Digital Transformation Outlook: Strategy Rebound, GenAI Impact and Ecosystems Importance in 2025

Strategy returns, pyramids crumble and everyone plays together nicer in the sandbox

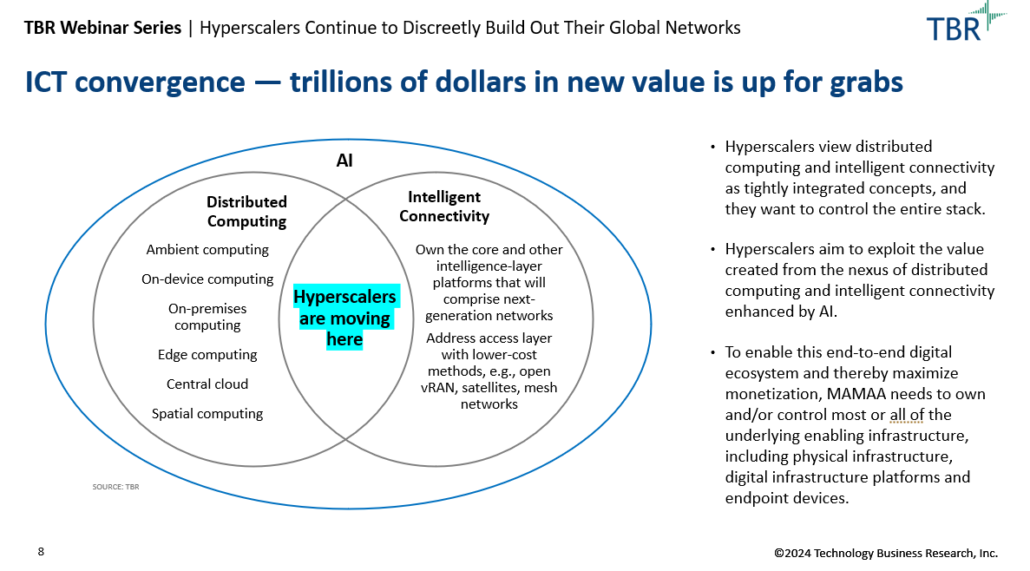

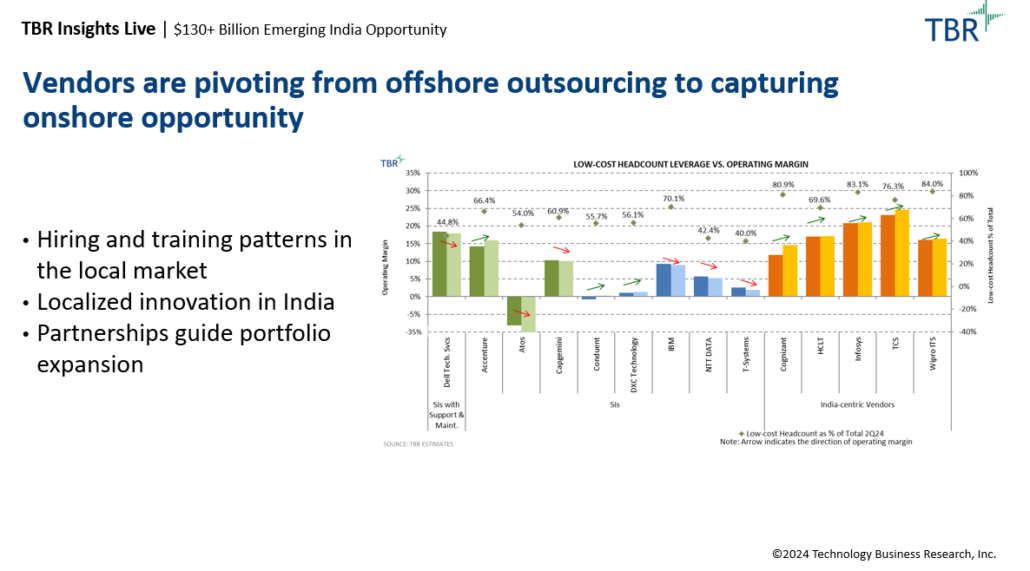

TBR expects monumental changes to the digital transformation landscape in 2025, from the resurgence of strategy consulting to generative AI (GenAI) adoption impacting everyone in the IT services and consulting ecosystem. Underpinning these changes will be leaders’ sharpened focus on how partners across the ecosystem go to market together, align sales teams and enhance knowledge sharing.

