2024-2029 Devices Market Forecast

TBR Spotlight Reports represent an excerpt of TBR’s full subscription research. Full reports and the complete data sets that underpin benchmarks, market forecasts and ecosystem reports are available as part of TBR’s subscription service. Click here to receive all new Spotlight Reports in your inbox.

Post Updated: Aug. 6, 2025

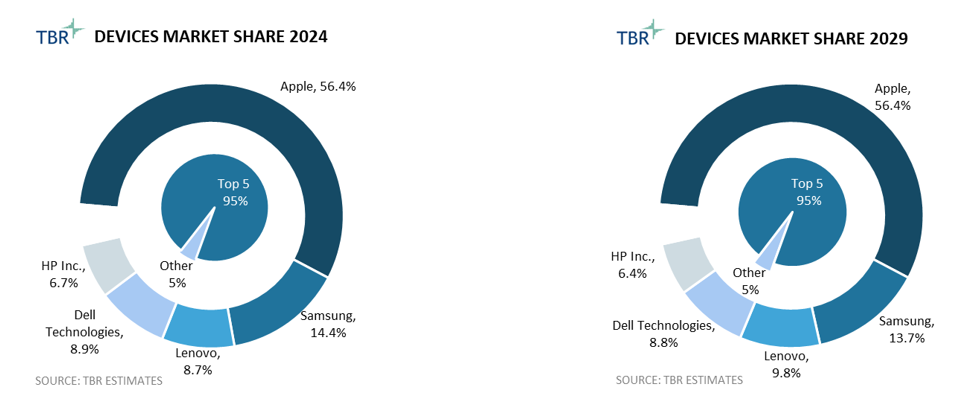

TBR predicts that Apple and Samsung will continue to lead in devices market share through 2029, and Lenovo will overtake Dell for the No. 3 spot

After declining for several quarters due to market saturation and tightened corporate IT budgets, PC demand is gradually recovering, particularly on the commercial side of the market as organizations begin to refresh their fleets of devices. TBR expects the devices market to grow at roughly a 2.7% CAGR from 2024 to 2029 as this recovery in PC demand is supplemented by growing smartphone and tablet revenue. TBR also expects demand for AI advisory and consultancy services will increase as organizations invest in implementing AI across IT infrastructure and client devices.

The proliferation of AI across the IT space presents devices vendors with a range of growth opportunities. PC OEMs will remain focused on driving AI PC adoption and gradually increasing these devices as a mix of total PC shipments to drive long-term revenue growth and average revenue per unit (ARPU) expansion. To help speed this adoption and increase services revenue, vendors will also continue to build out suites of services designed to help organizations take advantage of the productivity gains offered by AI PCs. TBR expects vendors to continue to increase their non-PC revenue mix, capitalizing on growth opportunities presented by AI and sheltering their top lines and margins from potential fluctuations in the PC market.

Apple continues to lead the devices market in revenue share by a significant margin due to its large, loyal and constantly expanding customer base, and TBR expects this position to remain unchanged through 2029. Among the major Windows PC OEMs, Dell Technologies (Dell) held the largest market share during 2024, followed by Lenovo and HP Inc. However, TBR expects Lenovo to overtake Dell for the top spot by 2029 as Lenovo takes advantage of PC revenue growth opportunities in China, bolstered by the expansion of its smartphone and tablet businesses.

TBR expects Apple will maintain its significant lead in the smartphone market through 2029, leveraging its Apple Intelligence platform to encourage customers to upgrade their devices

Apple remains the dominant player in the global smartphone market with its iPhone lineup, followed by Samsung, while Lenovo and Asus each maintain relatively small smartphone businesses that account for a combined total market share of less than 3%.

AI is becoming increasingly central to the smartphone space. Throughout the next several quarters, Apple will continue to expand the global availability and feature set of its Apple Intelligence AI platform. As Apple Intelligence is only compatible with the company’s newest lineup of smartphones, the iPhone 16 series, Apple intends to leverage the platform to encourage users to upgrade their devices sooner. So far, this strategy appears to be paying off, with Apple reporting on its 4Q24 earnings call that iPhone 16 sales were strongest in regions where Apple Intelligence is available.

Apple and Samsung will remain focused on driving sales of their high-end iPhone and Galaxy lineups, respectively, while Asus will continue to target the gaming market with devices under its Republic of Gamers (ROG) brand.

Premiumization is also central to Lenovo’s smartphone strategy, with the company focused on driving sales of phones under its Motorola brand, particularly the Moto Edge and the foldable Moto Razr. Additionally, Lenovo will leverage its purchase of former Fujitsu spinoff FCNT Ltd. to expand its smartphone market share in Japan.

Although China is a weak market for some vendors, TBR expects Lenovo to take advantage of AI PC opportunities in the country to expand APAC revenue

TBR expects the APAC devices market to grow at a 2.7% CAGR from 2024 to 2029 — a rate on par with the global devices market.

Over the last several quarters, vendors such as Apple and HP Inc. have reported China as being a particularly weak market for their devices businesses due to persistent softness in demand.

TBR expects that among the vendors included in this forecast, Lenovo will reap the greatest benefit from recovering PC demand in China due to its already large market share and its AI PC strategy in the country. In May 2024 Lenovo rolled out a lineup of devices in the country it dubbed its “five-feature” AI PCs, including a personal agent and local large language model (LLM). The company reported strong initial uptake of these devices during its 2Q24 and 3Q24 earnings calls, and TBR expects ongoing momentum in China will help drive Lenovo’s PC segment and top-line growth throughout the forecast period.

Technology Business Research, Inc.

Technology Business Research, Inc.

Technology Business Research, Inc.

Technology Business Research, Inc. Itjo, Getty Images

Itjo, Getty Images