IT Services Vendor Benchmark

TBR Spotlight Reports represent an excerpt of TBR’s full subscription research. Full reports and the complete data sets that underpin benchmarks, market forecasts and ecosystem reports are available as part of TBR’s subscription service. Click here to receive all new Spotlight Reports in your inbox.

Post updated: Nov. 15, 2025

A rebound in financial services and activities around improving productivity and optimizing costs drove revenue performance for IT services vendors during 2Q25

Outlook: TBR estimates trailing 12-month (TTM) revenue growth for the benchmarked IT services vendors will be 2.6% year-to-year in 2025, higher than 2024 revenue growth of 0.9% year-to-year. The market dynamics have not changed since 3Q23, when the uncertain macroeconomic environment began to pressure discretionary spending and consulting activities while fueling a wave of outsourcing demand around infrastructure and application modernization, productivity improvement and cost optimization. Clients are showing increased interest in large transformational offerings to increase productivity and reduce costs, and this trend is increasing the share of managed services deals in IT services providers’ signings mix. Manufacturing faces ongoing downward pressure in Europe, particularly in the automotive sector, but demand for supply chain optimization and digital transformation continues to fuel growth in the sector globally. Vendors are experiencing a rebound in demand from clients in the financial services sector such as banks seeking to improve customer experience (CX) through the use of agentic AI solutions. Although agency spending and headcount cuts by the Department of Government Efficiency (DOGE) negatively impacted the performance of some IT services providers in the U.S. public sector in 1H25, we expect new consulting opportunities to emerge in the long term around efficiency improvement, including systems enhancement, technology modernization and AI adoption. However, some vendors are warning that solicitations, award activity and adjudications have been slowing and that there will be some challenges in 2H25, and expect that consulting engagements will face increased scrutiny.

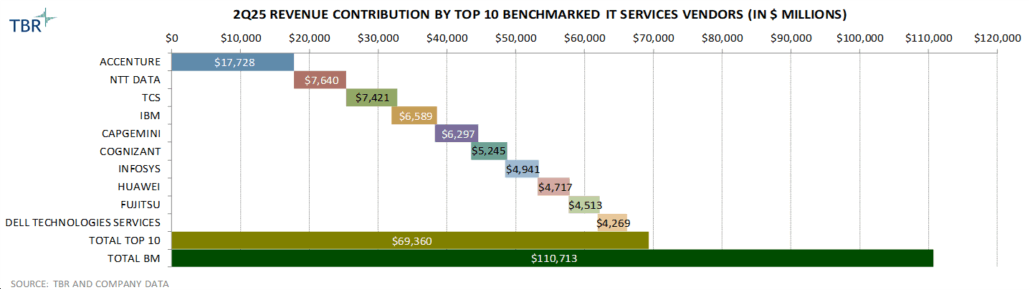

Key Vendors: Accenture remained the largest vendor in TBR’s IT Services Vendor Benchmark in terms of revenue and headcount and was No. 7 in TTM revenue growth in 2Q25. Accenture’s relentless execution will help the company maintain stakeholder trust as it enters the next phase of its business model rotation and pursues opportunities with upper-midmarket clients. NTT DATA was No. 2 in TTM revenue and No. 14 in TTM revenue growth in 2Q25. NTT’s recent purchase of the remaining shares of NTT DATA creates uncertainty around NTT DATA’s decentralized structure, which currently includes both domestic and overseas operations and enables NTT DATA to tailor service offerings to specific regional markets. Tata Consultancy Services (TCS), which was No. 3 in TTM revenue and No. 16 in TTM revenue growth in 2Q25, demonstrates a strong commitment to innovation through significant investment in research and development, which has incrementally created valuable intellectual property that supports the company’s cutting-edge platforms and solutions.