Join TBR’s Professional Services analyst team, Patrick M. Heffernan, Boz Hristov and Kelly Lesiczka, Thursday, Feb. 27, 2025, for an exclusive review of TBR’s 2025 Digital Transformation Predictions special report, Digital Transformation in 2025: From Optimization Fatigue to Business Model Reinvention. Don’t miss this opportunity to learn how the latest industry challenges will impact your company’s strategy in the coming year!

In this FREE session on the digital transformation outlook for 2025 you’ll learn:

- Why strategy consulting will rebound in 2025, and which consultancies will benefit

- Discussion of ERP consolidation (e.g., S4Hanna, Main frame modernization)

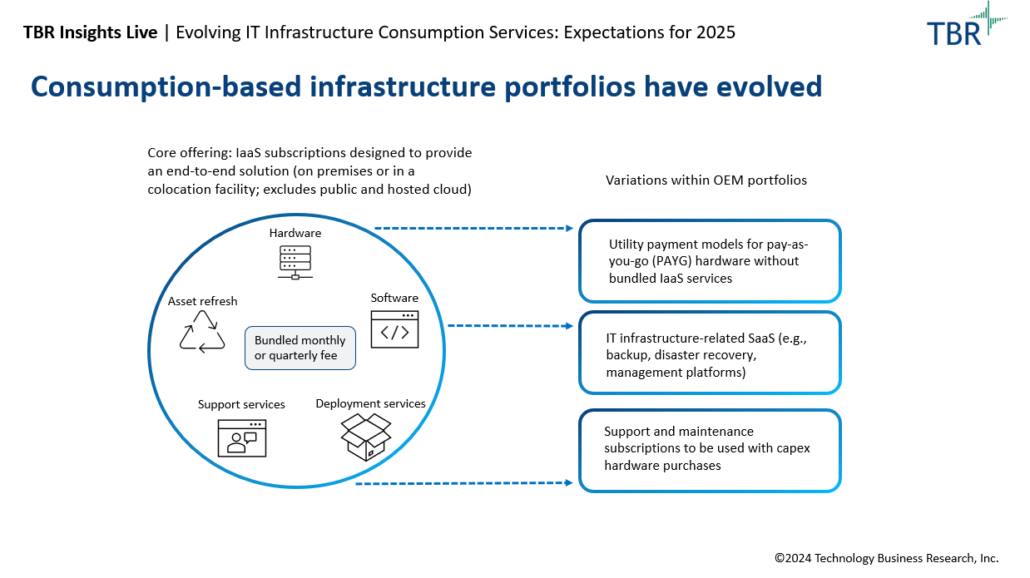

