New IT Services Vertical Revenue Data Shows TCS’ Public Sector Surge and Market Shifts

TBR has been tracking performance of IT services companies for decades. As go-to-market strategies increasingly focus on industry-centric solutions, TBR determined to build trailing 12-month revenue based on a standardized breakout of key industry verticals.

In 2018 we expanded our IT services coverage to include estimates for seven industry vertical splits (full list below), leading to the recent launch of the IT Services Industry Vertical Data Excel file. This extensive data file includes revenue estimates for 17 IT services companies, including Accenture, Capgemini, DXC Technology, IBM and Tech Mahindra (full list below). Quarterly estimates, year-to-year growth, and percentage of IT services totals date back to 1Q21.

This proprietary data stream, in conjunction with our qualitative analysis of these firms, including their partners and how they operate, offers unprecedented intelligence on which companies are growing or maintaining their revenue or experiencing declines within industry verticals and allows for partner adjustments and competitive maneuvering.

TBR’s vertical-specific IT services data reveals notable industry trends

In the most recently published data file, several key insights stand out, including highlights from TBR’s research on Tata Consultancy Services (TCS), Capgemini and Wipro.

Most notable: TCS’ public sector success in India

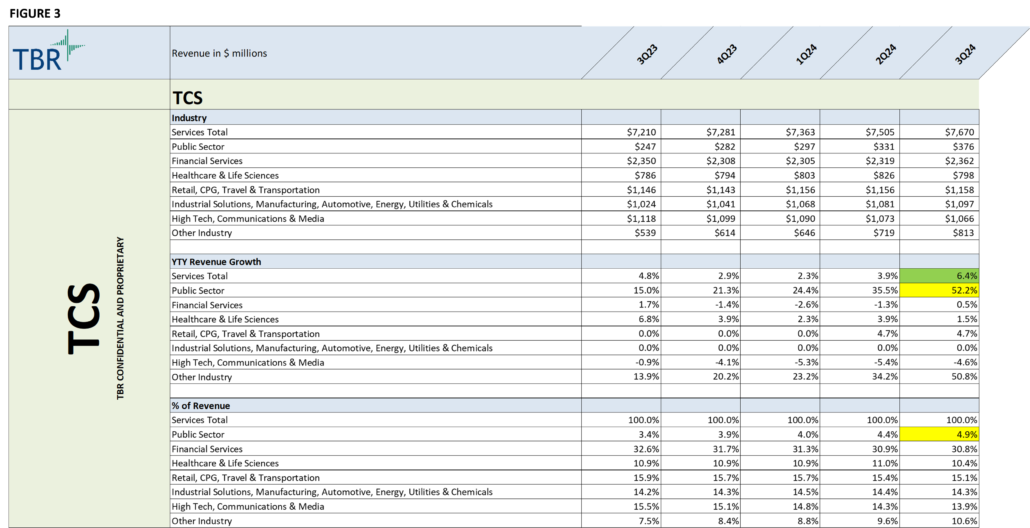

Tata Consultancy Services’ (TCS) public sector revenues jumped 52.2% year-to-year in 3Q24, extending — and accelerating — five straight quarters of double-digit growth. Curiously, however, TBR’s data shows a deviation from the norm in geo data. Reported India revenues by TCS (as a percentage of revenue) have been growing at a mid-double-digit range for over a year. In fact, reported revenue has grown so rapidly that India generated more revenue for TCS than the rest of the Asia Pacific region combined for the first time in 3Q24, and that gap expanded in 4Q24.

While it is unquestionably an impressive growth story, public sector revenue accounts for less than 5% of TCS’ overall IT services revenue, making it strong growth from a relatively small base. Still, 52.2% is impressive relative to the market, and analysis in TBR’s quarterly reports on TCS can help us understand this success. In short: It’s India.

- “India was again a bright spot for TCS, nearly doubling its revenue composition from the previous year, now accounting for 8.9% of total TCS revenue. We attribute the growth in India to strong brand reputation and favorable government policies to incentivize companies to digitize their IT operations.” — TBR’s 3Q24 Tata Consultancy Services report

- “Although India has historically only accounted for 5% to 6% of TCS’ total revenue, we anticipate this share will rise over the next few years, reaching double-digit figures before peaking and stabilizing. IT spending in India continues to increase, indicating there is plenty of opportunity, particularly for locally based IT services firms such as TCS. For example, during 2Q24 TCS and Indian state-owned telco Bharat Sanchar Nigam Limited announced plans to build four data centers across India to meet rising demand.” — TBR’s 2Q24 Tata Consultancy Services report

According to TBR’s lead analyst on TCS, Senior Analyst Kevin Collupy, “They are killing it with local Indian enterprises and government organizations. And last year we reported on an uptick in consultancies and IT services companies investing in their India-for-India capabilities, offerings and scale. So, 52.2% growth in public sector, even as TCS itself only grew 6.4%, tracks with the overall India growth story while illustrating just how well TCS has been doing.”

Additional insights from 3Q24 data

Capgemini’s revenue declined 1% year-to-year in U.S. dollars (USD) in 3Q24, but the company’s public sector revenue increased by more than 4% in the same period. At 15.1% of the company’s total IT services revenue, public sector revenue significantly buoyed what would have been an even rougher quarter. Retail, CPG, Travel & Transportation declined 4% year-to-year in USD in 3Q24 and accounted for 15.1% of Capgemini’s IT services.

Wipro’s 19.1% drop in public sector revenue in 3Q24 looks terrible, particularly in the context of an overall IT services decline of just over 2%. The vertical did not pull down Wipro as a whole though, as it represents just 0.5% of total revenue. The real culprits were Financial Services (down 1.3%, while accounting for 33.9% of revenue) and High Tech, Communications & Media (down 8.1%, at 15.4% of revenue).

Access all IT services vertical-specific data

While a single quarter is only a snapshot of the market narrative, the numbers in TBR’s vertical-specific IT services data starts to paint the picture while company reports fill out the story. An updated IT Services Industry Vertical Data Excel file will be released quarterly in TBR’s digital platform, Insight Center™.

If you are a current TBR user with access to the IT Services Vendor Benchmark, you can download the IT Services Industry Vertical Data Excel file today. If you’re interested in gaining access to the data, as well as TBR’s entire IT services research stream, start your free trial to Insight Center™.

Vendors covered in TBR’s IT Services Vendor Benchmark Data:

- Accenture

- Atos

- Capgemini

- CGI

- Cisco Customer Experience

- Cognizant

- DXC Technology

- Fujitsu

- HCLTech

- Hewlett Packard Enterprise Services

- IBM

- Infosys

- Kyndryl

- Tata Consultancy Services

- Tech Mahindra

- T-Systems

- Wipro IT Services

Industry coverage in TBR’s IT Services Vendor Benchmark Data:

- Financial Services

- Healthcare & Life Sciences

- High Tech, Communications & Media

- Industrial Solutions, Manufacturing, Automotive, Energy, Utilities & Chemicals

- Other Industry

- Public Sector

- Retail, Consumer Packaged Goods (CPG), Travel & Transportation

ispyfriend, Getty Images Signature

ispyfriend, Getty Images Signature Alphaspirit, Getty Images Signature via Canva Pro

Alphaspirit, Getty Images Signature via Canva Pro Vertigo3D, Getty Images

Vertigo3D, Getty Images