Private Cellular Networks: Growth Drivers, Challenges and Opportunities Expected Through 2028

What Verticals Will Lead in Private Cellular Networks Adoption Through 2028?

Despite persistent ecosystem maturity challenges, the private cellular networks (PCN) market is growing as leading enterprises advance their Industry 4.0 strategies and governments aim to capitalize on defense and public safety use cases. TBR research indicates that the private 5G network market will see strong growth through this decade as a wide range of industries and governments adopt the technology, but a confluence of factors is slowing the pace of market development relative to the industry’s original expectations.

In this TBR Insights Live session Senior Analyst Michael Soper gives n in-depth look at TBR’s private cellular networks research. Each year TBR publishes a vendor benchmark, market forecast and market landscape on PCN, each covering a different aspect of the market. TBR’s private cellular networks analysis includes rankings of key PCN vendors by various revenue splits, the ecosystem for private LTE and private 5G networks, spend on private LTE- and 5G related infrastructure, and more.

In The Above FREE Webinar on Private Cellular Networks You’ll Learn:

- Key growth drivers and detractors expected in the PCN market through 2028

- Which verticals are leading and lagging in PCN adoption

- Which ecosystem players are positioned to capitalize on trends in the PCN market

Excerpt From Private Cellular Networks: Growth Drivers, Challenges and Opportunities Expected Through 2028

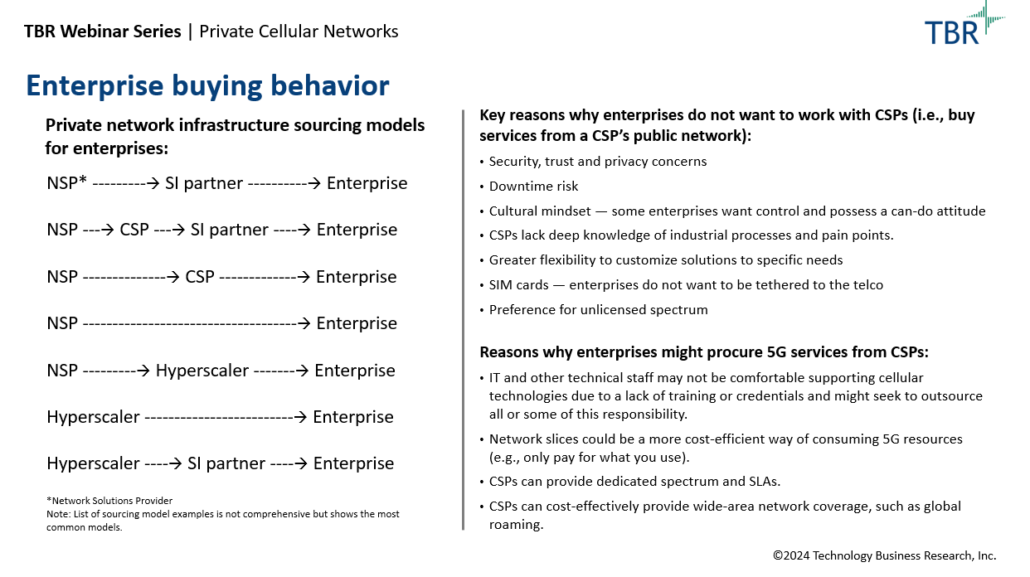

Enterprise buying behavior

Key reasons why enterprises do not want to work with CSPs (i.e., buy services from a CSP’s public network):

- Security, trust and privacy concerns

- Downtime risk

- Cultural mindset — some enterprises want control and possess a can-do attitude

- CSPs lack deep knowledge of industrial processes and pain points.

- Greater flexibility to customize solutions to specific needs

- SIM cards — enterprises do not want to be tethered to the telco

- Preference for unlicensed spectrum

Reasons why enterprises might procure 5G services from CSPs:

- IT and other technical staff may not be comfortable supporting cellular technologies due to a lack of training or credentials and might seek to outsource all or some of this responsibility.

- Network slices could be a more cost-efficient way of consuming 5G resources (e.g., only pay for what you use).

- CSPs can provide dedicated spectrum and SLAs.

- CSPs can cost-effectively provide wide-area network coverage, such as global roaming.

TBR Insights Live sessions are held typically on Thursdays at 1 p.m. ET and include a 15-minute Q&A session following the main presentation. Previous sessions can be viewed anytime on TBR’s Webinar Portal.

Technology Business Research, Inc.

Technology Business Research, Inc.

teekid, getty images via canva pro

teekid, getty images via canva pro LaymanZoom, Getty Images via Canva Pro

LaymanZoom, Getty Images via Canva Pro