As the Carlyle Group Continues to Fine-tune ManTech, Will We See It Go Public in 2025?

Embracing emerging technologies in core markets

When the Carlyle Group acquired ManTech for $4.2 billion in September 2022, TBR questioned how the federal IT vendor would be restructured. One month later, when Matt Tait succeeded Kevin Phillips as president and CEO of ManTech, he quickly signaled that the needs of the defense and intelligence markets would remain central to the company’s vision.

Since then, Tait has been steadily funneling resources into five technology focus areas: Analytics, Automation and AI (A3); Cognitive Cyber for Physical and Digital Platforms (Cognitive Cyber); Data at the Edge (D@tE); Intelligent Systems Engineering (ISE); and Mission & Enterprise IT (M/EIT). Rather than focusing on harnessing a single emerging technology, ManTech has explored how these technologies played off one another and how to leverage their synergies. In doing so, ManTech’s efforts aligned with the Biden administration’s spending priorities and the company captured lucrative awards like the U.S. Army’s $622 million Technology Insertion Transformation Unified Services (TITUS) task order.

While ManTech’s ongoing strategy appears to align with the Trump administration’s interests, the company will need to increasingly leverage its partner network to close the capabilities gap between it and Tier 1 peers like Leidos and Booz Allen Hamilton (BAH).

ManTech is increasingly collaborating with partners …

ManTech had been largely inactive on the alliance front since strengthening its ties with Amazon Web Services (AWS), Google and Red Hat in 2021, but the Carlyle Group’s takeover in 2022 has prompted ManTech to recently take steps in that direction.

For example, ManTech partnered with Marque Ventures in 2Q24 to find companies in the national security space making inroads with emerging technologies and incorporate them into ManTech’s offering ecosystem. ManTech also announced that Trust Stamp’s AI-powered Irreversibly Transformed Identity Token would be integrated with ManTech’s offerings as part of a teaming agreement the two reached during the first half of 2024.

… but so are its Tier 1 peers

Although ManTech has been accelerating its alliance formation and expansion activity, the company continues to lag its biggest federal systems integrator peers. Accenture Federal Service, BAH, CACI, SAIC and Leidos maintain extensive and well-run alliance ecosystems in the federal IT market, and each has been very active in forging new alliances or expanding existing collaborations (particularly in cloud computing and AI). Several of these vendors, such as BAH through its venture capital arm Booz Allen Ventures, have also made substantial venture capital investments in smaller, AI- and cloud-focused peers or partners with key adjacent technologies.

Leidos, the largest federal systems integrator by revenue, with over $14.2 billion in technology and technology-related sales in 2024, has a broad network of solutions and strategic partners. Leidos pursues partnerships across a wide swath of players, from Microsoft to NetApp. In most engagements, Leidos acts as the principal systems integrator thanks to its market-leading scale and ability to design and deliver open-architecture-based data management, security and communications solutions across federal agencies’ IT infrastructures. Leidos and Microsoft expanded the scope of their partnership in cloud computing in 2023 and formed a strategic collaboration agreement with AWS in 1Q24, deepening the long-standing relationship between the partners. Historically, Leidos and AWS have been active in the defense and intelligence sectors, and the enhanced collaboration will focus on advancing multidomain operations for the Department of Defense (DOD) and Intelligence Community (IC).

Entering the consulting sphere

When Tait initially took charge of ManTech in fall 2022, he gave no indications as to whether he would seek financial backing from the Carlyle Group to bolster ManTech’s sputtering civilian business. Less than a year later, ManTech acquired Definitive Logic for an undisclosed amount.

While the acquisition has certainly expanded ManTech’s presence in the defense and intelligence markets, it has also created new opportunities for ManTech in the civilian market. By purchasing the 330-person firm, ManTech was able to significantly speed up its efforts to incorporate consulting into its go-to-market strategy.

Since 2023, ManTech has launched multiple consulting practices, such as the Google Workspace Practice, that are dedicated to helping agencies adopt emerging technologies. Through the Google Workspace Practice, ManTech and Google Public Sector have expanded their partnership and are hosting immersive workshops tailored to agencies and other prospects’ needs to demonstrate how generative AI and Google Workspace can enhance operational efficiency.

