U.S. Mobile Operator Benchmark

TBR Spotlight Reports represent an excerpt of TBR’s full subscription research. Full reports and the complete data sets that underpin benchmarks, market forecasts and ecosystem reports are available as part of TBR’s subscription service. Click here to receive all new Spotlight Reports in your inbox.

Most operators will sustain wireless service revenue and connection growth in 2025 but face headwinds from macroeconomic challenges and Trump administration immigration policies

Most benchmarked operators sustained service revenue growth in 4Q24, driven by connection growth and higher ARPA

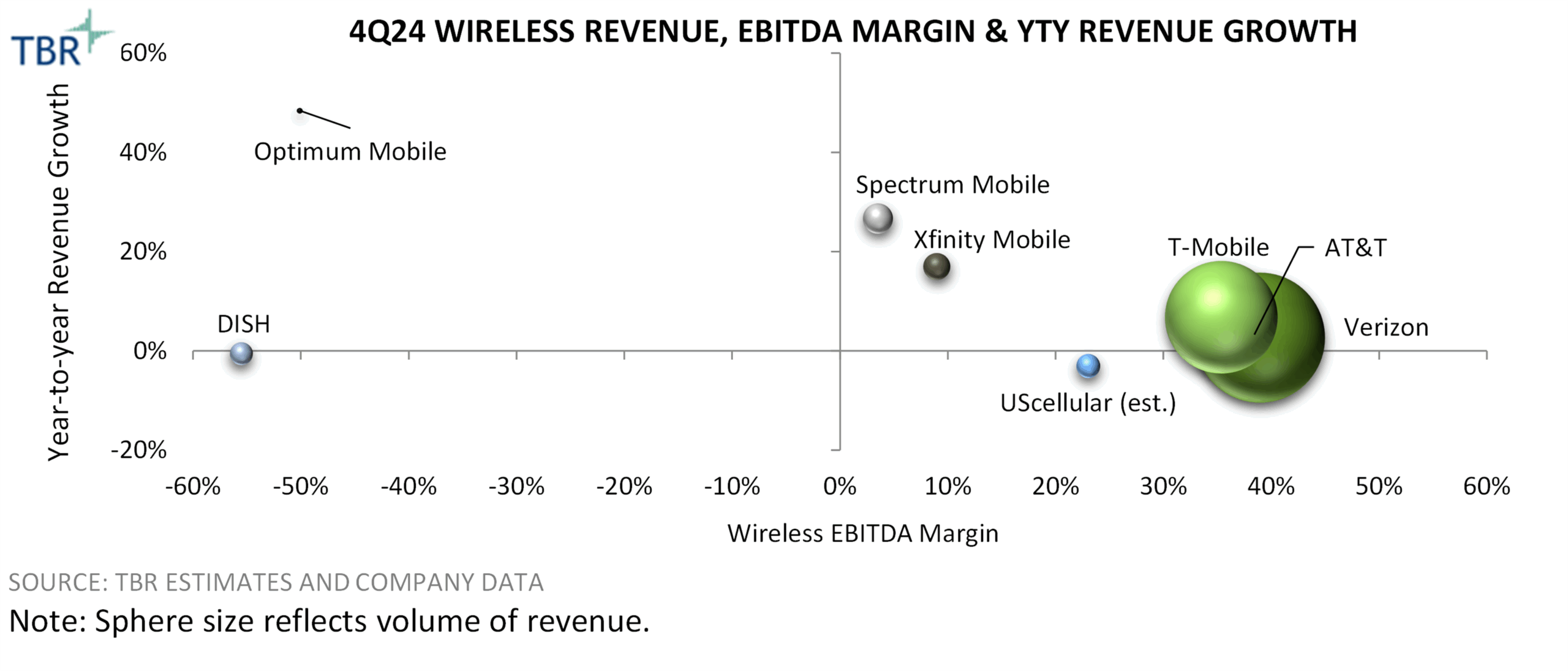

Total wireless revenue from benchmarked U.S. operators increased 4.5% year-to-year to $78.9 billion in 4Q24, mainly due to continued postpaid phone subscriber growth and higher average revenue per account (ARPA). Although the market is maturing, operators are maintaining postpaid phone net additions due to factors including population growth and more businesses purchasing mobile devices for employees. Higher ARPA is being driven by operators increasing connections per account, including from growing fixed wireless access (FWA) adoption, uptake of premium unlimited data plans and recent rate increases implemented over the past year.

Though most U.S. operators expect to continue to grow wireless service revenue and connections in 2025, they will face headwinds from factors including macroeconomic pressures (including layoffs within the private and public sectors and uncertainty around tariff impacts) and immigration policies under the Trump administration (including mass deportations).

