowing growth, combined with pressure from activist investors, has made efficiency and profit the company’s new primary financial focus.

On the company’s most recent earnings call, Salesforce CEO Marc Benioff alluded to taking a page out of the “Oracle Playbook” by re-evaluating internal operations and looking for ways to reduce expenses and increase profitability. We believe Salesforce is the first cloud vendor to undergo this change in financial focus, which is why we have dug into what the Oracle Playbook is and how it could be used to adjust other vendors’ cloud business models in coming quarters.

Using Oracle (NYSE: ORCL) strategies to reduce costs in select areas could yield billions of dollars in profit for Salesforce, causing other activist investors and cloud vendors to follow suit to optimize their bottom lines. Salesforce is projecting its fiscal 2024 operating margin to exceed 10%, which is a threefold increase from the prior fiscal year. If that comes to fruition, we anticipate the pressure will increase from activist investors and acquiring companies, with Broadcom’s (Nasdaq: AVGO) pending purchase of VMware (NYSE: VMW) and Zendesk’s (NYSE: ZEN) recent private equity buyout as examples.

Revenue growth will become a metric, not the metric

For Salesforce, much of this new focus on profit was precipitated by a slowdown in the pace of revenue growth. When the company was consistently growing at a rate above 20%, it had a certain amount of leeway in the rigor of its operational and cost models. Spending was necessary to support that rate of continued growth, and many inefficiencies were either masked or viewed as less of a priority than sustaining the expansion.

One of the takeaways from the Oracle Playbook is that the operating philosophy does not change based on the pace of revenue growth. Aside from large acquisitions, like the purchase of Cerner, which is driving the recent uptick in growth, Oracle’s year-to-year revenue growth has remained consistently in the single digits for much of the past decade. Whether revenue is contracting or expanding in a certain period, Oracle does not dramatically change its investment and expense strategy. Rather, it stays the course and focuses on efficiency and profitability. As Salesforce enters this new period of slower growth, we expect its approach to running the business to become more stable.

Salesforce can both improve sales productivity and reduce expenses

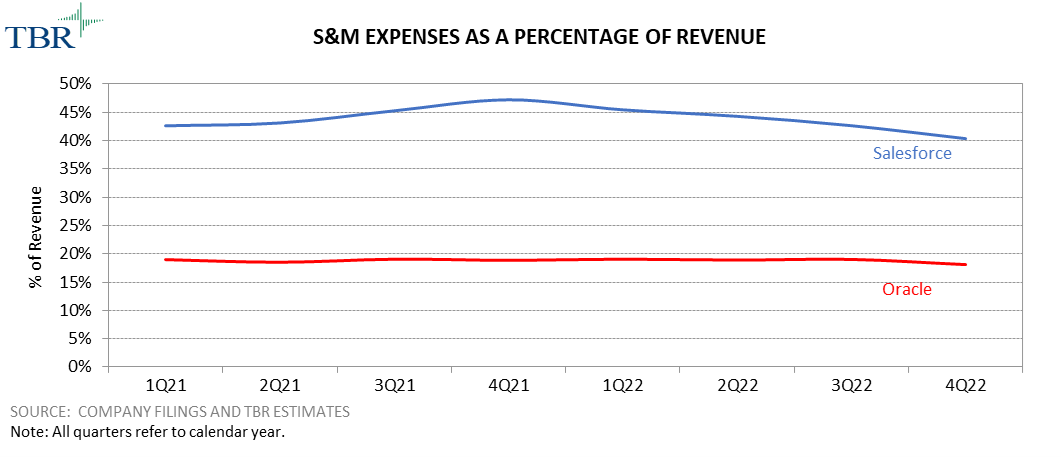

The largest difference between Salesforce’s current operations and Oracle’s strategy lies in sales and marketing expenses. In the most recent comparable period for the two vendors, Oracle reported sales and marketing expenses as a percentage of revenue of 18.1%, less than half of Salesforce’s 40.4%. The 22.3% gap between the two vendors is significant and represents the biggest opportunity for Salesforce to bolster its operating profitability through increased efficiency.

