GenAI, IT Modernization and Strategic M&A Drive Infrastructure as a Service and Platform as a Service Growth

Enterprise Migrations and Large-Scale M&A Are Influencing the IaaS and PaaS Market

Current State of the Infrastructure as a Service Market

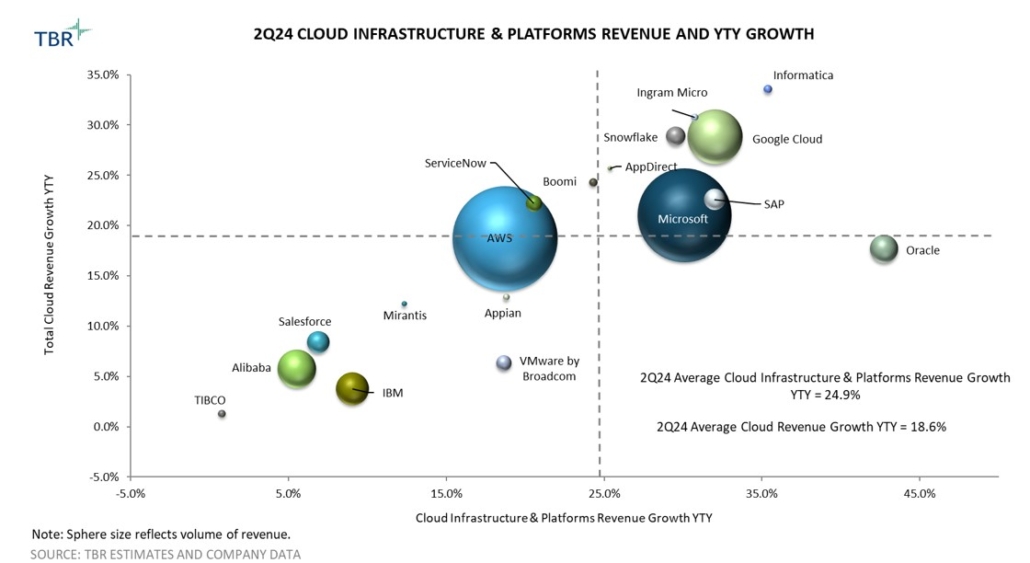

Among benchmarked Infrastructure as a Service (IaaS) vendors, average revenue growth increased 21% year-to-year in 2Q24, marking the fourth consecutive quarter of acceleration. There are two primary factors at play: enterprise IT modernization activity, which is much stronger now than it was this time last year, and generative AI (GenAI).

Top hyperscalers Amazon Web Services (AWS) and Microsoft are capturing legacy Oracle and SAP workloads as customers continue to migrate to the cloud to not only outsource their IT operations but also drive lasting business value. Though the geopolitical outlook is increasingly uncertain, we expect customers will continue to prioritize more traditional “lift and shift” migrations, and steps vendors are taking to deliver more integrated solutions could help. For instance, by the end of 2024, Oracle’s database services will officially be available on AWS, Microsoft Azure and Google Cloud Platform (GCP), which could be a big growth tailwind for these vendors. For context, converting Oracle’s remaining database support install base to the cloud represents a roughly $18 billion incremental revenue opportunity for these hyperscalers, including Oracle itself.

Regarding GenAI, investments in AI compute and new data centers are translating into top-line growth. Most vendors report they have multibillion-dollar AI and GenAI businesses, though this is minuscule compared to the tens of billions of dollars these vendors are investing. Vendor capex guidance for 2025 suggests that the level of investment will only increase, although we do expect this is when GenAI fatigue will hit and many customers may begin to re-evaluate their IT priorities.

Current State of the Platform as a Service Market

The Platform as a Service (PaaS) market is similarly growing behind GenAI adoption, as many customers, who still have a fear-of-missing-out mentality, are spinning up new workloads natively in the cloud with services like Amazon Bedrock, Microsoft Azure OpenAI and Google Vertex AI.

The PaaS market will similarly be impacted by GenAI disillusionment, but we believe this trend will also cause customers to focus more on the data layer, prompting them to take a second look at strategies around governance, data quality and integration for long-term AI success.

Another key trend driving PaaS market growth is M&A. IT leaders are acquiring to enter new markets and access IP they can ultimately sell as part of an entire end-to-end suite of offerings, as customers continue to crave more simplified, integrated solutions. By far the best example is Cisco’s acquisition of Splunk, which added $960 million to Cisco’s top line in 2Q24 and is quickly making Cisco a rising force in PaaS with its observability portfolio. IBM’s proposed acquisition of HashiCorp, which is expected to close by the end of this year, would be another transformative deal that would put IBM squarely into the Terraform space and deliver synergies with Red Hat that will be attractive to unsatisfied VMware customers.

Cloud Infrastructure and Platform Revenue Leaders

Steps Microsoft Is Taking to Elevate Its Data Portfolio as Part of the Broader AI Strategy Will Fuel Azure Growth and Marginalize AWS’ Segment Lead

Amazon Web Services: AWS continues to ride a wave of accelerating revenue growth and will cross the $100 billion threshold in annual sales by the end of 2024. Making it as easy as possible for customers to build GenAI applications in the cloud with Amazon Bedrock’s unified API, and adjacent developer tools like App Studio and SageMaker, is integral to AWS’ strategy and ability to drive IaaS growth. At this point, there are probably well over 10,000 customers using Amazon Bedrock for a range of generic use cases like text generation and virtual assistants.

Microsoft: Though AI infrastructure constraints caused Azure revenue to dip 2 percentage points to 29% in 2Q24, Azure is growing faster than AWS despite becoming larger and closing in on AWS’ revenue volume. Steps Microsoft is taking to advance its PaaS strategy through solutions like Fabric will continue to fuel Azure growth and help protect Microsoft’s lead in the AI space. For context, the number of Azure AI customers also using Microsoft’s data and analytics tools grew nearly 50% year-to-year in 2Q24, while Microsoft Fabric has now reached 14,000 paid customers.

Google Cloud: Recognizing that GenAI leadership stems from the infrastructure foundation, Google Cloud has been heavily building out its infrastructure portfolio by supporting not only NVIDIA’s Blackwell chips, which are expected to be available on GCP in early 2025, but also its own hardware. This includes Axion, Google Cloud’s first Arm-based processor that will support a range of GCP services, including data services key for GenAI like Dataproc and Dataflow. In 2Q24 Google Cloud also announced its sixth-generation TPU (tensor processing unit).

Ztudio, Canva Pro

Ztudio, Canva Pro

Technology Business Research, Inc.

Technology Business Research, Inc. Dalaifood, Canva Pro

Dalaifood, Canva Pro