U.S. operators increase focus on cross-selling mobile and broadband services

U.S. operators are focused on advancing their convergence strategies by offering plans bundling mobile and broadband services. The bundles create a stickier ecosystem to reduce churn long-term via the convenience of enrolling in broadband and mobility services from the same provider as well as by providing discounted pricing compared to purchasing those services separately.

Operators including AT&T, Charter, Comcast, T-Mobile and Verizon are growing their ability to offer these bundles via the expanding service availability of their broadband services (including wireline and FWA offerings). Operators are also targeting acquisitions to strengthen their convergence strategies, such as Verizon’s pending purchase of Frontier Communications and T-Mobile’s proposed joint ventures to acquire Metronet and Lumos. Cable operators also have significant opportunity to increase sales of converged services as a relatively low portion of cable broadband customers are enrolled in their service provider’s mobile offering.

AI is providing cost savings and revenue generation opportunities for U.S. operators

U.S. operators are focused on more deeply implementing AI technologies in areas including optimizing customer service and sales & marketing functions as well as enhancing network operations. For instance, deeper AI implementation will help AT&T reach its goal of generating $3 billion in run-rate cost savings between 2025 and 2027, while leveraging AI technologies will help T-Mobile meet its target of reducing the number of inbound customer care calls by 75%.

AI will also help operators optimize energy usage, especially as it pertains to network operations. Examples include using AI for optimal, dynamic traffic routing and to determine when to turn on and turn off radios to optimize energy usage. AI, especially providing network and real estate resources to support AI inferencing workloads, will create significant revenue opportunities for operators.

For instance, Verizon views telco AI delivery as having a $40 billion total addressable market, and the company has already secured a sales funnel of over $1 billion in business by leveraging its existing infrastructure and resources.

Operators are focused on cost-cutting initiatives, including streamlining headcount and more deeply implementing AI technologies, to improve margins

The impacts of inflation and challenging macroeconomic conditions, such as lower consumer discretionary spending, higher network operations and transportation expenses, and increased labor-related costs, are limiting profitability for U.S. operators. These challenges are leading operators to implement cost-cutting and restructuring initiatives to improve profitability, such as AT&T’s goal of generating $3 billion in savings from 2025 to the end of 2027 through its latest cost-cutting program.

Operators are streamlining headcount as part of their cost-cutting initiatives. For instance, about 4,800 employees are expected to leave Verizon by the end of March 2025 as part of the company’s latest voluntary separation program.

To increase cost savings and operational efficiencies, operators are more deeply implementing AI technologies in areas including customer service, field technician support and fleet vehicle fuel consumption.

T-Mobile is improving profitability, evidenced by its EBITDA margin growing by 220 basis points year-to-year to 35.4% in 4Q24, which was impacted by the company’s higher revenue and lower network costs aided by greater merger-related synergies. T-Mobile’s 2025 guidance for core adjusted EBITDA* is between $33.1 billion and $33.6 billion, compared to $31.8 billion in 2024. Service revenue growth as well as cost-cutting initiatives and merger-related synergies will all contribute to higher core adjusted EBITDA.

*Core adjusted EBITDA reflects T-Mobile’s adjusted EBITDA less device lease revenues.

T-Mobile continued to lead the U.S. in postpaid phone and broadband net additions in 4Q24 and recently launched new FWA pricing plans

