GenAI-related Workload Opportunities Compel NTT DATA to Deepen Ecosystem Relationships

NTT DATA turns to partners to unlock new revenue opportunities

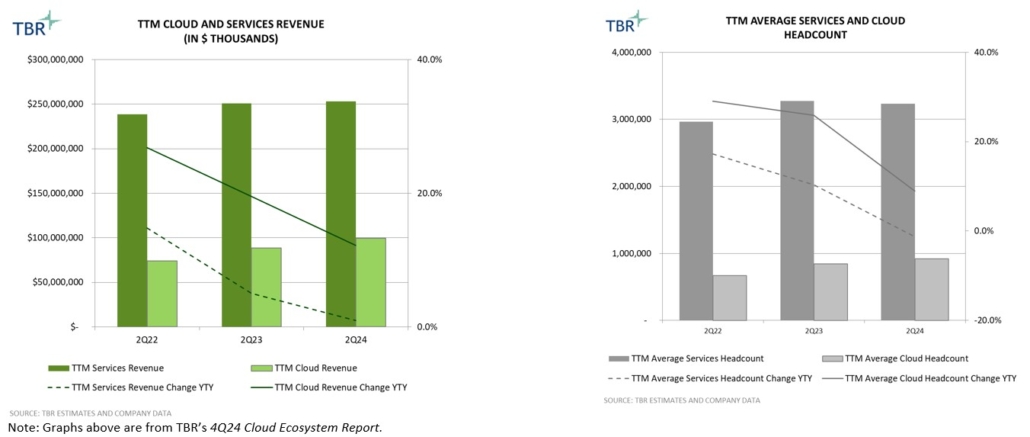

According to TBR’s 4Q24 Cloud Ecosystem Report, “Despite the recent slowdown in overall IT services revenue growth, global SIs (GSIs) remain committed to building out their hyperscaler practices as they try to maintain ecosystem stickiness and ensure they are ready when demand rebounds. GenAI [generative AI] continues to influence both services vendors’ and their hyperscaler partners’ go-to-market strategies with new implications centered on security and data privacy.

This is a natural market evolution as, following the hype and opportunities to experiment with large language model (LLM)-based tools in the past 24 months, enterprises are turning to proprietary data to scale GenAI deployments. This is resulting in the advent of small language models (SLMs), which are the new battleground for partners to prove value. Absent accounting for implications around data and AI security, these relationships will likely face challenges, especially as slower macroeconomic conditions have placed greater emphasis on vendors to ensure service quality. And delivering quality services begins with access to enterprise data.”

A year after completing the integration of various parts of NTT operations and the formation of NTT DATA Group Corp., NTT DATA continues to calibrate its portfolio and skills to protect its No. 2 position in terms of global revenue size among peers within TBR’s IT Services Benchmark. As TBR discussed in the 2Q24 NTT DATA report, the company’s alliance relationships have played an increasing role in these efforts. “Customer demand for cloud migrations remains strong, which presents opportunities for trusted service providers. NTT DATA is building up its alliance network and its internal capabilities around cloud platforms such as Amazon Web Services (AWS), Microsoft Azure and Google Cloud to address demand. By offering complementary services that seamlessly support client transitions to these hyperscaler platforms, NTT DATA is positioning itself to become a critical partner in cloud adoption journeys.”

NTT DATA understands the value of ecosystems

In November 2024 NTT DATA made two strategic announcements highlighting its efforts to strengthen trust and expand addressable market opportunities through its relationship with Google Cloud. First, the two deepened their relationship, forming the NTT DATA Google Cloud Business Unit centered on coinnovation and development of data and AI-ready industry solutions. Second, NTT DATA announced the acquisition — which has since closed — of India-headquartered Niveus Solutions.

