Supply Chain Threatens the Rise of AI PC in 2026

AI PC Ambitions Face an Unforgiving Reality of Memory Constraints and Budget Pressure

For the PC industry, 2025 was the year that the end of Windows 10 support would drive a massive PC refresh cycle. As part of this refresh, AI PCs, devices with neural processing units (NPUs) designed to execute AI and machine learning tasks, were expected to rise in popularity as businesses prepared their workforce for a new era of AI-infused productivity. The PC refresh cycle of 2025 did materialize to some extent, with the market growing about 5.3% year-to-year according to TBR’s estimates, but sellers ran into a snag in the commercial PC market: Many buyers were unwilling to pay 10% to 20% more for an AI PC that could future-proof their PC fleet but offer minimal added value today. This sentiment has driven ecosystem players such as Intel and Microsoft to invest in making the AI PC more compelling to and affordable for the commercial PC market. The beginning of 2026 ushers in the latest generation of AI PC processors from Intel, AMD and Qualcomm that is poised to attract customers with performance, efficiency and security enhancements. In many ways, 2026 is a critical year for the success of the AI PC due to the significant investment in the platforms that have been years in the making.

When vendors made these long-term investments in next-generation AI PCs, no one knew that these new models would launch just as insatiable demand in the AI server market caused an unprecedented shortage of memory. The shortage, which in TBR’s opinion could easily last for two to three years, has already caused significant price hikes in the PC market — with more on the way — and will result in longer lead times and lower availability. As such, PC market leaders’ desire to usher in a new era of more expensive AI computing now sits in direct odds with unavoidable component price increases and tight customer budgets.

Pressure to refresh drove 2025 growth, with the intrinsic value of AI PCs yet to be defined

In 2025 AI PCs capable of meeting Microsoft’s Copilot+ requirements began to hit the market in earnest, following their initial debut in the summer of 2024. On paper, the timing looked favorable: A Windows 11 refresh cycle was underway, and AI PCs were positioned to ride that momentum and steadily grow share within the broader commercial PC market. In practice, however, the refresh materialized unevenly and ultimately fell short of expectations. Although the market experienced solid growth, expanding an estimated 5.3% year-to-year in 2025, multiple structural and behavioral hurdles slowed adoption of AI PCs, preventing vendors from translating technical readiness into meaningful volume growth.

Pricing pressures emerged as a central inhibitor. Tariffs complicated OEM pricing strategies, and the incremental cost of NPU-enabled processors introduced a noticeable price increase that many commercial buyers were unprepared to absorb. This sticker shock was exacerbated by the lack of a compelling near-term value proposition for AI PCs. Vendors leaned heavily on the concept of future-proofing device fleets, a message that resonated poorly with budget-constrained IT buyers prioritizing immediate, tangible ROI. At the same time, commercial purchasing behavior has yet to normalize post-COVID. Some organizations are still digesting inventory acquired during earlier buying surges while others have permanently shifted from predictable refresh cycles to more opportunistic, as-needed purchases.

In response, OEMs and key ecosystem partners — notably Microsoft, Intel and AMD — adjusted their go-to-market strategies to reduce friction and keep AI PCs moving into commercial environments. OEMs refined system configurations where possible to lower bill-of-materials costs without undermining Copilot+ eligibility. Silicon providers increased front-end discounting, rebates and comarketing investments to narrow the price gap between traditional PCs and AI-capable systems. Together, these efforts drove down pricing of AI PCs in the commercial space and helped some customers make the transition to NPU-enabled silicon during their device refreshes.

