GenAI Use Cases: Where Enterprises Are Investing Now and What’s Next for Multimodal AI

Generative AI (GenAI) clients are looking for offerings that complement existing technologies and use cases built around customer zero and that deliver fast ROI. In this blog, we highlight some of the GenAI use cases currently seen in the professional and IT services, cloud, IT infrastructure, and telecom industries. To learn more about TBR’s AI and GenAI analysis and data, start your TBR Insight Center™ free trial today!

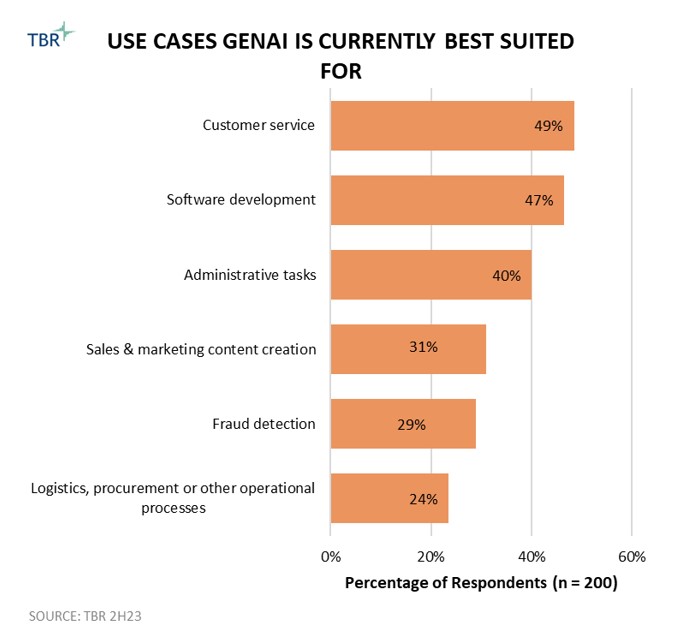

Perhaps no two questions have bedeviled the business side of the GenAI space more than which use cases are resonating with clients and where TBR and others expect to see near-term adoption and growth.

According to TBR’s research, use cases that provide a quick ROI with minimal enterprisewide disruption and no significant increase in risk profile get funded now; use cases with demands on data, dependencies on external data and/or long horizons to ROI remain the subjects of innovation sessions, proofs of concepts and road maps.

As Multimodal AI Extends GenAI’s Promise, Buyers Still Seek Immediately Effective Use Cases

Different from traditional large language models (LLMs), multimodal AI can process and interpret several types of data inputs, including text, images and sounds, at the same time. This versatility makes multimodal models critical for expanding the viable use cases for GenAI, specifically to support the creation of marketing content.

According to TBR’s latest research, multimodal AI is currently a top five use case for GenAI. Cloud service providers and foundation model vendors alike have made efforts to internally develop multimodal models or form collaborations to harness GenAI’s data interpretation capabilities. TBR believes cloud service providers and foundation model vendors will drive innovation of multimodal models to improve data interpretation and insights across all business segments.

GenAI Use Cases Across Industries

Professional and IT Services GenAI Use Cases

- In February 2024 Cisco launched Motific, a SaaS solution that enables adoption and application of GenAI in support of clients’ needs around data, security, AI and overall cost reduction. Through Motific, Cisco speeds up GenAI deployment while using automated controls to reduce the risks associated with the technologies. Leaning on its security prowess, Cisco applies its risk management tools, sensitive data capabilities and monitoring services to protect clients’ environments.

- Hewlett Packard Enterprise (HPE) introduced HPE GreenLake for LLMs, a cloud service that provisions AI-optimized high-performance computing resources designed for dedicated single-workload utilization, setting itself apart from public cloud resources that share infrastructure and run multiple workloads.

- Through its partnership with ServiceNow, EY looks to apply GenAI to risk management and governance. In June 2024 EY adopted ServiceNow’s Assist GenAI capabilities to facilitate its internal operations as well as drive innovation in AI risk and regulatory compliance needs.

- Some ongoing Leidos AI initiatives include helping the Department of Defense make training and other materials more easily accessible and improving the efficiency of new software testing using digital twinning solutions. GenAI also increasingly features in Leidos’ digital transformation work, as the company utilizes the technology to expedite the mapping of legacy IT infrastructures, which in turn accelerates downstream systems modernization. Leidos has also developed AI-based natural language solutions enabling military operators to interact more easily with autonomous drones deployed in contested environments.

- Infosys launched the Responsible AI suite, which includes accelerators across three main areas: Scan (identifying AI risk), Shield (building technical guardrails) and Steer (providing AI governance consulting). These capabilities will help Infosys strengthen ecosystem trust via the Responsible AI Coalition as well as foundation models and emerging startups. These models and startups are increasingly important among clients, many of which are reaching a point of fatigue and confusion amid a slew of GenAI-related announcements.

Cloud GenAI Use Cases

- Staying true to its history of releasing nascent services to the market and building them up into more feature-rich offerings over time, Amazon Web Services (AWS) recently launched new capabilities for Bedrock. For example, Custom Model Import allows customers to automatically pull entire Bedrock models they have already customized, likely with SageMaker, into the Bedrock interface. This allows customers to access their own custom model through the Bedrock API interface like they would with any other model from third parties, such as Anthropic and Cohere. The feature, in addition to other built-in tools native to Bedrock, reaffirms AWS’ commitment to making the service the best place to not only access out-of-the-box models but also customize them and develop applications that will ultimately spin the IaaS meter on AWS infrastructure.

- Google Cloud is putting Gemini to work, embedding the LLM into core Google Cloud Platform (GCP) products, from BigQuery for analytics use cases like data preparation and query recommendation to Looker for conversational analytics and automated BI. With these features and capabilities, Gemini is now at the heart of Google Cloud’s portfolio and replaces the existing Duet AI tool, which Google Cloud touted as its “always-on AI collaborator” in both GCP and Workspace just a few months ago. Google Cloud’s rapid transition from Duet AI to Gemini speaks to how quickly the GenAI space is evolving, as new vendors enter the market with out-of-the-box LLMs and incumbents expand context windows to make models more powerful and capable of handling more complex tasks.

IT Infrastructure GenAI Use Cases

- Dell Technologies and Supermicro have seen rapid growth with their 8-GPU servers certified on NVIDIA’s HGX platform and continue to add new liquid cooling options, networking choices and accelerator variants. In recognizing the opportunity in this market segment, Lenovo recently announced its first competing server.

- HPE’s AI server strategy primarily revolves around its Cray supercomputers and delivering solutions through its flagship HPE GreenLake platform, although the company has also rolled out a smaller validated server stack with NVIDIA.

- IBM is incorporating AI into its mainframe business through its Telum processor and close integrations with the watsonx platform.

Telecom GenAI Use Cases

The telecom industry is contemplating hundreds of use cases for GenAI, including those that are an evolution of traditional AI, such as chatbots.

Customer care:

- Chatbots (intelligent versus static) to handle higher-level customer issues

- Bill explainer

- Dynamic, contextualized prompts for care agents

- Foreign language support

- Truck route optimization

Administrative functions:

- Meeting transcription — notes/summarization

- Legal document creation

- Corporate document querying

IT:

- Code development

- Advanced threat detection and autonomous rectification

Sales:

- First pass at creating proposals

- Dynamic, contextualized prompts for salespeople

- Offer customization and personalization

Marketing:

- First pass at creating marketing materials

Network:

- Code development

- Performance monitoring

- Advanced alarm management

Technology Business Research, Inc.

Technology Business Research, Inc. Technology Business Research, Inc.

Technology Business Research, Inc.