Informatica’s Alliance Strategy: Powering GSIs, Scaling AI and Strengthening the Data Ecosystem

Informatica uses the ‘power of three solutions’ to bolster its ecosystem

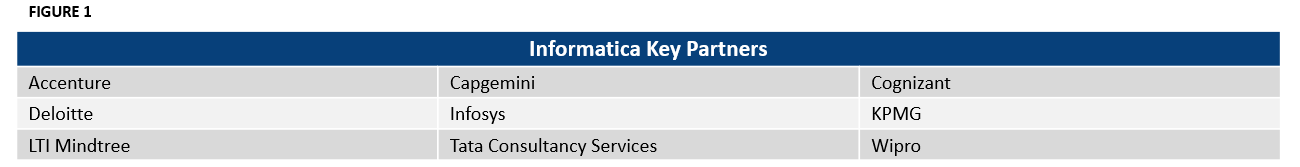

An increasing amount of research and analysis time at TBR is focused on ecosystem intelligence, which applies a set of questions and frameworks to extend traditional market intelligence and competitive intelligence approaches in an effort to better understand a market. Recently, TBR analysts spoke with Informatica’s Richard Ganley, Senior Vice President, Global Partners, and his insights into the actions the company is taking to enhance its alliance relationships with nine key partners (Figure 1) stood out to the team. We believe Informatica is doing the following things really well:

- Enthusiastically embracing the “power of three solutions,” that is, solutions pulling together resources from a global systems integrator (GSI), a cloud or software vendor, and Informatica. According to Ganley, this approach helps enterprise IT clients “modernize faster … [and] master some of their most critical data with multivendor solutions.”

- Consistently evaluating GSIs based on their performance with Informatica, including growth, new solutions and mindshare

- Ensuring the company as a whole understands the evolving importance of the ecosystem to Informatica’s success

Informatica’s relationship with GSIs

Ganley cited four reasons why GSIs want closer relationships with Informatica. First, Informatica has a mature data platform, the Intelligence Data Management Cloud (IDMC). According to Ganley, one part of the platform’s appeal is its simplicity: GSIs “don’t need to work with small vendors who we compete with and pick three or four of them and stitch together their technologies to try and make a platform. They can just work with us and everything is there.”

Second, simply scale. Although Ganley did not say it explicitly, every GSI that TBR covers has been working to consistently (and profitably) bridge the gap between AI pilots and limited AI deployments to AI at scale. Informatica’s established scale brings GSI partners reassurance. As Ganley put it, GSIs “can see eventually how they can build a billion-dollar practice with Informatica.”

Third, Informatica partners with the GSI’s partners, including what Ganley described as “very close engineering relationships with the hyperscalers.” Fourth, Ganley described a “huge uptick” in GSI partners’ professionals being trained and certified on Informatica’s solutions, increasing from around 8,000 per year in 2020 to more than 15,000 in 2024. Ganley noted, “one of the reasons we’re seeing so many of our partners wanting to double down with us [is] because they see us as very important foundational work for AI to be possible.”

Ganley also highlighted Informatica’s relationship with LTI Mindtree, specifically within the context of how Informatica evaluates (and invests people and resources in) GSI partners. Of the nine strategic GSIs listed in Figure 1, LTI Mindtree is unquestionably the smallest in terms of revenue, and Ganley noted that LTI and Mindtree, as separate companies, were very appealing as strategic partners. After the merger was completed and LTI Mindtree recruited experienced talent known to Informatica, the two companies reconsidered a strategic partnership. Informatica laid out specific criteria, and LTI Mindtree invested in training and other aspects of the alliance. The CEOs of both companies formally announced the new alliance.

The result has been, according to Ganley, highly successful for both parties: “They’ve been absolutely amazing to work with … and their data and AI practice is quite a good size. They’ve got 12,000 people in the practice, and I think that’s more than 10% of their business. So it’s pretty meaningful for them.” In TBR’s view, this deliberate, strategic approach to alliances has been the exception, not the rule, across the IT services, cloud and software ecosystem. Having an explicit set of criteria for continually evaluating a partnership — beyond simply revenue or sales opportunities — is a critical component, as is CEO-to-CEO buy-in. Informatica clearly has this figured out.