Ecosystem investments years in the making underpin the future success of AI PCs

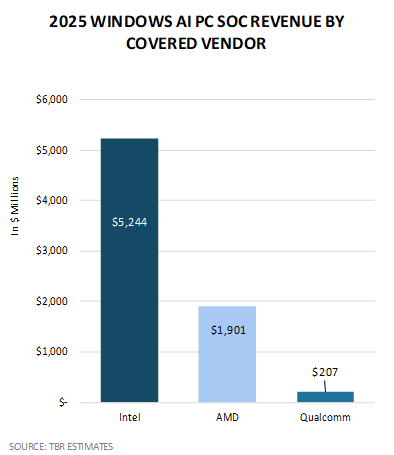

Despite increasing competition from AMD and Qualcomm, Intel remains the PC silicon market share leader due in large part to the robustness of the company’s partner and incentive programs. PC OEMs and the broader industry supplying PCs rely heavily on Intel to influence market direction and demand. Understanding that the AI PC market is somewhat nebulous due to ill-defined use cases, Intel has invested significantly to make its latest chips — Core Ultra Series 3 — a success, leaning into its heritage as an integrated device manufacturer and shifting manufacturing of the compute tile on the new system on a chip (SoC) in-house rather than outsourcing to Taiwan Semiconductor Manufacturing Co. as it did with the Core Ultra Series 2. Although the investment to bring 18A capacity online has been massive, in the long run Intel could benefit from a cost of sales perspective with the manufacturing based in the U.S. and improved yields as the process matures. In contrast, as fabless companies, AMD and Qualcomm rely solely on third-party manufacturing, which presents fewer risks but could prove more costly in the long run.

Silicon vendors’ investments in driving AI PC adoption have looked similar from company to company, with AMD, Intel and Qualcomm providing developer resources such as samples, guidance and reference applications to drive NPU-enabled application development. However, although AMD’s and Qualcomm’s resources are limited to software developer kits and other software stacks directly targeting the NPU, Intel’s play also leans into its reputation as a market maker with its AI PC Acceleration Program, incentivizing collaboration between ISVs and independent hardware vendors (IHVs) to create features that leverage the NPU. Additionally, with the engineering staff available through Intel Open Labs serving as a differentiator, Intel arguably provides more design resources, sales support and go-to-market funding than AMD and Qualcomm, echoing the company’s long-running strategy that has positioned it atop the Windows PC silicon market. Similar to what silicon vendors are providing, Microsoft has launched tools that will help ISVs refine their Windows-based apps to make the best use of CPU, GPU and NPU.

Qualcomm, more so than Intel and AMD, needs to prove itself in the commercial market and demonstrate not only that Arm can outperform x86 in commercial uses but also that the platform is a trustworthy investment. However, much of this weight falls on Microsoft’s shoulders as Windows on Arm is inherently its own initiative. Perhaps more important than its advances in performance in TOPS (trillions of operations per second), Qualcomm’s newly launched Snapdragon X2 Plus platform offers a competitive answer to Intel’s vPro platform with Snapdragon Guardian, which allows for advanced remote management and security features. However, Intel vPro’s Active Management Technology, which allows for out-of-band remote management, remains core to the company’s value proposition, is still unmatched by Qualcomm and AMD, and is a key reason noncloud-first organizations tend to choose Intel over its competition.

Massive scale AI infrastructure deployments are driving unprecedented fluctuations in memory costs, negatively impacting supply for the PC market

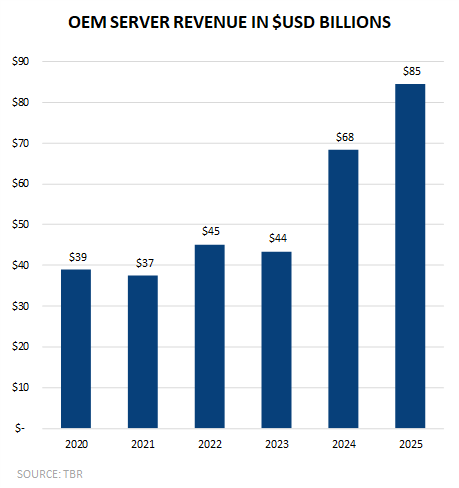

The PC market has weathered many component shortages that have had short-term impacts on product availability and pricing. In recent history, shortages have been caused by factors ranging from pandemic-induced buying changes and natural disasters to manufacturing industry consolidation and delays in next-generation technology rollouts. However, the current memory component shortage is unique due to its ties to structural AI demand versus a temporary shock to the market. Over the past two years, demand for AI infrastructure has shifted the slow-growing server market into hypergrowth, with TBR estimating that server spend nearly doubled from 2023 to 2025. Not only has the demand risen dramatically, but the AI server silicon, whether GPUs or AI ASICs, also requires significant amounts of high-bandwidth memory (HBM), unlike their traditional server counterparts.

As such, hyperscalers and neoclouds are absorbing a disproportionate share of DRAM and HBM as they scale AI training and inference infrastructure, and the same suppliers sell both HBM and conventional DRAM. As these memory suppliers prioritize higher-margin HBM, commodity DRAM output growth tightens as investments in new capacity are allocated more heavily toward supporting AI infrastructure rather than client devices.