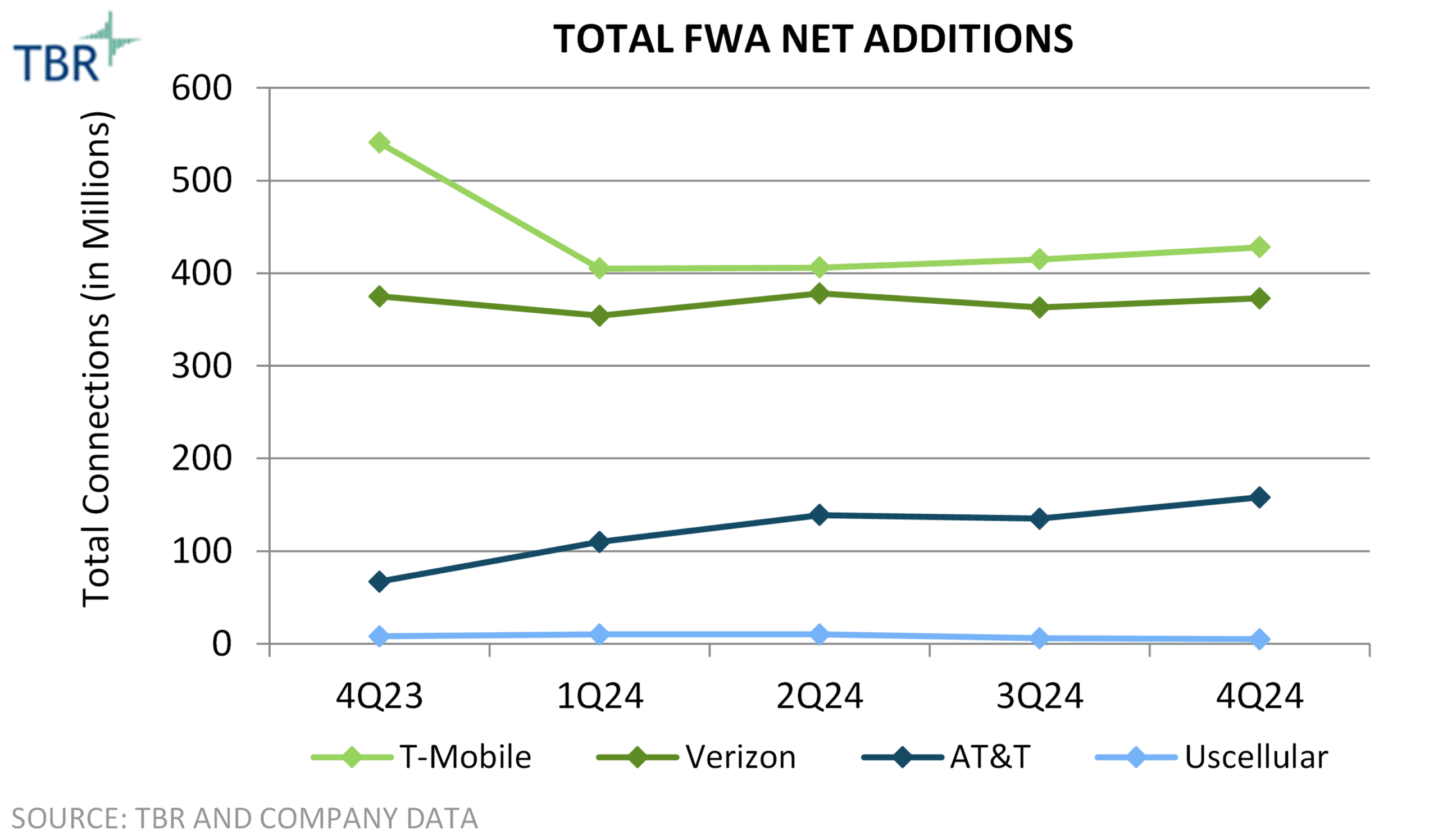

Operators are attracting FWA customers, mainly because FWA offerings have lower price points compared to other broadband services and are available to customers in markets with limited other high-speed broadband options, such as within rural markets. Though consumers account for the bulk of FWA connections, FWA is also gaining momentum among businesses seeking to reduce connectivity expenses and/or companies needing to quickly launch new branch locations, as the technology can be installed faster than fixed broadband.

In 4Q24 T-Mobile continued to lead the U.S. in broadband subscriber growth, driven by its FWA services, aided by the company continuing to gain market share against cable companies including Comcast and Charter, which reported steeper broadband customer losses in 4Q24 both year-to-year and sequentially. T-Mobile also reported its highest-ever year-to-year broadband ARPU growth in 4Q24, which was aided by the company revamping its 5G Home Internet and Small Business Internet plans in December.

Wireless capex moderated for most U.S. CSPs in 2024 as they are in the later stages of 5G rollouts

Verizon’s consolidated capex will increase to a guidance range of $17.5 billion to $18.5 billion in 2025, compared to $17.1 billion in 2024 (higher consolidated capex is mainly due to increased wireline capex to support Verizon’s accelerated Fios build). TBR estimates Verizon’s wireless capex in 2025 will be relatively consistent compared to 2024 as the company will focus on the continued expansion of C-Band 5G services into suburban and rural markets.

AT&T’s 2025 guidance for capital investment, which includes capex and cash paid for vendor financing, is in the $22 billion range, consistent with $22.1 billion in capital investment in 2024. Capital investment in 2025 will entail materially lower vendor financing payments compared to 2024, while capex is expected to increase year-to-year in 2025. TBR estimates AT&T’s wireless capex will be about $10.6 billion in 2025, which will help to meet AT&T’s goals, including providing midband 5G coverage to over 300 million POPs by the end of 2026 and completing the majority of its transition to open-RAN-compliant technologies by 2027.

T-Mobile’s capex guidance for 2025 is around $9.5 billion, compared to $8.8 billion in capex spent in 2024, with spending focused on continued 5G network deployments as well as investments in IT platforms to enhance efficiency and customer experience.

Technology Business Research, Inc.

Technology Business Research, Inc.

Technology Business Research, Inc.

Technology Business Research, Inc. Technology Business Research, Inc.

Technology Business Research, Inc.