- Cloud migration services, custom apps development and workflow management

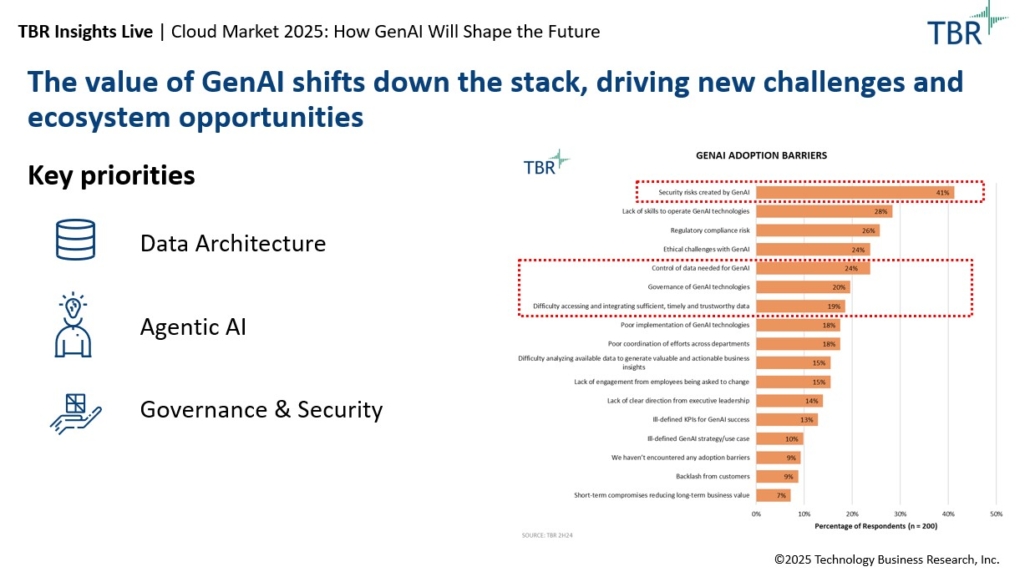

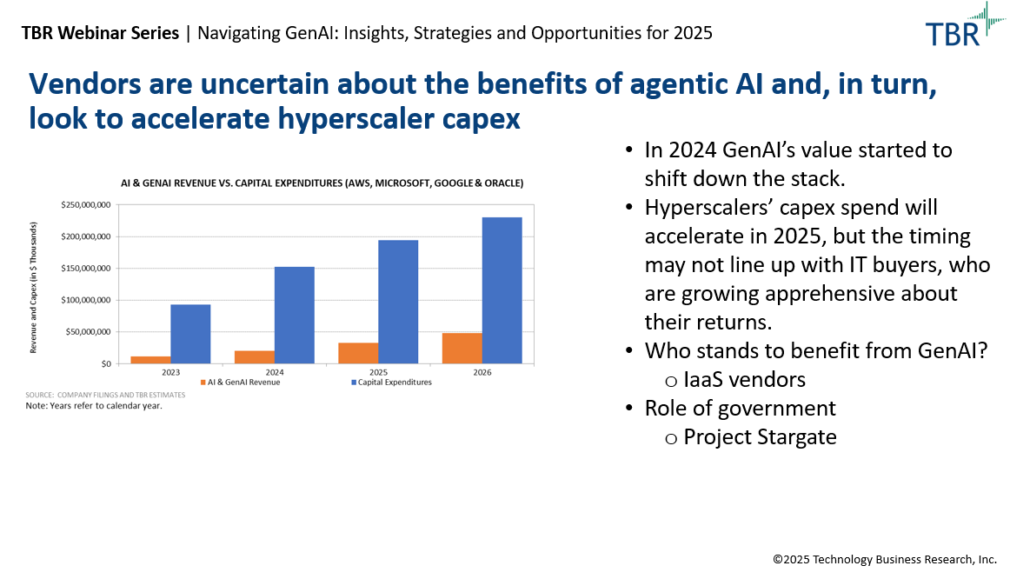

- How GenAI-enabled solutions will upend organizational structures and business models for IT services and consultancies, with follow-on effects for partners

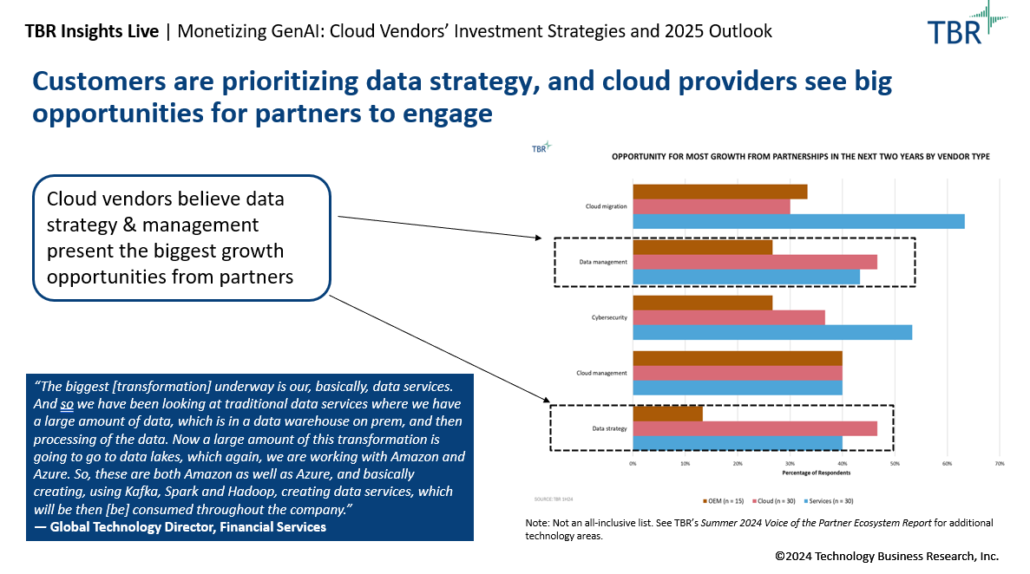

- How the emergence of ecosystem intelligence as a strategic priority will impact IT services companies, consultancies and technology alliance partners

TBR Insights Live sessions are held typically on Thursdays at 1 p.m. ET and include a 15-minute Q&A session following the main presentation. Previous sessions can be viewed anytime on TBR’s Webinar Portal.