Edge Computing’s Role in Tackling Latency, Privacy and Resiliency Challenges

TBR’s Enterprise Edge Compute Market Landscape provides insights on marketwide trends among 16 vendors across the edge stack. The research focuses on the infrastructure, software and services that facilitate edge data processing and analysis. Vendor coverage includes Amazon Web Services, Google Cloud, IBM, Amazon Web Services, IBM, Hewlett Packard Enterprise and more. To access the entire report and dataset, sign up for your TBR Insight Center™ free trial today!

Cloud adoption is on the rise, but for many customers, particularly those deploying workloads across multiple clouds, latency, data flow, privacy and overall business resiliency remain core challenges.

Edge computing is an emerging segment in IT, giving customers a way to supplement their cloud and IT core investments by processing data locally for minimum latency and backing it up to an adjacent environment for use cases like analytics and application development.

Enterprise Edge Computing Market Forecast

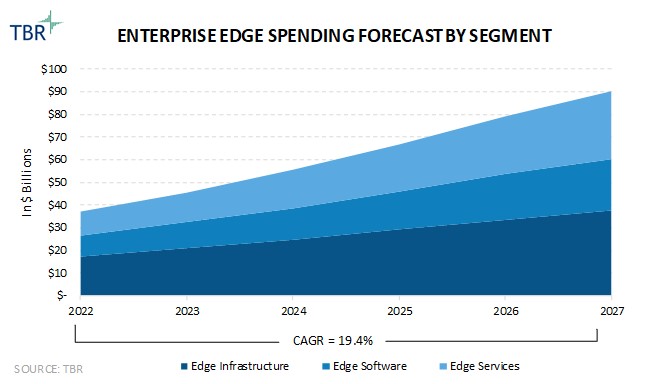

TBR research estimates the enterprise edge computing market will grow at a 19.4% CAGR from 2022 to 2027, surpassing $90 billion by 2027. Professional and managed services will remain the fastest-growing segment, followed by software, at estimated CAGRs of 23.2% and 19.8%, respectively.

We continue to revise our enterprise edge computing market forecast to account for the pullback in spending across traditional IT and cloud markets. Deceleration of growth in the edge market will not be as severe as in other markets due to the strategic nature of edge investments.

Further, although the enterprise edge market will benefit from the hype surrounding AI in 2024, many pilot projects may not enter production and more concrete use cases around edge AI need to be developed.

Enterprise Edge Computing Adoption Remains Sluggish, With Other ROI-friendly Alternatives Taking Precedence

Edge Computing Expansion Lags Compared to Other Deployment Methods

According to TBR’s 2Q24 Infrastructure Strategy Customer Research, 34% of respondents expect to expand IT resources at edge sites and branch locations over the next two years. But this is noticeably lower than the 55% who plan to expand IT resources within centralized data centers, while the central cloud and managed hosting are also gaining more traction.

The possibility of large capital outlays and an unclear path to ROI remain the biggest adoption hurdles to edge technology, with some customers exploring other alternatives that have a clearer path to ROI.

CrowdStrike Outage Reinforces Edge Computing’s Role in Decentralized IT

There are many lessons to take away from the CrowdStrike incident in July, where a faulty update caused Microsoft Windows to fail, resulting in a major disruption to global businesses. The issue extends well beyond cybersecurity and speaks to the risk of having a centralized IT architecture with limited disaster recovery and backup solutions in place.

The CrowdStrike outage has been called out by many edge computing advocates and business leaders, including ZEDEDA CEO Said Ouissal, who argues that a distributed architecture that uses more autonomous capabilities, including edge-specific operating systems, is a much more efficient approach, as opposed to having to manually reset multiple endpoints, as was the case with CrowdStrike.

This message certainly has merit, as distributed architectures that are built from the ground up and can effectively extend resources from cloud to edge have been gaining traction among customers and vendors. But securing these distributed architectures remains a big challenge, and vendors have a lot of work to do to assure customers their data is secure across the entire infrastructure landscape.

Hyperscalers Continue to Address the Edge Opportunity, and GenAI May Exacerbate This Trend

AI and generative AI (GenAI) have the potential to gain a lot of traction at the edge, and the hyperscalers are well positioned to address this opportunity. With their vast access to data, the hyperscalers will be a natural choice for customers that do not want to move their GenAI solutions to a separate compute ecosystem but want to process the data closer to the point of use.

We continue to see hyperscalers move into the edge space, with Google Cloud’s air-gapped configuration of Google Distributed Cloud and the continued expansion of Amazon Web Services Local Zones, including Dedicated Local Zones, among the key examples.

Just_Super, Getty Images via Canva Pro

Just_Super, Getty Images via Canva Pro

Annatodica, Getty Images via Canva Pro

Annatodica, Getty Images via Canva Pro