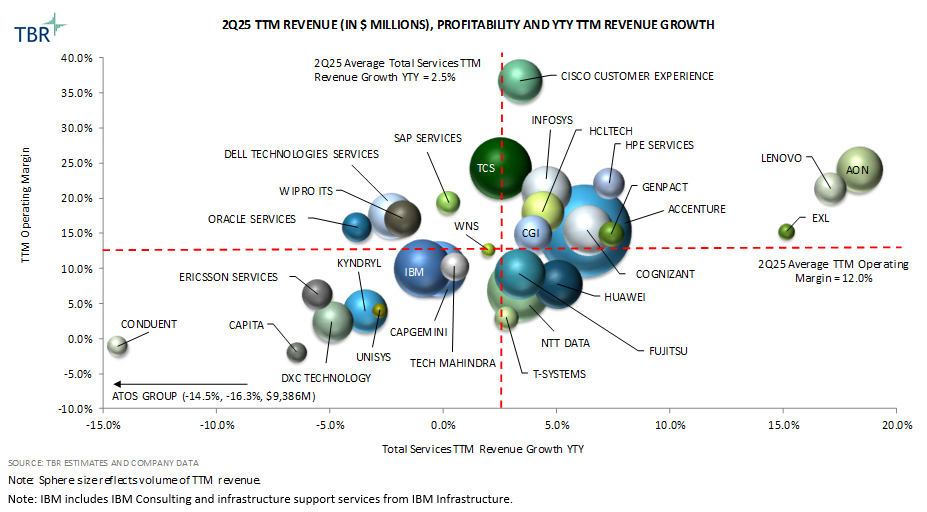

Market Overview: TTM IT services revenue grew 2.5% year-to-year in 2Q25, compared to year-to-year increases of 1.6% in 1Q25 and 0.9% in 2Q24. Accelerated momentum in financial services and activities around IT modernization and efficiency improvement enabled vendors to alleviate pressures from tight discretionary spending and extended buyer decision cycles. Vendors were able to stabilize profitability in 2Q25, with 20 of the 31 benchmarked vendors improving TTM operating margins year-to-year due to tight expense management, productivity initiatives and stable utilization, and increased use of automation, generative AI (GenAI) and agentic AI solutions.

Solutions enabled by technology partner capabilities increase IT services providers’ value proposition around addressing specific infrastructure, operational and business challenges

Quarterly focus: Alliances

TBR Assessment: According to TBR’s 2Q25 Cloud Ecosystem Report, “Enterprise buyers are becoming increasingly conflicted in their expectations of how vendors can best support their technology needs. … In a nutshell, vendors cannot rely on a one-size-fits-all AI ecosystem strategy across regions. Success will require region-specific approaches: IP-led initiatives in APAC, orchestration frameworks in Europe, and startup-centric marketplaces in the Americas. All must be underpinned by interoperable APIs and strong governance to help IT services providers capture and monetize local demand. Executing against such expectations while continuing to rely on a traditional labor-arbitrage model will test professional services firms’ readiness to transform their own operations while maintaining trust with hyperscalers, which continue to explore the opportunity to drive professional services revenue by simplifying the sales process and marketplace through the use of agentic AI.”

Examples of recent vendor activities

IBM is expanding activities with technology providers to augment its cloud and AI capabilities and support clients through all stages of transformation and optimization. Since April IBM has expanded its relationships with Microsoft, Amazon Web Services (AWS), Oracle, Salesforce and SAP. IBM Consulting established a Microsoft practice with 33,000 certified experts dedicated to technologies such as Azure OpenAI, Azure Cloud, Copilot, Fabric and Sentinel. IBM, which has approximately 12,000 AWS-trained professionals, introduced tools and frameworks for building and managing AI agents and integrating them with technologies available on the AWS Marketplace. IBM Consulting is providing AI Integration Services to help clients establish agentic AI capabilities and is offering the IBM Consulting Advantage solution to transform processes through agentic AI on AWS. IBM and Oracle provide agentic AI and hybrid cloud solutions by bringing IBM watsonx to Oracle Cloud Infrastructure. IBM, which has more than 10,000 dedicated Oracle consultants, is expanding its consulting services to enable the use of AI agents across platforms and transform business processes. IBM has more than 7,000 Salesforce-certified professionals and is developing its Salesforce capabilities by introducing AI agents based on IBM watsonx Orchestrate that work with Salesforce technologies and IBM Granite models. IBM has more than 18,000 SAP-certified consultants and, together with SAP, launched a hyperscaler option for moving SAP S/4HANA workloads from on-premises IBM Power servers to the cloud.

Although client trust wavered in the past several quarters due to uncertainty around Atos Group’s transformation, the company received stable support from its technology partners, which will drive portfolio expansion and position the company for growth. In July Atos Group was awarded the Golden Certificate from SAP and was certified for the 10th consecutive time as a SAP Global Operations Partner. The award reflects Atos Group’s dedication to its partnership with SAP, which has spanned more than 20 years, and established managed services capabilities with over 10,000 professionals with SAP expertise. Also in July, Atos Group renewed its status as a Google Cloud Managed Service Provider, driven by capabilities around providing cloud-native services, infrastructure solutions and digital modernization. In April Atos Group received Microsoft’s Private Cloud Solution Partner Designation due to its track record of providing Azure Cloud in data centers globally. Expanding capabilities around Google Cloud and Microsoft diversifies Atos Group’s infrastructure services capabilities and creates opportunities for growth outside of commoditized and low-growth traditional infrastructure services segments. Over the past several years the company has been decreasing its dependency on legacy infrastructure services and reviewing and exiting low-growth and low-margin contracts in the segment.ications strengthens Cognizant’s Neuro AI platform.

