U.S. Wireless Market Outlook

Acquisitions, Convergence and Fixed Wireless Access Drive Revenue Growth in U.S. Wireless Market

U.S. operators are focused on advancing their convergence strategies to grow revenue and create a stickier ecosystem to reduce churn long-term. Operators are improving their ability to offer mobile and broadband service bundles by increasing the availability of their broadband services (including wireline and fixed wireless access [FWA] offerings) and focusing on acquisitions, such as Verizon’s pending purchase of Frontier Communications and T-Mobile’s proposed joint ventures to acquire Metronet and Lumos.

In this TBR Insights Live session, Senior Analyst Steve Vachon gives for an in-depth, exclusive review of TBR’s latest research in the U.S. mobile operator space. Steve discusses the financial and go-to-market performance of leading U.S. wireless operators as well as recent key developments impacting the U.S. market, such as convergence and FWA.

TBR’s U.S. mobile operator research stream details and compares the initiatives, strategies and performance of the largest U.S. operators, including AT&T, DISH Network, Optimum Mobile, Spectrum Mobile, T-Mobile, UScellular, Verizon and Xfinity Mobile.

In the above session on the U.S. wireless market outlook you’ll learn:

- The impact convergence is having on the market via initiatives around M&A and fiber expansion as well as increased competition among cable MVNOs

- How FWA services are disrupting the U.S. broadband market

- How U.S. operators are expanding the scope of their FWA strategies to maximize opportunity capture

- Insights into wireless capex trends in the U.S. and the next phase of 5G investments

Excerpt from U.S. Wireless Market Outlook: Acquisitions, Convergence and Fixed Wireless Access Drive Revenue Growth in U.S. Wireless Market

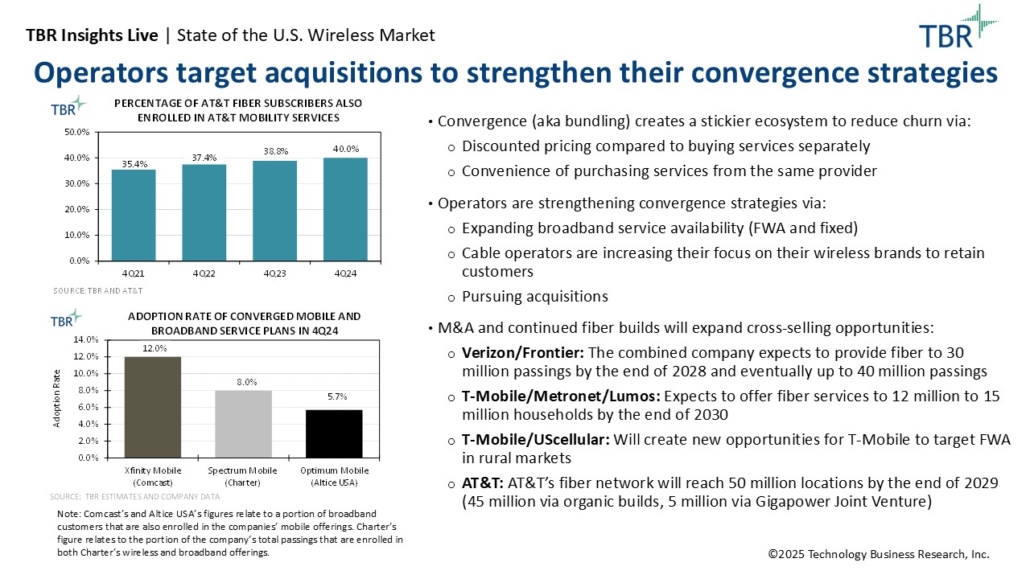

Operators target acquisitions to strengthen their convergence strategies

Convergence (aka bundling) creates a stickier ecosystem to reduce churn via:

- Discounted pricing compared to buying services separately

- Convenience of purchasing services from the same provider

Operators are strengthening convergence strategies via:

- Expanding broadband service availability (FWA and fixed)

- Cable operators are increasing their focus on their wireless brands to retain customers

- Pursuing acquisitions

M&A and continued fiber builds will expand cross-selling opportunities:

- Verizon/Frontier: The combined company expects to provide fiber to 30 million passings by the end of 2028 and eventually up to 40 million passings

- T-Mobile/Metronet/Lumos: Expects to offer fiber services to 12 million to 15 million households by the end of 2030

- T-Mobile/UScellular: Will create new opportunities for T-Mobile to target FWA in rural markets

- AT&T: AT&T’s fiber network will reach 50 million locations by the end of 2029 (45 million via organic builds, 5 million via Gigapower Joint Venture)

Visit this link to download this session’s presentation deck here.

TBR Insights Live sessions are held typically on Thursdays at 1 p.m. ET and include a 15-minute Q&A session following the main presentation. Previous sessions can be viewed anytime on TBR’s Webinar Portal.

Technology Business Research, Inc..

Technology Business Research, Inc..

Geopaul, Getty Signatures Image

Geopaul, Getty Signatures Image