Immigration Policy Changes Portend a Growth Shock for the U.S. Wireless Industry

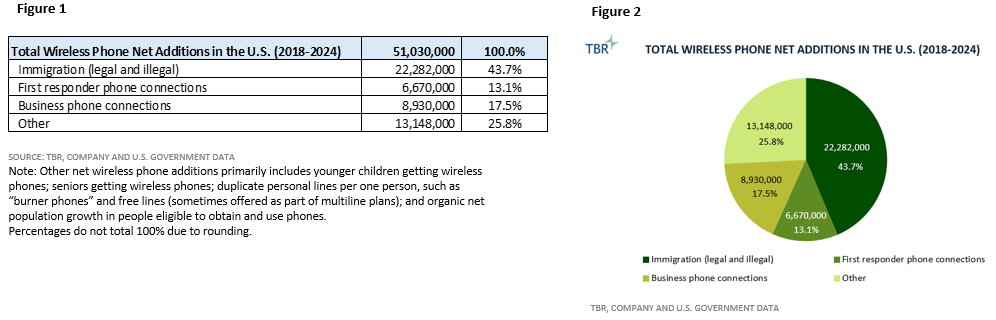

U.S. wireless operators added more than 51 million new wireless phone connections from 2018 to 2024. Where did they come from?

According to company-reported data, industry data, U.S. government data and TBR estimates, U.S. wireless operators collectively added more than 51 million wireless phone connections (prepaid and postpaid) from the beginning of 2018 through the end of 2024, a relatively large number considering the organic population growth rate in the U.S. has slowed significantly over the past two decades as Americans have fewer children and since most people in the country already have at least one wireless phone.

A portion of this increase in phone connections can be explained by situations where one person has multiple lines, such as through work (e.g., business line or first responder line) or by long-tail situations, such as younger and older people subscribing to wireless phone plans for the first time, as well as the net change from births and deaths in the overall population.

However, based on TBR’s research, this only accounts for approximately 56% of total wireless phone net additions during this time frame. Where did the rest of these phone connections come from?

Approximately 44% of wireless phone connection net additions in the U.S. from 2018 to 2024 were from immigrants (legal and illegal)

According to TBR’s research, these 51 million new phone connections fall into four main categories, as outlined in Figure 1.

As shown in figures 1 and 2, immigration (both legal and illegal*) was the largest driver of wireless phone net additions for U.S. operators from 2018 to 2024, accounting for an estimated 22.3 million net additions, or nearly 44% of total wireless phone net additions during this seven-year time frame.

This number makes sense considering that, according to official government statistics such as from the Department of Homeland Security (DHS) and Customs and Border Protection (CBP), more than 30 million immigrants (legal and illegal) entered and stayed in the U.S. between 2018 and 2024. Of this number, it is reasonable to assume around three-quarters of these immigrants obtained cellphone service (prepaid or postpaid).

One of the first things immigrants do when they enter the country (legally or illegally) with the intention of staying is to purchase wireless phones and wireless phone service. Most people who enter the country are of an age that they would use phones.

This significant influx of new population into the U.S. drove a secular growth trend for wireless phone connection additions for the wireless industry from 2018 to 2024, and immigration represented the largest driver of wireless phone connection additions for U.S. wireless operators.

However, now that immigration policy is fundamentally changing under the Trump administration, this tailwind has become a headwind for operators and will require a structural reassessment of growth prospects for the industry.

TBR expects this growth shock will begin to present itself in operators’ 2Q25 results, with the effects more clearly seen in 2H25 results.

*Legal immigration primarily includes green card holders, visa holders (e.g., H-1B for temporary works; F1 and J1 for international students) and refugees/asylum seekers. Illegal immigration primarily reflects CBP encounters (all borders), “gotaways” and visa overstays.

Why will there be a growth shock for wireless phone net adds in the U.S. in 2025?

Given this growth slowdown, U.S. wireless operators face a conundrum. How will they continue showing robust net phone additions every quarter? There is no easy solution, but in the last section of this report TBR outlines some tactics operators are employing, or might employ in the future, to mitigate the negative immigration-related effects on their earnings results.

Since the start of President Trump’s second term, there has been a reduction of more than 80% in the flow of illegal immigrants into the country, and legal immigration into the U.S. has also declined significantly. Additionally, there are other population headwinds at play:

- Deportations of immigrants currently residing in the U.S. are ramping up (U.S. government agencies are on pace for over 500,000 deportations in calendar year 2025, up from over 271,000 in 2024)

- Emigration has increased as more people are choosing to leave the country voluntarily.

- Slowing birth rate

- Increase in death rate as the baby boomer generation ages

If we use a conservative estimate and assume a 50% reduction in the number of total new immigrants entering the U.S. from 2025 onward (and if other variables stay constant), this implies a reduction of more than 20% in the total level of new wireless phone connections, a significant challenge for wireless operators since phone connections are operators’ most lucrative offering. Even a 20% reduction in total wireless phone net additions would have a significant impact on operators’ revenue, margins and cash flow.

