GenAI Reshapes IT Services Talent Strategy as Vendors Balance Innovation, Ecosystem Alignment and Economic Headwinds

GenAI training becomes table stakes for IT services and consulting, but specialization remains selective

In the short-to-mid-term, TBR expects generative AI (GenAI)-specific training to become a standard part of an IT services or consulting professional’s basic tool kit, with specialized training around technology partners’ solutions or a company’s own IP and platforms reserved for those professionals dedicated to AI roles. While some may argue every role is an AI role, the near-term reality is that only a select few among the broader professional services talent base will need specialized training, and the associated budgets will decrease in the coming years.

In the long term, we expect vendors’ announcements about training their entire workforce will seem less relevant compared to what is on the horizon for GenAI. That change may take a bit longer, in part because training will affect IT services companies’ commercial models.

For example, Infosys’ three talent categories — traditional software engineers, digital specialists focused on digital transformation and ongoing support, and Power Programmers — allow the company to balance innovation and growth while calibrating its business and commercial models. The Power Programmers group consists of highly skilled professionals who are responsible for developing products and ensuring that the intellectual property they create and use meets the cost-saving requirements Infosys pitches to clients.

While the other two groups follow a traditional employee pyramid structure, the Power Programmers group is much leaner and resembles the business models that many vendors, including Infosys, may aspire to adopt in the future.

Developing a GenAI-ready, partner-aligned workforce allows vendors to demonstrate value as the market evolves toward SLMs, but accounting for new commercial models will force pyramid calibration

According to TBR’s 4Q24 AI and GenAI Market Landscape, “As TBR predicted in the first half of 2024, the trend around IT services companies and consultancies committing to training their professionals on GenAI platforms and solutions specific to their (preferred?) technology partners accelerated as the year went on. IT services companies and consultancies continued moving away from vendor-agnosticism.

Technology partners, most notably the hyperscalers, continued to see their IT services and consultancy partners as essential to convincing enterprises to adopt GenAI solutions, generating further demand for technology. And every professional services company TBR covers announced new training or some kind of benchmark achieved in training their talent on GenAI.”

Highlighted activities by vendors in TBR’s Spring 2025 Global Delivery Benchmark reflect the direction of the GenAI market, especially as buyers lean on their existing IT infrastructure and systems to ensure they capitalized on their data lakes to build industry- and/or function-specific small language model (SLMs), compelling IT services vendors to build their GenAI skills around tech partners.

- Accenture, Microsoft and Avanade launched a Copilot practice in November 2024 that houses 5,000 professionals. Additionally, through its collaboration with Stanford University, Accenture launched an on-demand GenAI learning platform that curates AI content from Stanford Online.

- In October Atos and Amazon Web Services (AWS) established a GenAI Innovation Studio in Pune, India, enabling both companies to collaborate with clients on industry-specific use cases. The studio will offer training and certification programs, hackathons, and AWS DeepRacer competitions, in addition to hosting technology events as the partners try to foster joint innovation.

- In July HCLTech expanded its learning resources through a partnership with upGrad Enterprise to create a learning program around GenAI development. HCLTech will establish a Data Science and AI Academy of Excellence, providing upGrad’s education frameworks and resources alongside HCLTech’s industry and technology content. In May 2024 HCLTech worked with Google Cloud around HCLTech’s AI Force platform, bringing in Google Gemini’s AI and large language model (LLM) capabilities. Through its collaboration with SAP, HCLTech continues to enhance its positioning around AI technologies. In addition to leveraging the SAP Learning Platform and expanding its certifications, HCLTech opened an innovation lab for SAP Business AI in December. The lab, located in Munich, will provide SAP S/4HANA Cloud, RISE with SAP and SAP Business AI technology to guide clients’ AI adoption and improve business operations.

- To support joint activities with AWS, IBM Consulting trained 10,000 people on AWS GenAI services through the end of 2024.

- Wipro expanded its relationship with Google Cloud during 3Q24. The company will leverage Google Cloud’s Vertex AI and Gemini offerings, enabling its employees to help clients with their cloud migrations and GenAI adoption.

Choppy market demand buys vendors time to adjust staffing pyramids and test new operating models to account for GenAI implications