ManTech’s pivot into the consulting space may come as a surprise given the company’s history, but it aligns with the Carlyle Group’s priorities since purchasing ManTech. The private equity specialist has been fine-tuning ManTech to expand its addressable market size, build out a more diverse array of capabilities, and bring its margin performance more in line with that of its peers. Having ManTech expand beyond its traditional plug-and-play role and support all stages of a client’s journey addresses all of those goals and is why more vendors like General Dynamics Information Technology (GDIT) have also recently thrown their hats into the consulting ring.

ManTech has an advantage over GDIT in the consulting space because it is currently a private company and can take its time fine-tuning operations without facing the scrutiny of Wall Street. Consulting fundamentally comes down to people and permission, which can be difficult to build and/or acquire. Consulting also requires money and patience to be successful — things that are rarely rewarded when facing the never-ending 90-day clock of earnings.

What is next?

While private equity always has an exit strategy, it is unlikely that the Carlyle Group will take ManTech public or sell it to another company in the near future.

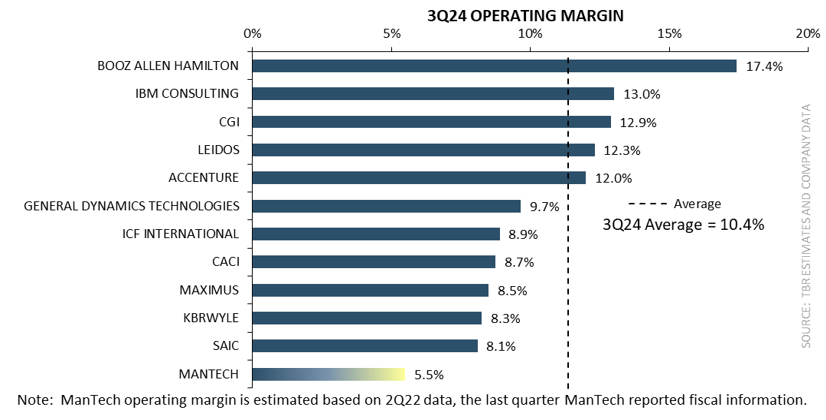

When the Carlyle Group first took over ManTech, the company was a margin laggard with organic revenue growth that paled in comparison to its peers in TBR’s Federal IT Services Benchmark. The Carlyle Group has had a positive impact on ManTech’s profitability by optimizing its headcount, making necessary divestitures and pivoting into the margin-friendly consulting business, but it will still take time to bring ManTech’s operating margin in line with vendors like CGI Federal.

Additionally, while ManTech is making inroads with its consulting business and earning seats on high-profile contract vehicles like the FBI’s Information Technology Supplies and Support Services 2nd Generation initiative (ITSSS-2) program, TBR believes that the company’s revenue growth continues to lag far behind that of Tier 1 peers like BAH and CACI. ManTech recently stood up civilian and defense-oriented advisory boards to better understand how it can gain traction across these markets, but it will be a while before these efforts yield results.

Similarly, bringing ManTech’s AI, analytics, automation, systems engineering and solutions to the scale that its competitors offer is also a longer-term goal. Given that the M&A market is becoming increasingly buyer-friendly, TBR anticipates that ManTech will leverage financial backing from the Carlyle Group to quickly strengthen these capabilities.

The Carlyle Group spent roughly two and a half years restructuring an already high-functioning BAH before cashing out. TBR believes the Carlyle Group will be patient with ManTech and ensure that the company is better positioned across the defense market as well as the civilian market by leveraging its technology focus areas and fostering margin growth to ensure long-term success. Once ManTech can generate predictable revenue and profit streams, TBR believes the Carlyle Group will cash out, but we do not expect this to occur until 2027 at the earliest.

Canva Pro

Canva Pro Douglas Rissing, Getty Images via Canva Pro

Douglas Rissing, Getty Images via Canva Pro Simonkr, Getty Images Signature via Canva Pro

Simonkr, Getty Images Signature via Canva Pro