This trend of elevated server demand combined with disproportionate consumption of high-performance memory will not abate anytime soon. OEMs’ total server order backlogs remain in the billions exiting 2025, and during AMD’s 4Q25 earnings call CEO Lisa Su reported the company expanded manufacturing capacity for server CPUs, confirming that component suppliers continue to shift their manufacturing lines in favor of servers rather than PCs.

As a result, PC DRAM supply has not grown enough to support increasing demand. The DRAM found in thin-and-light PCs is the same DRAM found in most smartphones, and the replaceable DRAM typically found in desktops and workstations is also used in traditional enterprise servers. Due to this supply-and-demand imbalance, prices for PC DRAM have skyrocketed and are likely to remain elevated through at least 2026 and into 2027. Already, contract prices for the DRAM found in desktops and workstations have increased between 10% and 30% year-to-year going into 2026 with the DRAM found in thin-and-light PCs increasing at an estimated rate of between 20% and 40%.

Memory costs and longer lead times put AI PC momentum at risk

TBR expects the memory shortage will impact commercial PC buyers in three ways: pricing, availability and product assortment. Channel partners in contact with TBR have reported PC OEM prices have increased twice since the beginning of 2026, with more price hikes planned. Although price increases to date have been estimated between 10% and 20%, a partner noted a customer whose specific PC configuration price had increased by 40% since December 2025. Channel partners have also noted that delivery times have already become longer, meaning customers will have to accept longer lead times going forward.

These dynamics put AI PC models with higher-priced silicon in a precarious position. Customers with finite spend are already facing significant price increases on memory that offers no additional value. Many customers will face a choice of further delaying PC refresh, reallocating budget from other IT projects, or seeking watered-down configurations to reduce costs.

OEMs will need to maintain tight cost controls as much as possible through supply chain management and focus on product assortment. For example, OEMs will likely push more models with 16GB of RAM, which is the minimum requirement for Copilot+ PCs, over those with 32GB or 64GB. Ultimately, with longer lead times and a tight product assortment a likely outcome, TBR expects OEMs will focus on configurations and segments where they can maintain margins and best serve the customers that are willing to pay.

The cost burden will not fall solely on the OEMs. With all three AI PC silicon vendors launching new chips at CES in January, these vendors are motivated to make the new platforms a success. OEMs and silicon vendors already had to adjust pricing on NPU-enabled silicon in 2025 to reach a point where customers were willing to upgrade. TBR expects OEMs will pressure Intel, AMD and Qualcomm to provide additional discounting to ensure the success of the latest generation of chips.

