Growing Infrastructure as a Service Commitments and Competitive Dynamics

Hyperscalers Forge Larger, Longer-term Deals Amid Intensifying Competition

Customers Are Engaging in Long-term Contracts

Market leaders Amazon Web Services (AWS) and Microsoft have highlighted that customers are signing larger cloud contracts with longer terms. At least in the case of AWS, customers are increasingly applying their cloud credits toward one- or three-year subscription offerings like Savings Plans and Reserved Instances.

Microsoft offers similar plans, and in FY3Q24 reported an 80% year-to-year increase in the company’s number of $100-plus million Azure deals. We expect this trend to persist and potentially bring a greater degree of stability to hyperscalers’ top lines.

Google Cloud Should Keep an Eye on OCI’s Expansions

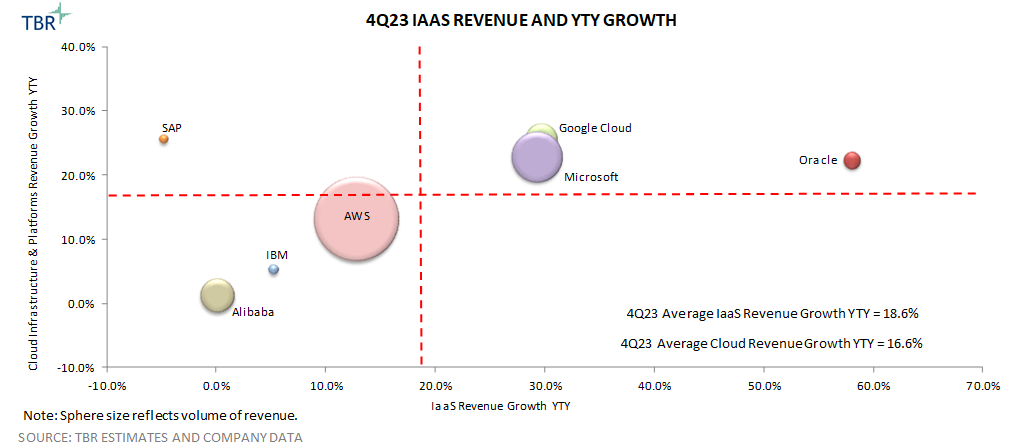

Oracle Cloud Infrastructure (OCI) is growing noticeably faster than competing services as Oracle rapidly fills data center capacity. Oracle has an unofficial goal of closing the revenue gap with Google Cloud Platform (GCP). Though this is a lofty goal, Oracle’s $60-plus billion backlog balance and strategic use of third-party colocation providers, alongside a series of cloud regions that interconnect with Azure, should be noted.

Google Cloud has opted to build and operate its own data centers, and while the company is expanding its footprint, competitors are doing so at a rapid pace, leading Google Cloud to enter markets where AWS, Microsoft and, in many cases, Oracle already have an established footprint.

Oracle Remains a Rising Force in IaaS, Growing Noticeably Faster Than Peers

Demand for OCI exceeds supply, but Oracle is quickly building new data centers, specifically smaller facilities that deliver high uptime and reliability, and is also leveraging third-party colocation providers. As Oracle fills capacity within its OCI data centers, Infrastructure as a Service (IaaS) revenue will continue to grow, and executives appear confident Oracle can maintain a 50%-plus growth rate on cloud infrastructure revenue for the near future.

Cloud Infrastructure Vendor Spotlights

Amazon Web Services

Essentially the first company to bring GPUs to the cloud, AWS has an established relationship with NVIDIA that AWS will hone to make sure customers continue to build applications on AWS infrastructure. For instance, AWS is supporting NVIDIA’s latest GB200 chips, allowing customers to scale up to thousands of GPUs in a single cluster, and is exploring the codevelopment of industry-specific solutions. Despite this alliance, AWS continues to invest in its own custom AI chips.

Microsoft

IaaS revenue growth is reaccelerating, coming off a challenging 2023, but Microsoft is also reporting a revenue uplift for AI services. In 4Q23 Microsoft reported that AI services contributed 6 points of growth in the Azure and other Cloud Services business. Serious about leading the AI market, Microsoft made the long-anticipated move to release its own custom line of chips, dubbed Maia, to better support AI workloads, including Copilot, and keep pace with peers, which have long invested in custom silicon.

Alibaba Cloud

Alibaba Cloud’s IaaS revenue growth continues to struggle due to ongoing economic headwinds in the China market, resulting in another quarter of negative growth in 4Q23. To hedge against this trend, Alibaba Cloud announced it will cut prices on more than 100 of its core products by up to 55%. The organization hopes to attract more enterprises and developers involved with AI development projects to promote overall AI adoption.

mazirama, getty images via can va pro

mazirama, getty images via can va pro danisacch, getty images via canva pro

danisacch, getty images via canva pro teekid, getty images via canva pro

teekid, getty images via canva pro