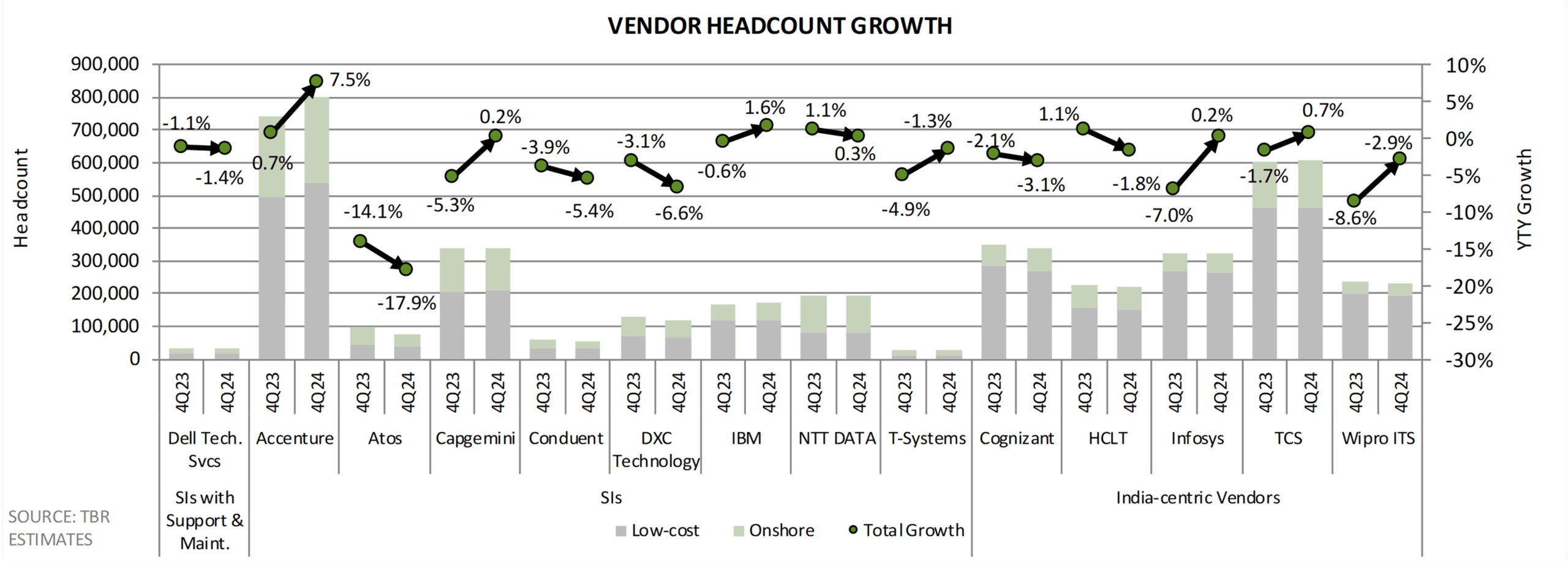

Headcount growth improved across benchmarked vendors in 4Q24, which was a reversal from a trend that began 12 months ago. The expansion, however, was rather small, with average headcount increasing 0.4% year-to-year in 4Q24, largely due to Accenture adding over 55,000 net-new additions mainly through acquisitions, which skewed the overall direction.

Meanwhile, vendors are at the crossroads of adjusting staffing pyramids to account for long-term GenAI implications and operating in a stagnant market where any spend is oriented toward large transformational deals that require quality in service delivery, often achieved through reskilling and/or acquiring partner-certified staff.

Securing trust with legacy and large technology alliance relationships as well as investing in knowledge management frameworks are essential for vendors to protect their incumbent positions. Growing technology complexity is accelerating demand for data and AI security capabilities, compelling vendors to build skills that can enable them to operate in both legacy and new GenAI-enabled environments, further challenging their staffing decisions as the opportunity for robots protecting from other robots might seem enticing at first but carries a fair amount of risk in the long term.

In the short-to-mid-term, acquisitions and staff rebadging will likely remain the two main levers for any net-new staff additions as vendors focus on reskilling existing staff as they take a wait-and-see approach until macroeconomic conditions improve.

We expect one of two scenarios to occur in the next six months: First, vendors remain diligent and continue to calibrate and fine-tune their staffing pyramids, keeping overall headcount flat to declining with one-off strategic acquisitions and/or rebadging to provide a blip in sequential headcount expansion.

Alternatively, macroeconomic conditions improve, largely enabled by better-than-anticipated tariff deals paired with deregulations and lower corporate tax rates in the U.S., resulting in an accelerated rebound in discretionary spending. As a result, vendors race back to hire in bulk quickly, forgetting about their GenAI-fueled optimism and the need to adjust operating models to account for GenAI implications.

A bonus scenario: Demand for GenAI drives the need for specialized talent, especially as vendors see the opportunity to pursue custom model development. While this might seem counterintuitive to the promise that the tech will supplement coders, the trust in the technology is not there yet, creating an opening for vendors to hire and train at speed.

TBR’s Global Delivery Benchmark

TBR’s Global Delivery Benchmark is a semiannual research program providing efficiency comparisons, assessments and insight into global delivery strategies and investments across 14 leading IT services firms.

Vendor coverage for this research includes Accenture, Atos, Capgemini, Cognizant, Conduent, Dell Technologies Services, DXC Technology, HCLTech, Infosys, IBM, NTT DATA, Tata Consultancy Services (TCS), T-Systems and Wipro IT Services (Wipro ITS). Market segments covered include systems integrators (SIs) with support and maintenance, SIs, and India-centric vendors, while service lines covered are application outsourcing, IT outsourcing, business process outsourcing, and consulting and systems integration.

Download a free preview of TBR’s latest global delivery benchmark research: Subscribe to Insights Flight today!

Getty Images

Getty Images

Technology Business Research, Inc.

Technology Business Research, Inc. Technology Business Research, Inc.

Technology Business Research, Inc.