Although managed services activities contributed to an acceleration in 2Q25 overall TTM revenue growth year-to-year, 15 of the 31 benchmarked vendors ranked below the average

Trailing 12-month Revenue , Profitability and Year-to-year Trailing 12-month Revenue Growth for Benchmarked IT Services Vendors (Source: TBR)

Vendor spotlight excerpt

Accenture pursues new revenue growth opportunities with upper-midmarket clients, while TCS leverages its cloud and AI expertise and solutions to pull long-term managed services deals

Key Findings and TBR Assessment

Accenture, NTT DATA and TCS retained their No. 1, No. 2 and No. 3 revenue contribution positions, respectively, compared to 1Q25. Vendors will be challenged to maintain sales growth momentum in 2026 as Accenture navigates macroeconomic headwinds and internal operating model adjustments. Building a pipeline in the midmarket will gradually augment Accenture’s performance. TCS leverages its scale and cost-efficient global talent to offer flexible, competitive pricing, which will be a key advantage as clients scrutinize budgets during uncertain economic times.

IBM moved up from No. 5 to No. 4, Capgemini rose from No. 6 to No. 5, and Fujitsu dropped from No. 4 to No. 9. Although IBM Consulting’s revenue growth has been negatively impacted by clients’ extended decision making, the business continues to benefit from clients’ emphasis on cost-efficient, high-impact technology investments. Pursuing opportunities in the public sector in Europe, specifically in the defense subsegment and around sovereignty solutions, will positively affect Capgemini’s revenue expansion in 2H25.

Cognizant and Infosys each moved up by one position, to No. 6 and No. 7, respectively, compared to 1Q25. Cognizant is capturing opportunities in vendor consolidation, cost reduction and efficiency improvements, and is leveraging its AI expertise and Neuro AI platform to effectively win new projects with existing clients. Infosys is deploying industry-centric, cloud-ready, GenAI-enabled services and solutions within established IT buyer relationships while also relying on customer-zero use cases.

Revenue segment views excerpt

C&SI revenue growth year-to-year accelerated from 2Q24 to 2Q25, indicating clients are becoming more open to signing discretionary funded engagements

C&SI: Although discretionary spending remained tight, some of the IT services providers saw pockets of growth in C&SI in 2Q25, leading to an increase in C&SI revenue share and revenue growth year-to-year acceleration compared to 2Q24. Portfolio development, client relationship building and skills development to drive transformational engagements aided revenue performance in 2Q25. For example, Accenture is partnering with Deloitte and Korn Ferry to support Saudi Aramco’s employee experience transformation program using LearnVantage capabilities. Capgemini is working with GN Hearing to improve the company’s customer experience and order processing by implementing a Salesforce global order management system.

BPO: Vendors’ BPO businesses continue to benefit from the ongoing shift in buyer priorities from innovation and growth to business resiliency and optimization. Automation, GenAI and agentic AI capabilities within BPO will shift vendors’ service delivery models and generate productivity improvements; however, GenAI and agentic AI threaten the core value proposition centered on human-backed service delivery. IBM Consulting will combine AI Integration Services with capabilities from its partner ecosystem to enable clients to reengineer business processes, improve the user experience, and orchestrate systems comprising AI assistants, agents and data.

Application outsourcing (AO): Application outsourcing revenue growth accelerated year-to-year to 2Q24. Enterprise applications are core to broader digital transformation engagements and create expansion opportunities for vendors. Preparing clients’ applications and data streams for cloud and AI integration continues to fuel managed application services opportunities.

IT outsourcing (ITO): Integration of new infrastructure, enabled by vendors’ cloud and consulting practices, provides a natural starting point for companies to build their managed services pipeline. Demand for IT optimization and IT operations efficiency through AI and automation, and security services continues to fuel ITO revenue opportunities. For example, in July Atos Group renewed its status as a Google Cloud Managed Service Provider due to its capabilities around delivering cloud-native services, scalable infrastructure solutions and digital modernization to enterprises globally through advanced support, optimization and AI-driven management of Google Cloud environments.

Technology Business Research, Inc.

Technology Business Research, Inc.

Technology Business Research, Inc.

Technology Business Research, Inc.