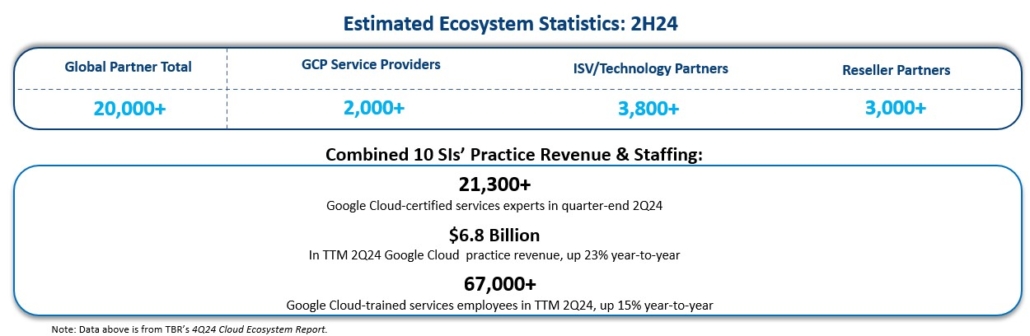

The purchase adds over 1,000 cloud engineers with skills in Google Cloud Platform (GCP) including GCP-native modernization, data engineering and AI. Following the purchase of Niveus Solutions, NTT DATA’s GCP-certified headcount now sits at approximately 3,600 professionals. According to TBR’s estimates in the 4Q24 Cloud Ecosystem Report, this is higher than the GCP-skilled headcount at Atos, Capgemini, DXC Technology, IBM, Infosys and Wipro. We estimate NTT DATA’s GCP-related revenue to be north of $400 million, or about 12% of its total cloud revenue, with the bulk of the remaining revenue share generated by the company’s relationships with Microsoft and SAP.

Why Google?

As TBR wrote in the 4Q24 TBR Cloud Ecosystem Report, “In many ways Google Cloud is staying the course with its partner strategy, focusing on scaling existing programs and incentives to help partners close larger deals more quickly. As part of its vision to foster the most ‘open AI ecosystem,’ Google Cloud has recently put a lot of focus on partner breadth and onboarding new partners that can help Google Cloud appeal to new audiences.

One example is with developers, and while there are over 1 million developers using GenAI tools, such as Vertex AI on GCP, Google Cloud aims to follow in AWS’ footsteps, boosting developer mindshare and delivering more seamless experiences. As such, Google Cloud has been delivering integrations with platforms like GitHub, which in 4Q24 announced support for Google’s latest Gemini models.

The other big priority for Google Cloud is around Marketplace. Though we often put AWS in a category of its own when it comes to marketplaces, with essentially all AWS’ top 1,000 customers having at least one active subscription, it is clear these platforms are where customers are buying their cloud software. As such, Google Cloud has been scaling the Marketplace with Private Offers, allowing resellers to deliver ISV solutions on GCP, and Google Cloud continues to cite momentum from partners co-selling Marketplace solutions alongside GCP. That said, it is clear Google Cloud wants its partners to continue to move away from traditional resell, toward value-added services, and Google Cloud maintains its commitment to driving 100% partner attach on all services deals.”

Pivoting from a two-dimensional foundation to a multiparty ecosystem play will test NTT DATA’s ability to manage trust

NTT DATA understands the need to pivot toward outcome-based services sales. Although it is easier said than done, the company has an opportunity to deliver value to clients provided it relies more on its alliance partners and continues to stick to its core expertise. Additionally, it will be essential for NTT DATA to invest in a partner framework that helps it address the following questions, which TBR outlined in the special report, Top Predictions for Ecosystems & Alliances:

- Can your alliance partners tell your clients what makes you special?

- Do your alliance partners’ sales teams know what value you bring to the ecosystem?

- Are you sure you placed your strategic ecosystem bets on alliance partners that are well positioned for the next growth wave?

- Are your competitors gaining ground with your common alliance partners through sales programs, go-to-market motions and training that you are not doing?

According to our Ecosystem Intelligence research, no single vendor has mastered the answers to all of these questions. NTT DATA is not new to managing alliance partnerships, as evidenced by its long-standing relationships with Microsoft and SAP. For example, the company touts $2.5-plus billion worth of SAP services business backed by more than 22,000 SAP-trained professionals. As outlined in TBR’s October 2024 SAP, Oracle and Workday Ecosystem Report, the size of its SAP practice places NTT DATA in a close race with EY and Tata Consultancy Services and above Capgemini, Cognizant, DXC Technology, Infosys and PwC.

Moving forward, NTT DATA’s success will also depend on the company’s ability to use a multiparty ecosystem lens and bring parties together. We believe an element of NTT DATA’s success with SAP is its ability to take a three-way approach with Microsoft and SAP to drive more targeted conversations. NTT DATA’s opportunity around Google Cloud will require a similar blueprint. Given Google Cloud’s push in data, AI and security, NTT DATA needs to think strategically about how to bring the likes of ISVs to the table that can help fill in that gap.

Alphaspirit, Getty Images Signature via Canva Pro

Alphaspirit, Getty Images Signature via Canva Pro Tadamichi, Getty Images Signature

Tadamichi, Getty Images Signature ispyfriend, Getty Images Signature

ispyfriend, Getty Images Signature