Informatica’s ‘power of three’ approach integrates technology in a unique way

Throughout our coverage of Informatica, we regularly discuss the company’s partner-first approach, and why Informatica continues to position itself as “the Switzerland of data.” Take Informatica’s seven core tech alliance partners: Microsoft, Amazon Web Services (AWS), Oracle, Google Cloud, Databricks, Snowflake and MongoDB. We cannot identify any company in that list that has a tailored go-to-market approach with all the other six vendors; even if you take the hyperscalers out of the equation, there is simply too much overlap in their capabilities.

Of the vendors TBR covers, Informatica is the only PaaS ISV that has worked across a broad cloud ecosystem in a way that gets the company natively embedded in critical layers of the data stack (i.e., Microsoft Fabric), thus making it easier for customers to adopt more components of IDMC. So, it is not surprising that GSI partners are excited about working with Informatica and unlocking growth via the cross-alliance structure.

The seven core tech alliance partners listed above, as well as other SaaS vendors like SAP and Salesforce, are becoming more integrated with each other by improving data sharing, opening up their APIs and making a comprehensive shift toward more open architectures. Although competitive obstacles will continue to exist, this trend could generate many opportunities for Informatica given its already established role with many of these tech partners. SAP’s new partnership with Databricks — in which Databricks will be sold as a native SAP service — offers a great model for Informatica, particularly if it wants to capture more engagements around SAP modernization, which the GSIs will help support.

SAP

SAP is not an Informatica technology partner, but naturally, ingesting, managing and integrating SAP data remains an important use case. We have spoken to enterprise customers that leverage Informatica’s data ingestion capabilities to extract data from SAP systems and make it available in a data lake from Informatica partners such as Databricks, as part of the ERP modernization process. For many ISVs, developing a partnership with SAP can be difficult, but Informatica’s work with the biggest GSIs — including Accenture, Deloitte and Capgemini, which according to TBR’s SAP, Oracle and Workday Ecosystem Report collectively employ more than 144,000 people trained on SAP offerings — will play a huge role in getting Informatica in front of SAP and the related ERP modernization opportunities.

In describing Informatica’s strategies around “power of three solutions,” Ganley noted that the most frequent teaming approach would include a person from the GSI, a person from that GSI’s technology team (for example, a Deloitte SAP practice professional), and a person from Informatica.

In TBR’s view, this approach solidifies Informatica’s relationship with the GSI while helping the GSI solidify its relationship with the cloud or software vendor. As multiparty go-to-market approaches and solutions become more common across the ecosystem, TBR will be watching to see who staffs those teams, which vendor leads, and whether Informatica’s approach is emulated by others.

The value of the ecosystem can be measured: 17%, 47% and 83%

Admittedly, not every player or every professional in the technology space is sold on how ecosystems are changing and how valuable alliances are to long-term growth. Ganley provided perhaps the starkest evidence why ecosystems matter with a few simple numbers: “We looked at basically all the opportunities that we’d had in our system, which we’d either won or we’d lost over the past two years. And we found if we didn’t work with a partner, our win rate was around 17%.

If we worked with one partner, it went up to 47%, which kind of makes sense because we’ve got somebody in there speaking up for us, recommending us. But if we worked with two partners, and by two we mean one from the GSI and one from the ecosystem … the win rate goes up to 83%.” 17%, 47%, 83%. TBR has not seen a more compelling case for alliance management and ecosystem intelligence.

According to TBR’s Summer 2024 Voice of the Partner Ecosystem Report, data management ranked among the top three growth areas for services vendors in the next two years, sending a signal to the ecosystem that they will continue to invest in resources and guide conversations with mature enterprise buyers that are further along with their digital transformation programs and can embark on the next phase: setting up a strong foundation for generative AI. Informatica’s portfolio and alliance strategy is well aligned with the emphasis on data management, which is helping it become an invaluable strategic partner for GSIs and reinforcing the company’s tagline “Everyone is ready for AI except your data.”

Claim your free preview of TBR’s ecosystem intelligence research: Subscribe to Insights Flight today!

Geopaul, Getty Signatures Image

Geopaul, Getty Signatures Image Husein Signart

Husein Signart Technology Business Research, Inc..

Technology Business Research, Inc..