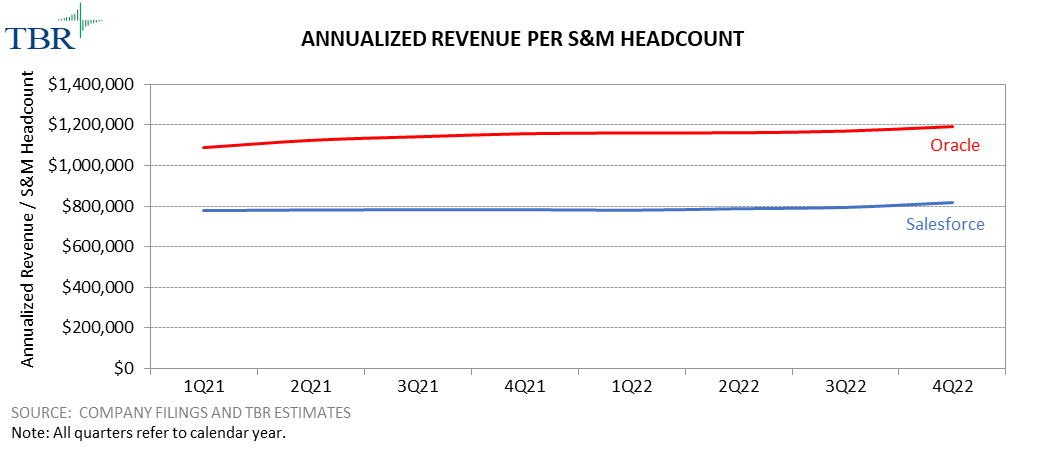

The first difference between Oracle and Salesforce in S&M strategy lies in productivity. On average, each Oracle sales and marketing employee generated more than $1.19 million in annualized revenue. Salesforce’s productivity steadily increased through the close of 2022 but is still well below that mark, with each sales and marketing employee most recently generating $816,000 in annualized revenue.

The challenge in improving productivity was reflected in Benioff’s comments, as he claimed that new employees were less productive than their more tenured counterparts. Especially in light of Salesforce’s recent layoffs and slowdown in hiring, we expect annualized revenue production per Salesforce sales and marketing employee to increase and eventually approach $1 million.

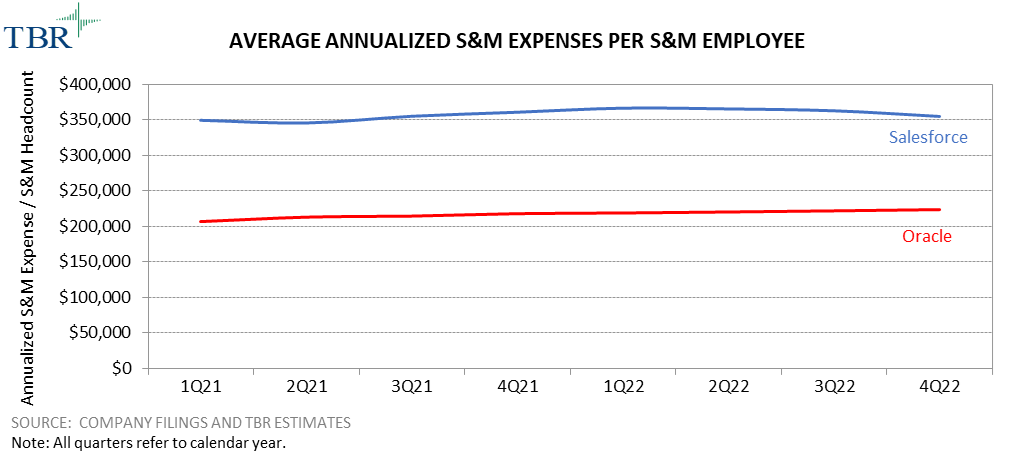

Oracle and Salesforce differ strategically around not only productivity but also the composition of the companies’ S&M teams. This is best illustrated by the annualized cost per S&M employee. Salesforce incurs an average of $355,000 in sales and marketing expense for each employee per year, whereas Oracle spent $224,000, on average, in 4Q22. Not only is there a gap in the level of expense, but Salesforce also saw its average increase moderately during 2022 before falling in 4Q22 as the company sought to control costs.

Oracle, on the other hand, has seen average expenses increase slightly during the past year, partially driven by the integration of Cerner. Despite the increase, average expenses in 2022 remained marginally lower than 2019 expense levels. Oracle’s advantage in the area of average cost per S&M employee is a force multiplier, allowing the company to staff larger teams with lower expense levels and use each sales and marketing resource as a driver of bottom-line profitability.

