What to Expect: Cloud Provider Market Share Through 2027

Hyperscalers, Traditional Software Players and Consulting Firms Drive Hybrid Multicloud Adoption Amid Shifting Market Priorities

Cloud Providers’ Market Share Projections

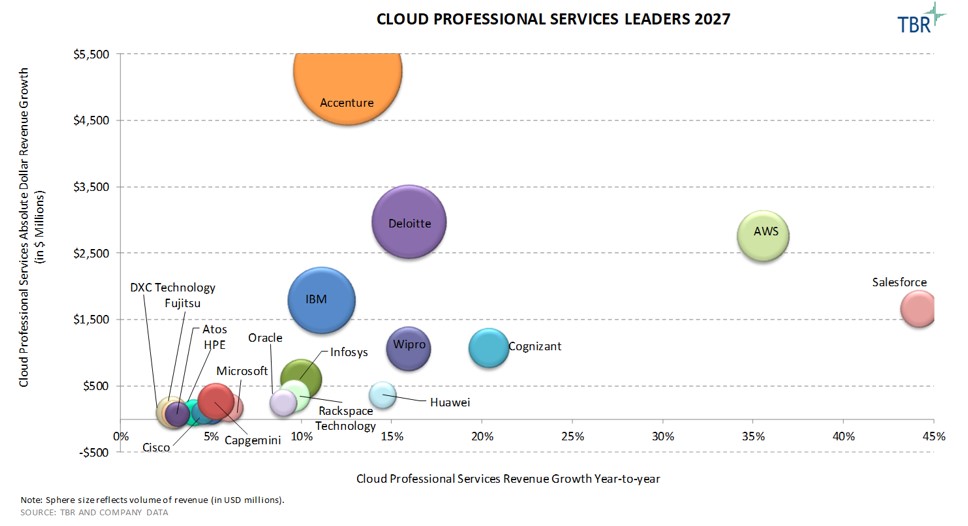

Over the next five years, TBR expects to see incremental strengthening of the professional services capabilities of hyperscalers, including Amazon Web Services (AWS), Microsoft and Google Cloud, as well as traditional software players, such as Oracle and SAP. However, professional services companies such as Deloitte and Accenture, along with India-centric players, have demonstrated their ability to scale vast talent benches to serve clients and act as go-to partners for the biggest cloud vendors.

Cloud Segment Forecast

Modern IT environments are increasingly relying on hybrid multicloud technologies and cloud-native applications to manage data streams, expanding professional services vendors’ importance in the market. Automation continues to threaten aspects of some segments, such as infrastructure management, but new opportunities will arise with the continual development of emerging technologies.

Cloud Providers’ Geographic Focus

As the U.S. cloud market matures, price is becoming less of a determining factor in enterprise cloud migration decisions. In many cases, customers are willing to pay a premium to get the best business outcome. In line with Western European regulations and the increasing value governments are placing on data sovereignty, cloud vendors are adjusting their go-to-market strategies to lead with localized talent and providing managed services through dedicated cloud regions that offer additional security protocols.

Cloud Market Share Expectations Through 2027

Accenture Is Expected to Continue Its Cloud Dominance, Growing Its Leadership Position Over the Next 5 Years

Accenture’s acquisition strategy has been critical to bolstering the company’s headcount with skilled cloud talent and has helped enhance its cloud business groups and the Accenture Cloud First unit. Further, leveraging inorganic assets will allow Accenture to upsell and cross-sell its consulting and IT services offerings, stimulating revenue growth. For IBM, acquisition candidates primarily consist of companies that specialize in cloud and AI capabilities, as well as industry and niche consulting experts who can support the expansion of IBM Consulting with more software and technical services.

Professional service providers continually expand their cloud portfolios through solution development to target cloud opportunities. For example, Cisco invested in technologies to bolster Cisco Customer Experience’s ability to support the adoption of security, cloud, analytics and IoT solutions. India-centric vendors are investing in high-demand solutions and skill sets such as AI, security and engineering to innovate within their cloud portfolios, such as Wipro FullStride Cloud Services and Infosys Cobalt.

To access all available cloud data and analysis, start your free Insight Center™ trial today.

Kohlerphoto, Getty Images Signature via Canva Pro

Kohlerphoto, Getty Images Signature via Canva Pro

Technology Business Research, Inc.

Technology Business Research, Inc.