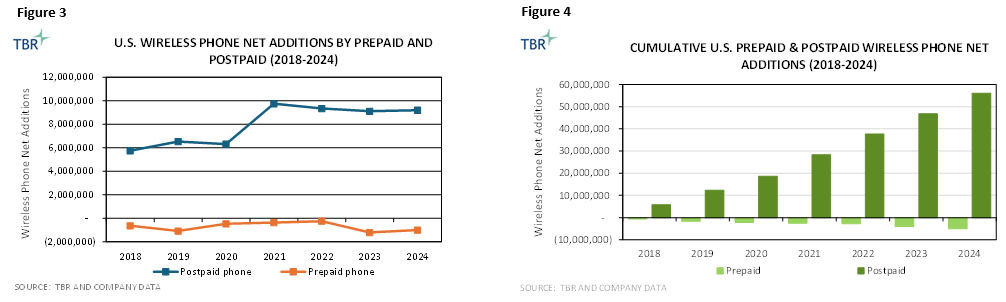

It is incorrect to assume immigrants only use prepaid plans

Despite claims by the U.S. wireless industry that immigrants predominately use prepaid phone service, the reality is that total prepaid phone connections declined by nearly 5 million in aggregate from 2018 to 2024 while postpaid phone net additions exceeded 56 million in the same period. Given that more than 30 million immigrants are estimated to have entered and stayed in the U.S. during that seven-year period (according to official U.S. government statistics from agencies such as CBP and DHS), it is unreasonable to assume that such a large influx of the population was absorbed by the prepaid market. Rather, it must have been mostly absorbed by the postpaid market.

What U.S. telcos are not saying but Canadian telcos are

U.S. wireless operators have been asked by Wall Street analysts on quarterly earnings calls and at investment conferences about the potential effects of immigration policy changes on their phone connection metrics. Thus far, operators have unanimously downplayed any impact. However, given immigration levels have plummeted since January 2025 (illegal border crossings are down 80% to 90% year-to-year) and voluntary and involuntary deportations are ramping up, there must be at least some impact.

Given immigration has represented approximately 44% of total phone net additions from 2018 to 2024, assuming legal and illegal immigration levels are down a conservative 50% compared to the past seven years, this would imply a reduction of more than 20% in the level of phone net additions moving forward, essentially taking the seven-year annual average of 7.3 million industrywide wireless phone net additions down to an annual average of 5.8 million moving forward. This reduction in new phone additions (which is operators’ most lucrative connection type from an average revenue per user [ARPU] and margin perspective) implies a growth shock, which would force operators to lower revenue and earnings projections. It is possible that operators expect most or all of any reduction in the immigration aspect of their phone connection dynamics could be mitigated by growth in other phone connection types, but history suggests that is unlikely.

The minimal wireless phone connection net addition impact observed in U.S. wireless operators’ financial results in 4Q24 and 1Q25 is likely due to the following reasons:

- Lag time between when someone enters the country and obtains a phone and phone plan and when that result is reflected in U.S. wireless operators’ earnings reports

- The timing of the new administration taking over and implementing and enforcing policy changes

- The delay between when someone is deported or emigrates and their phone line is shut off

- The lag in company reporting — earnings are publicly released one to two months after the quarter ends; there was a surge in immigrants entering the country leading up to the change in administrations and immigration reform began to be implemented and enforced in late January 2025

However, this will change, starting as soon as in 2Q25 and more so in 2H25 as the decline in net immigration begins to flow through U.S. wireless operators’ quarterly figures.

By contrast, the Big Three telcos in Canada have been very forthcoming in talking about and shaping expectations with stakeholders about the effects of immigration policy changes in the country. In 2024 the Canadian government reduced target levels for permanent residents by 20% from 2025 to 2026, set caps on international students, and tightened eligibility requirements for foreign workers. These policy changes are not at the same level as those in the U.S. Why are operators in Canada publicly stating that the country’s lower immigration targets are slowing their subscriber net additions, yet U.S. telcos claim there will be no meaningful impact? Something does not add up.