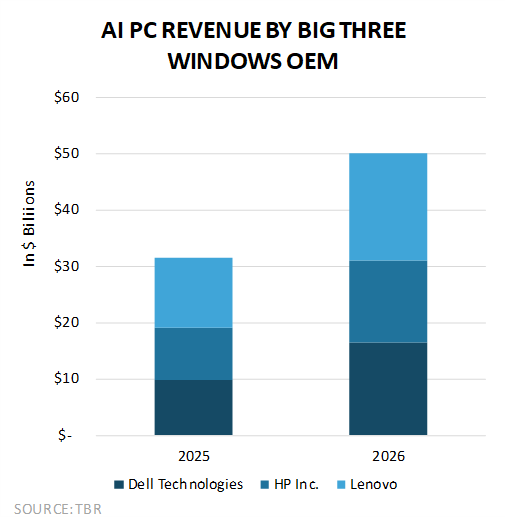

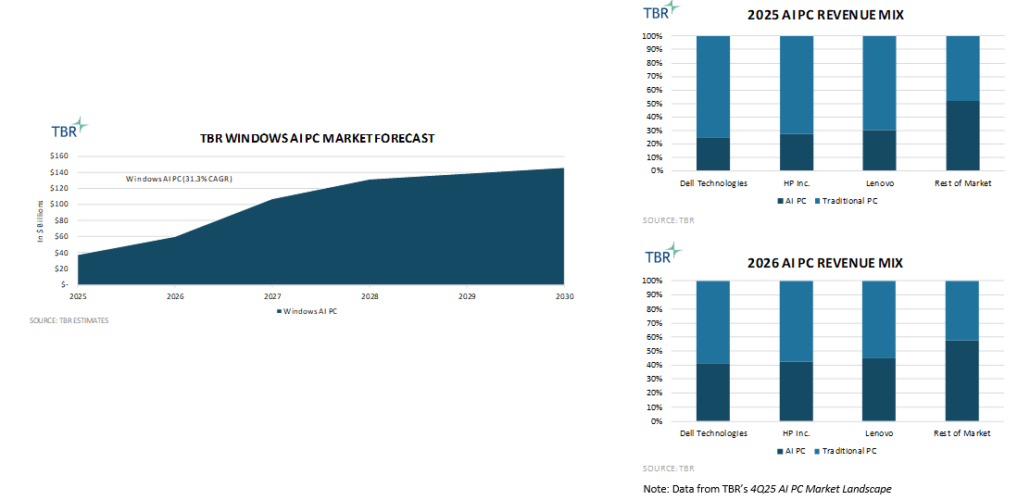

AI PC Revenue by Big Three Windows OEMs [Dell Technologies, HP Inc., Lenovo] for 2025 and 2026 (Source: TBR)

2026 outlook: Increasing prices will stifle overall market growth and slow AI PC mix shift

Despite significant pricing impacts, TBR expects the PC market will grow in 2026. In fact, the early part of the year may perform better than expected if customers pull in buying to avoid additional price increases coming down the road.

Although the PC ecosystem has been investing in making NPU-enabled silicon more useful, the use cases for most AI PC buyers remain thin and focused on future innovation. The AI PC mix will continue to increase, but TBR believes the growth rate will be lower than we predicted in 2025. The increase in mix will be based more on the availability of chips and manufacturers’ emphasis on AI PCs than on organic customer demand.

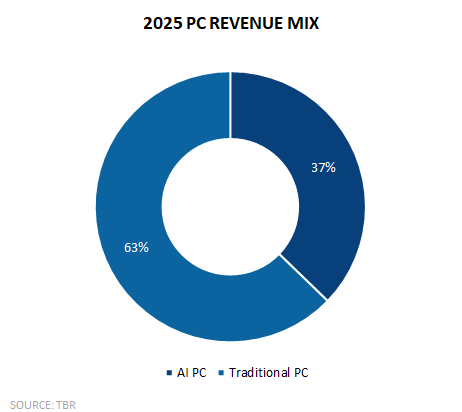

Although TBR estimates the overall value of the PC market will grow 1.7% year-to-year in 2026, the increase will be driven by rising selling prices, not shipments, which are expected to decline as many buyers delay PC refreshes unless absolutely necessary. Meanwhile, TBR forecasts the overall value of the AI PC market will expand 33.4% in 2026 due in large part to a relatively small compare and PC OEMs’ (excluding Apple) growing AI PC revenue mix, which TBR predicts will increase from 23.9% in 2025 to 37.9% in 2026, a difference of 1,400 basis points. Although this mix shift is pronounced, TBR firmly believes that had PC DRAM prices remained the same, the increase would be more robust.

Conclusion

Rising demand for the types of DRAM found in PCs, in combination with memory suppliers focusing production capacity build-out on supporting massive-scale AI infrastructure deployments, has led to a supply-and-demand imbalance in the market, causing memory manufacturers and suppliers to rapidly increase PC DRAM prices. With margins already thin, PC OEMs are passing their rising build costs on to buyers in an attempt to protect profitability. AI PC prices were already higher than traditional PC prices, and with AI PCs typically configured with more memory, on average, AI PC prices are poised to continue increasing more than traditional PC prices, making the future-proofing-led sales proposition less compelling. Not only will these rising prices result in slower-than-anticipated adoption of AI PCs, but they will also cause more organizations to delay their PC refreshes. However, once PC DRAM prices stabilize and begin to fall, pent-up demand from delayed refreshes could yield a prosperous cycle for PC OEMs and silicon vendors alike.

Fortunately, although the rate at which memory prices are increasing is unprecedented, PC OEMs have weathered component shortages in the past. While increasing PC prices will slow the market’s transition to AI PCs in the near term, the proliferation of the AI PC over the next five years is almost guaranteed due to the alignment of ecosystem players, including PC silicon vendors, PC OEMs and Microsoft, which owns the operating system. As such, increasing memory costs and PC prices are less of a roadblock to AI PC adoption and more a speed bump impacting the momentum of adoption.

Alemedia.ID via Canva Pro

Alemedia.ID via Canva Pro

Dee Angela, Canva Pro

Dee Angela, Canva Pro