Top 2023 Takeaways for the Federal IT Services Market [Infographic]

Update: For the latest developments in the U.S. federal IT market, check out our December 2024 blog Federal IT Spending Will Remain Robust in FFY25 Amid AI Prioritization, which highlights the proposed budget for FFY25 and its potential impact on federal systems integrators. Click here to read the full blog.

Current State of the Federal IT Services Market

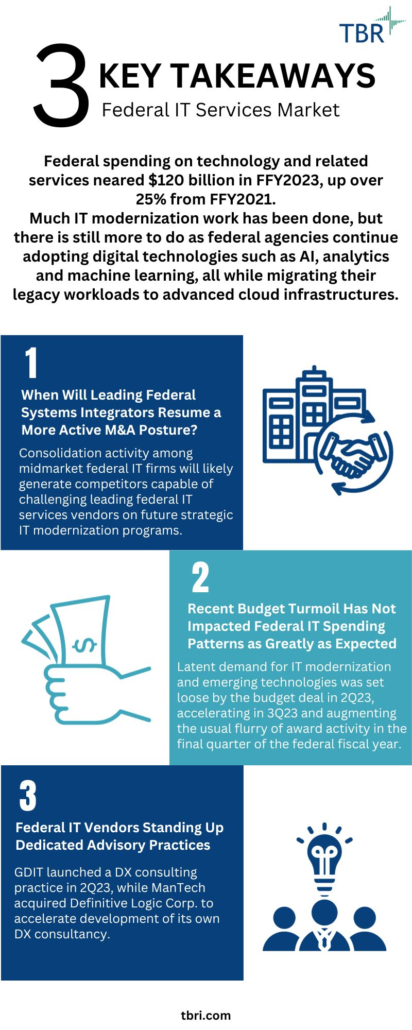

The most intensive bull market in federal IT spending continues, and the federal IT services market will remain robust through federal fiscal year 2024 (FFY2024). Much IT modernization work has been done, but there is still more to do as federal agencies continue adopting digital technologies such as AI, analytics and machine learning, all while migrating their legacy workloads to advanced cloud infrastructures. Federal spending on technology and related services neared $120 billion in FFY2023, up over 25% from FFY2021 and on a trajectory to surpass $130 billion by FFY2025.

The below infographic contains the three key takeaways from TBR’s latest research on the U.S. federal IT services market and what these events mean for you.

Top 3 Takeaways for 2024

When Will Leading Federal Systems Integrators Resume a More Active M&A Posture?

Consolidation activity among midmarket federal IT firms remains very robust and will likely generate competitors with the scale and the depth of digital capabilities to challenge the leading federal IT services vendors on future strategic IT modernization programs.

Recent Budget Turmoil Has Not Impacted Federal IT Spending Patterns as Greatly as Expected

Overall growth in the federal IT sector in 3Q23 was the most aggressive TBR has observed since launching its coverage of the market in 2008. The debt ceiling agreement in June 2023 provided a much-needed respite for the federal IT market from the budget turmoil that had impeded growth through FFY2022 and early FFY2023. Latent demand for IT modernization and emerging technologies was set loose by the budget deal in 2Q23, accelerating in 3Q23 and augmenting the usual flurry of award activity in the final quarter of the federal fiscal year.

Federal IT Vendors Standing Up Dedicated Advisory Practices

General Dynamics Information Technology (GDIT) launched a digital transformation (DX) consulting practice in 2Q23, leveraging its network of Centers of Excellence and Emerge Labs, as well as the expertise gained from the more than 4,000 research initiatives that have provided its clients actionable market insights on emerging technologies like AI.

On the heels of GDIT’s announcement, ManTech acquired Definitive Logic Corp. to accelerate the development of its own digital transformation consultancy, adding 330 employees skilled in digital transformation services like data engineering.

What This Means for You

Leading federal integrators will keep a close eye on their midmarket IT services peers, perhaps ahead of renewed M&A activity by the top-of-the-market firms. There is still the threat of a government shutdown during FFY2024, and top-tier integrators have all factored that into their plans for 2024.

Expanding advisory capabilities points not only to the capabilities needs of the vendors that are launching consulting operations but also to the importance of advisory competencies in federal digital transformation.

Conclusion

Technology procurement by federal agencies in 2024 is likely to continue at a brisk pace, as evidenced by expanding outlays for IT initiatives in the Biden administration’s FFY2024 budget across the civilian, defense and intelligence sectors. Several federal systems integrators have also tendered projections for continued robust top-line growth in 2024, even if there is a government shutdown during FFY2024.

As such, TBR is confident there is headroom for growth for not only the legacy federal IT vendors but also their smaller, Tier 2 federal integration peers as well as commercially centric technology companies looking to make inroads into the federal space.

Subscribe to TBR’s Insights Flight to receive exclusive federal IT services content, including excerpts from our top research and invitations to upcoming TBR Insights Live sessions with our subject-matter experts.

Technology Business Research, Inc.

Technology Business Research, Inc.