“We anticipate the environment for our businesses to remain competitive in the coming year with continued moderating wireless subscriber growth versus 2024 as Canada’s immigration and foreign student levels decline.” — Glenn Brandt, CFO, Rogers, 4Q24 earnings transcript

“The decrease in gross and net additions this quarter was a result of a less active market, slowing population growth as a result of changes to government immigration policies, and our focus on attracting subscribers to our premium 5G Rogers brand.” — Rogers 1Q25 earnings press release

“In the quarter, Rogers delivered a combined 34,000 net new wireless subscribers, down from 61,000 last year, reflecting the smaller market size due to reduced immigration.” — Glenn Brandt, CFO of Rogers, 1Q25 earnings transcript

Canadian telecom industry experiencing ‘strong subscriber growth’ thanks to immigration: report — Mobile Syrup, Feb. 22, 2024

Telcos blame Canada’s immigration policies for slower subscriber growth — Mobile Syrup, May 12, 2025

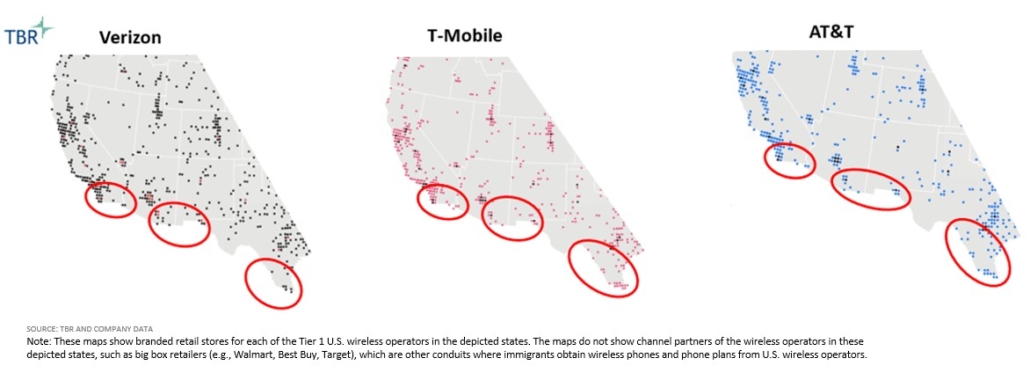

AT&T, T-Mobile and Verizon all gained the most subscribers from immigration and now have the most subscribers to lose

The largest U.S. telcos will be disproportionately affected by lower immigration levels. These operators have been the biggest beneficiaries of immigration flows, adding millions of net-new wireless phone subscribers to each of their businesses since 2018, but now this tailwind is turning into a headwind.

All of the major U.S. telcos have clusters of branded retail stores near major border-crossing areas with Mexico, such as in southern California and parts of Texas. Having store clusters near crossing hubs enables telcos to cater to the needs of migrants coming into the country (one of the first things immigrants do when they come into the country is buy wireless phones and phone plans) and jockey for new phone subscriber opportunities.

Tactics U.S. telcos can employ to mitigate the immigration impact

Though some telcos might start to publicly discuss the impact of immigration on their businesses, TBR expects most U.S. telcos to remain cagey about these changes and the effects of immigration on their businesses. TBR believes the telcos can leverage certain tactics to mask or mitigate the impact to their business results.

Indicators to watch

- Free line offers: Offering free lines enables telcos to show enhanced phone connection figures even though the revenue from the free line is not generating the revenue of an actual phone subscriber. Telcos will likely still receive activation fees and collect some other taxes and fees for allowing subscribers to carry the “free” line.

- Increase in competitive pricing offers and promotions: Special deals enable telcos to retain existing customers and take phone connection share from other operators. This could serve to offset some of the negative effects of immigration-related phone disconnections.

- Timing of line shutdowns: Another potential tactic telcos could employ is to delay the roll-off of line shutdowns. One situation where this can occur is when illegal immigrants are deported, leaving their phone service still in effect even though no one is using it and the bill is unlikely to be paid. There is also a trend of emigration, whereby immigrants (legal or illegal) leave the country voluntarily, canceling their phone service before they leave. This is another headwind to phone connection metrics for the telecom industry.

- Increase in allowance for doubtful accounts: This is also referred to as allowance for credit losses. The shutdowns described above typically lead to bad debt expense, which will likely rise with deportations on pace to exceed 500,000 in 2025.

Key takeaways

If you see minimal impact in operators’ headline wireless phone subscriber numbers from immigration, keep in mind that the aforementioned tactics are likely in play.

The negative effects might not show up in 2Q25 results and might not show up in a major way thereafter because wireless operators might be able to hide most of the impact via programs like offering a free phone line on multiline plans, such as what T-Mobile is doing.

Conclusion

Though the topic is rarely discussed, U.S. wireless operators have been relying on both legal and illegal immigrants to drive a significant portion of their underlying growth in phone connection net additions.

U.S. wireless operators face a major new headwind starting in 2H25 as traditionally important drivers of net wireless phone additions — operators’ most lucrative customers — slow meaningfully. With total immigration levels (legal and illegal) into the U.S. down by more than 50% so far this year compared to year-ago levels, coupled with an increase in deportations of existing residents as well as other population headwinds, telcos will struggle to demonstrate the same level of phone net addition numbers they have enjoyed for the past decade.

Getty Images

Getty Images