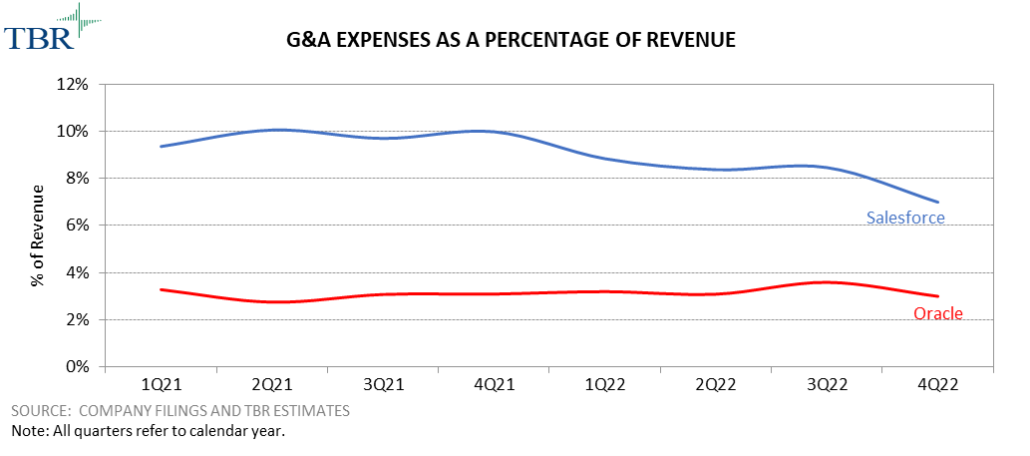

For general and administrative functions, less will be more

Another area ripe for improvement is Salesforce’s G&A expenses. While the gap between Oracle and Salesforce in this area is narrower in terms of sheer size, proportionally it is quite significant. As a percentage of revenue over the past two years, Salesforce’s G&A expenses as a percentage of revenue were between two and three times what Oracle spends. With Salesforce spending more than $2.5 billion in G&A expenses during 2022, any efficiency improvement would have a noticeable impact on profitability.

One of the lessons from Oracle’s approach to G&A expenses is to minimize any investment that does not have a direct impact on the company’s core value proposition. Maintaining financial systems, administering human resource services and managing overall corporate functions that are included in G&A are important but do not differentiate a business in the market. This is also an area where Oracle relies on technology — mostly its own technology — to tout the efficiency of its operations. Oracle executives such as CEO Safra Catz frequently mention the company’s speed in completing quarter-end financial reconciliations and publishing periodic Securities and Exchange Commission (SEC) filings, attributing that speed to Oracle’s own financial management offerings.

Salesforce is already running the Oracle Playbook for research & development and cost of goods sold

While Oracle does shine a light on areas where Salesforce could reduce expenses and increase profitability, the companies’ respective R&D expenses and cost of goods sold (COGS) are two areas that are currently well aligned. Oracle is well known for its innovation and the overall quality of its offerings, and the vendor continues to prioritize its investment in R&D. Salesforce has a similar reputation, and the two vendors have remarkably similar levels of investment in R&D: Oracle most recently spent 17.4% of revenue in R&D, while Salesforce’s expenses were slightly lower at 16.1% of revenue. Due to the importance of improving offerings and funding innovation, we do not expect to see significant changes in R&D spend for Salesforce.

In a related area, the two vendors are also quite close in their gross margins, reflecting the efficiency with which both can deliver offerings to customers. The diversity of Oracle’s business, spanning traditional software, cloud and even hardware, is a complicating factor in its gross margin, which was 72.6% during 4Q22. Salesforce has a much more focused set of offerings and reported a 75% gross margin during 4Q22.

Long-term, there could be more opportunity for Oracle to improve its cloud gross margin levels, given the reliance on its own technology and data centers. Salesforce has been moving away from its own data centers and utilizes its Hyperforce program to shift delivery responsibility onto the major hyperscale platform providers. There could still be improvements in the efficiency of COGS for both companies, but that will be slower to develop and reflects broader trends like data center capacity and hardware depreciation cycles. Similar to R&D, gross margin is also tied closely to the customer experience and value, so the companies will have to balance cost reductions against customer impacts.

Salesforce will stop short of becoming a full-fledged Oracle clone

Salesforce will certainly implement and benefit from many of the cost-saving strategies that have led to Oracle’s sizable profit margins. However, we expect Salesforce to continue purposely avoiding many aspects of what makes the Oracle culture unique.

Coming from Oracle, Benioff consciously decided to make Salesforce a fundamentally different company in many respects. Salesforce’s family-like “Ohana” culture is in stark contrast to the more aggressive, competitive and cut-throat culture that defines Oracle. Salesforce’s culture did take a hit and moderate a bit considering the recent layoffs, but many aspects of it will endure.

The other major difference in culture that will persist is Salesforce’s customer centricity. Oracle is known for aggressive contracting and for locking in customers, even if its technology and offerings provide significant value. Salesforce should continue to take a softer approach, emphasizing customer success and offering the scale-up, scale-down nature of cloud, which provides a relief valve for negotiations should customer situations change. The downside of that model is part of what has precipitated Salesforce’s recent slowdown in revenue, as customers require fewer seats and grapple with more challenging economic conditions. So, while the Oracle Playbook should yield significantly greater profitability, we see limits in how far Salesforce will go to emulate the strategies of its more mature peer.

Our most-read analysis, free in your inbox each week — Subscribe today!

Technology Business Research, Inc.

Technology Business Research, Inc. Technology Business Research, Inc.

Technology Business Research, Inc.